1) DeFi is growing fast in this early ecosystem, and a robust, structured decentralized financial system is needed to deliver the next-generation financial system to the world. Here we have produced an industry report covering the first part- DEXs. @TokenInsight (Long Thread) https://twitter.com/TokenInsight/status/1283685464201809920">https://twitter.com/TokenInsi...

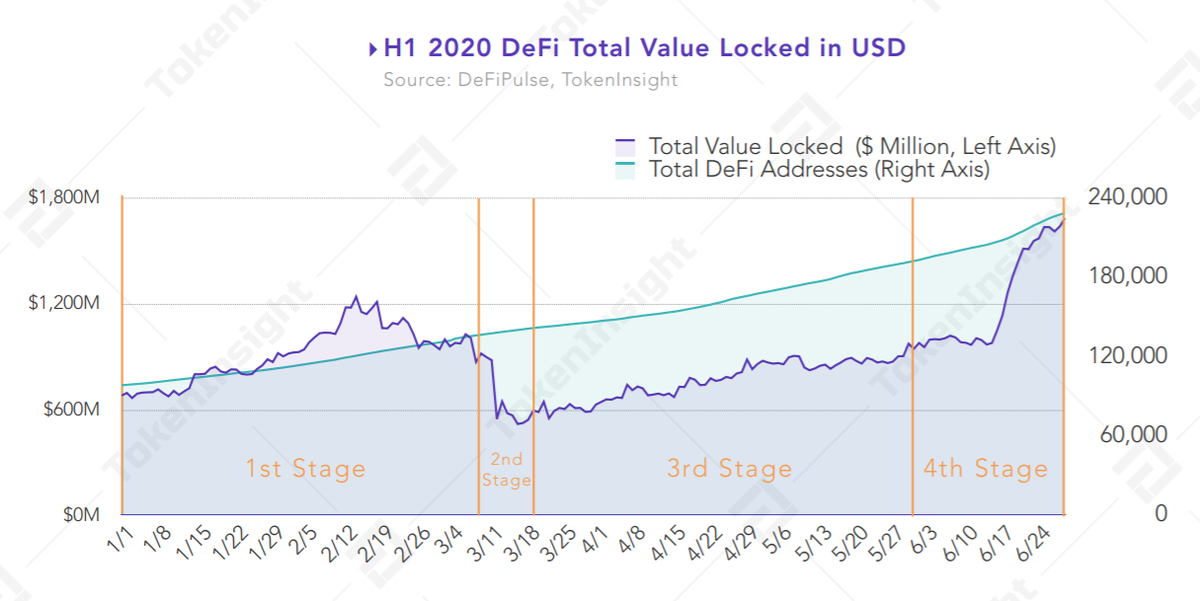

2) One of the most important metrics looking at the growth of DeFi is Total Value Locked in USD (TVL). The TVL has experienced dramatic increases from mid-June where it was hovering around 1 billion and jumped to more than 1.6 billion in just a matter of 2 weeks. @TokenInsight

3) The DeFi ecosystem experienced a significant downturn in mid-February from $1.2 billion in TVL to its recent lowest point of $500 million during the Black Thursday. Post-market crash, the TVL has been consistently increasing and shot up incentivised liquidity mining.

4) Throughout H1 2020, the amount of DeFi& #39;s TVL went through 4 major stages: 1. The growth phase from January to February 2020. TVL experienced a strong growth increased from $680 million reached its local peak at $1.2 billion, and then fluctuated around $1 billion. @TokenInsight

5) 2. Due to the impact of the global financial market downturn, the crypto Black Thursday market plunge resulting in the DeFi TVL fell off a cliff from $1 billion to its local low of $550 million. @TokenInsight

6) 3. The recovery of the cryptocurrency market post-Black Thursday helped the DeFi TVL value to regain its position. The TVL slowly recovered from the Black Thursday low of $500 million to roughly $900 million. @TokenInsight

7) 4. The explosive growth of the DeFi ecosystem due to the popularity of the incentivised liquidity mining (aka yield farming) in June 2020 combined with high lending interest rate attracted strong market interest in the industry and the TVL grew to more than $1.68 billion

