In new #JPMCInstitute research https://institute.jpmorganchase.com/institute/research/labor-markets/unemployment-insurance-covid19-pandemic">https://institute.jpmorganchase.com/institute... we look at spending responses to $600 UI Supplement. BOTTOM LINE: UI is providing crucial spending support for the economy, and if we cut to zero on July 31, expect bad effects. Details in Thread:

Background: The CARES Act added a $600 weekly payment on top of regular state UI. In prior research, @p_ganong @pascaljnoel and I showed this leads to high replacement rates for many unemployed https://bfi.uchicago.edu/wp-content/uploads/BFI_WP_202062-1.pdf">https://bfi.uchicago.edu/wp-conten...

Unfortunately, many interpreted our study as a call to cut benefits. It was not! It was purely descriptive and made no policy recommendations, because at the time we hadn& #39;t yet measured effects of high replacement rates. So we didn& #39;t know the strength of pros and cons

The new #JPMCInstitute study starts to fill this gap and finds important benefits of the $600 payments for unemployed households and for the overall economy.

There’s lots of anecdotal evidence on effects of UI, but our study uses individual bank account data to perform what (I think) is the first systematic analysis of individual spending responses to UI policy during the pandemic.

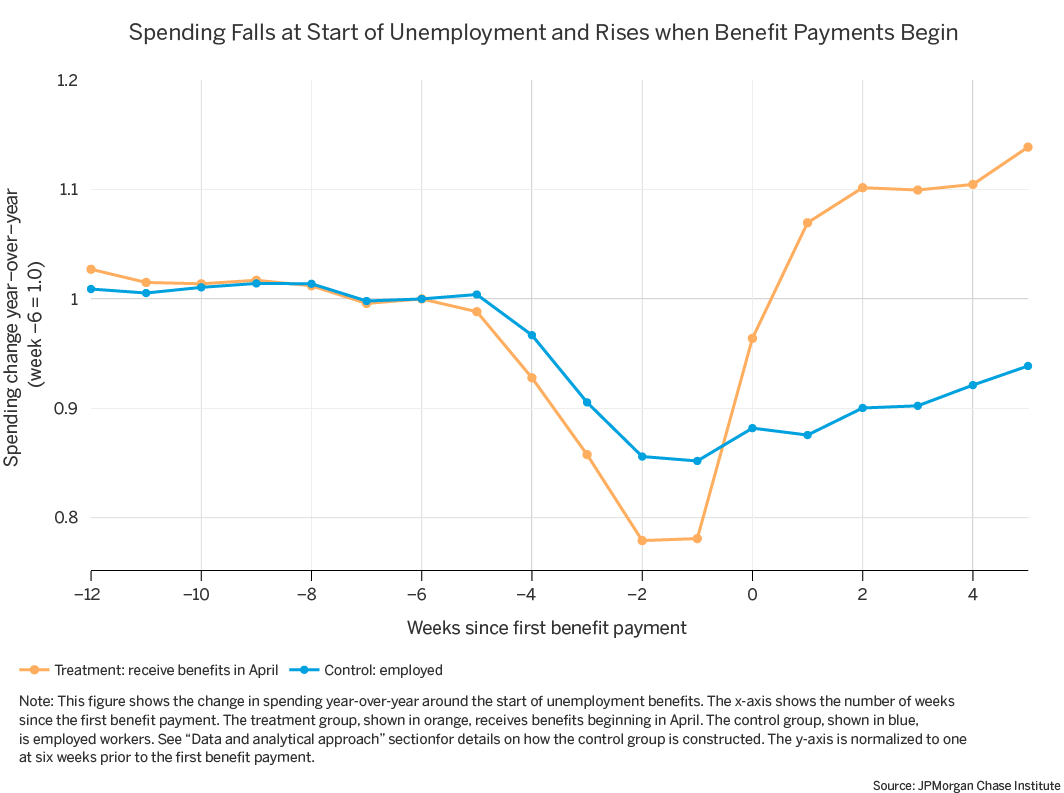

We find that prior to the receipt of UI benefits, unemployed households’ spending falls substantially relative to the employed… but when they start getting UI benefits, their spending rapidly recovers.

Our back-of-the-envelope calculation implies a weekly MPC of $0.73. This means $440 of the $600 supplement is spent in the first week it is received. This is spending that is helping unemployed survive the pandemic, and these $ then flow to businesses and help the overall economy

There are strong assumptions underlying this, and we hope to come up with more refined estimates in future work. But it means our best guess based on the data right now is if the $600 is cut to $0 in 2 weeks, we can expect unemployed households to cut spending by $440 a week.

There are around 30 million people getting $600 payments right now (Regular UI recipients + PUA ‘gig workers’ also get the $600). If they all reduce spending by $440 a week, that’s a decline in spend of $13 billion a week. That’s more than a 5% decline in PCE.

