I’ll show you how I’m making an extra $40-$100 weekly using a simple technique

[THREAD]

What is a covered call?

A covered call is a type of Options contract where you are agreeing to sell 100 shares of a given stock to someone else at a chosen strike price.

It’s considered “covered” since you do already own the 100 shares https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">

A covered call is a type of Options contract where you are agreeing to sell 100 shares of a given stock to someone else at a chosen strike price.

It’s considered “covered” since you do already own the 100 shares

If the stock reaches the strike price, the buyer gets to buy your 100 shares at that price, and you get your premium!

If the stock does not reach the strike price, then the contract expires and is unfulfilled. You get to keep your 100 shares + the premium!!

If the stock does not reach the strike price, then the contract expires and is unfulfilled. You get to keep your 100 shares + the premium!!

I’ll be using $T as an example:

1. I currently own 203 shares of $T, therefore, I can do 2 contracts per week (each contract is 100 shares)

I need to look at my average cost, which for me it’s $31.40

1. I currently own 203 shares of $T, therefore, I can do 2 contracts per week (each contract is 100 shares)

I need to look at my average cost, which for me it’s $31.40

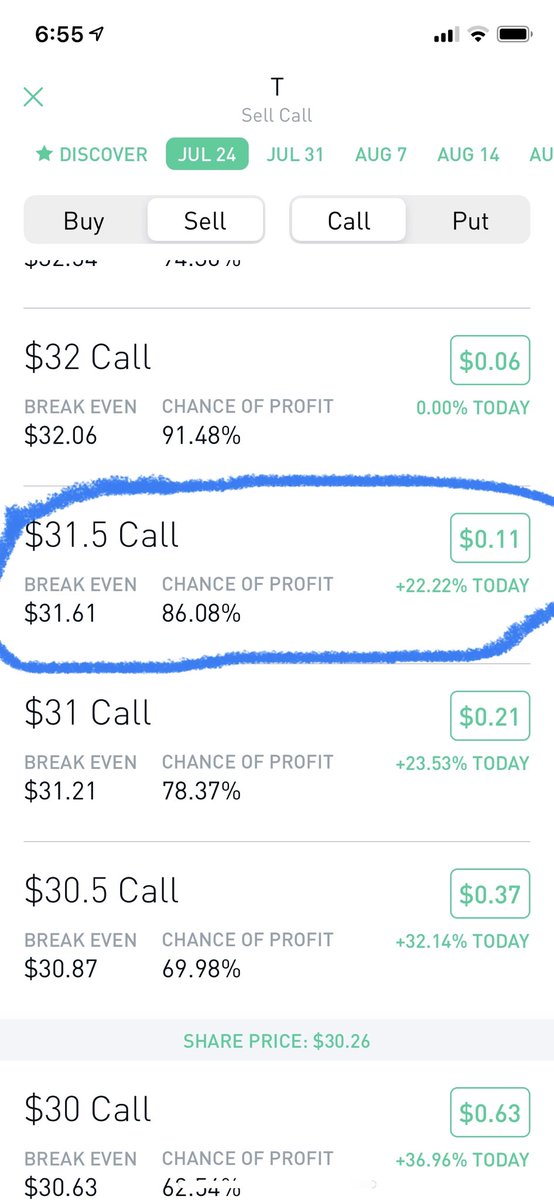

2. Now I will look at the current offers for selling calls!!

I want to specifically look for a strike price that is higher than my average cost!!

I chose this $31.5 strike price

The $0.11 next to it is where we make our money https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">

I want to specifically look for a strike price that is higher than my average cost!!

I chose this $31.5 strike price

The $0.11 next to it is where we make our money

This is what we call a premium!!

We, as the sellers, earn this premium whether the contract is fulfilled or not

That is 11 cents per share, since our contracts have 100 shares, we will earn $11 for each contract!

In this case, since I’m selling two contracts, I’ll make $22 https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">

We, as the sellers, earn this premium whether the contract is fulfilled or not

That is 11 cents per share, since our contracts have 100 shares, we will earn $11 for each contract!

In this case, since I’m selling two contracts, I’ll make $22

**Make sure that you pay attention to the date of expiration all the way up top**

Also, make sure that you are at “Sell” and “Call”

Also, make sure that you are at “Sell” and “Call”

Once I commit to selling those two contracts, I instantly gain the $22 in premium https://abs.twimg.com/emoji/v2/... draggable="false" alt="‼️" title="Doppeltes Ausrufezeichen" aria-label="Emoji: Doppeltes Ausrufezeichen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="‼️" title="Doppeltes Ausrufezeichen" aria-label="Emoji: Doppeltes Ausrufezeichen">

So, why is this beneficial https://abs.twimg.com/emoji/v2/... draggable="false" alt="❓" title="Rotes Fragezeichen-Symbol" aria-label="Emoji: Rotes Fragezeichen-Symbol">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="❓" title="Rotes Fragezeichen-Symbol" aria-label="Emoji: Rotes Fragezeichen-Symbol"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="❓" title="Rotes Fragezeichen-Symbol" aria-label="Emoji: Rotes Fragezeichen-Symbol">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="❓" title="Rotes Fragezeichen-Symbol" aria-label="Emoji: Rotes Fragezeichen-Symbol">

