NEW: today we’ve launched a live dashboard tracking the UK’s economic recovery in real-time.

We’re using fast data (lagged by as little as one day) on transactions, footfall & job ads to show which sectors are bouncing back and which aren’t.

Full piece: http://ft.com/uk-econ-tracker ">https://ft.com/uk-econ-t...

We’re using fast data (lagged by as little as one day) on transactions, footfall & job ads to show which sectors are bouncing back and which aren’t.

Full piece: http://ft.com/uk-econ-tracker ">https://ft.com/uk-econ-t...

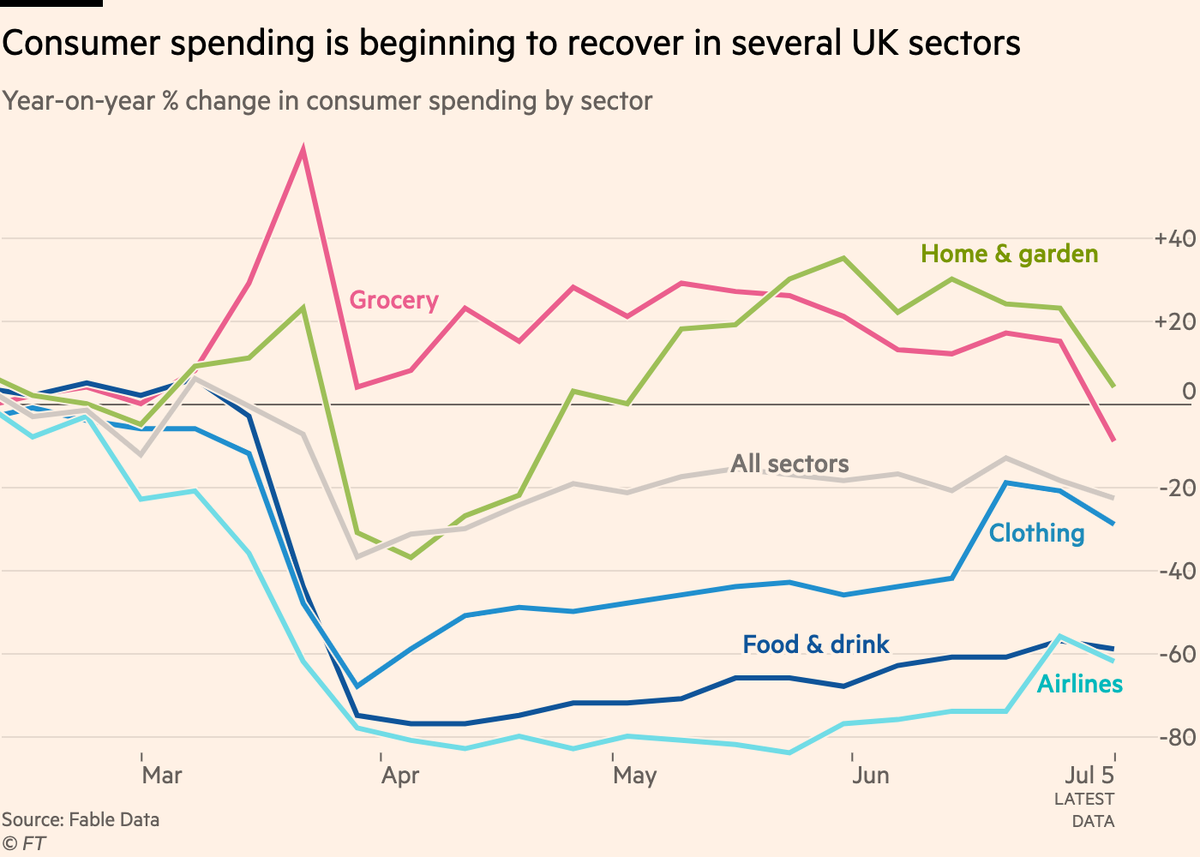

So far, the overall picture is of a slow and abortive recovery.

Total consumer spending was down year-on-year by almost 40% as the lockdown bit. It has recovered half of that loss, but has been stuck at around -20% y-o-y for weeks with no sign of a renewed rebound.

Total consumer spending was down year-on-year by almost 40% as the lockdown bit. It has recovered half of that loss, but has been stuck at around -20% y-o-y for weeks with no sign of a renewed rebound.

