Our G-SOEP survey finds much higher private wealth & higher wealth inequality in Germany than previously known:

Top 0.1% have 20% of all private wealth (prev. 7%)

Top 1% have 35% (22%)

Top 10% have 67% (59%)

Bottom 50% have 1.5%

Report (in German):

https://www.diw.de/documents/publikationen/73/diw_01.c.793785.de/20-29-1.pdf">https://www.diw.de/documents...

Top 0.1% have 20% of all private wealth (prev. 7%)

Top 1% have 35% (22%)

Top 10% have 67% (59%)

Bottom 50% have 1.5%

Report (in German):

https://www.diw.de/documents/publikationen/73/diw_01.c.793785.de/20-29-1.pdf">https://www.diw.de/documents...

Facts on wealth in Germany #2:

Our new G-SOEP survey of the rich “discovered” €2100 billion (about 65% of GDP) in “new” private wealth in Germany, for a total of €10,300 billion, using a new methodology.

@PikettyLeMonde

Our study @DIW_Berlin_en :

https://www.diw.de/documents/publikationen/73/diw_01.c.793785.de/20-29-1.pdf">https://www.diw.de/documents...

Our new G-SOEP survey of the rich “discovered” €2100 billion (about 65% of GDP) in “new” private wealth in Germany, for a total of €10,300 billion, using a new methodology.

@PikettyLeMonde

Our study @DIW_Berlin_en :

https://www.diw.de/documents/publikationen/73/diw_01.c.793785.de/20-29-1.pdf">https://www.diw.de/documents...

Facts on wealth in Germany #3:

The richest 1% in Germany have with 35% about as high a share of all private wealth as in the United States, and with wealth inequality being almost as high in Germany as in the US.

@gabriel_zucman

Source: Bartels, Schularick

The richest 1% in Germany have with 35% about as high a share of all private wealth as in the United States, and with wealth inequality being almost as high in Germany as in the US.

@gabriel_zucman

Source: Bartels, Schularick

Facts on wealth in Germany #4:

Germany has one of the highest wealth inequalities in Europe, with a Gini of 0.83.

What is unusual is that the poorest 50% have barely any net wealth. Their share is 1.5%, with almost a third having no meaningful net wealth at all.

@PikettyLeMonde

Germany has one of the highest wealth inequalities in Europe, with a Gini of 0.83.

What is unusual is that the poorest 50% have barely any net wealth. Their share is 1.5%, with almost a third having no meaningful net wealth at all.

@PikettyLeMonde

Facts on wealth in Germany #5:

There are about 1 million millionaires in Germany (out of 83 million inhabitants).

The average millionaire has €3 million in net wealth.

The average adult in the bottom half of the wealth distribution has €3682.

Our @DIW_Berlin_en -SOEP survey

There are about 1 million millionaires in Germany (out of 83 million inhabitants).

The average millionaire has €3 million in net wealth.

The average adult in the bottom half of the wealth distribution has €3682.

Our @DIW_Berlin_en -SOEP survey

Facts on wealth in Germany #6:

43% of net wealth is in the form of company ownership & 41% in real estate among the rich.

The poorest 50% hold almost all of their savings as cash, with almost none having real estate. (only 45% of Germans have real estate).

@JosephEStiglitz

43% of net wealth is in the form of company ownership & 41% in real estate among the rich.

The poorest 50% hold almost all of their savings as cash, with almost none having real estate. (only 45% of Germans have real estate).

@JosephEStiglitz

Facts on wealth in Germany #7:

Wealthy Germans have predominantly six specific characteristics:

· male – 69%

· middle/old age – 77%

· no migration background – 86%

· from West Germany – 94%

· well educated

· self-employed – 73%

Wealthy Germans have predominantly six specific characteristics:

