New: A @nytimes investigation found a pattern of insiders at biotech companies selling shares shortly after announcing incremental progress on coronavirus vaccines. When their stock prices jumped, they sold $1 billion+ of stock. @dgelles @JesseDrucker https://www.nytimes.com/2020/07/25/business/coronavirus-vaccine-profits-vaxart.html">https://www.nytimes.com/2020/07/2...

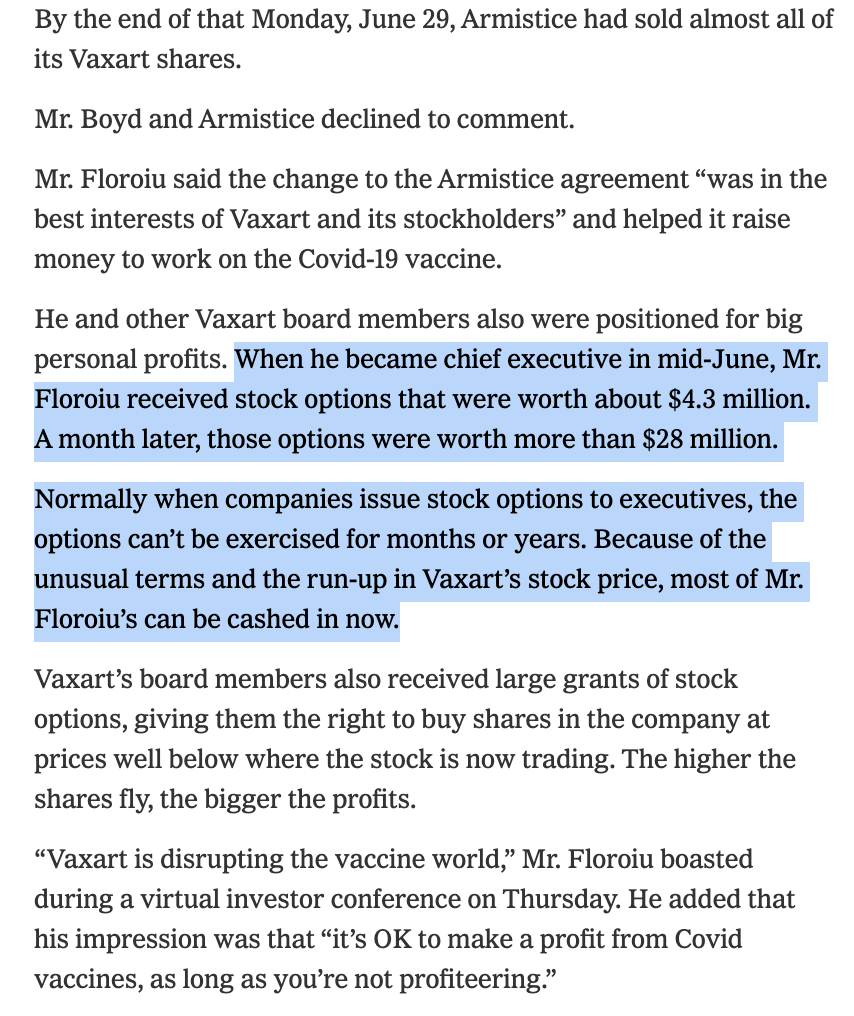

For example: In June, the biotech company Vaxart gave stock options to its CEO and agreed to let its top shareholder quickly buy and sell its shares.

Weeks later, Vaxart said it was selected for Operation Warp Speed, the federal vaccine initiative. Its shares instantly doubled.

Weeks later, Vaxart said it was selected for Operation Warp Speed, the federal vaccine initiative. Its shares instantly doubled.

The CEO& #39;s stock awards went from $4m to $28m. Vaxart& #39;s top shareholder immediately sold all its shares, netting $200m of profits.

@HHSgov tells us Vaxart& #39;s Warp Speed work is confined to a single monkey trial. HHS officials suspect Vaxart is citing Warp Speed to hype its stock.

@HHSgov tells us Vaxart& #39;s Warp Speed work is confined to a single monkey trial. HHS officials suspect Vaxart is citing Warp Speed to hype its stock.

Execs and board members from at least 10 other companies have sold shares after positive vaccine news and/or received stock awards shortly before such news. The companies include @moderna_tx @Regeneron @Novavax

Read the story – there& #39;s lots more. https://www.nytimes.com/2020/07/25/business/coronavirus-vaccine-profits-vaxart.html">https://www.nytimes.com/2020/07/2...

Read the story – there& #39;s lots more. https://www.nytimes.com/2020/07/25/business/coronavirus-vaccine-profits-vaxart.html">https://www.nytimes.com/2020/07/2...

Read on Twitter

Read on Twitter