With the potential of a global copper shortage, today I will be doing one of my deep dives in $FCX.

Stay tuned for a fully unbiased stock review thread, you will be learning in real time as I do in the making of this thread.

1/x

Stay tuned for a fully unbiased stock review thread, you will be learning in real time as I do in the making of this thread.

1/x

this thread will go a bit in depth on $FCX, but that is not the main focus. The main focus is to look at the conditions the last time $FCX and other copper stocks were making ATH& #39;s and compare them to today& #39;s market conditions.

2/x

2/x

the thesis here is that copper prices are at a perfect point that is not attractive enough for new entrants, yet demand is building up and we may be entering a copper shortage that could be great for the copper price - and $FCX.

3/x

3/x

micro: $FCX is looking great, golden cross was taken very well and yielded a 10% day, bulls have strong belief.

macro: has a lot of room to move, not much major support until ~ $30.

4/x

macro: has a lot of room to move, not much major support until ~ $30.

4/x

now for the copper/lbs chart. While it follows a similar trend to $FCX, the variance in this chart is less than that of $FCX. The bias has fallen to the downside for the price of $FCX in relation to copper in the recent years.

why is this? let& #39;s see if we can find out.

5/x

why is this? let& #39;s see if we can find out.

5/x

After a little bit of digging into $FCX& #39;s history, it has become apparent to me as to why their stock has had more volatility (to the downside) than the underlying commodity that they sell.

$FCX is still feeling the ~ $20b mistake of trying to re-enter the oil industry.

6/x

$FCX is still feeling the ~ $20b mistake of trying to re-enter the oil industry.

6/x

This oversight came in the shape of 2012 oil asset acquisitions of McMoRan Exploration & Plains Exploration/Production. This increased their long-term debt from $3.5b to $20b.

This chart tells the story of what happened in oil a year or so after the highly levered purchase.

7/x

This chart tells the story of what happened in oil a year or so after the highly levered purchase.

7/x

But confidence in $FCX didn& #39;t bottom out there.

Fast forward to 2017, $FCX is now starting to recover from their oil mistake. However, the Indonesian government has other plans for the copper company.

8/x

Fast forward to 2017, $FCX is now starting to recover from their oil mistake. However, the Indonesian government has other plans for the copper company.

8/x

The gov knows that around 1/3 of all of $FCX& #39;s copper production is coming from a single mine they operate inside of their country and they want a piece of the pie.

The result was the gov mandated that $FCX sold them 51% of their mine. Fortuitously, it was at fair value.

9/x

The result was the gov mandated that $FCX sold them 51% of their mine. Fortuitously, it was at fair value.

9/x

We& #39;re a couple years out from that deal now, $FCX has sold their oil assets and paid down a good portion of their debt. I believe that we are coming to some great market conditions for an inflection in $FCX.

Here& #39;s why:

10/x

Here& #39;s why:

10/x

In 2019 people were starting to call for supply shortages of copper by 2021. The demand for copper would outpace the supply of copper until the price could increase enough for new entrants to be willing to flood the market with new mining operations. That lag time is key.

11/x

11/x

Taking the impacts of COVID into play, I think that this only widens the copper shortage to come.

During the lockdowns we can say that COVID had essentially a neutral effect. There was no supply, yet also no demand.

12/x

During the lockdowns we can say that COVID had essentially a neutral effect. There was no supply, yet also no demand.

12/x

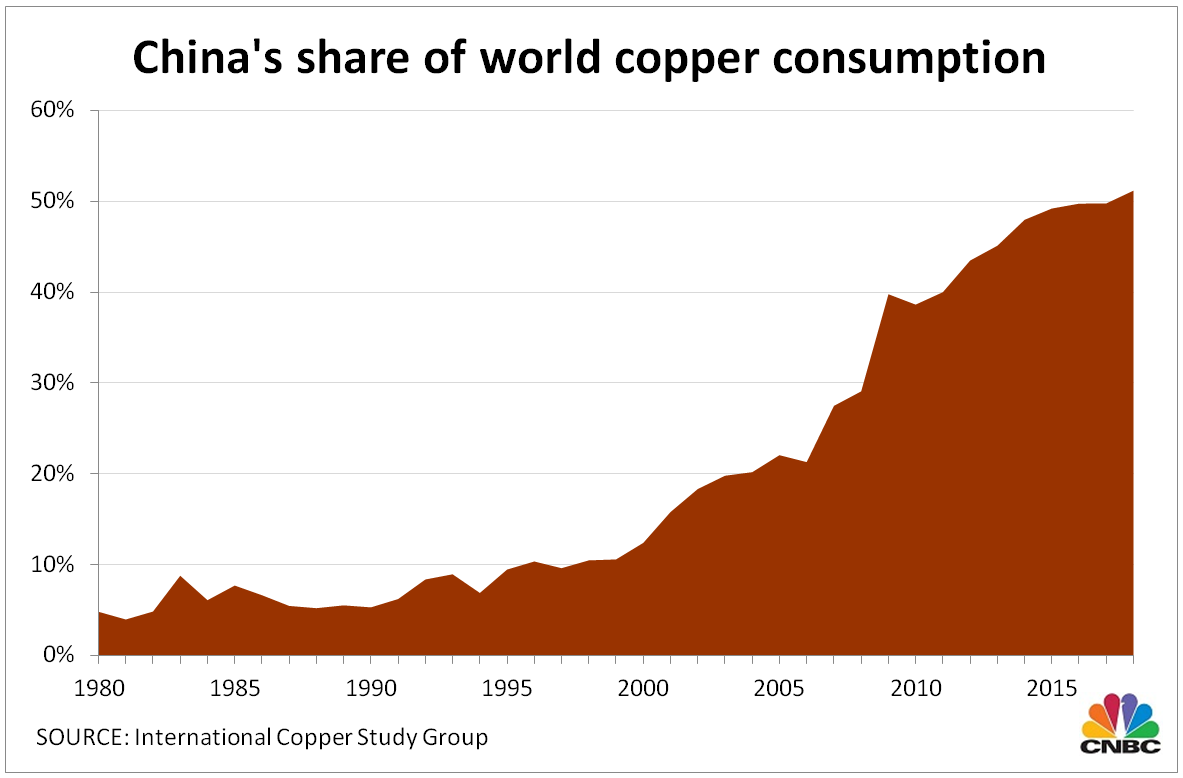

Although, the country leading us out of the COVID lockdown world also just happens to be the largest consumer of copper -- China.

This could significantly widen the shortage if China& #39;s demand rises quicker than the rest of the world supply can get back online.

13/x

This could significantly widen the shortage if China& #39;s demand rises quicker than the rest of the world supply can get back online.

13/x

The best part? China uses all of this copper for infrastructure & construction. This means that regardless of what the rest of the world is doing, China will most likely still need copper for their initiatives like the massive & #39;Belt & Road& #39; project.

14/x

14/x

In conclusion, a medium-term history of pitfalls has led their stock to underperform the underlying asset they sell and lean towards being undervalued. Combine this with a likely shortage of copper going forward -- I like $FCX to say the least.

15/x

15/x

Read on Twitter

Read on Twitter