· male – 69%

· middle/old age – 77%

· no migration background – 86%

· from West Germany – 94%

· well educated

· self-employed – 73%

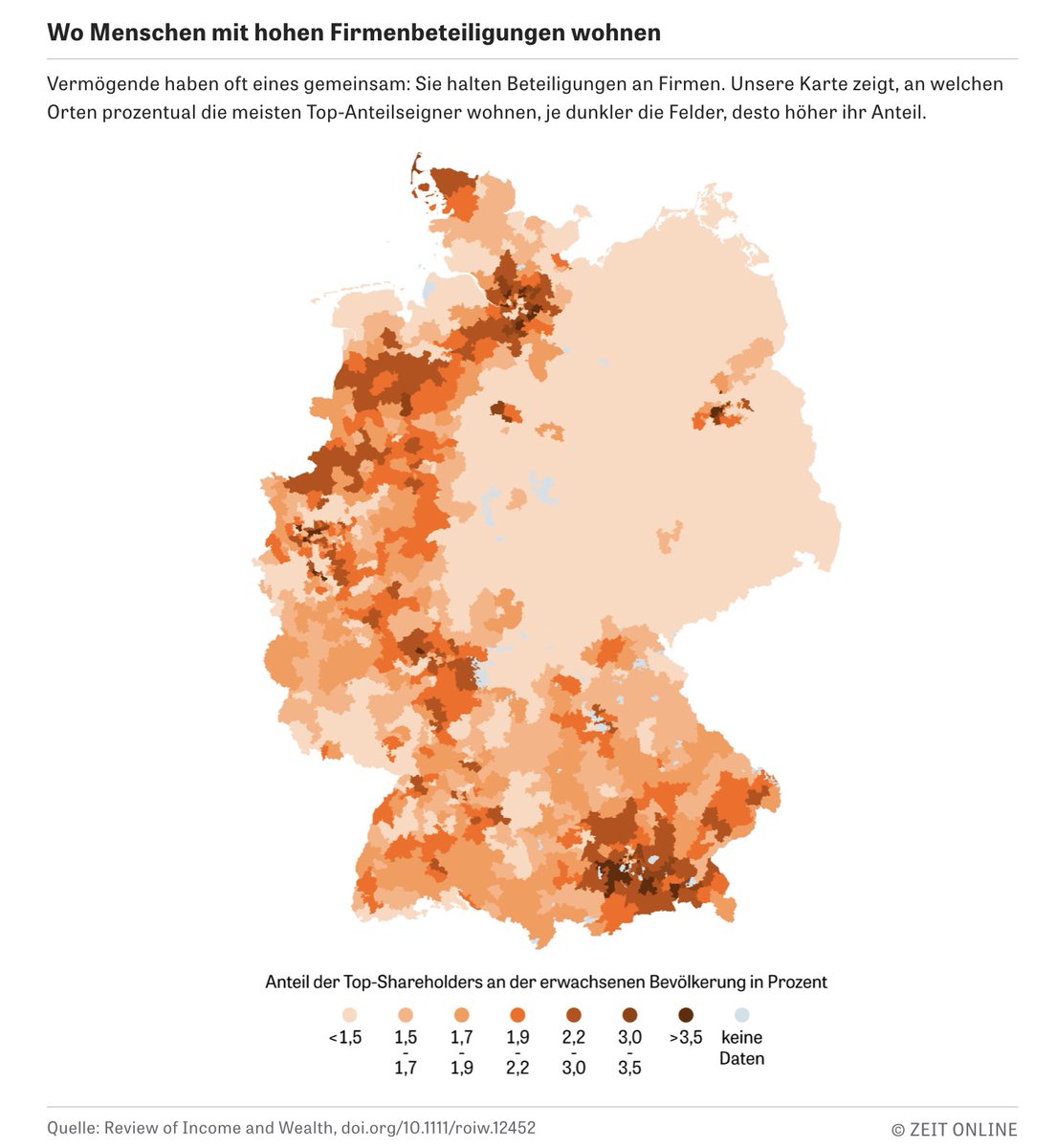

Facts on wealth in Germany #8:

Wealth is distributed very unequally geographically within Germany – as this graph shows for equity ownership of companies.

This graph comes from the excellent reporting by @zeitonline on our new study on wealth in Germany.

Wealth is distributed very unequally geographically within Germany – as this graph shows for equity ownership of companies.

This graph comes from the excellent reporting by @zeitonline on our new study on wealth in Germany.

