WSJ investigation from @samschech @KirstenGrind & @JohnWest finds that Google Search steers users to YouTube videos! This is part of a Larger antitrust steering story. (1/6) https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏼" title="Rückhand Zeigefinger nach unten (mittelheller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (mittelheller Hautton)"> https://www.wsj.com/articles/google-steers-users-to-youtube-over-rivals-11594745232?st=y72z5xnjcalw33s&reflink=article_copyURL_share">https://www.wsj.com/articles/...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏼" title="Rückhand Zeigefinger nach unten (mittelheller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (mittelheller Hautton)"> https://www.wsj.com/articles/google-steers-users-to-youtube-over-rivals-11594745232?st=y72z5xnjcalw33s&reflink=article_copyURL_share">https://www.wsj.com/articles/...

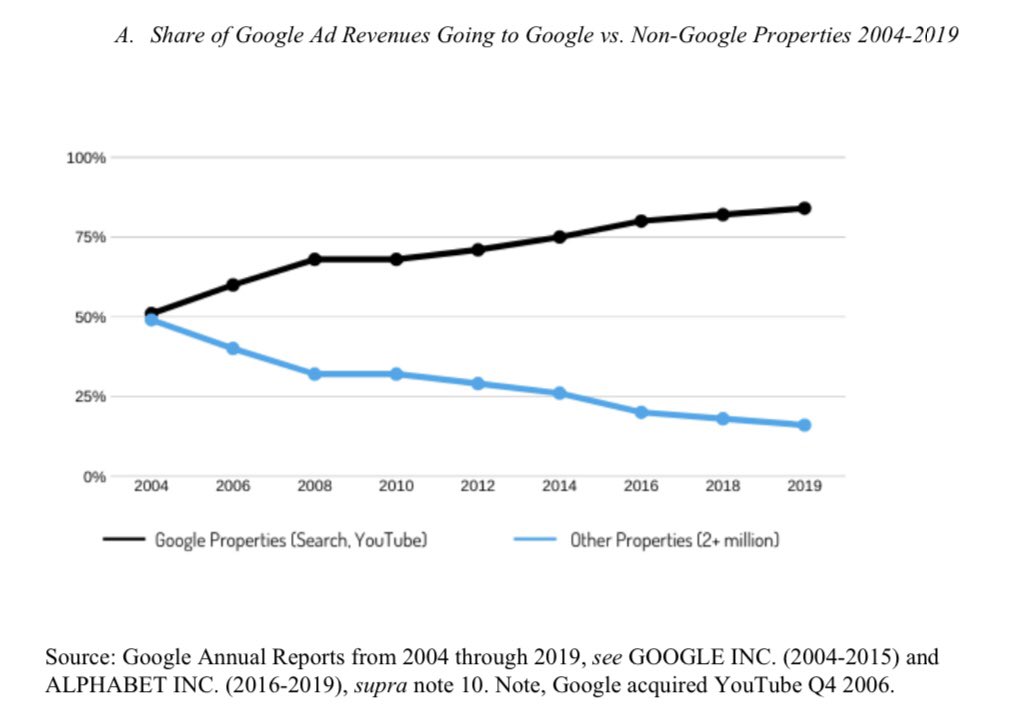

(2/6) The bigger picture is how this steering distorts outcomes in the online advertising market — traded on Exchanges. Graph from my Google paper demonstrates this — data pulled from Google 10Ks from 2004-2019. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3500919">https://papers.ssrn.com/sol3/pape...

(3/6) In Q1 2020, this split widened again. Generally, 86% of advertising revenue that flow through Google’s “brokerage houses” go to Google properties vs. the 14% that gets split between 2+ million publishers that sell their ads on Google’s exchange and through its middlemen.

(4/6) And we haven’t yet touched on algorithmic matching bias at the DSP/“brokerage house” level — similar issues comes up in equities markets and they are called trade allocation problems (we manage those too).

(5/6) These unmanaged conflicts-of-interest contribute to “why can’t news publishers make money selling ads problems” ... Google is the unicorn but other guys selling ads are quasi dead.

(/end) In other exchange-based markets, we manage for conflicts of interest. We don’t let exchanges and brokerage-house-equivalents self-preference. We even stopped the airlines from doing it with the GDSs ... we don’t need to reinvent the wheel.

Read on Twitter

Read on Twitter