Good morning everyone! Our event will be starting shortly and we will be live tweeting the discussion.

@ronan_wifi introduces the discussion and asks how actions inplemented now will serve to build our long-term future

COVID19 has been an unprecedented economic shock, says @Isabel_Schnabel and now requires a structural change to the economy, also exposes harmful impacts of previous trends such as denial of science

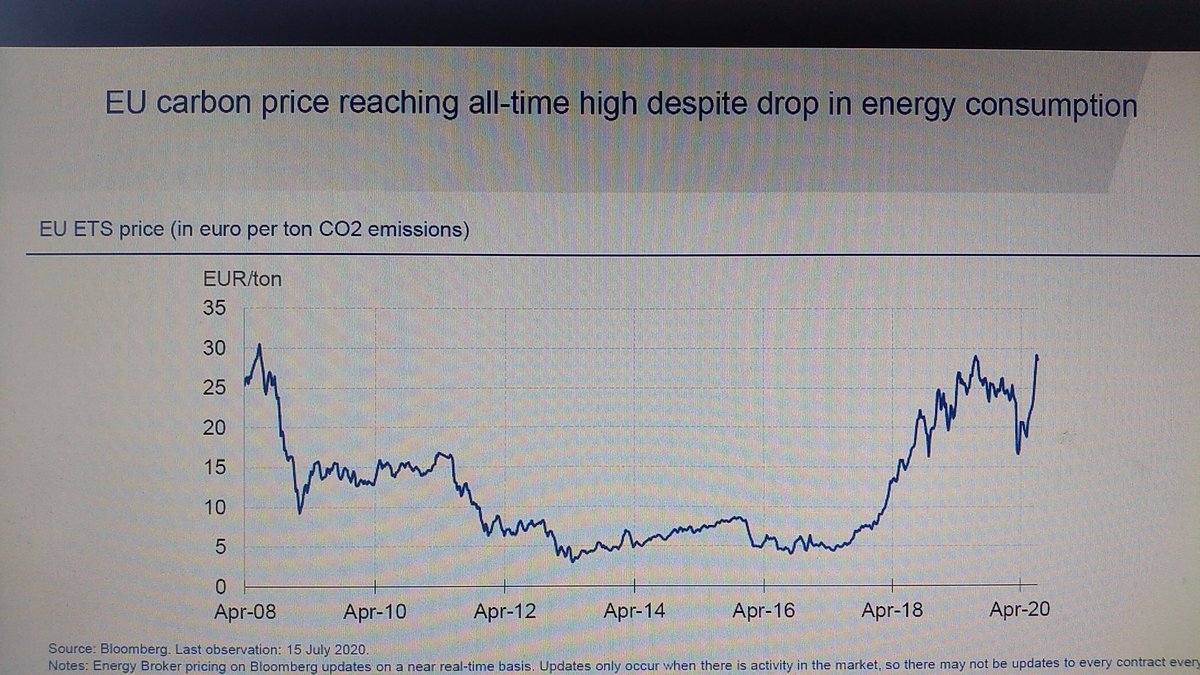

. @ecb says climate is well within the mandate of central bank action. Carbon pricing is one key pillar of action, prices are surging despite unprecedented fall in emissions.

