A lot of talk around Libor widening into the year end - what we call the "turn". EDZ0 99.625/50 ps has seen a lot of interest accordingly. There are a few things to understand here.

First, a lot of this turn is already priced in (chart) with Sep-Dec-Mar FRA-OIS fly at ~15bps

First, a lot of this turn is already priced in (chart) with Sep-Dec-Mar FRA-OIS fly at ~15bps

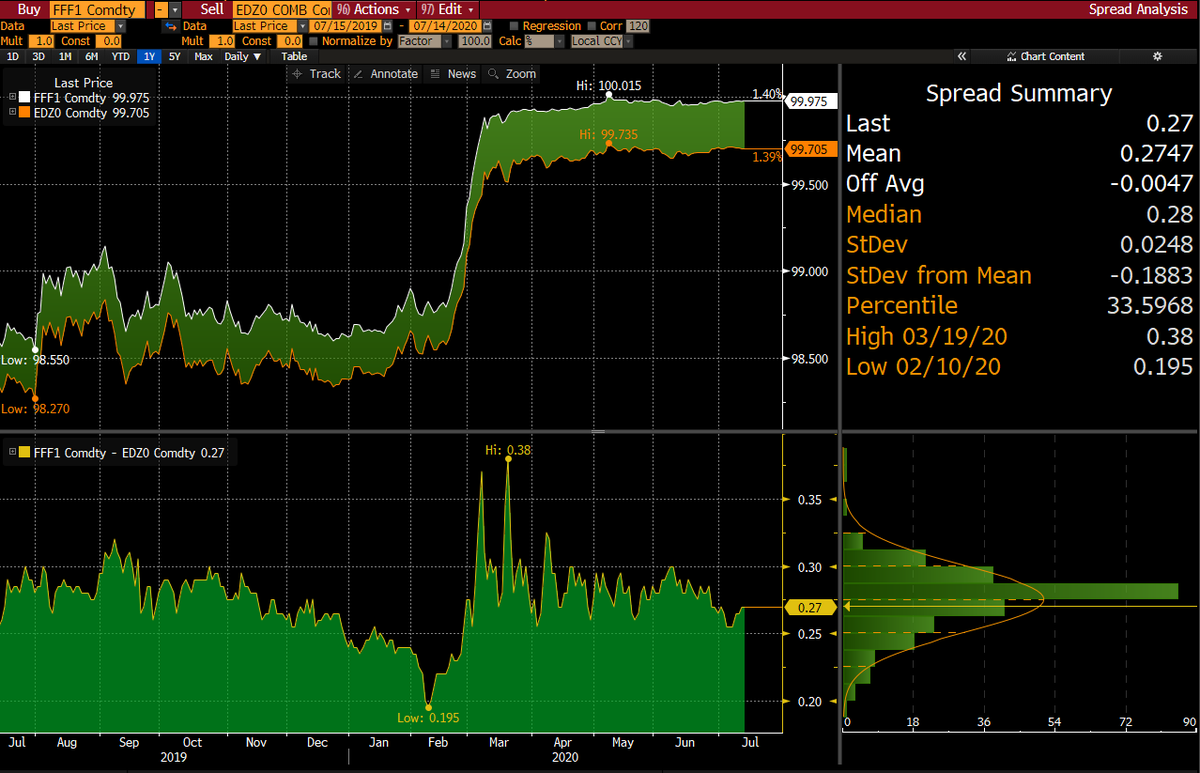

Second, Dec FRA-OIS (using EDZ0 vs FFF1 as a proxy) hasn& #39;t gone anywhere itself. So the kink that we saw above was all driven by expectations of tighter FRA-OIS in Sep and March. If this were to continue, those Z0 puts won& #39;t be of much use.

Third, this implies that markets buying Z0 puts are expecting two things to happen at the same time.