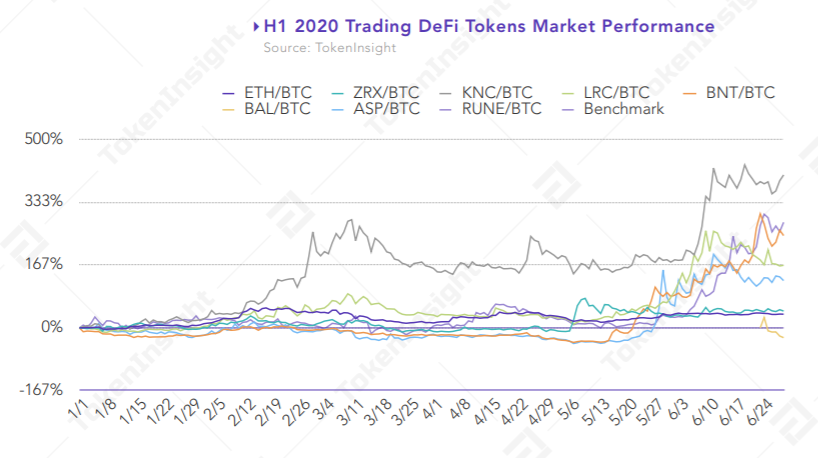

8) Trading Projects such as @KyberNetwork delivered more than 4x return against BTC since the beginning of the year, @thorchain_org delivered more than 2x against BTC and @Bancor delivered more than 2x during H1 2020. @0xProject @loopringorg @airswap have outperformed BTC

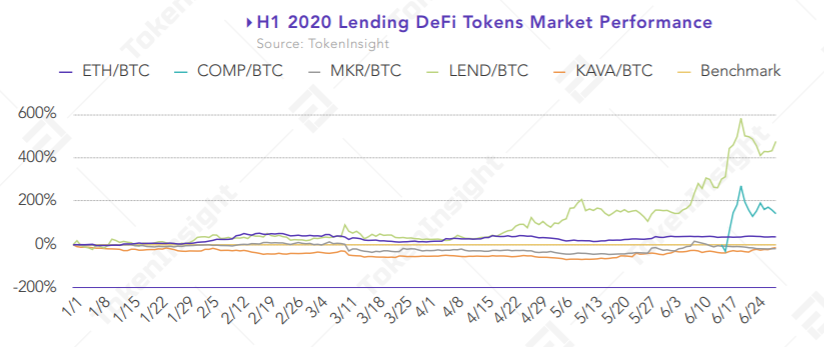

9) Lending sector also experienced strong growth in H1 2020, with @compoundfinance and @AaveAave delivered 2x and 5x return against BTC throughout the 6 months. Others including @MakerDAO , @kava_labs have generally underperformed the ETH/BTC pair.