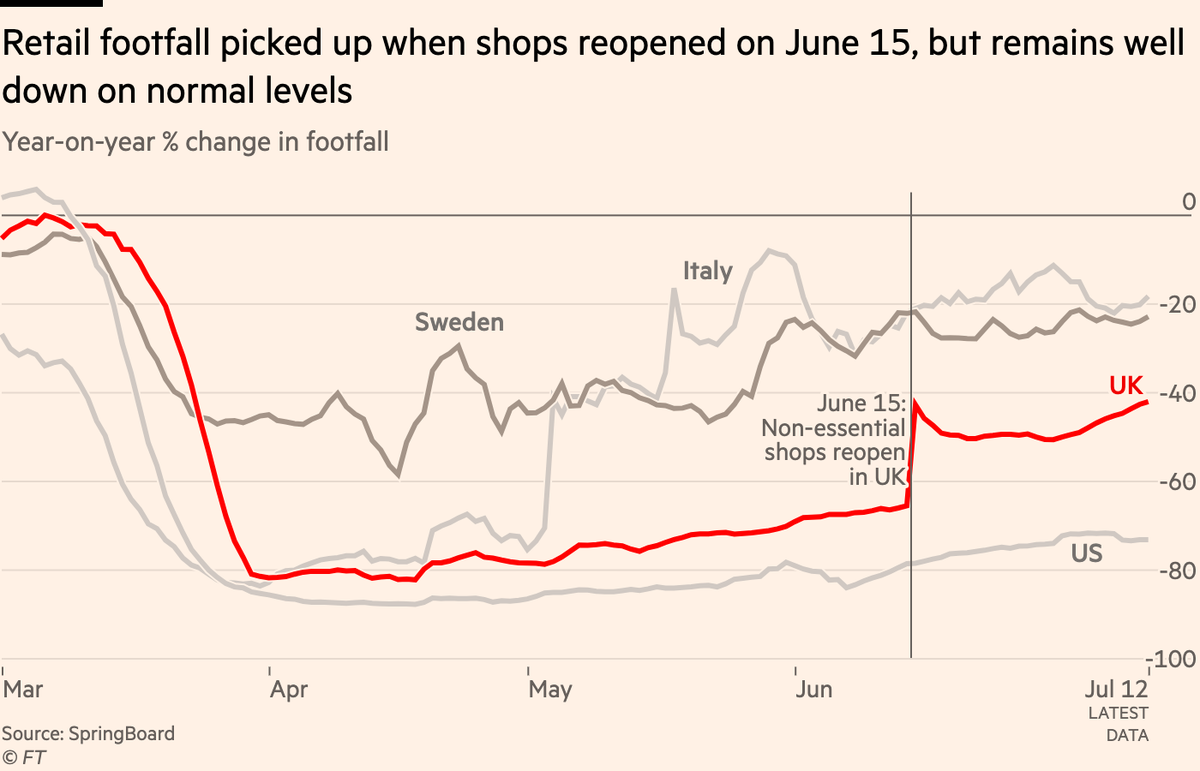

We see a similar picture in retail footfall, where the reopening of non-essential shops on June 15 sparked a sharp uptick, but since then progress has been minimal.

Visits to shops are still -40% year-on-year, well below what we see in peer countries like Sweden & Italy.

Visits to shops are still -40% year-on-year, well below what we see in peer countries like Sweden & Italy.

The same is true when we look at Google’s data on visits to entertainment locations including eating/drinking out and visiting theatres, cinemas and museums etc.

UK’s recovery in the hospitality & entertainment sector lags all European peers.

UK’s recovery in the hospitality & entertainment sector lags all European peers.