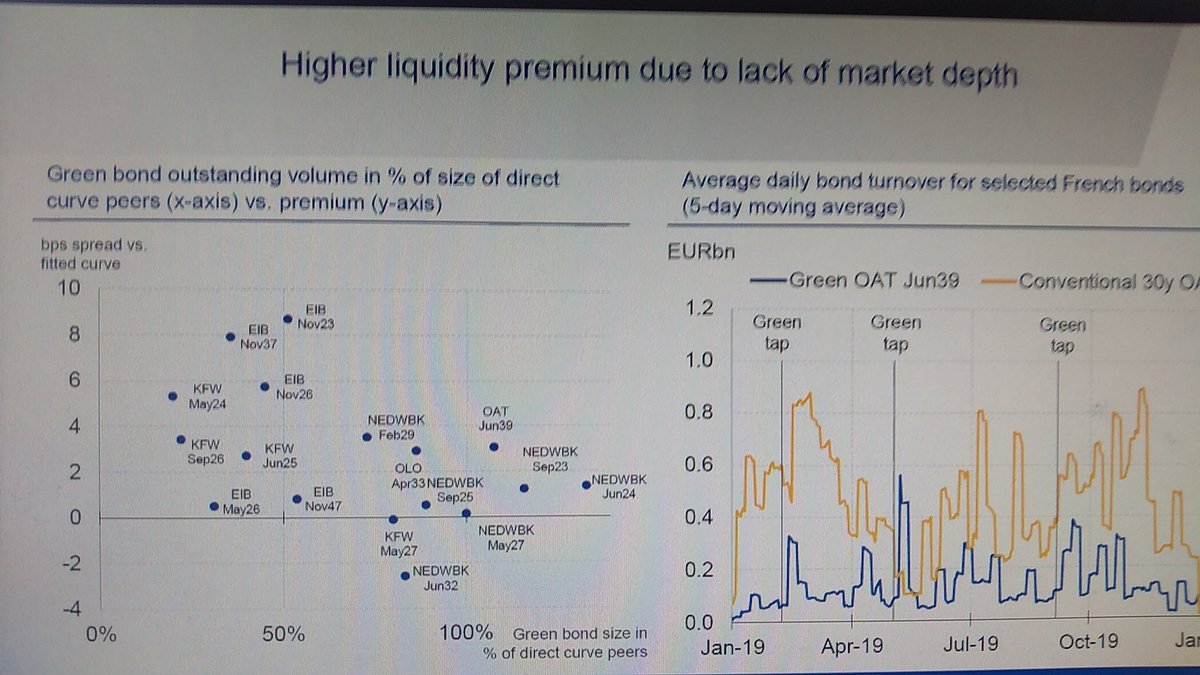

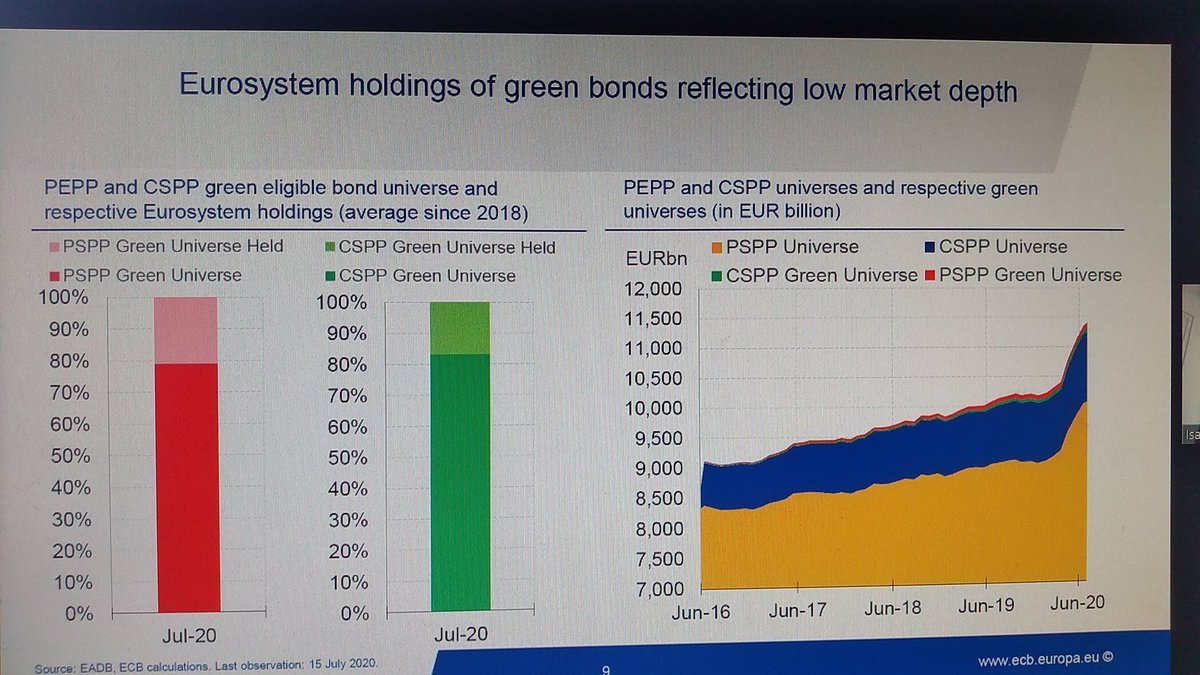

Low-carbon businesses need more support says @Isabel_Schnabel and green financial markets need to grow and become more liquid. Stock markets more effective than bond markets to finance green industries.

