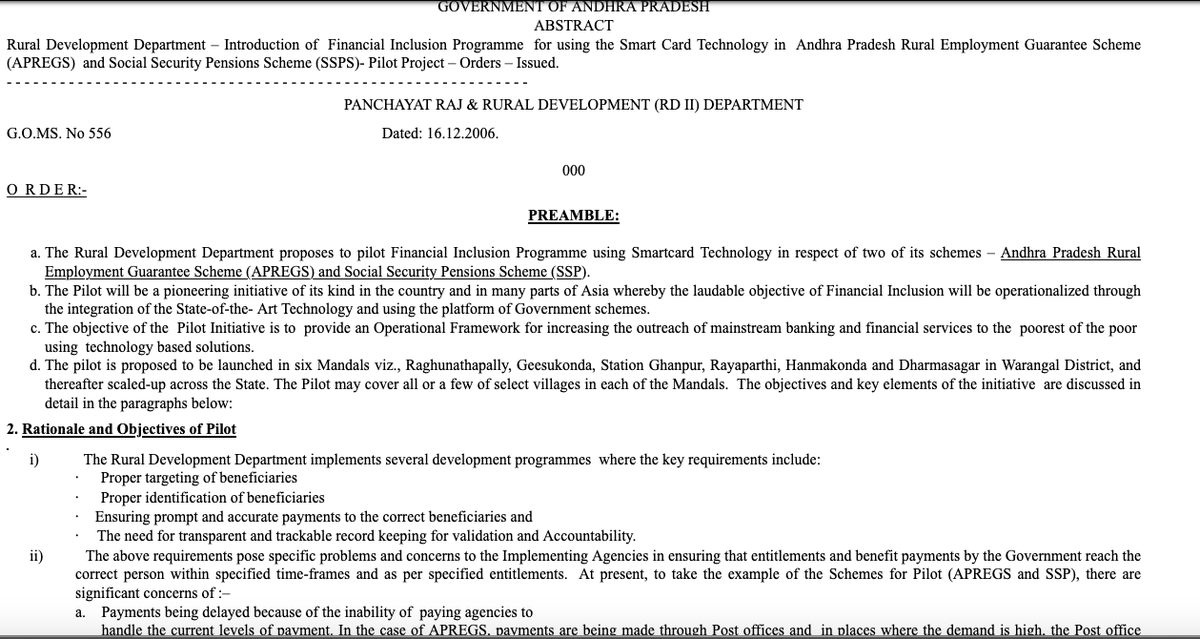

Thread on origins of bio-metrics in banking and subsidy delivery with Electronic Banking System in Andhra Pradesh in 2006. This is about the AP smart card project. This is the true origin of biometrics with #Aadhaar & Direct Benefit Transfer System.

https://web.archive.org/web/20071208194644/http://www.rd.ap.gov.in:80/GOs/smartcard_go556_161206.htm">https://web.archive.org/web/20071...

https://web.archive.org/web/20071208194644/http://www.rd.ap.gov.in:80/GOs/smartcard_go556_161206.htm">https://web.archive.org/web/20071...

The idea around DBT primarily comes with the whole Financial Inclusion Initiatives being promoted by government. But the usage of bio-metrics though happened with this smart card project in Andhra Pradesh. The project was a pilot which & it identified few cores areas.

Since the pilot was for NREGA work payments, identification of work payments was required. So it all centered around identity. Biometrics with smart cards was decided to be used. Reason for this according to me is the already existing SCOSTA card standard https://www.scosta.gov.in/ ">https://www.scosta.gov.in/">...

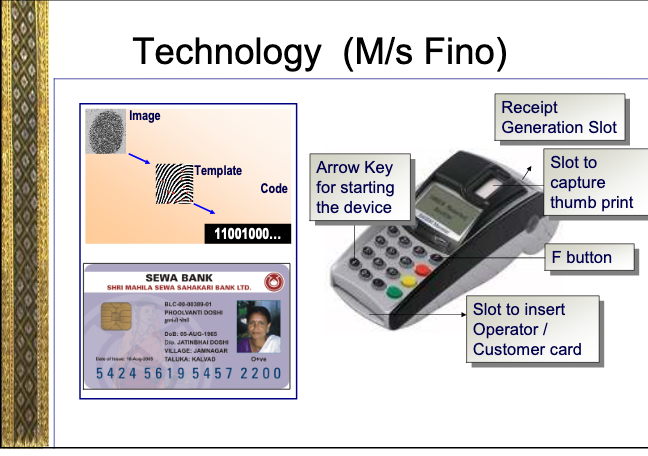

The business correspondence model was recommended to be used by RBI for Financial Inclusion. Institute for Development and Research in Banking Technology (IDRBT) was tasked with development of the technology to implement the scheme. Banks obviously were responsible to manage BCs

One of the main Business Correspondents to implement this and supply technology was M/S FINO. It was FINO which had the technology to supply these biometric authentication devices and smart card. Later when Aadhaar project came, they became part of its ecosystem.

