Something doesn’t feel right to me. I can’t place it. Need to dust off the chart book. It feels like correlations are broken. Not bullish. Not bearish. Decent amount of noise. Hopefully I can  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👃" title="Nase" aria-label="Emoji: Nase"> something out this wkd. Will keep this thread pinned.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👃" title="Nase" aria-label="Emoji: Nase"> something out this wkd. Will keep this thread pinned.

Feel free to tack on here if you noticed stuff that was unusual. Stuff that you’d expect to be positively or negatively correlated but the relationships didn’t hold. Not looking at macro here. Sectors but single names even better for analysis.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏" title="Folded hands" aria-label="Emoji: Folded hands">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏" title="Folded hands" aria-label="Emoji: Folded hands"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤙" title="„Ruf mich an!”" aria-label="Emoji: „Ruf mich an!”">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤙" title="„Ruf mich an!”" aria-label="Emoji: „Ruf mich an!”">

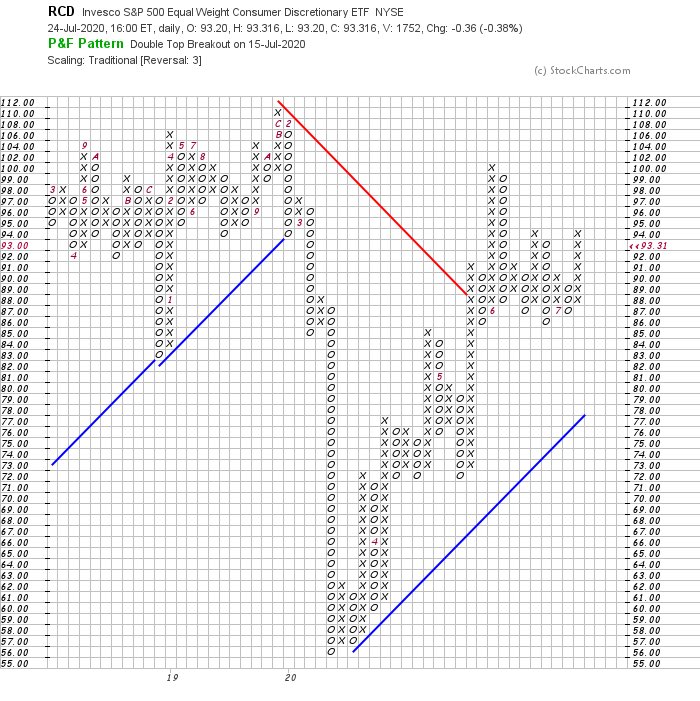

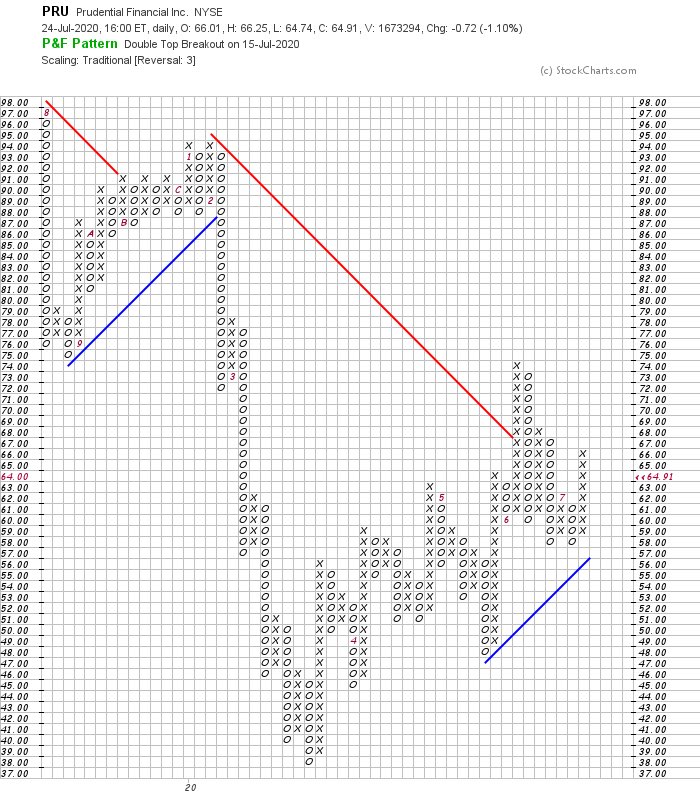

From what I’ve seen we have a few competing thesis: a) bearish reversal where all will go to  https://abs.twimg.com/emoji/v2/... draggable="false" alt="💩" title="Dreckshaufen" aria-label="Emoji: Dreckshaufen">. b) reflation (banks, financials go higher, as do inflation trades).

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💩" title="Dreckshaufen" aria-label="Emoji: Dreckshaufen">. b) reflation (banks, financials go higher, as do inflation trades).

C) bonds are bid due to some FUD-du-jour (COVID, China/USA consulate spat,etc) the bid causes curve to stay flat and this supports high beta stuff tier continues pumping (PMs too).

D) we then have the election regime change. Trump/Biden. Then the question of senate flipping to Dems. Maybe that’s being priced in.