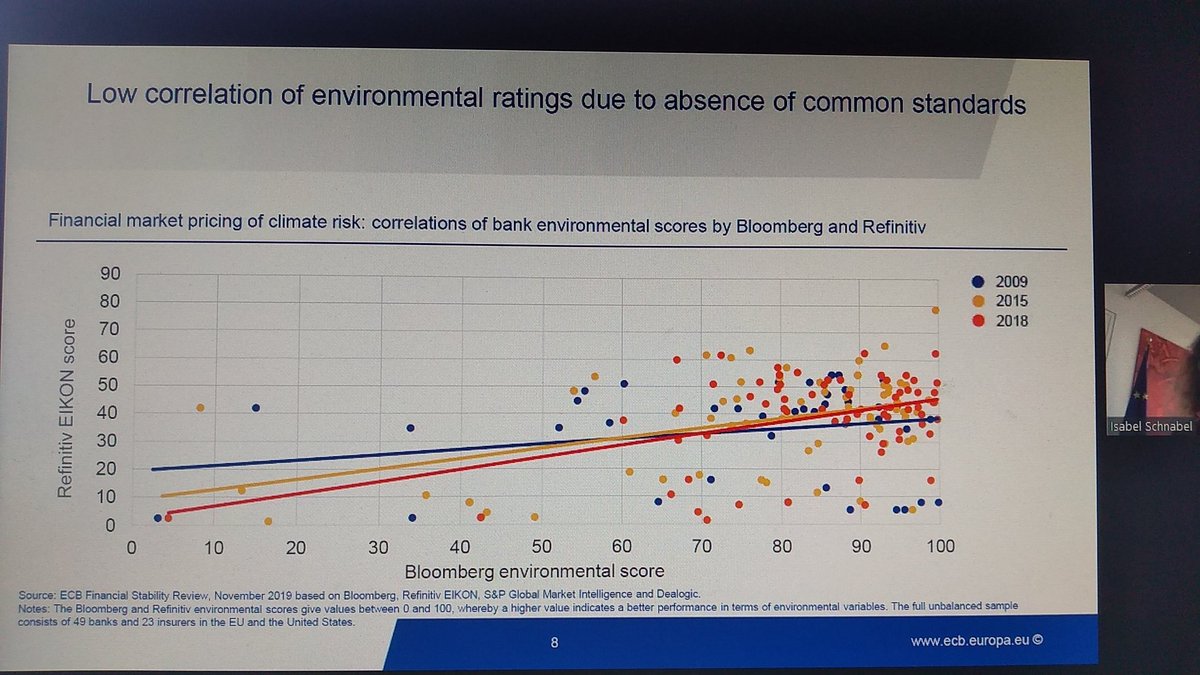

Climate reporting should be mandatory to provide more granular and reliable data to market, says @Isabel_Schnabel. This will help support the ability of central banks to deal with crises, alongside fiscal policy.