Well, it’s a win-win strategy https://abs.twimg.com/emoji/v2/... draggable="false" alt="‼️" title="Doppeltes Ausrufezeichen" aria-label="Emoji: Doppeltes Ausrufezeichen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="‼️" title="Doppeltes Ausrufezeichen" aria-label="Emoji: Doppeltes Ausrufezeichen">

Contract Unfulfilled - You keep your 100 shares + the premium https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">

Contract Fulfilled - You sell your 100 shares at a profit (since strike price is higher than average cost) + the premium https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">

Well, it’s a win-win strategy

Contract Unfulfilled - You keep your 100 shares + the premium

Contract Fulfilled - You sell your 100 shares at a profit (since strike price is higher than average cost) + the premium

And, the contracts have expired https://abs.twimg.com/emoji/v2/... draggable="false" alt="‼️" title="Doppeltes Ausrufezeichen" aria-label="Emoji: Doppeltes Ausrufezeichen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="‼️" title="Doppeltes Ausrufezeichen" aria-label="Emoji: Doppeltes Ausrufezeichen">

They were not fulfilled, therefore I got to keep all of my stocks

+

$22 in premium for free https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">

They were not fulfilled, therefore I got to keep all of my stocks

+

$22 in premium for free

Read on Twitter

Read on Twitter How to make extra money from your Dividend stockshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌟" title="Leuchtender Stern" aria-label="Emoji: Leuchtender Stern"> Covered Calls https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌟" title="Leuchtender Stern" aria-label="Emoji: Leuchtender Stern"> I’ll show you how I’m making an extra $40-$100 weekly using a simple technique https://abs.twimg.com/emoji/v2/... draggable="false" alt="💯" title="Hundert Punkte Symbol" aria-label="Emoji: Hundert Punkte Symbol">[THREAD]https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">How to make extra money from your Dividend stockshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌟" title="Leuchtender Stern" aria-label="Emoji: Leuchtender Stern"> Covered Calls https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌟" title="Leuchtender Stern" aria-label="Emoji: Leuchtender Stern"> I’ll show you how I’m making an extra $40-$100 weekly using a simple technique https://abs.twimg.com/emoji/v2/... draggable="false" alt="💯" title="Hundert Punkte Symbol" aria-label="Emoji: Hundert Punkte Symbol">[THREAD]https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">" class="img-responsive" style="max-width:100%;"/>

How to make extra money from your Dividend stockshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌟" title="Leuchtender Stern" aria-label="Emoji: Leuchtender Stern"> Covered Calls https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌟" title="Leuchtender Stern" aria-label="Emoji: Leuchtender Stern"> I’ll show you how I’m making an extra $40-$100 weekly using a simple technique https://abs.twimg.com/emoji/v2/... draggable="false" alt="💯" title="Hundert Punkte Symbol" aria-label="Emoji: Hundert Punkte Symbol">[THREAD]https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">How to make extra money from your Dividend stockshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌟" title="Leuchtender Stern" aria-label="Emoji: Leuchtender Stern"> Covered Calls https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌟" title="Leuchtender Stern" aria-label="Emoji: Leuchtender Stern"> I’ll show you how I’m making an extra $40-$100 weekly using a simple technique https://abs.twimg.com/emoji/v2/... draggable="false" alt="💯" title="Hundert Punkte Symbol" aria-label="Emoji: Hundert Punkte Symbol">[THREAD]https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">" class="img-responsive" style="max-width:100%;"/>

" title="2. Now I will look at the current offers for selling calls!!I want to specifically look for a strike price that is higher than my average cost!!I chose this $31.5 strike priceThe $0.11 next to it is where we make our money https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">" class="img-responsive" style="max-width:100%;"/>

" title="2. Now I will look at the current offers for selling calls!!I want to specifically look for a strike price that is higher than my average cost!!I chose this $31.5 strike priceThe $0.11 next to it is where we make our money https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">" class="img-responsive" style="max-width:100%;"/>

" title="Once I commit to selling those two contracts, I instantly gain the $22 in premiumhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="‼️" title="Doppeltes Ausrufezeichen" aria-label="Emoji: Doppeltes Ausrufezeichen">" class="img-responsive" style="max-width:100%;"/>

" title="Once I commit to selling those two contracts, I instantly gain the $22 in premiumhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="‼️" title="Doppeltes Ausrufezeichen" aria-label="Emoji: Doppeltes Ausrufezeichen">" class="img-responsive" style="max-width:100%;"/>

They were not fulfilled, therefore I got to keep all of my stocks +$22 in premium for free https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">" title="And, the contracts have expiredhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="‼️" title="Doppeltes Ausrufezeichen" aria-label="Emoji: Doppeltes Ausrufezeichen">They were not fulfilled, therefore I got to keep all of my stocks +$22 in premium for free https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">" class="img-responsive" style="max-width:100%;"/>

They were not fulfilled, therefore I got to keep all of my stocks +$22 in premium for free https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">" title="And, the contracts have expiredhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="‼️" title="Doppeltes Ausrufezeichen" aria-label="Emoji: Doppeltes Ausrufezeichen">They were not fulfilled, therefore I got to keep all of my stocks +$22 in premium for free https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">" class="img-responsive" style="max-width:100%;"/>