A housing crash by the end of 2020 may spell the last chance many renters will have to hop into homeownership...

if they can survive the upcoming eviction tsunami in the next several months.

A thread.

if they can survive the upcoming eviction tsunami in the next several months.

A thread.

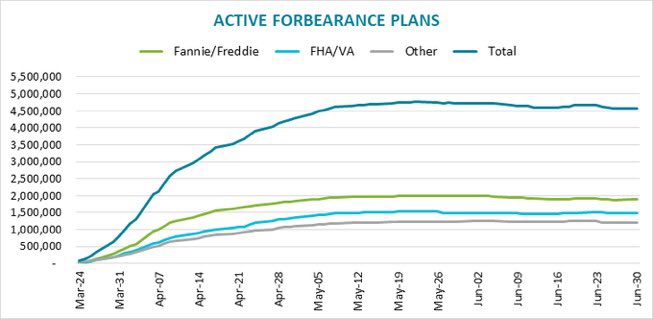

As of June 30, 4.58 million homeowners are in forbearance plans, representing 8.6% of all active mortgages.

This represents just under $1 trillion in unpaid principal ($995B).

This represents just under $1 trillion in unpaid principal ($995B).

Homeowners in forbearance who are able to make their payments is declining:

April: 46% made their payment

May: 30% made their payment

June: 25% made their payment

This will get worse.

April: 46% made their payment

May: 30% made their payment

June: 25% made their payment

This will get worse.

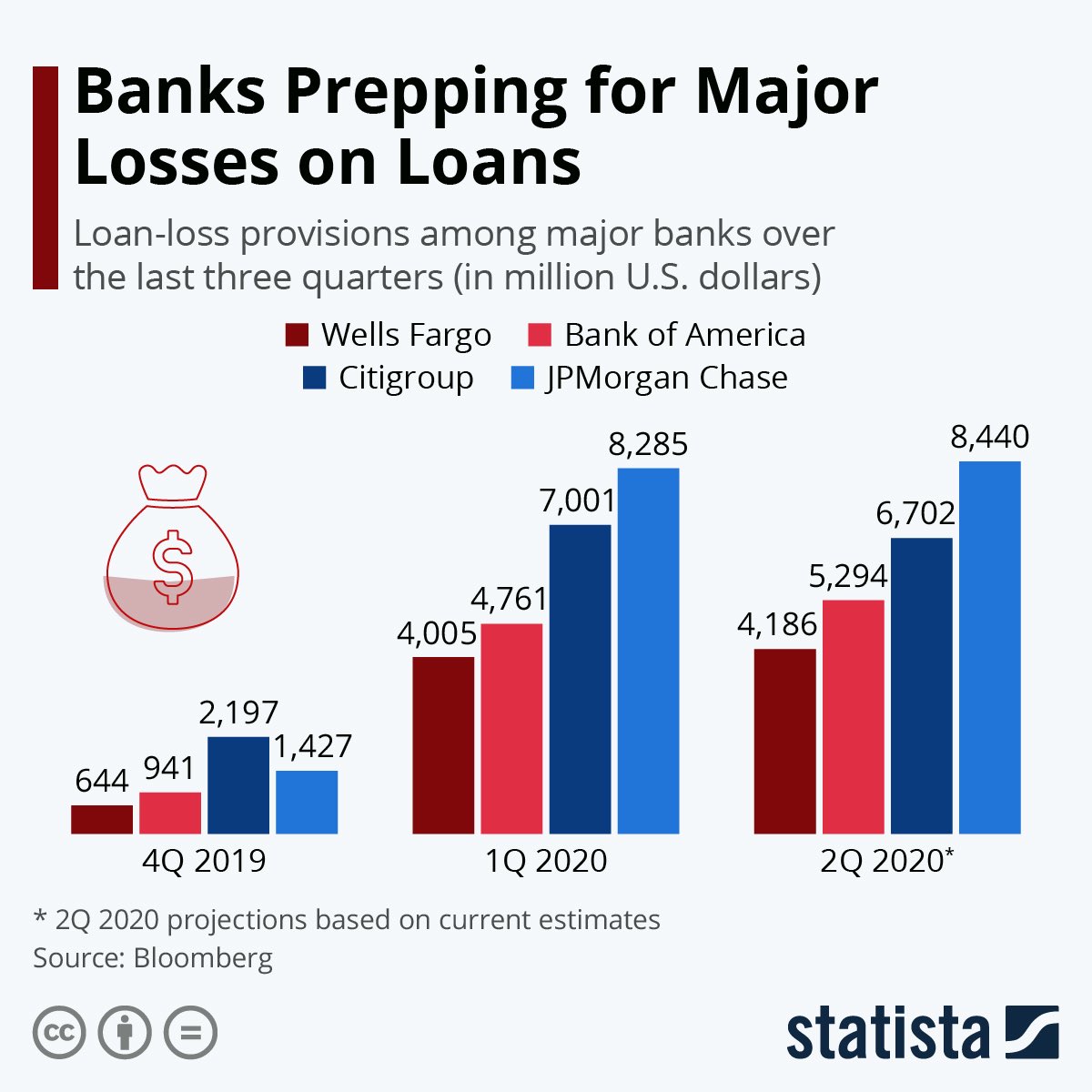

In addition to forbearances, banks are increasing their Loan Loss accounts.

Banks do this when they are planning to sell off bad loans at a discount.

You can buy defaulted loans for as low as $0.40 on the dollar. Prices may fall as supply increases.

Banks do this when they are planning to sell off bad loans at a discount.

You can buy defaulted loans for as low as $0.40 on the dollar. Prices may fall as supply increases.

Currently, home prices are fairly stable. Why? Because not many people want to move during a pandemic.

Fewer movers, fewer listings.

Fewer listings, higher demand.

High demand, stable prices.

Not to mention the $6.5T in “tappable equity”.

Fewer movers, fewer listings.

Fewer listings, higher demand.

High demand, stable prices.

Not to mention the $6.5T in “tappable equity”.

“Tappable equity” means you can take out a line of credit against your house and STILL have 20% equity left over.

If you’re in this position, you could take out a loan against your house and ride out until the pandemic is over without losing a wink of sleep.

If you’re in this position, you could take out a loan against your house and ride out until the pandemic is over without losing a wink of sleep.

However, once the foreclosures & loan sales begin, it’ll come crashing down.

Prices will fall.

Inventory will increase.

Sellers will get desperate.

And it will create a window... albeit small, for those who were locked out of ownership to finally have a shot.

/end

Prices will fall.

Inventory will increase.

Sellers will get desperate.

And it will create a window... albeit small, for those who were locked out of ownership to finally have a shot.

/end

Read on Twitter

Read on Twitter