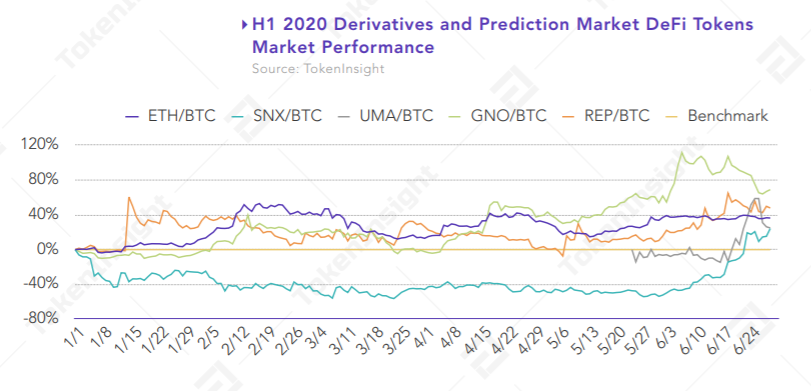

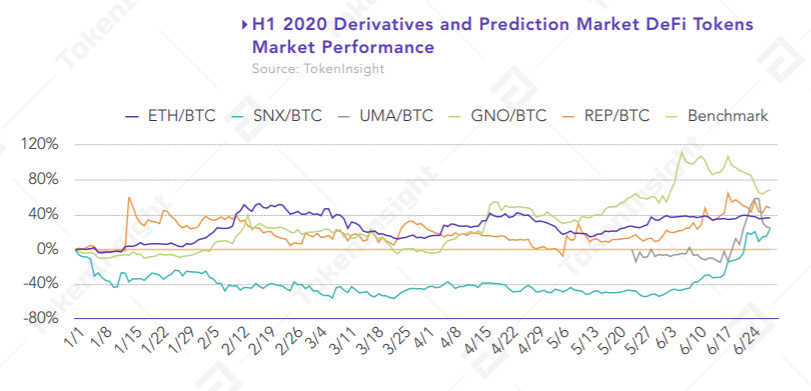

10) The derivatives and prediction market projects also saw a positive return but somewhat less than the return compared to lending and trading projects. Prediction market projects such as @gnosisPM and @AugurProject delivered the highest return in the sector.

11) @synthetix_io as one of the most successful derivatives DeFi projects has experienced a relatively weak performance before June 2020 However its token price took off again during June 2020 and within a month delivered 100% return in the market.

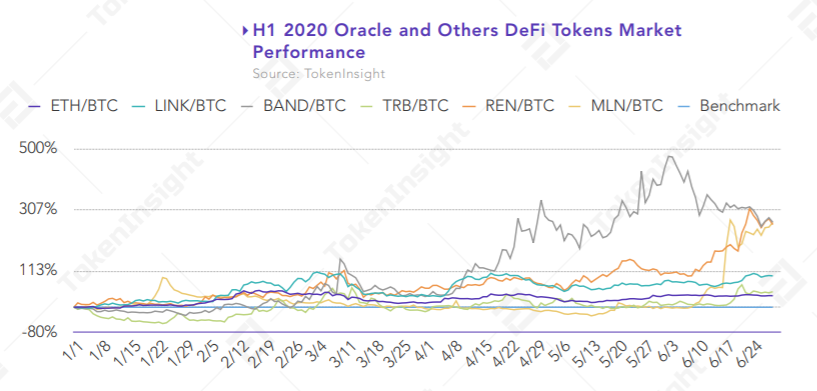

12) Oracle projects also performed positively compared to other DeFi projects in which @BandProtocol delivered nearly 500% return at its peak, other price oracle projects such as @chainlink and @WeAreTellor also saw moderate growth in the secondary market.

