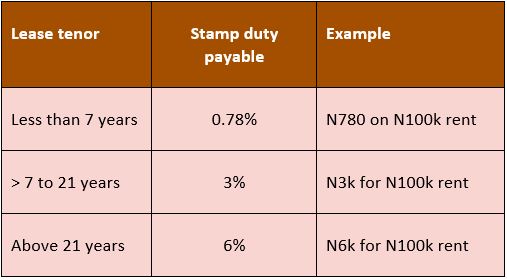

#Tax101 - Stamp duty on most rent agreements is at the rate of 0.78%, not 6% as being widely circulated. Based on the Stamp Duties Act, stamp duty on lease or rent agreement is payable as follows:

Thread

Thread

If the lease term is less than 7 years, stamp duty rate is 0.78% (e.g. N780 on N100k rent)

For a term of 7+ to 21 years, stamp duty rate is 3% (means N3k for N100k rent)

For a term above 21 years, stamp duty rate is 6% (e.g. N6k for N100k rent)

For a term of 7+ to 21 years, stamp duty rate is 3% (means N3k for N100k rent)

For a term above 21 years, stamp duty rate is 6% (e.g. N6k for N100k rent)

Given that most people enter into rent agreements for less than 7 years, the applicable stamp duty rate to most people will be 0.78%.

If you are an individual renting from another individual, your stamp duty is payable to the state tax authority such as LIRS if you are resident in Lagos. If either the tenant or the landlord is a company, then the duty is payable to FIRS.

The obligation to pay stamp duty on rent rests with the tenant. However, FIRS is seeking to appoint the landlord as the agent to collect and remit the tax.

Here is the summary of stamp duty payable on rent. Don& #39;t pay for ignorance.

Read on Twitter

Read on Twitter