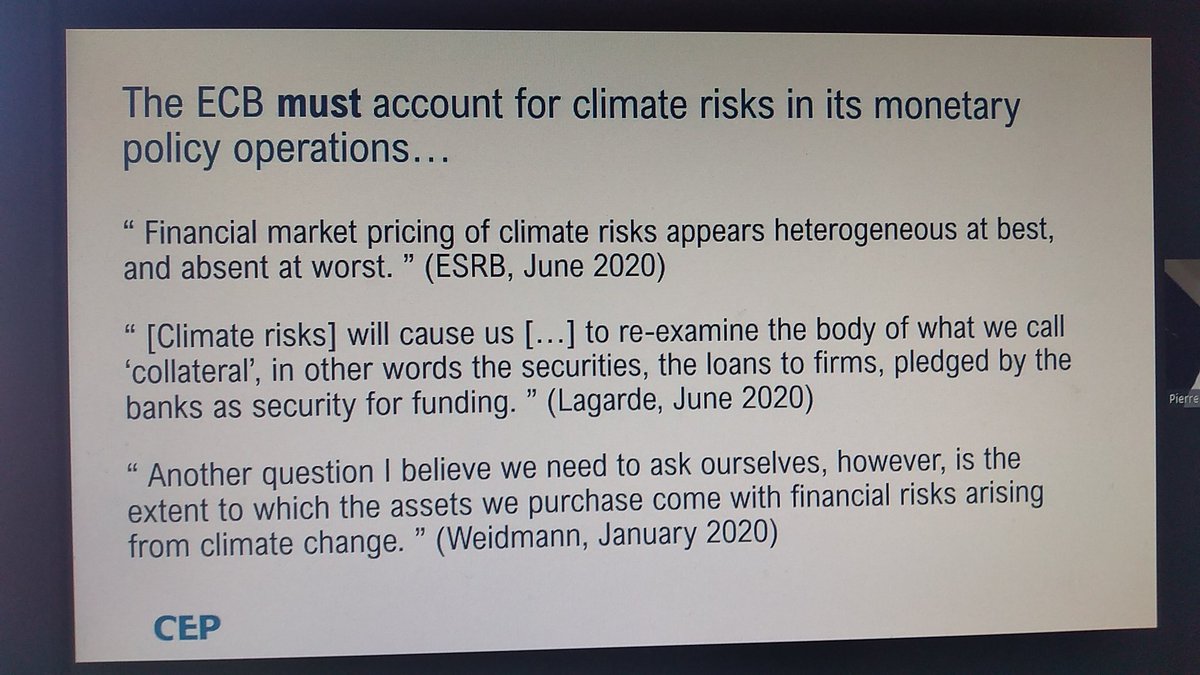

Should @ecb green asset purchases and collateral framework? This question features prominently in bank policy review and is hard-fought. The current crisis shows that rapid and large-scale action is necessary in the face of a crisis. The ECB will be no bystander in this journey.

Turning now to Sabine Mauderer, @bundesbank. Both COVID and climate change bring substantial financial risk and it is in the interest of central banks to act on this. Understanding risk is key for resilience.

Sabine Mauderer: how can we create standards for credit ratings agencies, which are key to banks& #39; own operations and risk exposure? Central banks should consider only purchasing securities from banks which have disclosed and manage their climate risk.

If strengthening climate disclosure rules is a burden, perhaps it is a necessary one, says Sabine Mauderer of @bundesbank, and high-carbon industries should be treated differently than others.