1 Libor to have bottomed

2. Turn pricing to remain constant or widen

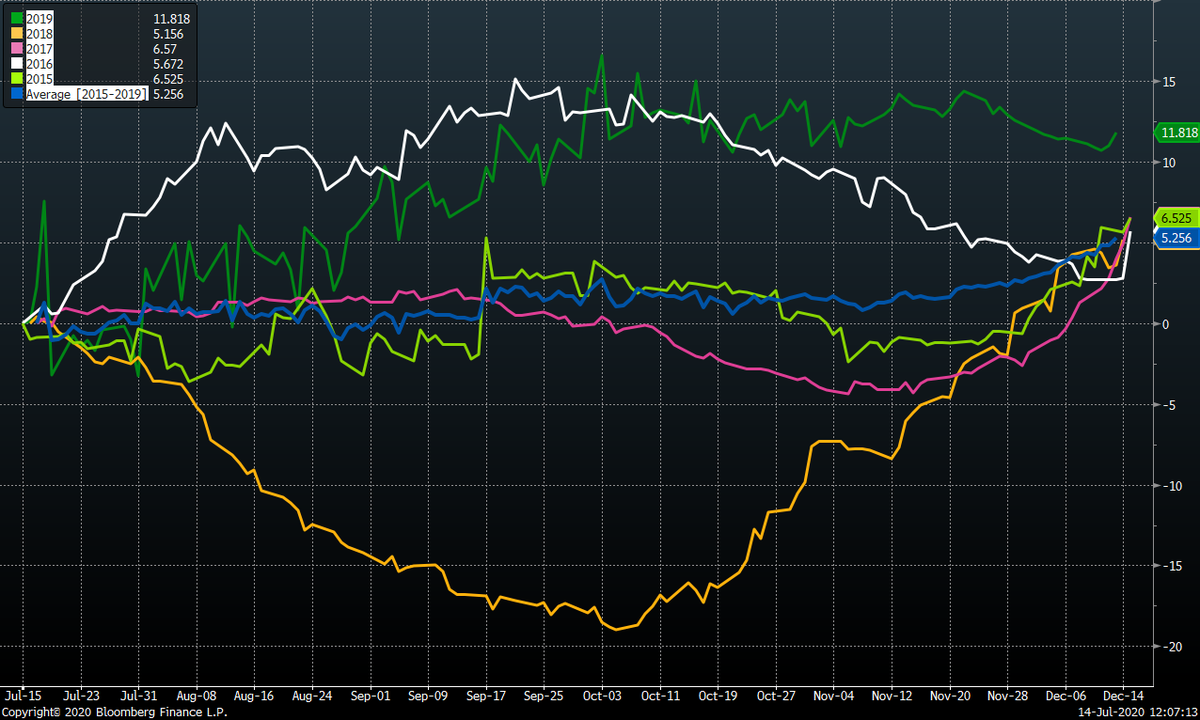

On #2, if you look at the last 5 years, I don& #39;t think the turn is necessarily under-priced right now.

1 Libor to have bottomed

2. Turn pricing to remain constant or widen

On #2, if you look at the last 5 years, I don& #39;t think the turn is necessarily under-priced right now.

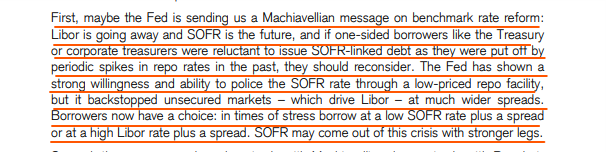

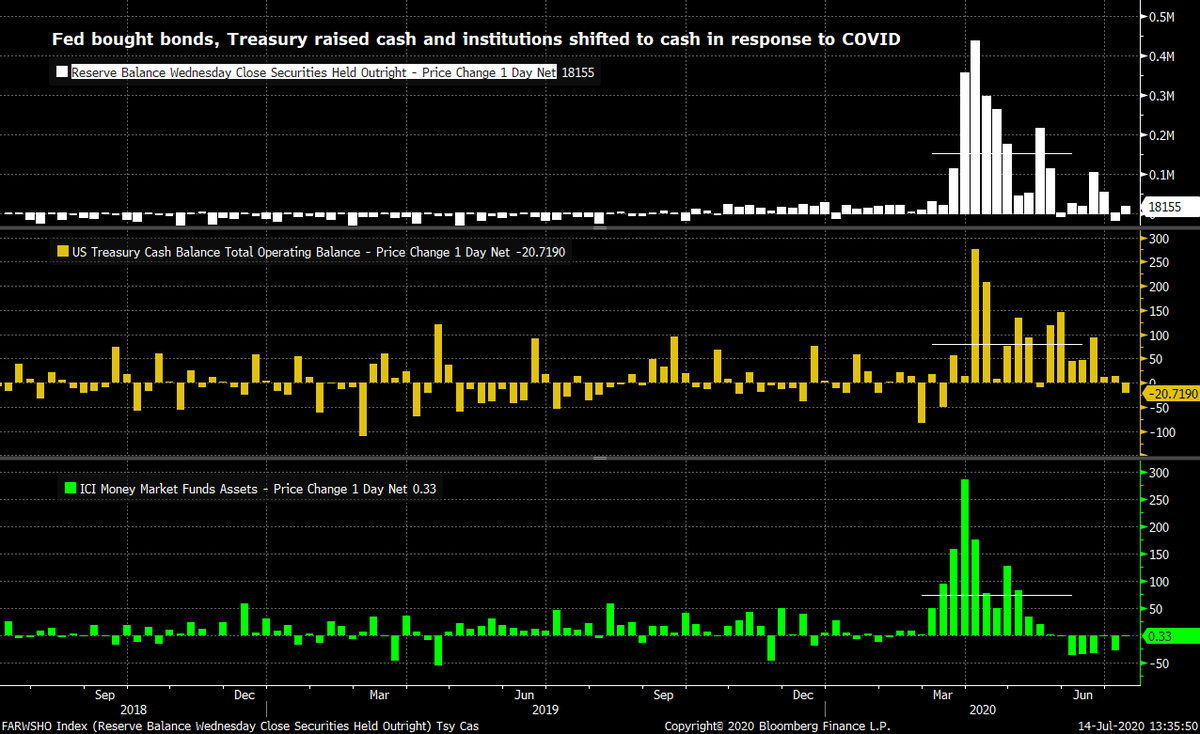

Although, the GSIB surcharge is likely to be a bigger issue in 2020 if the Fed chooses not to do anything (Zoltan explains why that might happen) https://plus.credit-suisse.com/rpc4/ravDocView?docid=V7ln0S2AN-VHSK">https://plus.credit-suisse.com/rpc4/ravD... This along with a risk of defaults hitting banks should reopening be pushed into 2021 can widen the turn.

What about spot Libor having bottomed? The arguments calling for a floor for Libor basically rely on the spread to bills and bank CDS. 12.5 seems like a pretty good level historically, which implies a current floor of 25bps for Libor

Read on Twitter

Read on Twitter