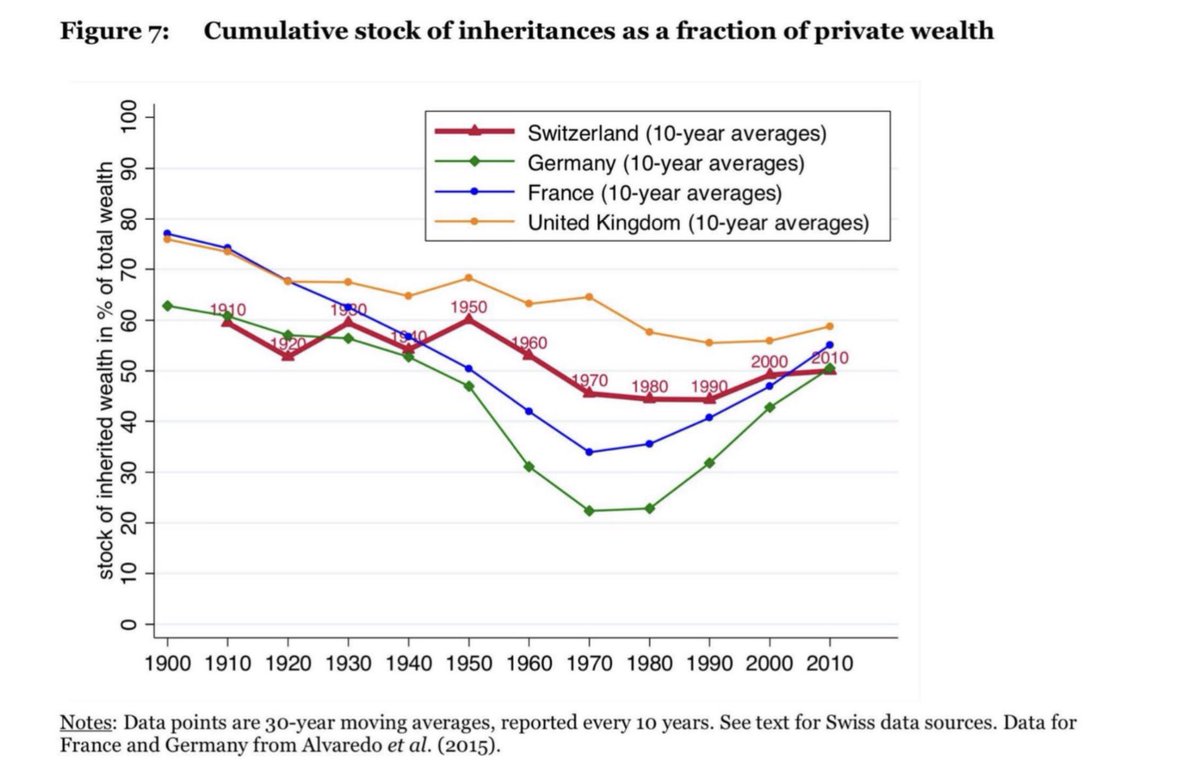

Facts on wealth in Germany #9:

More than 50% of wealth in Germany has been acquired through inheritance, not through one’s own work.

Most of those 38% being lucky enough to receive an inheritance are well educated and have a relatively high income.

http://www.hec.unil.ch/mbrulhar/papers/BrulhartDupertuisMoreau.pdf">https://www.hec.unil.ch/mbrulhar/...

More than 50% of wealth in Germany has been acquired through inheritance, not through one’s own work.

Most of those 38% being lucky enough to receive an inheritance are well educated and have a relatively high income.

http://www.hec.unil.ch/mbrulhar/papers/BrulhartDupertuisMoreau.pdf">https://www.hec.unil.ch/mbrulhar/...