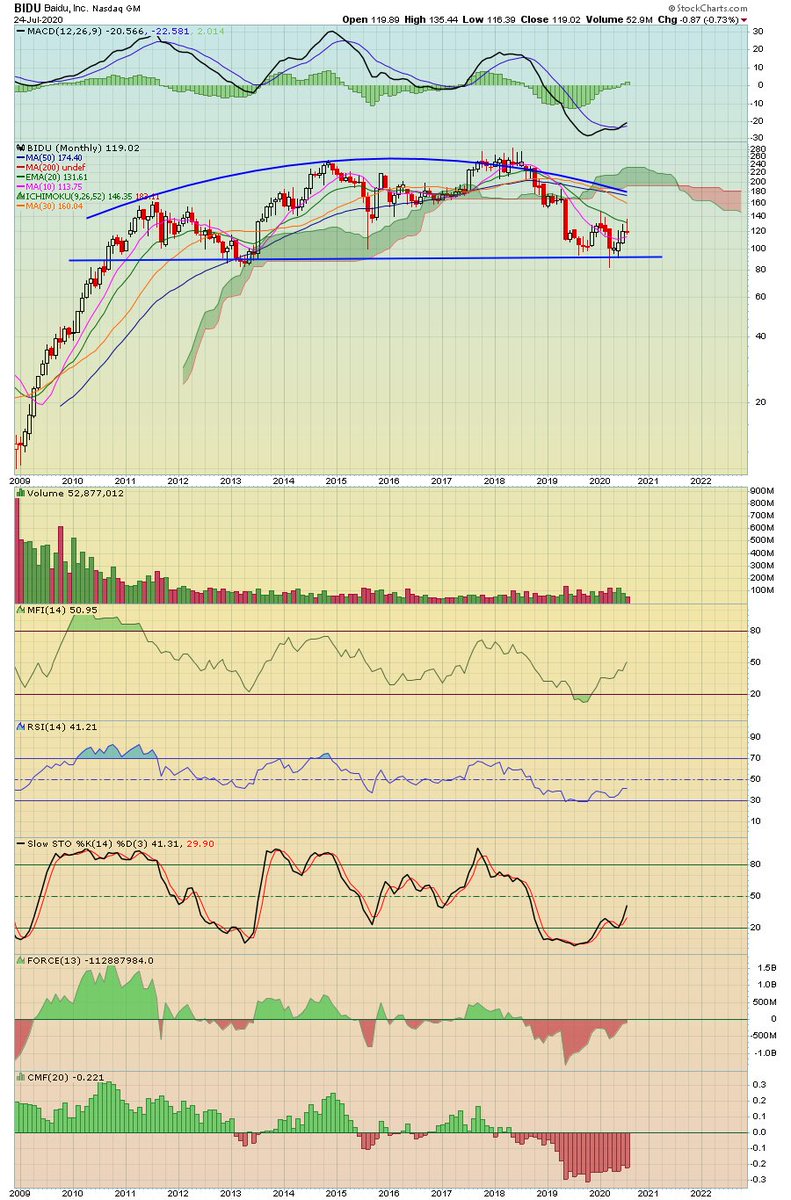

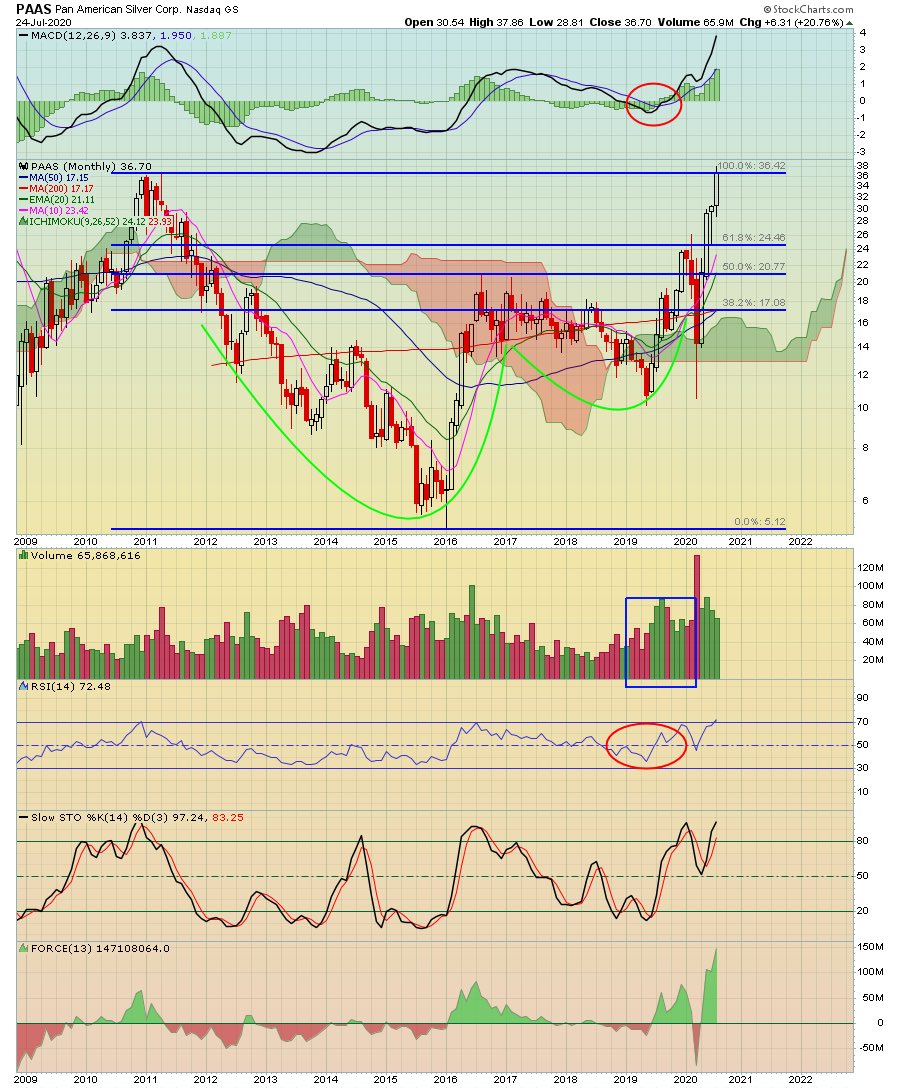

e) and finally precious metals. I am a bull. Have owned metals and miners. Don’t churn them so don’t study the chart much but why the Tesla-esque surge last two weeks? I can explain it on technicals (I think), gold/silver ratio but could it be something imminent ?