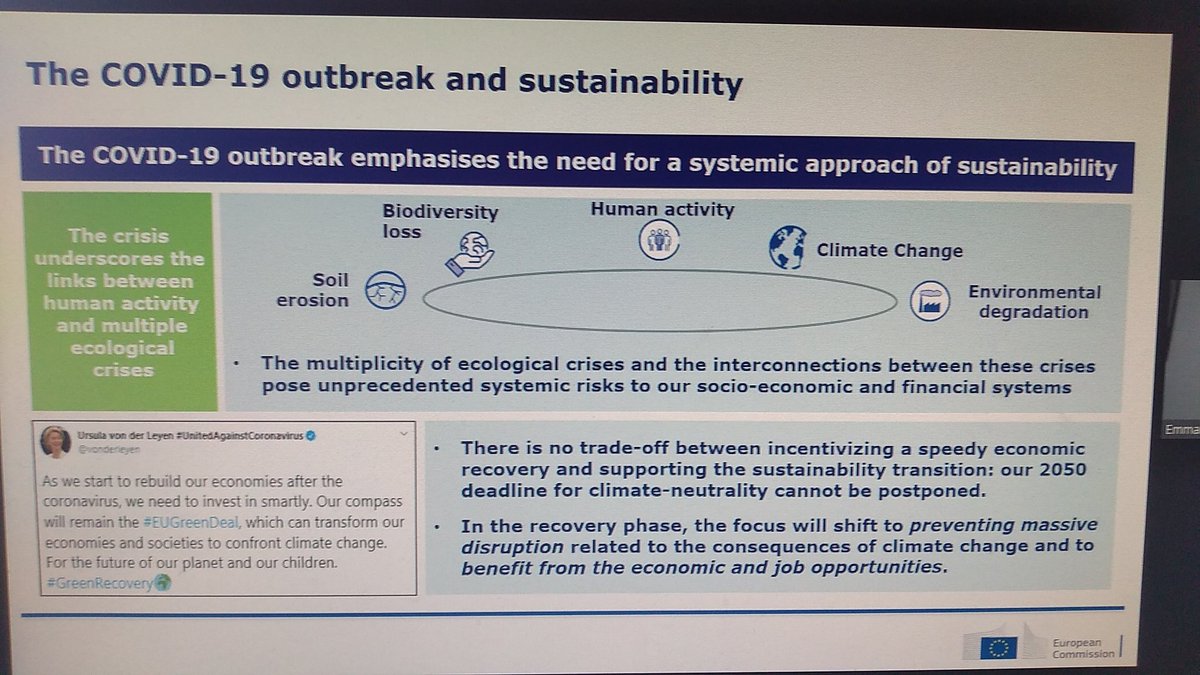

And now to Emmanuel Buttin of @EU_Finance... this is the biggest crisis since WWII and it is a sustainability-related crisis. A sustainable recovery is the only way to avoid massive disruption from climate change and have a resilient financial sector.

It is our collective duty to reach climate neutrality by 2050, bounce back better and build back better, says Emmanuel Buttin @EU_Finance. But the financial changes required are very large and need actions from all institutions.