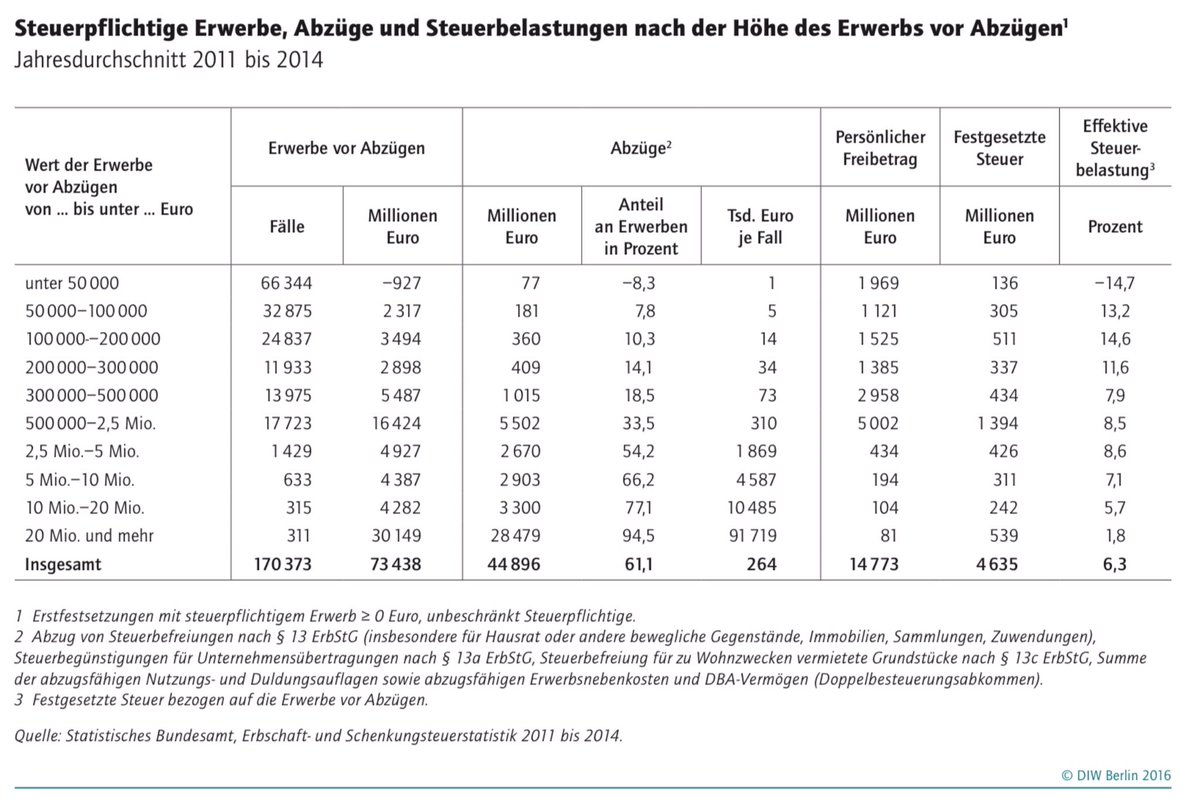

Facts on wealth in Germany #10:

Germans inheriting more than €20 million pay on average 1.8% in inheritance taxes.

Germans inheriting less than €500,000 pay on average 12% in inheritance taxes.

@gabriel_zucman @EDerenoncourt

https://www.diw.de/documents/publikationen/73/diw_01.c.524690.de/16-3-1.pdf">https://www.diw.de/documents...

Germans inheriting more than €20 million pay on average 1.8% in inheritance taxes.

Germans inheriting less than €500,000 pay on average 12% in inheritance taxes.

@gabriel_zucman @EDerenoncourt

https://www.diw.de/documents/publikationen/73/diw_01.c.524690.de/16-3-1.pdf">https://www.diw.de/documents...