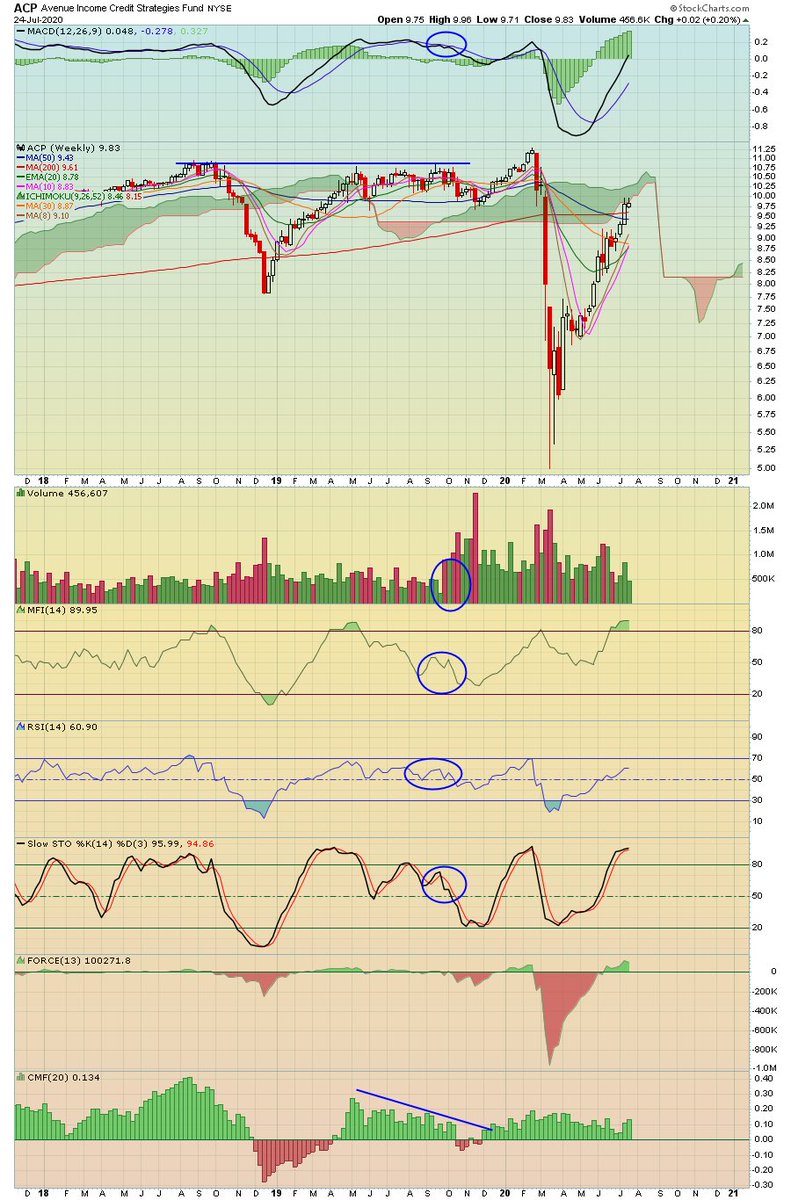

The noise that is making charting difficult now IMO is coming into resistance for some of these names as well as sentiment.

The selling felt genuine. Now that I am seeing some 2h charts I’m seeing signs of distortion but I can’t place my finger on it. Know what I mean? I’m not seeing the “get me out” action. Are you ? In sectors ?

SPX quarterly. vs USD in gold. This tells me Fed is at the end of its rope. Negative rates or start buying QQQ. Right ? Hard in an election year though. The oligarchs don’t want populist uprising.