With the requirement of biometrics usage for Financial Inclusion & Andhra Pradesh project. @RBI appointed committed in March 2007 to look at IT based solutions for financial inclusion. It was this committee which brought bio-metric standards in payments.

https://www.rbi.org.in/Scripts/bs_viewcontent.aspx?Id=1103">https://www.rbi.org.in/Scripts/b...

https://www.rbi.org.in/Scripts/bs_viewcontent.aspx?Id=1103">https://www.rbi.org.in/Scripts/b...

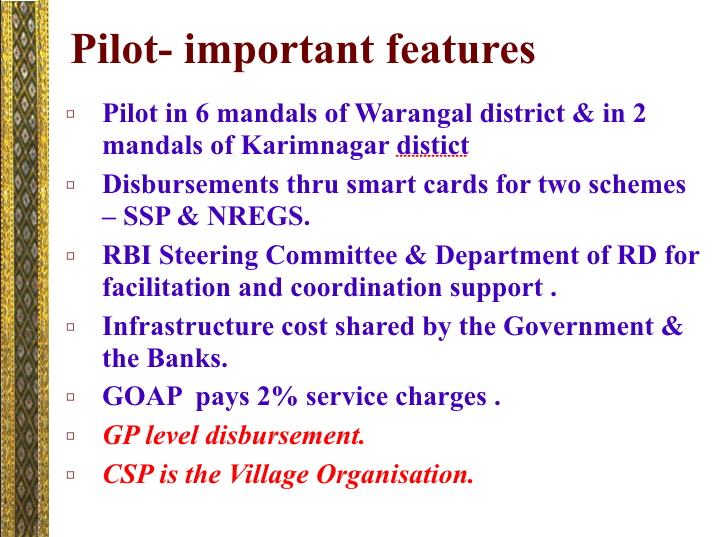

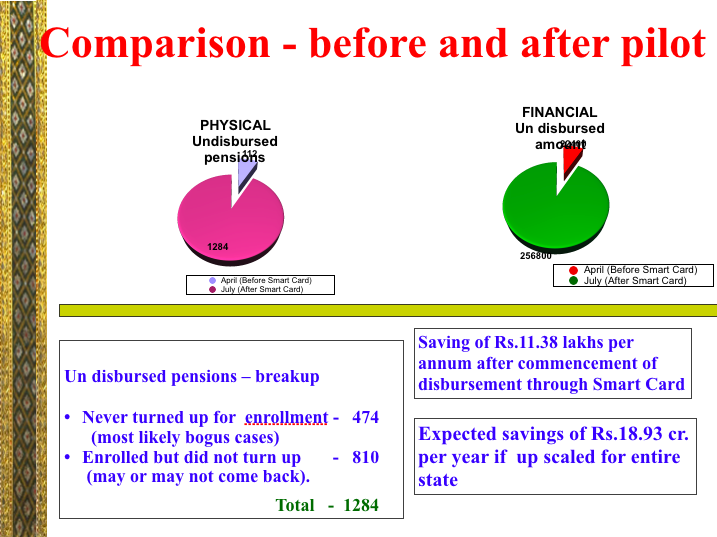

This entire project was new for banks and even by AP govt. So @RBI was monitoring the pilot and you have AP govt pitching how great their solution was in finding duplicate accounts and saving money.

https://web.archive.org/web/20101203045436/http://www.rd.ap.gov.in/SmartCard/RBI.pps">https://web.archive.org/web/20101...

https://web.archive.org/web/20101203045436/http://www.rd.ap.gov.in/SmartCard/RBI.pps">https://web.archive.org/web/20101...

This whole savings claims in AP & use of bio-metrics to find duplicates thus became part of @RBI Report of the Committee on Suggesting a Framework for Electronic Benefit Transfer in 2008. This is where the first requirement of de-duplication system pops up

https://www.rbi.org.in/Scripts/bs_viewcontent.aspx?Id=1267">https://www.rbi.org.in/Scripts/b...

https://www.rbi.org.in/Scripts/bs_viewcontent.aspx?Id=1267">https://www.rbi.org.in/Scripts/b...

The AP smart card project was reviewed by National Institute of Smart Governance. They made recommendations on Technology Architecture and Business Processes.

https://web.archive.org/web/20170309231039/http://rd.ap.gov.in:80/SmartCard/SmartCard_Pilot_Evaluation_By_NISG.pdf">https://web.archive.org/web/20170...

https://web.archive.org/web/20170309231039/http://rd.ap.gov.in:80/SmartCard/SmartCard_Pilot_Evaluation_By_NISG.pdf">https://web.archive.org/web/20170...

All of this was way before the formation of @UIDAI & Nandan Nilekani heading it. Most of the technical decisions were pre-made & all nilekani did was market this to everyone in the country and expand it everywhere in the name of Financial Inclusion.

I will be reviewing all of these documents and evaluation papers tomorrow over a discussion. If you want to know more or ask me questions, join. https://hasgeek.com/kaarana/roots-of-direct-benefit-transfer-program/">https://hasgeek.com/kaarana/r...

Read on Twitter

Read on Twitter