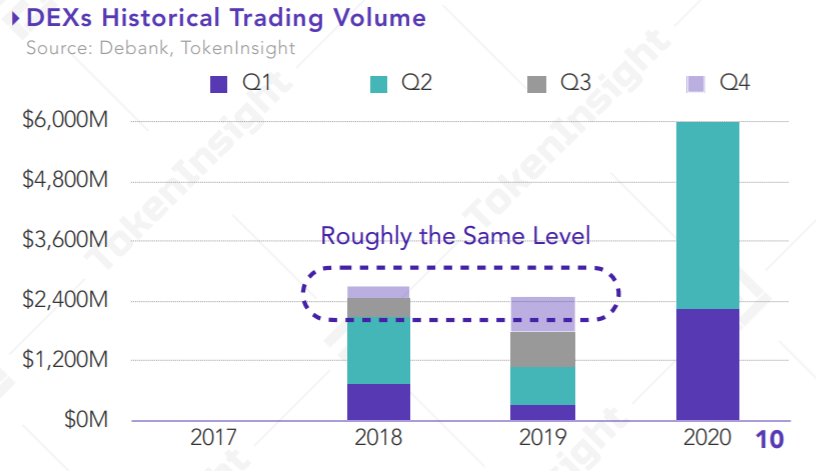

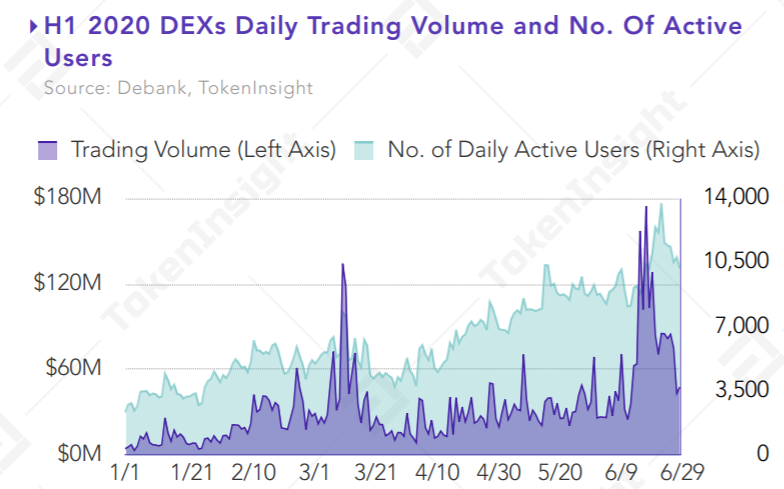

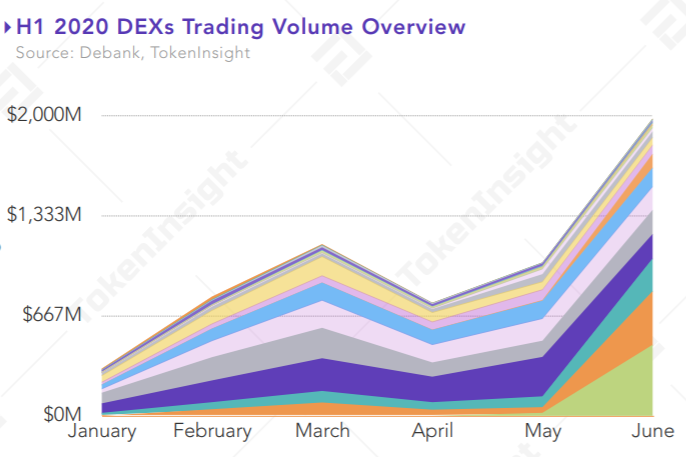

13) In 2020, the DEX sector as a whole entered a stage of rapid development, and its first-quarter trading volume ($2.3 billion) almost equates to the 2019 total yearly trading volume, with the second quarter volume jumped to a record high of $3.7 billion.