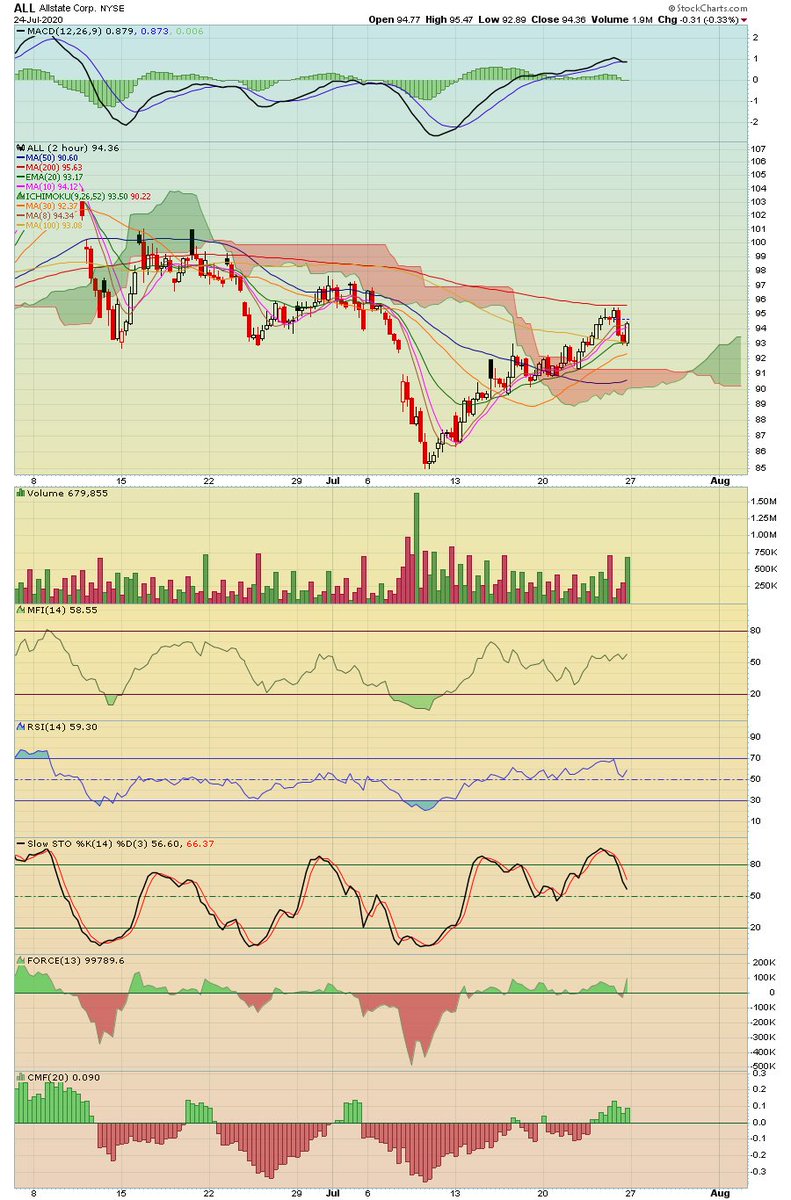

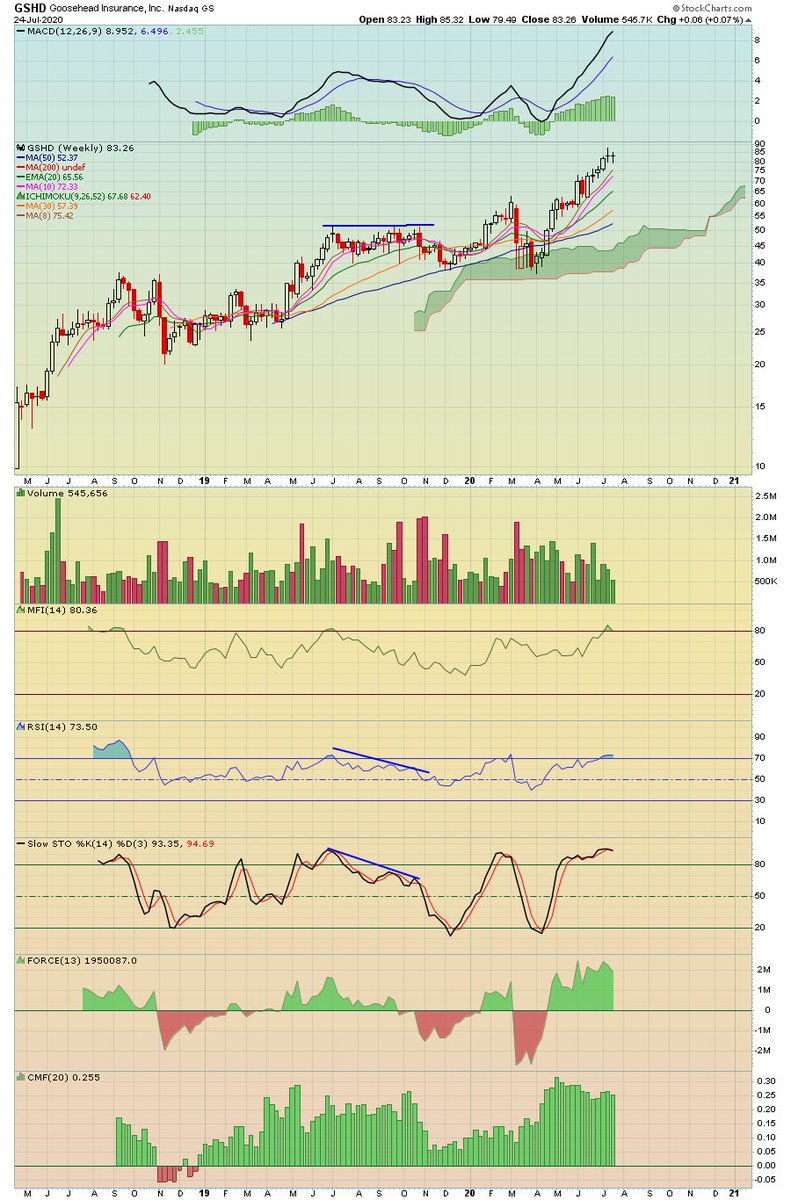

Throwing some random charts here in the thread. ALL. insurance should puke if we are heading to flattening. This looks like they’re still buying. Right ? Just needs oscillators and Macd to cool off. Maybe form right invest shoulder.

2h Amex says it’s been under distribution for a while. Right ?little IHS but the volume gives ur away IMO