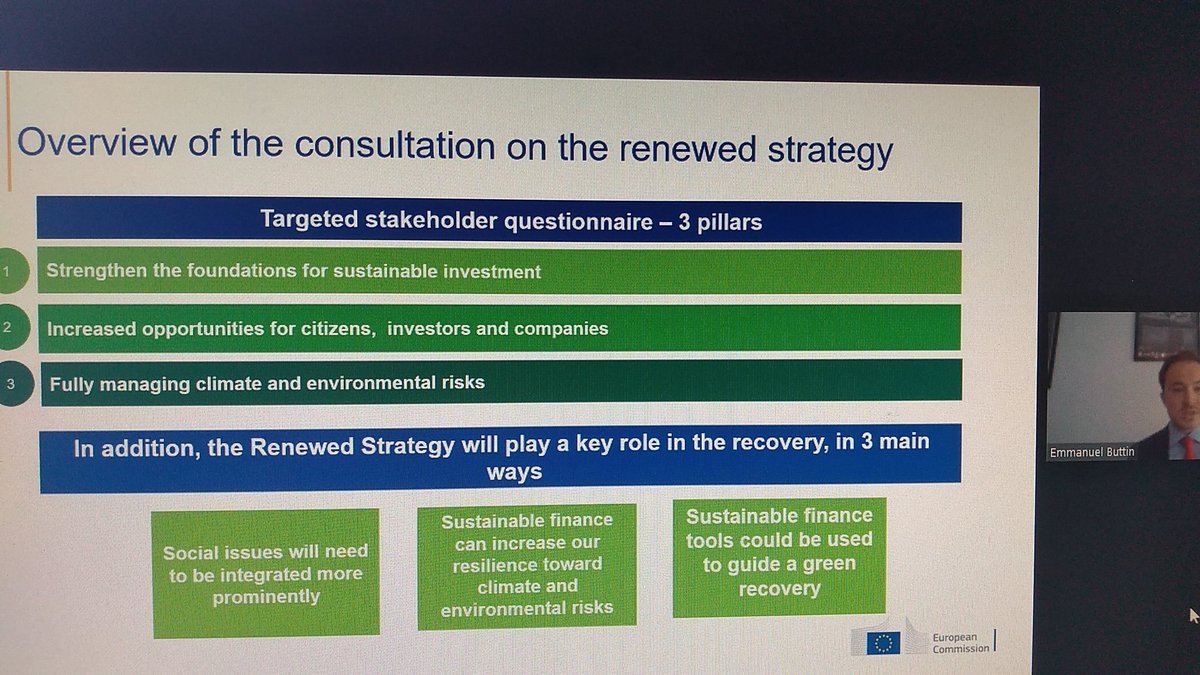

The Commission& #39;s Renewed Sustainable Finance Strategy consultation had 650 responses, 1/3 from individual citizens. It aims to create an enabling environment for rapid financial reform at all levels in support of COVID recovery.

Over now to @Pierre_Monnin of @CEPweb: to address climate change risk central banks need to act now because we are at a crucial decision point for the future warming trajectory of the world, and need a transition.

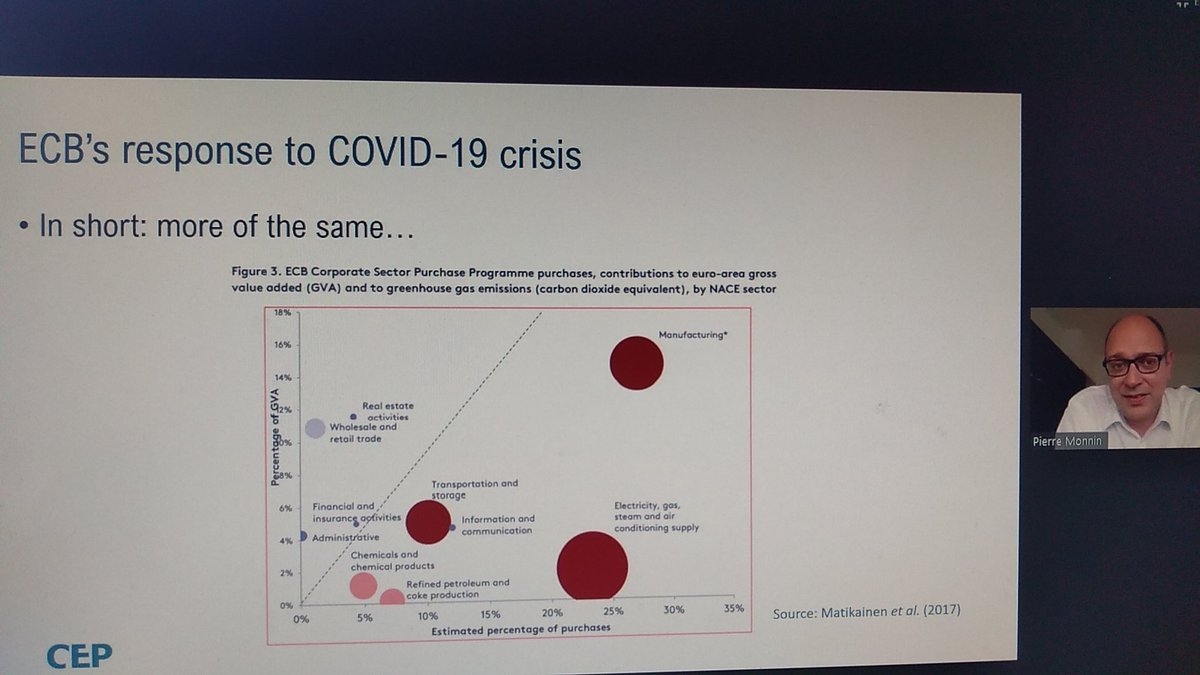

The ECB& #39;s asset purchase policies to date do not support a climate transition and are biased towards high-carbon sectors, reflecting the state of the market which does not price climate risk adequately, says @Pierre_Monnin

