The coronavirus hasn’t stopped the world’s biggest asset bubble from getting bigger. In March, 288 apartments in a new Shenzhen development sold out in eight minutes. Important story on China& #39;s ever-inflating property bubble, by @yifanxie @Birdyword

https://on.wsj.com/32qXZVs ">https://on.wsj.com/32qXZVs&q...

https://on.wsj.com/32qXZVs ">https://on.wsj.com/32qXZVs&q...

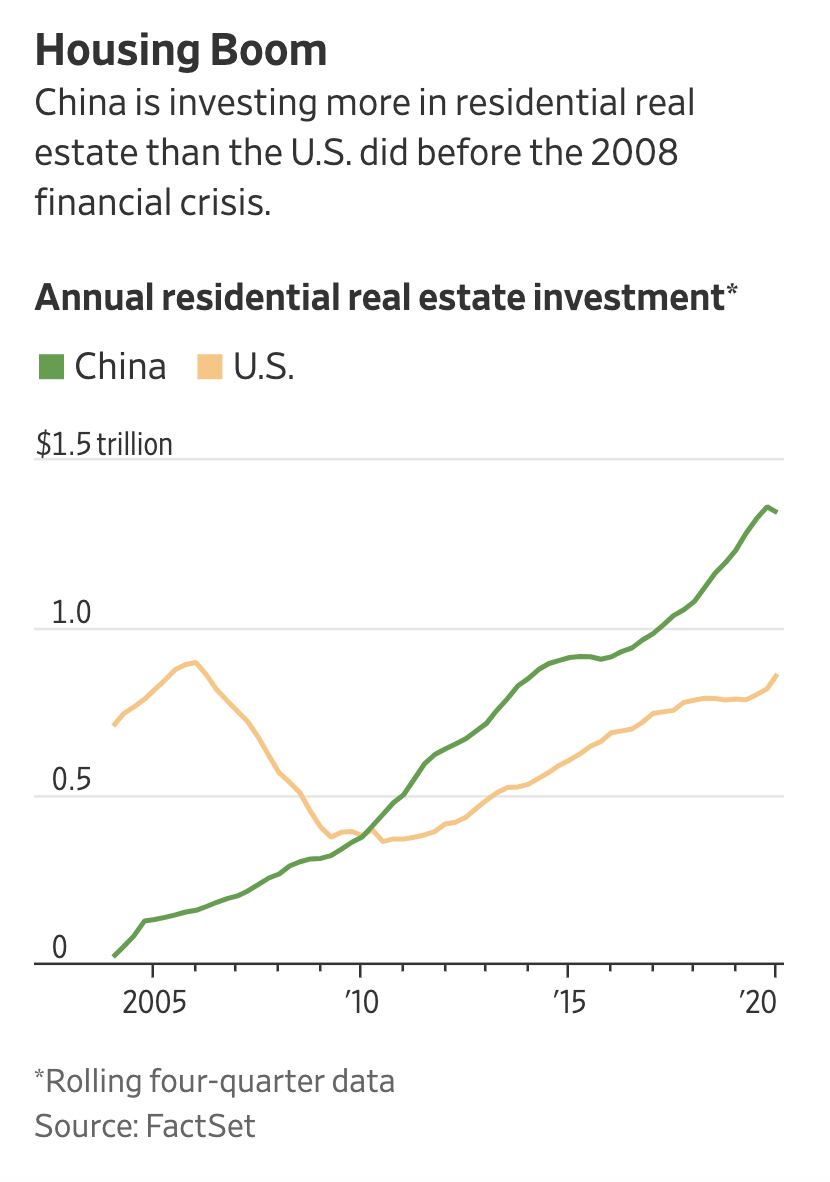

"At the peak of the U.S. property boom, about $900B a year was being invested in residential real estate. In the 12 months ending in June, about $1.4T was invested in Chinese housing. More was invested last month…than any other month on record." https://on.wsj.com/32qXZVs ">https://on.wsj.com/32qXZVs&q...

The total value of Chinese homes and developers’ inventory hit $52 trillion in 2019, according to Goldman Sachs, twice the size of the U.S. residential market and outstripping even the entire U.S. bond market.

@Birdyword @yifanxie https://on.wsj.com/32qXZVs ">https://on.wsj.com/32qXZVs&q...

@Birdyword @yifanxie https://on.wsj.com/32qXZVs ">https://on.wsj.com/32qXZVs&q...

"Buyers have figured out the government doesn’t appear to be willing to let the market fall. If home prices did drop significantly, it would wipe out most citizens’ primary source of wealth…& #39;Property has hijacked China’s economy.& #39;" https://on.wsj.com/32qXZVs ">https://on.wsj.com/32qXZVs&q...

No one is sure how China can manage the problem without destabilizing the economy. Even if the market stays strong, policy makers have had to hold off on more aggressive economic stimulus this year partly because of fears it will inflate housing further. https://on.wsj.com/32qXZVs ">https://on.wsj.com/32qXZVs&q...

In Tianjin, apartments in upscale areas sell for $836 a square foot, roughly the price an average buyer would pay in some of the most expensive parts of London, even though disposable incomes are seven times higher in London than Tianjin. https://on.wsj.com/32qXZVs ">https://on.wsj.com/32qXZVs&q...

Read on Twitter

Read on Twitter