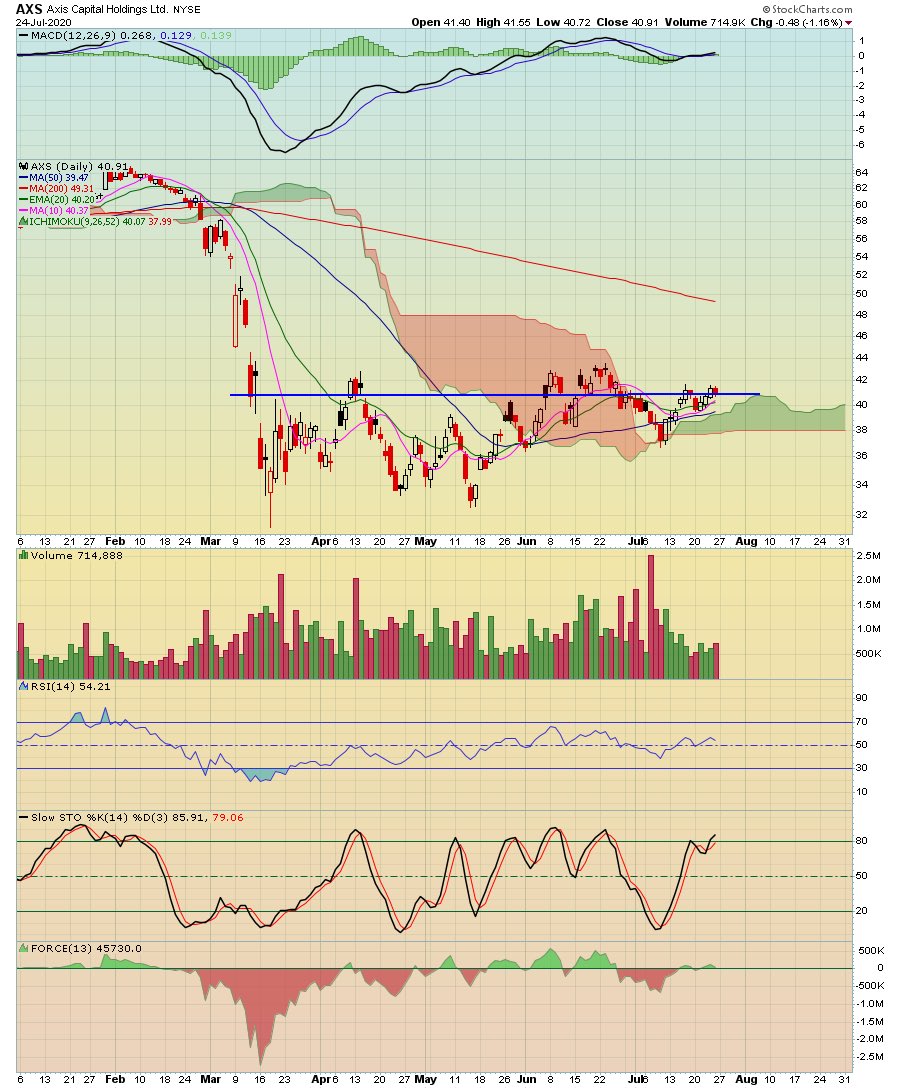

Axs. Insurance stock. Could be basing. Could be struggling. Spiked volume. @axelroark thoughts ? Not a hugely important name for me but speaks to that failed B/o you mentioned

Bac. Dang. You wouldn’t see it in the price action as easily as these 2h volume bars. Distribution. Right? Green after 13th but not clean. Thoughts ?