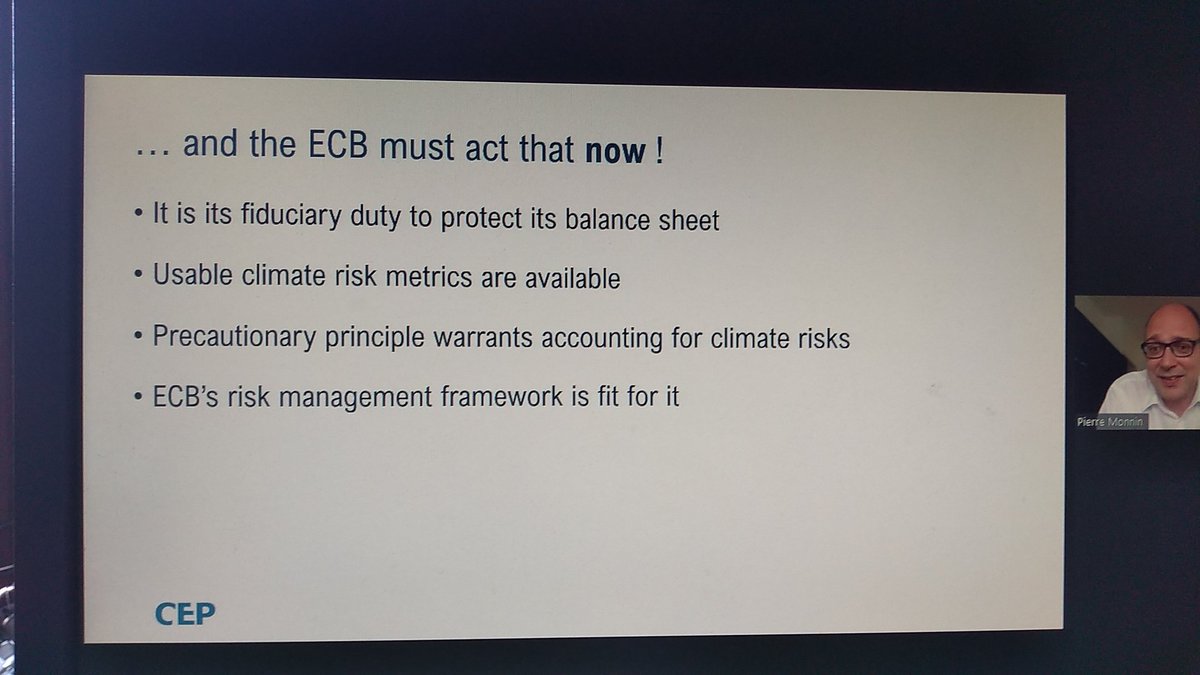

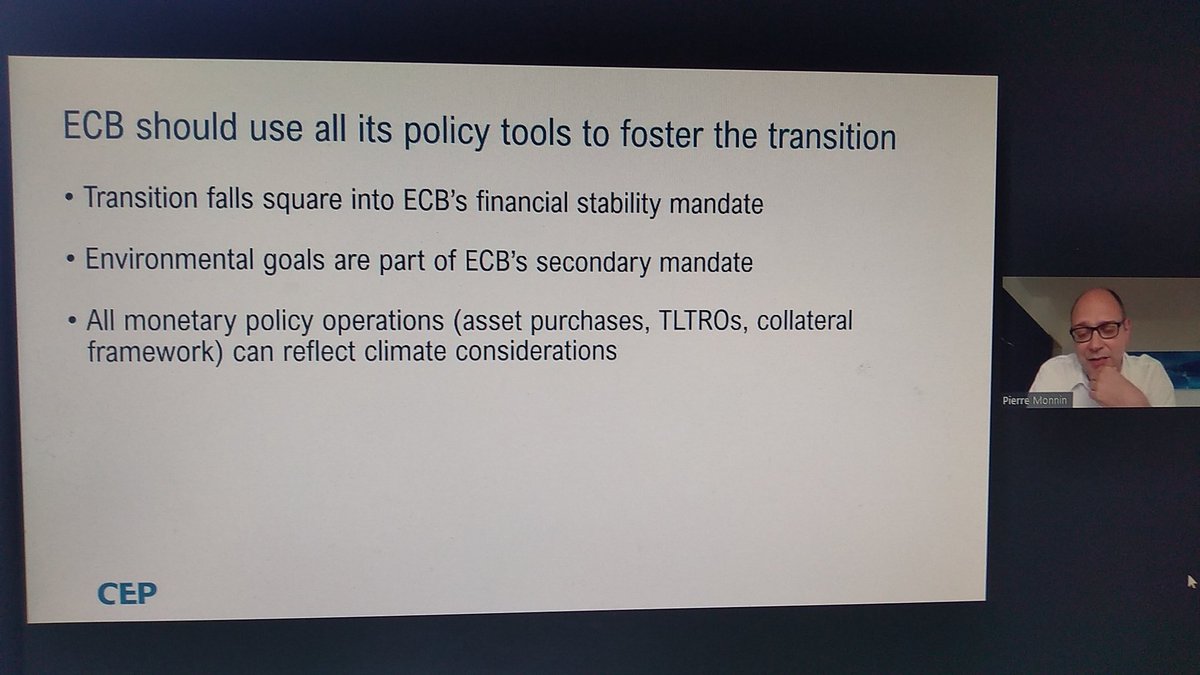

The @ecb must act now, says @Pierre_Monnin @CEPweb in line with its fiduciary duty. Usable risk metrics are available and there is no excuse for inaction. It should use all of its policy tools for an early and smooth climate transition.

We move to our final panellist, Thierry Philipponat of @forfinancewatch: he says that supporting unsustainable industries or worrying about sustainable debt is meaningless if the sustainability of the world is being traded off.

Finance is the enabler of climate change but also will be severely affected. We need forward-looking financial data, and climate stress tests, says Thierry Philipponat @forfinancewatch. Scenario analysis needs to address disruption risk, as well as transition and physical risk.

Central banks must act but so must policymakers and legislators, says Thierry Philipponat, @forfinancewatch. The next crisis could be much worse if climate risks not addressed. We need to use equity finance to support financial stability.

...and, we are back to @ronan_wifi who asks @Isabel_Schnabel to comment on the discussion. She says that it is encouraging that there is an emerging consensus around the role for central banks among many actors, and that global carbon pricing is now a priority.

