The public tend to focus more on nominal interest rates rather than real ones, which is dubbed by economists as "money illusion." Indian savers enjoyed positive real interest rates for a few years, with all experts screaming about the damage the real rates caused the economy. 1/8

2/8 Former RBI governor Raghuram Rajan popularised the idea of providing positive real interest rate spread of about 1.5%-2.0% to savers. Once he& #39;s gone, we seem to have forgotten about real interest rates. The drumbeat changes to a different tune when people at the helm change.

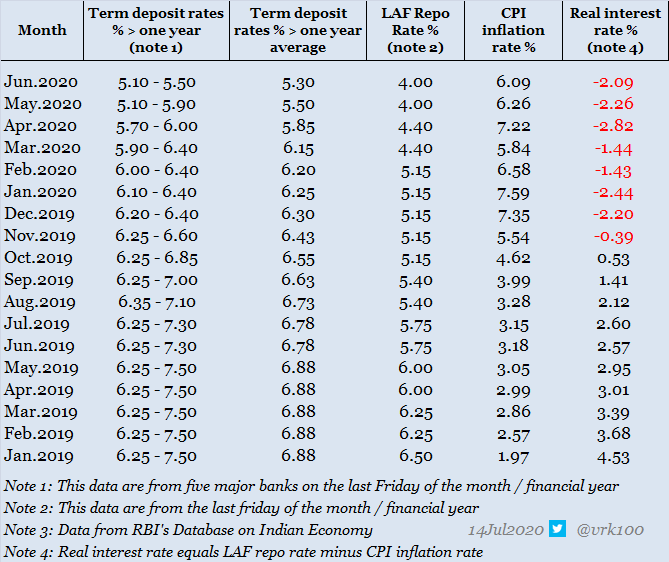

3/8 CPI inflation in India made an epic comeback since Sep2019. Even though official CPI inflation figures don& #39;t match with the real price rise suffered by people, let us check how real interest rates (LAF repo rate minus CPI inflation) have moved between Jan2019 and Jun2020.

4/8 The data from Jan2019 to Jun2020 are attached. For comparison purpose, term deposit rates for more than one-year period are given, in addition to data related to LAF repo rate and CPI inflation. As can be seen, real rates have turned negative since Nov2019 >

5/8 Negative real interest rates show savers are getting lower deposit rates versus the inflation--means savings have no incentives for the past 10 months (this could tempt investors& #39; toward riskier investing choices is a different matter).

6/8 India& #39;s RBI cut interest rates by 250 basis points since Jan2019 and banks promptly cut interest rates drastically to protect their profits--which is natural. But it& #39;s also natural for banks / other lenders not to cut lending rates in a similar fashion (RBI ineffective).

7/8 As savers have suffered the damage due to this negative real rates for the past 10 months, experts (who screamed about +ve real rates) seem to have forgotten about balancing the interests of savers. Hope this gets the attention of those at the helm. https://twitter.com/vrk100/status/1245358195108745221">https://twitter.com/vrk100/st...

8/8 Maybe, Indian savers have to make sacrifices for reviving the moribund economy? Sadly, the saving community don& #39;t seem to have much lobbying power (the likes of LIC of India and other insurers enjoy such power).

Read on Twitter

Read on Twitter