OKAY IT& #39;S HERE! As most of you know I closed on my first rental property yesterday, and now as promised I will be breaking down how I actually acquired this asset.

This is how I did it, I& #39;m sure there are other, possibly better ways to go about it, but this is how I did it.

This is how I did it, I& #39;m sure there are other, possibly better ways to go about it, but this is how I did it.

I can& #39;t think of an actual date, but sometime in 2016, I realized that real estate is a great way to build wealth. I was too young to actually own any RE in my name, so I attended local REIA meetings (real estate investors association) to learn as much as I could in the meantime.

Fast forward to 12:00 AM on November 16th, 2019 (my 18th birthday), I was on the computer starting to build my credit by applying for credit cards for my mortgage pre-approval. At this point, I started to actually viewing properties.

I was approved for a 3.5% down FHA loan with my parents as co-signers. I realize not everybody has this available. Don& #39;t let that stop you, there are plenty of other ways to get into RE. DM me!

The way my loan was set up I couldn& #39;t get into multi-family with co-signers, so I started looking into single-family. After analyzing 100s of deals, viewing around 7 properties, and putting in 4 offers I finally got one accepted. That& #39;s the house you saw in the photo above

Alright, yall are probably ready to hear about the numbers now, but you should know a bit about me, I& #39;m an 18-year-old business-owner/freelancer. Since 15 I have been selling photo prints and providing photography services in New Orleans. ( http://www.colefrechou.com"> http://www.colefrechou.com )

You definitely don& #39;t have to be self-employed to do this honestly, it& #39;s more difficult. The banks love a good w-9 job to pre-approve you.

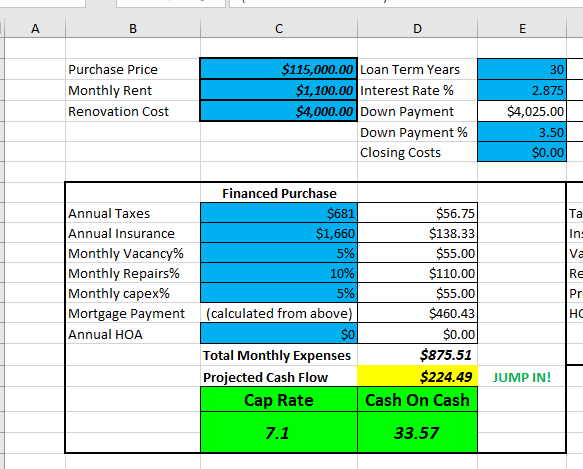

Here& #39;s some info about the property

3 Bed 2 Bath - 1050sqft located in a New Orleans suburb

Purchase price of $115,000

Rehab ~$4000

Rent after rehab $1100-1200

3 Bed 2 Bath - 1050sqft located in a New Orleans suburb

Purchase price of $115,000

Rehab ~$4000

Rent after rehab $1100-1200

This cash-flow should only increase because of the location, rents tend to always increase across the board, and after I refinance I will get rid of my PMI insurance ($87/mo) I know, it sucks

I financed this using a 3.5% down FHA loan, now a lot of you may know that this is an owner-occupied loan. I intend on living there for 1 year, and afterward turning it into a traditional rental. During this year I will have roommates paying me rent that will cover my mortgage.

Ended up with a 2.875% interest rate for a 30-year mortgage. Getting my credit started early really helped with this. I can do a thread on credit later on.

My mortgage with principal, interest, taxes, and insurance is $655/mo, so that& #39;s $400-500 cashflow without reserves (monthly 5% vacancy, 10% repairs and 5% capex).

I should be cash-flowing right around $220/mo after my very conservative rent, rehab, and reserve numbers.

I should be cash-flowing right around $220/mo after my very conservative rent, rehab, and reserve numbers.

My thoughts are that cash-flow should only increase because of the location, rents seem to always increase across the board, and after I refinance I will get rid of my PMI insurance.

Cash-flow isn& #39;t the only thing sweet about this deal. I& #39;ll have some renters paying down my note thus increasing my equity, and I will also speculatively have some appreciation because the city it& #39;s in is BOOMING.

I realize there are much better deals out there, especially in the multi-family world, but this was a safe investment that will provide some steady cash-flow for the years to come. I& #39;m basically treating this as my retirement plan, haha.

So that& #39;s my first deal! What are yall& #39;s thoughts? It& #39;s not the best deal of all time, but it& #39;s not the worst. Hoping the deals get better and better especially with multi-family on the horizon. More on that another day.

If there& #39;s something yall would like me to dive deeper into, let me know, and ill try my best to answer any questions. I& #39;m just getting started and still have a lot to learn. Appreciate all the support!

Also! If any of you all found this helpful make sure to retweet and like it! I will be doing many more threads just like this one!

Read on Twitter

Read on Twitter