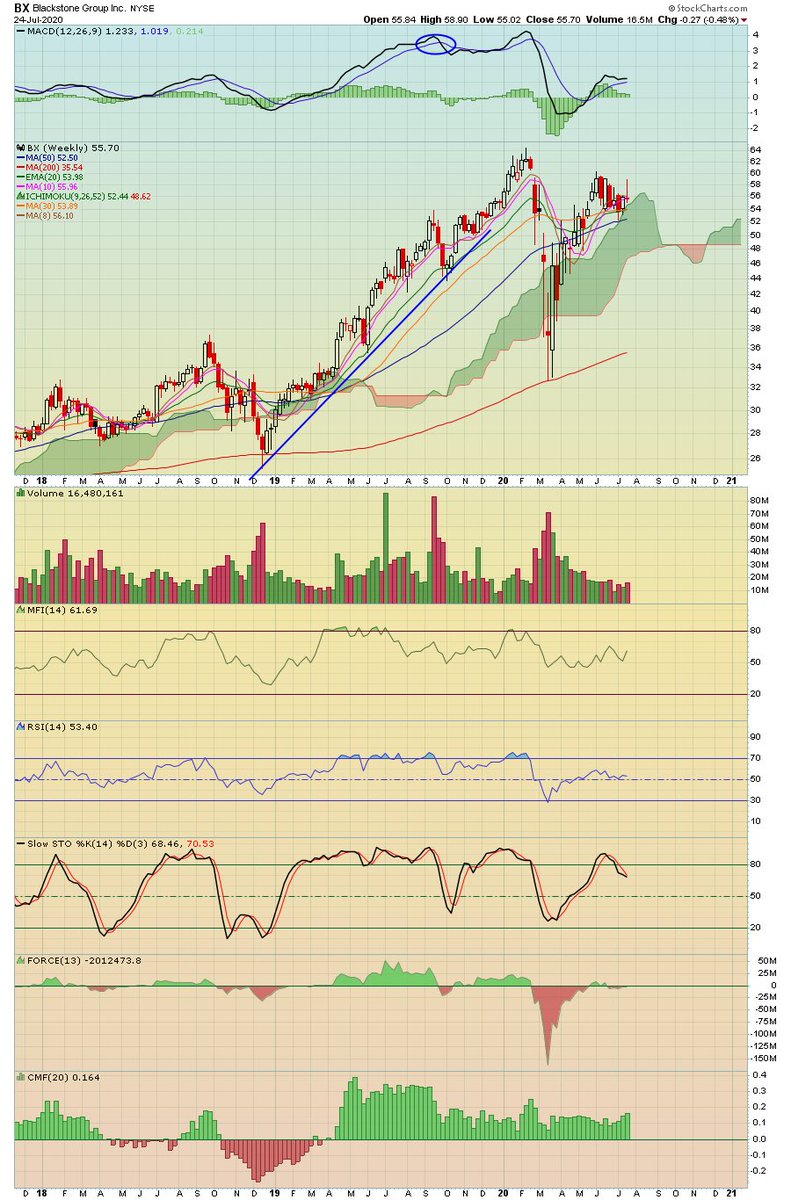

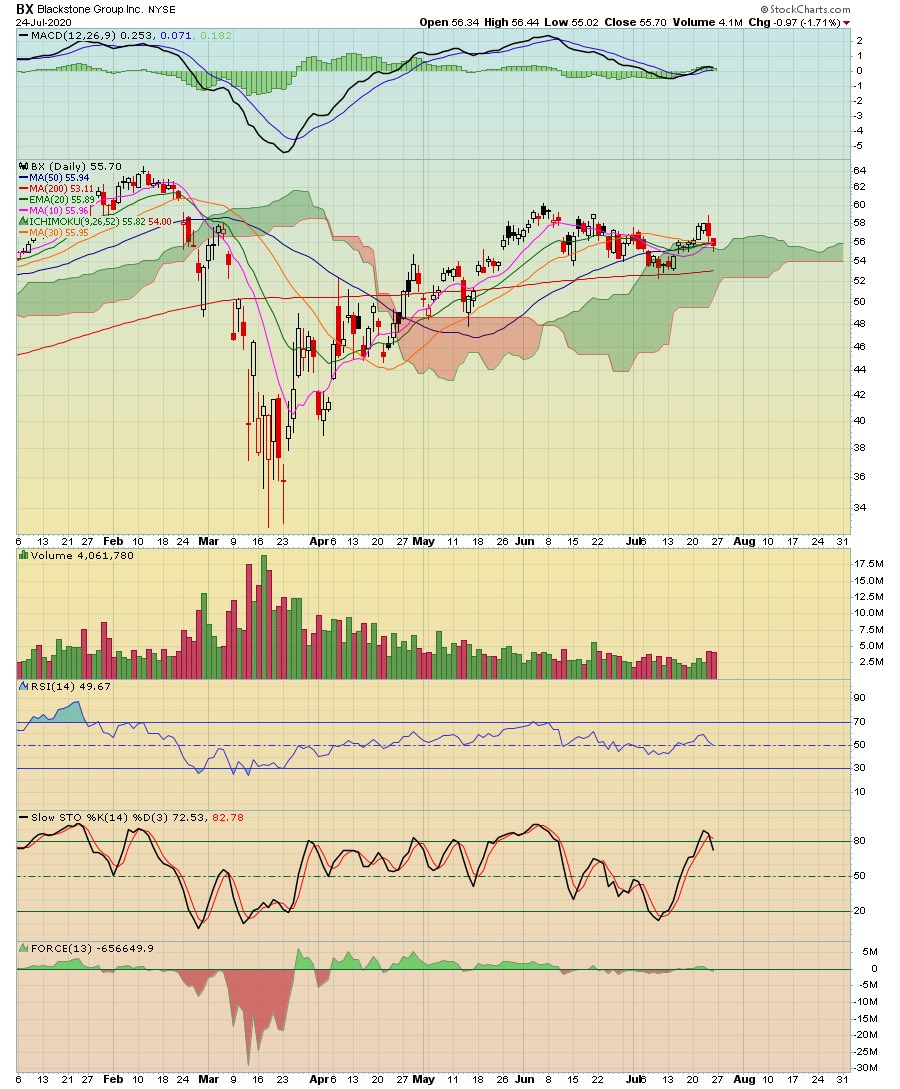

BX has been a very tough fade for me in the past. Maybe something is here finally? If Dems are bringing carried interest taxation maybe they leak it to the firms ? Prob w PE is they get massive $$ from sovereigns also...

Pay attn to $PAAS. Stalking out around the 2011 double top. Miners like to make multi year cup and handles so this could chop or even pull back hard.

Strong move on PGR so this could be bull flagging. If the Econ is dumping these P+c will sniff it out. (People insure less cars, drive less, cut back coverage , and insurance companies inv return expectations r poor.

Read on Twitter

Read on Twitter