So a friend was asking me why I am in favour of NGDP targeting, so here is my take.

If there is a prism through which I think about public policy generally, it is this: "Do the real thing". Identify as narrowly as possible the outcome you want to change, and change it as directly as possible.

So what is the "real thing" of macro-economic stabilisation? It is "make the economy operate at full capacity all the time". We want to produce as much real goods and services as we can. That is the real thing.

A necessary (but not sufficient) condition for being at full productive capacity is being at full employment. What does full employment looks like? It looks like employment reaching a low stable base and staying there.

A successful macro stabilisation regime gets us to full employment and we spend most of our time there, with temporary deviations for recessions and other shocks. Unemployment should barely change at full employment as its controlled by slow moving structural factors.

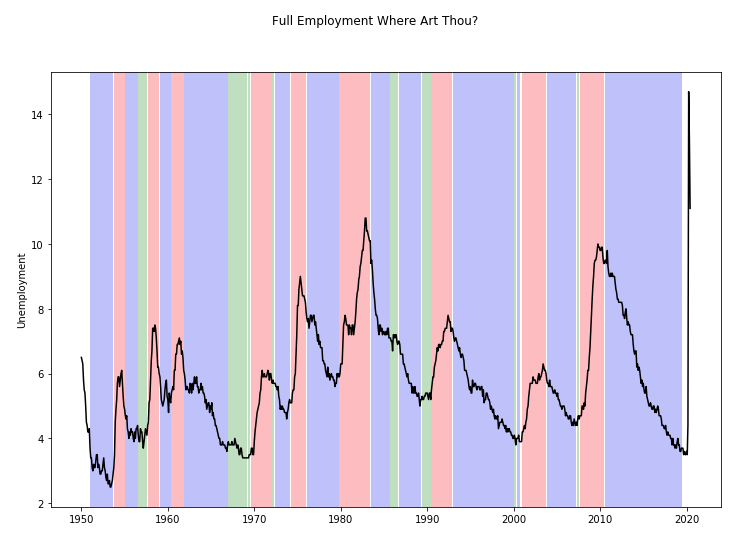

So the graph below has in green candidate periods for full employment, - periods where the unemployment rate changed by less than 0.25% in a year (with some smoothing of regimes cause data is noisy). Red is getting worse, blue is unemployment falling, green is potentially at FE.

The US has barely ever been at full employment, and not at all since ~1990. In the decade from the GFC to covid we never once approached full employment. Let that sink in. We have consistently failed at macro-economic stabilisation for thirty years.

Its time for a change. We need to move monetary policy to a significantly more aggressive equilibrium all the time. There are a couple of ways to do this:

1) Switch to price level targeting to force CBs to make up for past mistakes.

2) Raise the inflation target.

3) NGDPLT.

1) Switch to price level targeting to force CBs to make up for past mistakes.

2) Raise the inflation target.

3) NGDPLT.

I would vote for any of these. Any of these would see unemployment decline faster between recessions on average due to higher aggregate demand paths. Aggregate demand (the total spending in the economy) is the real thing. NGDP directly targets the thing we want to effect.

Inflation targeting only works as a proxy for aggregate demand, because we believe that if people are increasing prices, then demand exceeds supply and we are eroding capacity. Why not just target demand? This is the Real Thing.

But the broader reason we should be changing MP regime is because the current one has been a failure. We have simply not been at full productive capacity for any extended period in thirty years. Not even once. Central banks need to take this truth on board.

When we understand that the great moderation was a policy failure, we will be ready to have an honest conversation about how to change central bank goals. Too many, especially insiders, see the great moderation as a success. It was not.

Read on Twitter

Read on Twitter