There is no time for excuses, says @Isabel_Schnabel @ecb and she is sympathetic to many of the remarks made in today& #39;s discussion. The role of carbon pricing, in addition, is to support correct pricing of climate risks in the market.

Sabine Mauderer of @bundesbank highlights the urgency for action and calls for a move from the & #39;why& #39; to the & #39;how& #39;. We need information and we need to evaluate this information. At the @NGFS_ central banks are working to quantify the climate risk of every jurisdiction by end 2021.

Sabine Mauderer @bundesbank calls again for common standards for risk assessment by credit ratings agencies, together with clear disclosure rules.

Emmanuel Buttin @EU_Finance says that carbon pricing alone will not be sufficient, companies need clear guidance on how to transition e.g. via the EU taxonomy of sustainable economic activities, and there are potential roles for central banks here e.g. monetary policy.

The Commission will announce latest plans on disclosure early next week, says Emmanuel Buttin @EU_Finance and we need consolidation of standards. New Strategy will hopefully include new actions on credit ratings agencies.

Final word from Thierry Philipponat @forfinancewatch - we must take action now! And that& #39;s a wrap, @ronanwifi concludes the session. Thank you for reading and be sure to keep following our project and it& #39;s next outputs @e3g @CSF_SOAS @BennettInst @SEACENCentre @INSPIRE_sec

Read on Twitter

Read on Twitter