1/X) Being cynical for a moment, HMT might see the issue with low earners in net pay schemes as a Trojan Horse.

The call for evidence reads as though requiring DC schemes to move to RAS is the policy frontrunner. Why might HMT like that?

The call for evidence reads as though requiring DC schemes to move to RAS is the policy frontrunner. Why might HMT like that?

2/X) First, while the current tax regime stays in place, some 40% taxpayers moved to RAS may fail to claim their full relief. This could more than outweigh the cost of extra tax relief for non-taxpayers.

3/X) Second, it means the apparatus would be there to move from marginal rate relief to a flat top-up for all DC employer contributions. (Doing this for employer contributions, which account for the majority of relief, would need more work but could follow the same template.)

4/X) This could also pave the way for an acceleration of revenues via a T+EE system -you just make the flat rate top-up smaller in return for not charging tax on the way out.

5/X) They talk about making the RAS shift for DC only. Starting to separate the DB and DC regimes makes it easier to change the latter fundamentally w/o reopening public sector remuneration.

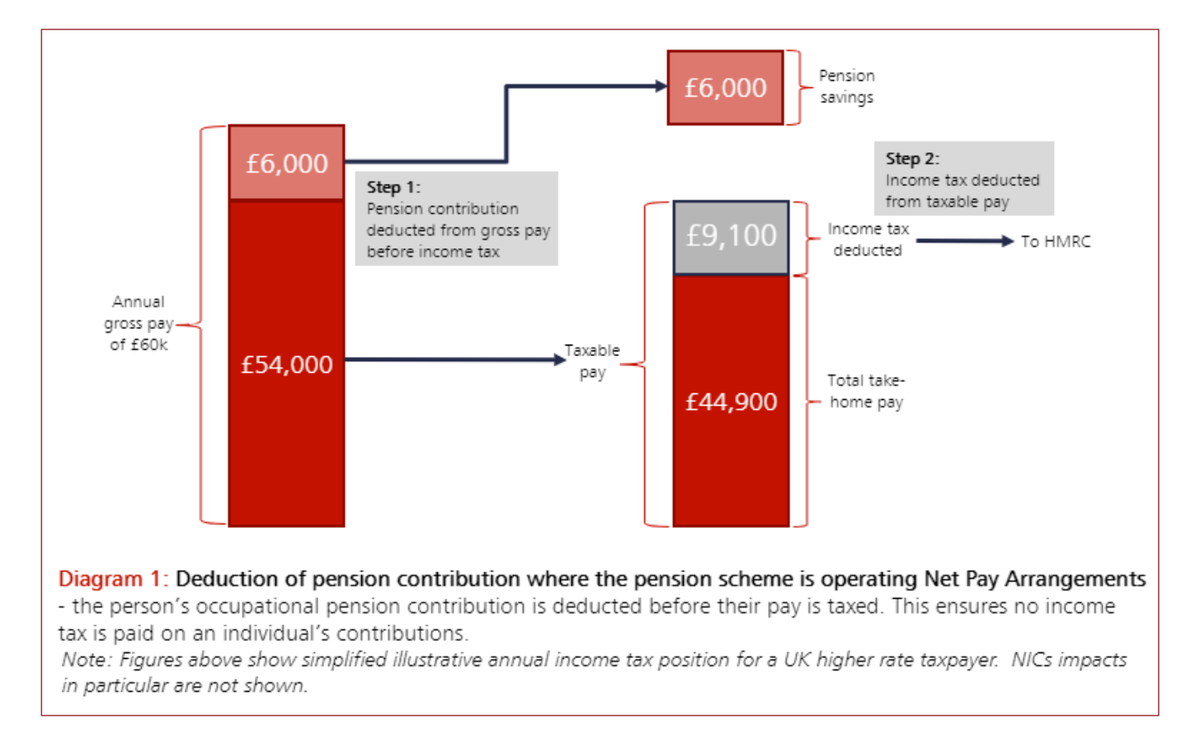

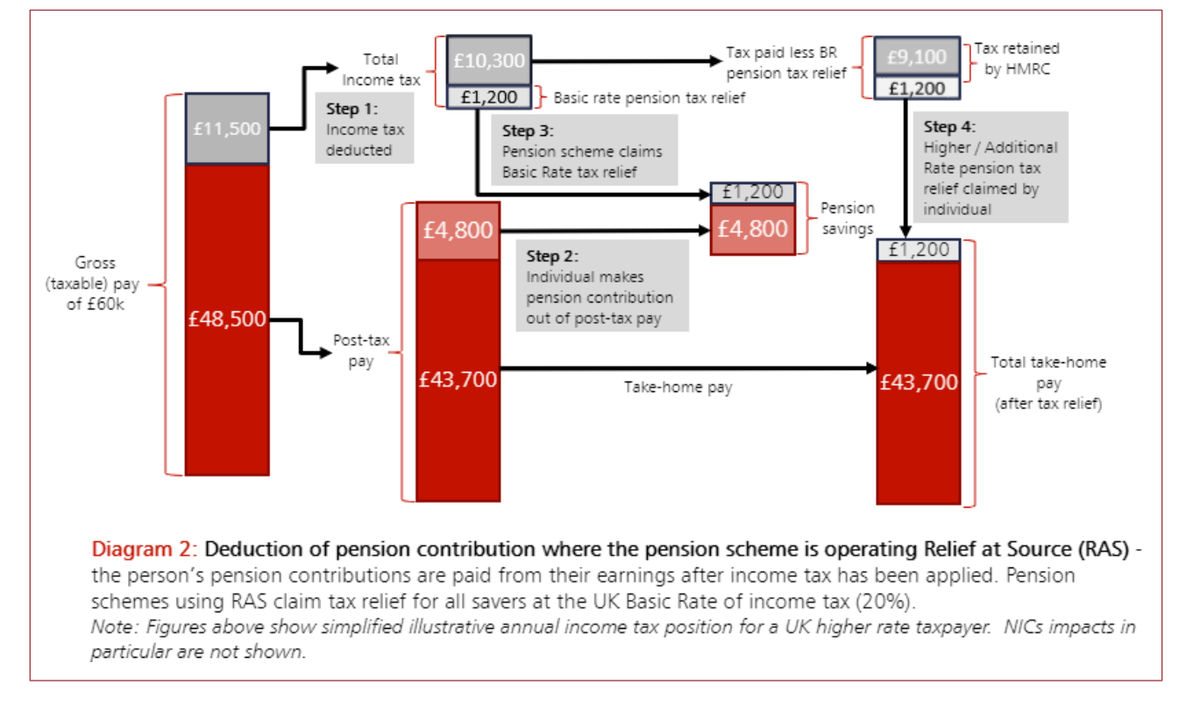

6/6) In the meantime, higher rate taxpayers would move from the simple system in HMT& #39;s 1st diagram to the complex system in its 2nd diagram.

Sorry - spotted a typo in the 3rd tweet in this thread. It should say the apparatus would be there to move to a flat top-up on *employee* contributions, with more work needed for *employer* contributions to follow a similar template. Apologies.

Read on Twitter

Read on Twitter