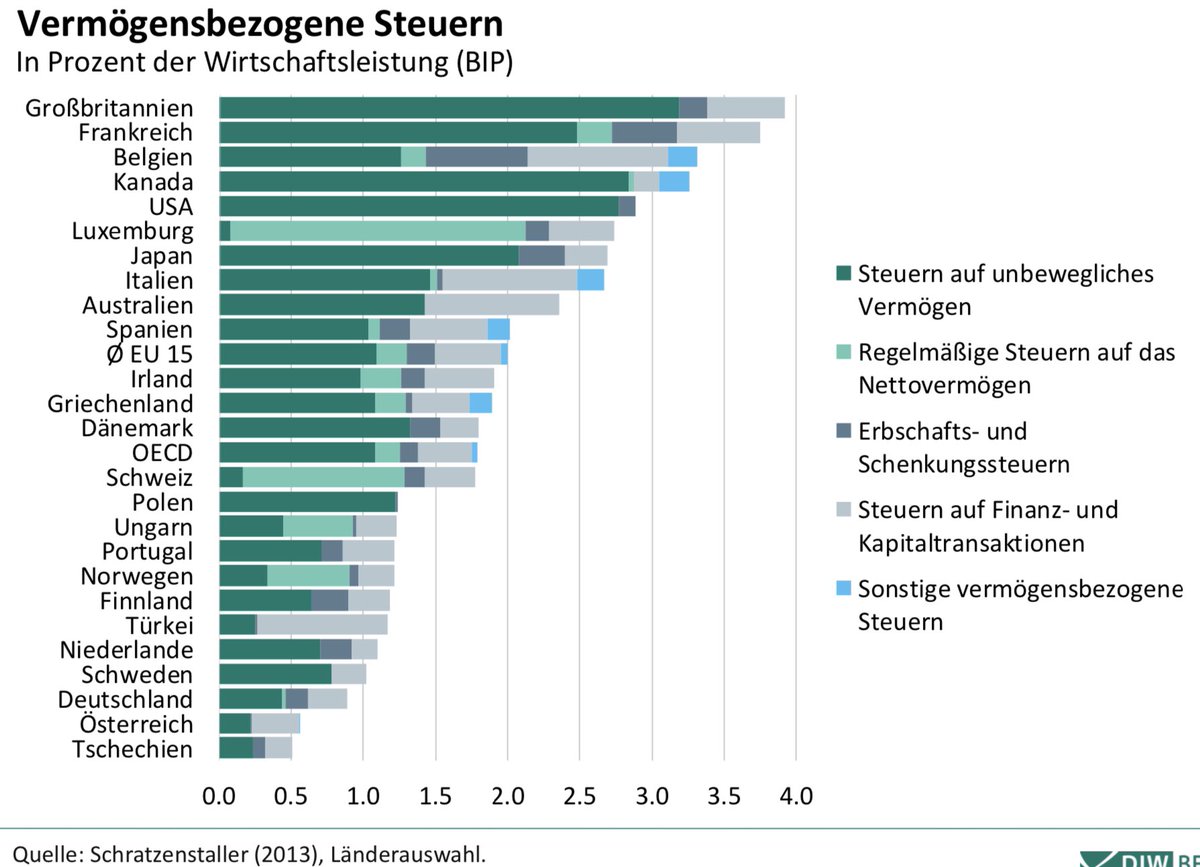

Facts on wealth in Germany #11:

Hardly any country has higher taxes on labour income and lower taxes on (income on) wealth than Germany.

Germany has about one quarter of the revenues from wealth-related taxes compared to the US, UK and France.

Hardly any country has higher taxes on labour income and lower taxes on (income on) wealth than Germany.

Germany has about one quarter of the revenues from wealth-related taxes compared to the US, UK and France.

Facts on wealth in Germany #12:

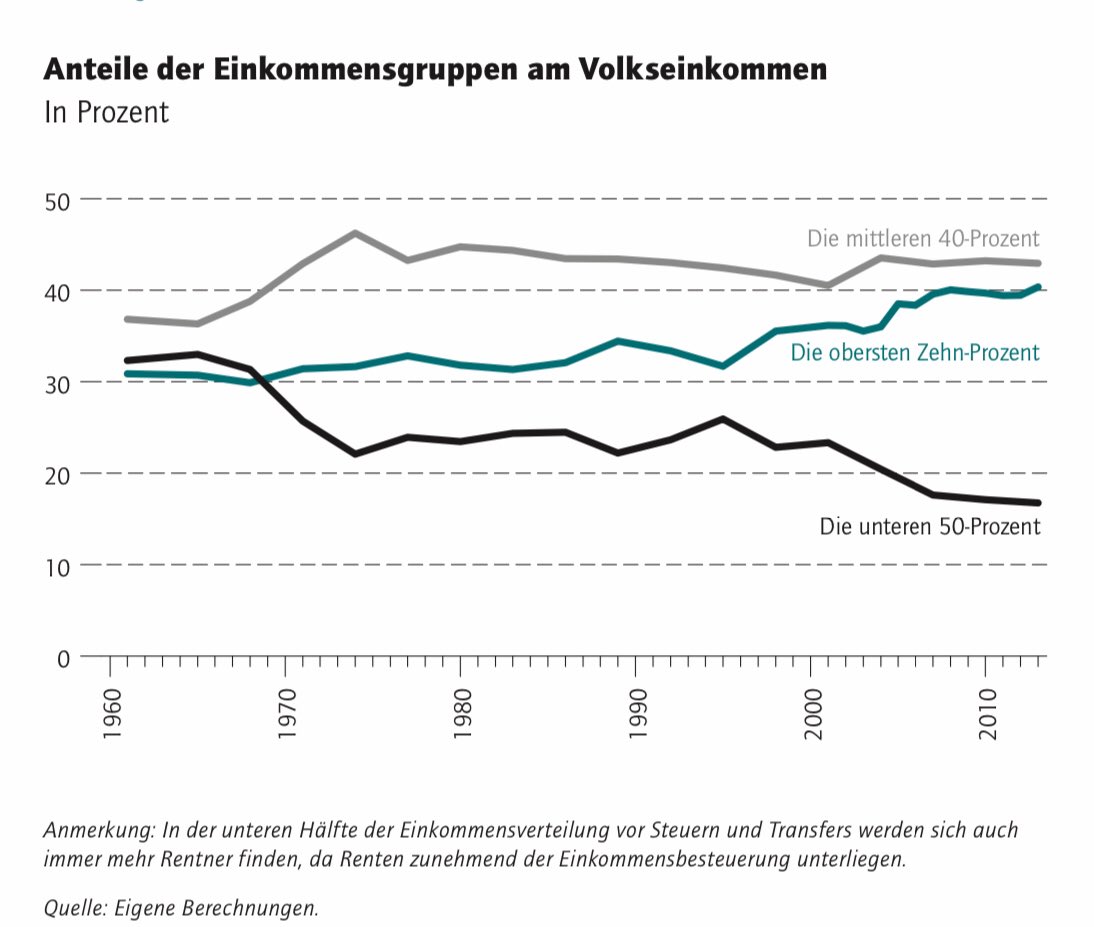

The share of income going to the bottom 50% in Germany has declined from 33% in the 1960s to 17% today.

The increase in income inequality is an important reason for the rise in wealth inequality.

@PikettyLeMonde

Study by my colleague C Bartels:

The share of income going to the bottom 50% in Germany has declined from 33% in the 1960s to 17% today.

The increase in income inequality is an important reason for the rise in wealth inequality.

@PikettyLeMonde

Study by my colleague C Bartels:

Facts on wealth in Germany #13:

Millionaires have a significantly higher life satisfaction (esp. with regard to work, family, health).

As a consolation to all the others: millionaires seem to have less fun – they are less satisfied with their leisure time.

@JustinWolfers G-SOEP

Millionaires have a significantly higher life satisfaction (esp. with regard to work, family, health).

As a consolation to all the others: millionaires seem to have less fun – they are less satisfied with their leisure time.

@JustinWolfers G-SOEP

Implications for the political debate on wealth in Germany:

1. High wealth is not necessarily unjust or economically inefficient. In Germany there is an unusually large share of wealth in the form of company ownership, especially mid-sized, family run firms (“Mittelstand”).

1. High wealth is not necessarily unjust or economically inefficient. In Germany there is an unusually large share of wealth in the form of company ownership, especially mid-sized, family run firms (“Mittelstand”).

2. The main problem from an economic/positive perspective is that more than half of all private wealth has been inherited and has not be created through one’s own efforts and work.

3. Germany’s tax system is highly inefficient, as labour income is taxed very strongly and wealth hardly at all, thus creating distortions and disincentives.

4. The key problem is that almost one out of three citizens in Germany has no wealth/savings, thus limiting their own autonomy and making them highly dependent on the social welfare state.

5. Germany has a very strong social welfare state, making it less urgent for people to acquire savings. But caution: claims on social welfare (including public pensions) are not wealth. And they provide little help in a crisis, such as this pandemic.

6. Most citizens in Germany have no savings, not because they voluntarily choose to do so, but because they have a low labour income. Germany has one of the largest low-wage sectors in Europe (21% of workers earn less than 60% of the median).

7. A top political priority should be to help people with low and medium incomes to build up savings. Higher wages and higher net income from labour, incentives to save and a more efficient tax system should be three key priorities.

Read on Twitter

Read on Twitter