The #EUCO deal is a mixed bag. The Recovery Instrument is nothing short of a historic step. But the MFF is mediocre and a missed chance. And the eternal rule has been confirmed: Unanimity is poison.

My take on last night& #39;s season finale:

My take on last night& #39;s season finale:

1/ First things first: This weekend was an important milestone in the history of European integration. One should be careful with such hyperbolic statements, but here, it is justified. For the first time, the Union will be allowed to borrow in the markets to fund EU expenditure.

2/ And we are not talking symbolic amounts but triple-digit billion euros. When @COdendahl, @GrundSebastian and I proposed this in early April, we were told that this was legally impossible and politically outlandish. We tended to agree on the latter. Yet, here we are.

3/ The core of the Recovery Instrument, the RRF, has survived the cutting orgy. It will substantially contribute both politically and economically to a stronger recovery, in particular in countries like  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇮🇹" title="Flagge von Italien" aria-label="Emoji: Flagge von Italien">. See below approximate allocations as per the deal and latest forecasts.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇮🇹" title="Flagge von Italien" aria-label="Emoji: Flagge von Italien">. See below approximate allocations as per the deal and latest forecasts.

4/ #EUCO has done its best to make the governance of the RRF miserable. There is a veiled veto in the disbursement phase of the funds (though not for the approval of the plans) and has massively strengthened the role of member states vis-à-vis the Commission. EP, your turn.

5/ The RI has been shrunk exclusively by cutting MFF top-ups (see below). In addition, we get a whopping 360bn in possible additional loans that I doubt will be used much as they can only be tapped via the RRF. Still, this is almost half of the ESM& #39;s firepower in loans.

6/ So on the RI, the glass is more than half full. We do not get a permanent fiscal capacity (yet). But this establishes the precedent that substantial borrowing is a permissible means to fund EU expenditure. And all member states agreed to this.

7/But there is a dark side of this deal: The MFF. Its size means that the Brexit gap is exclusively compensated through cuts in expenditure, not by additional revenue. At a time when expectations towards the EU to deliver all kinds of things continuously increase, this is a joke.

8/ The very modest modernization attempts by the @EU_Commission have failed again. Even when factoring in the RI, expenditure for Heading 1, innovation, is lower than it was in February and much lower than the Commission had proposed in 2018.

CAP and cohesion win, as always.

CAP and cohesion win, as always.

9/ This was a disaster in the making since 2018. The large net payers incl.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇩🇪" title="Flagge von Deutschland" aria-label="Emoji: Flagge von Deutschland"> deserve a lot of the blame as they focused the conversation from the start on volume rather than substance. But also other member states showed no willingness to let go off old funding structures.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇩🇪" title="Flagge von Deutschland" aria-label="Emoji: Flagge von Deutschland"> deserve a lot of the blame as they focused the conversation from the start on volume rather than substance. But also other member states showed no willingness to let go off old funding structures.

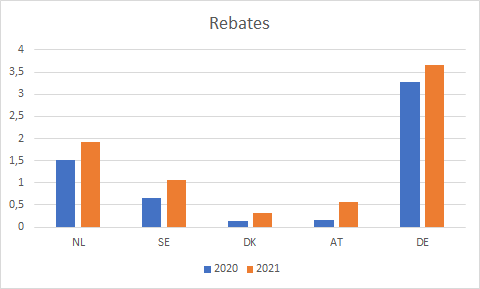

10/ On the revenue side, besides the plastic levy, there is no genuine new own resource. Instead of phasing out the rebates, they increase strongly. Rebates are per se not a bad tool to settle things at the end - but this is too much and a big liability for the next round.

11/ On rule of law, the decision on a mechanism is postponed to whenever. Of course MFF unanimity is to blame - but this also reflects a wider uncertainty on how to properly deal with the subject in all kinds of policy areas. Money is just no exception here.

12/ So now the ball is in the court of the EP. From their perspective, this deal is bad: On the RI side, no role in RRF governance. On the MFF, almost everything goes against the EP position, from size to composition to rule of law.

13/ The EP will now have to decide whether to oppose this deal on a broad front, and potentially risking a substantial delay for both MFF and RI, or to focus on a few essential items like RRF governance and own resources, thus sacrificing a lot of their positions. Tough call.

14/ The #EUCO did what it always does. It produced a messy compromise that cannot make anyone truly happy. But at least on the Recovery Instrument, it did the job. And now we should think hard and long how to get a better result seven years from now. It would be worth it.

Read on Twitter

Read on Twitter . See below approximate allocations as per the deal and latest forecasts." title="3/ The core of the Recovery Instrument, the RRF, has survived the cutting orgy. It will substantially contribute both politically and economically to a stronger recovery, in particular in countries like https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇮🇹" title="Flagge von Italien" aria-label="Emoji: Flagge von Italien">. See below approximate allocations as per the deal and latest forecasts." class="img-responsive" style="max-width:100%;"/>

. See below approximate allocations as per the deal and latest forecasts." title="3/ The core of the Recovery Instrument, the RRF, has survived the cutting orgy. It will substantially contribute both politically and economically to a stronger recovery, in particular in countries like https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇮🇹" title="Flagge von Italien" aria-label="Emoji: Flagge von Italien">. See below approximate allocations as per the deal and latest forecasts." class="img-responsive" style="max-width:100%;"/>