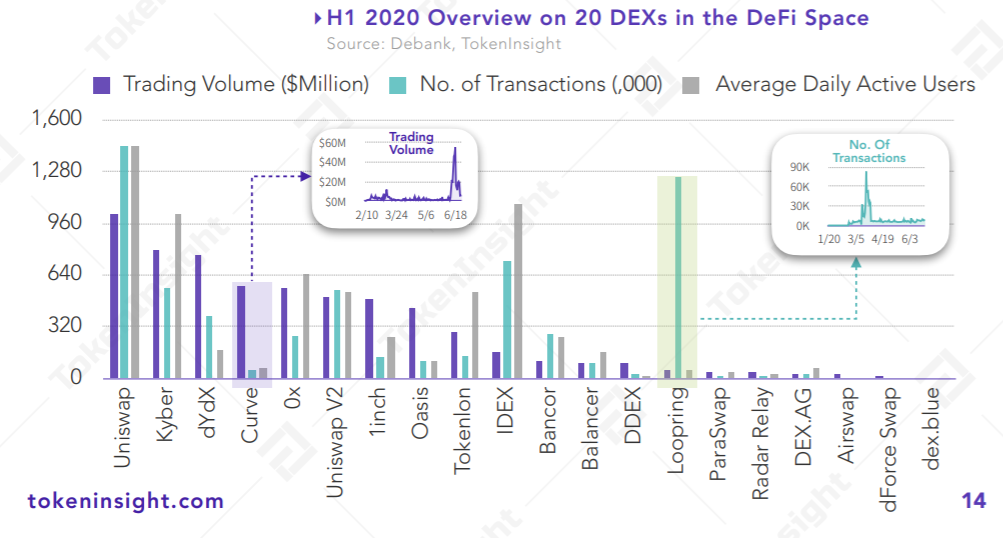

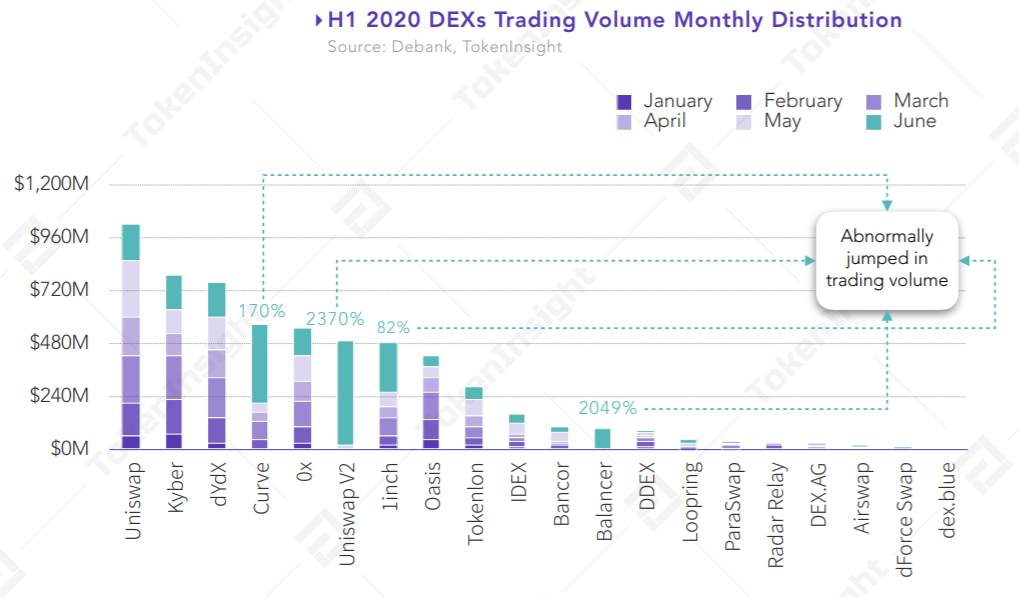

14) With the launch of @UniswapProtocol V2 protocol, it has successfully acquired more than 24% of the market share since June 2020. Combined with the market share of Uniswap V1, the Uniswap project became the biggest winner with a total DEX market share of 32% in June 2020.

15) Followed by @CurveFinance where it’s market share jumped from 4% in May to 18% in June due to higher demands of stablecoins from the incentivised liquidity mining activities in the DeFi space.

16) In H1 2020, the total trading volume and the number of transactions in the DEX sector show that the top five DEX platforms account for more than 60% of the DEX market. @TokenInsight

17) Among them, @UniswapProtocol and @KyberNetwork occupy the first place in terms of the total trading volume and No. of the transaction respectively. The total trading volume and total transactions of these two DEXs account for more than 30% of the entire DEX market.