That’s a BIG drop. Definitely big enough to matter for macro. It’s bigger than the total drop in PCE during the Great Recession. Lots of uncertainty in our MPC numbers and this is a super simple PEQ extrapolation. But even if off by a factor of 2 or 3, it’s still a big spend cut.

(ht to @profsufi https://twitter.com/profsufi/status/1283786812989886464">https://twitter.com/profsufi/... but his calculation if anything understates benefits and resulting spending cuts since it doesn’t include PUA recipients who also get $600)

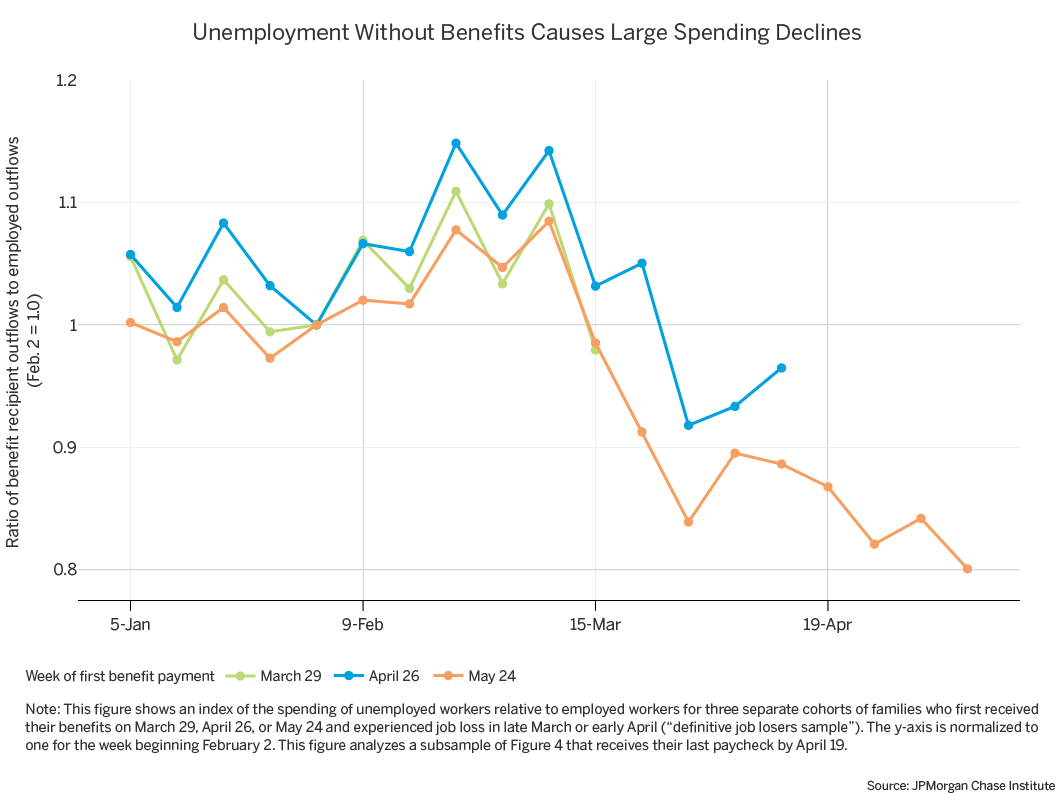

Another important finding from the JPMCI report: delays in getting benefits out really hurt the households who couldn’t get checks. Among households who lose their jobs at same time, we see big spending declines for those who get benefits later.

So we should better fund state UI agencies and invest in better IT infrastructure. Better IT, would also let us move from fixed payments to proportional payments. Proportional payments do a better job of getting money to households, without distorting incentives

Overall our research shows big positive spending effects of UI. This is likely providing a big benefit for the economy. Of course, we do not measure any labor supply disincentives of high replacement rates. But these are likely a reduced concern while the pandemic remains bad

We hope to explore this more in ongoing research, and see also this thread https://twitter.com/ernietedeschi/status/1283829018735910917">https://twitter.com/ernietede... by @ernietedeschi for some nice preliminary evidence consistent with small labor supply effects of high replacement rates (for now)

My view is that some form of continued UI benefits remain crucial, especially as the pandemic remains in force and unemployment remains high. I& #39;d really like to see the level of benefits tied to local economic conditions.

High UI payments make more sense when unemployment is high than when it is low.

Cutting benefits too early is a mistake, but leaving them too high for too long is also a mistake. So don’t constraint things to a fixed period of time. Set them to what you need for conditions on the ground.

Summarizing: If this $600 supplement goes to $0 in two weeks, we can expect spending cuts of $440 a week per unemployed household. And there are millions of unemployed households.

UI expansion is really boosting spending, so be wary of cutting it too fast.

Read on Twitter

Read on Twitter