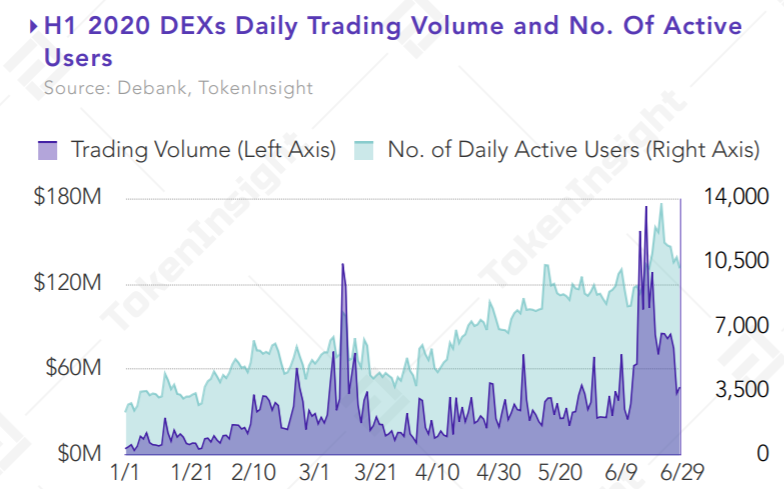

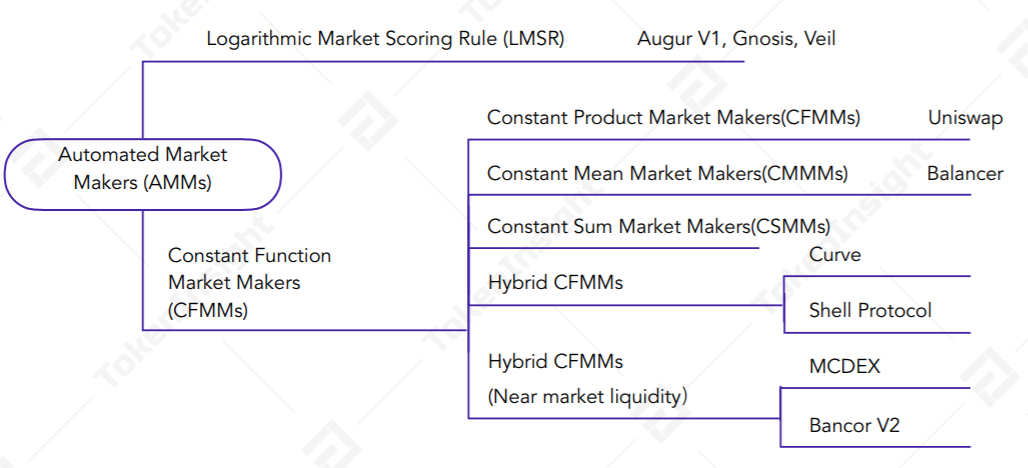

18) In June, the Automated Market Makers (AMMs) concept drove the market in the DEX sector. Among them, @CurveFinance and @UniswapProtocol were the main contributing sources to the surge of DEX trading volume to the record high.

19) TokenInsight Research believes that this is due to the fierce liquidity mining in June leading to strong demand for stablecoin in the market. Considering that @1inchExchange have integrated @CurveFinance and users can receive the best stablecoin conversion rate.

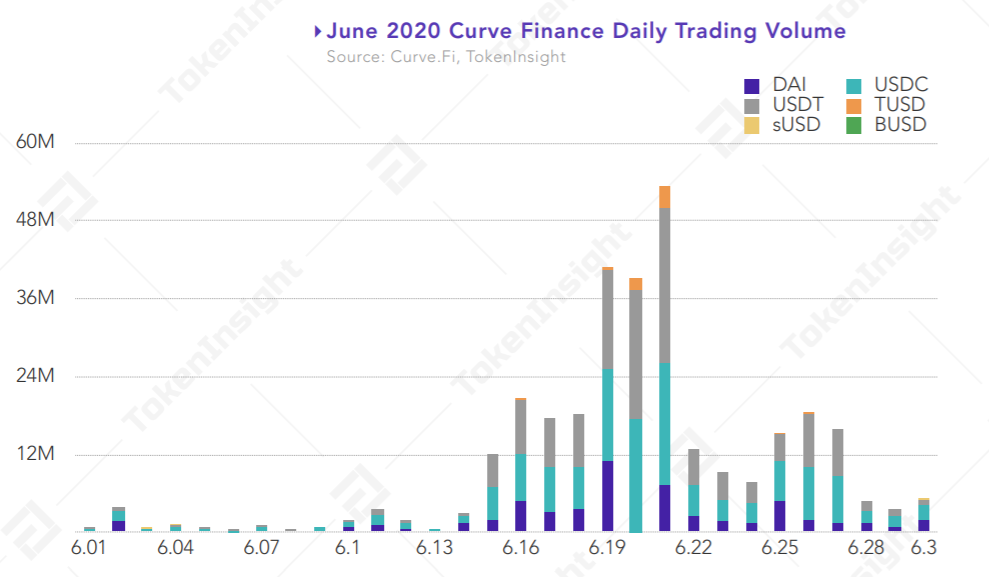

20) On June 21 2020, the total trading volume on @CurveFinance reached nearly $55 million while Uniswap V1 and V2 combined generated $22 million worth of trading volume. The following figure shows the daily trading volume of each stablecoins on Curve.

21) The DEX sector started to grow significantly in 2020, with a trading volume of roughly $6 billion in H1 2020. We have seen the competitive landscape changed significantly, and it is getting diversified by many innovative players entering the market. @TokenInsight

22) The development of the DEX sector experienced a change in 2019 and experienced significant growth in 2020. We believe with the continuous development of the DEX sector, it will create ripple effects that could influence the DeFi space in all aspects. @TokenInsight

@threader_app compile

Read on Twitter

Read on Twitter