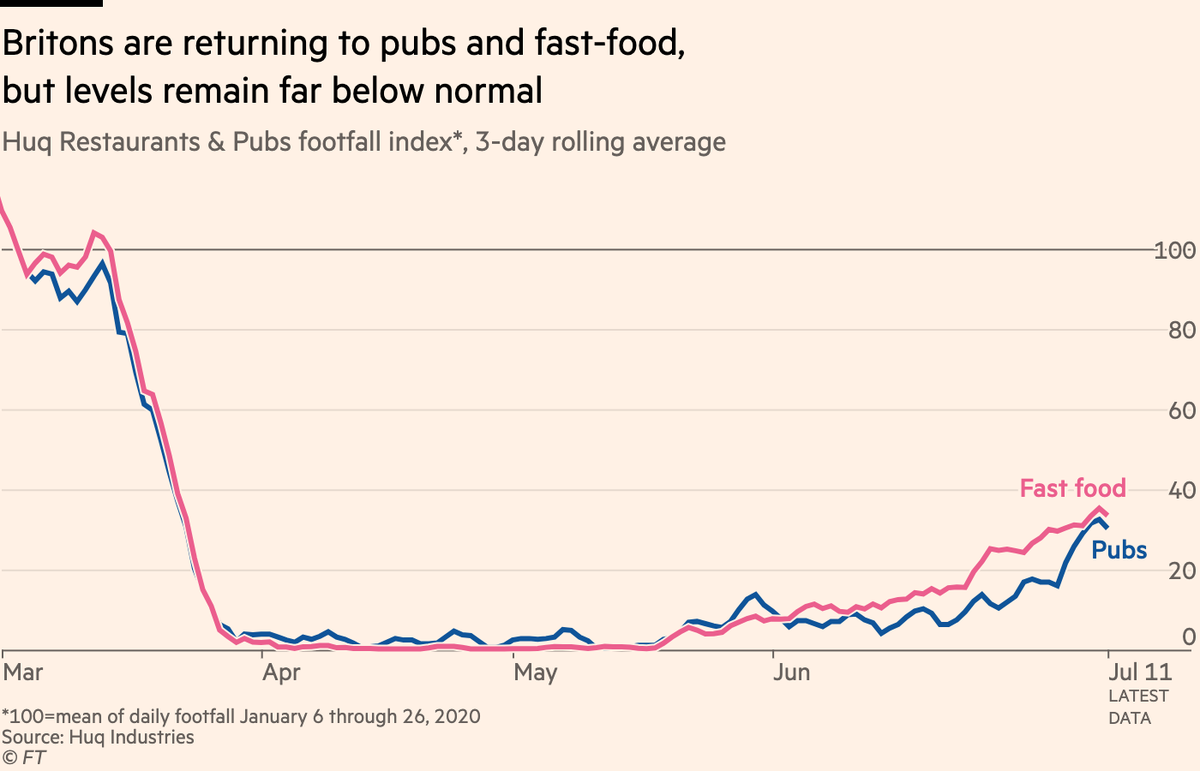

There are signs of faster progress in some corners of the economy — data from @OpenTable shows that restaurants bookings have leaped upward sine July 4 — but the question is how long the other half of the rebound will take.

And Britons remain reluctant to head to the pub, underscoring how simply declaring things open does not guarantee a rapid return to business as usual.

People still feel unsafe in indoor settings, and this will take a very long time (and progress in combating the virus) to change

People still feel unsafe in indoor settings, and this will take a very long time (and progress in combating the virus) to change

This reluctance to flock back to shops and restaurants is entirely understandable, and it explains why certain sectors of the UK economy face a much steeper and rockier road to recovery than others, with thousands of job losses looming in some industries.

Here’s @ONS data on how different sectors are faring.

The grey dashed lines are businesses that have temporarily closed. Half of employers in arts & hospitality were still shuttered mid June with only 1-in-5 staff working.

As gov support fades, furlough could become redundancy.

The grey dashed lines are businesses that have temporarily closed. Half of employers in arts & hospitality were still shuttered mid June with only 1-in-5 staff working.

As gov support fades, furlough could become redundancy.

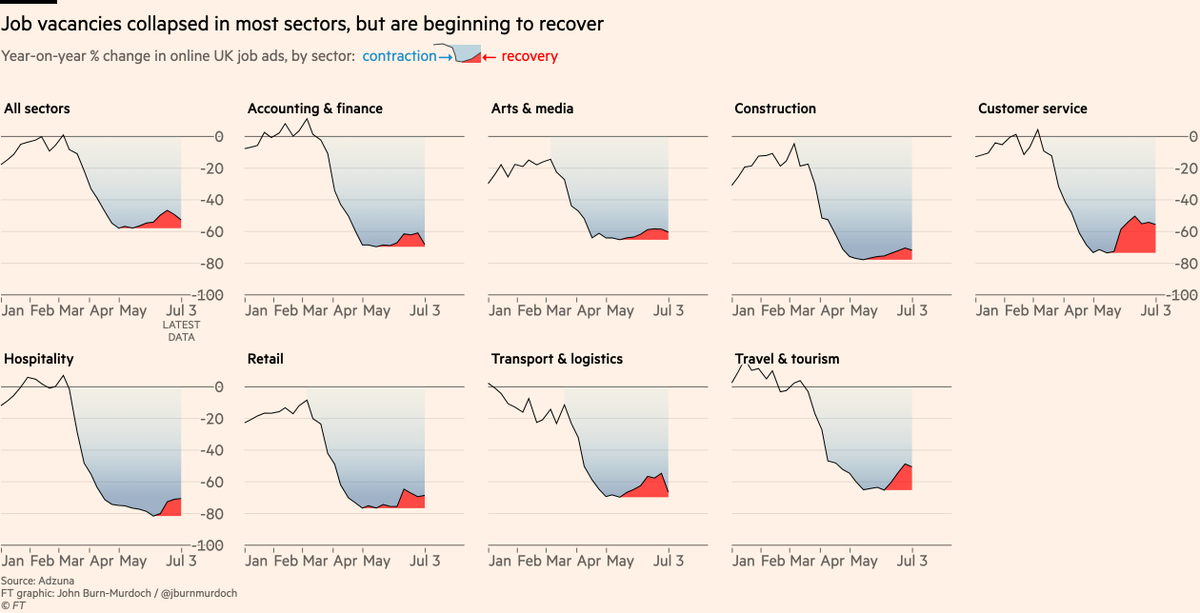

And here are job ads from @adzuna.

Hospitality sector has seen 80% drop in vacancies, recovering slightly to -70% in July.

Still far to go for normal vacancy levels in all sectors. For the new cohort of graduates, and people who’ve lost their jobs, this is a brutal environment.

Hospitality sector has seen 80% drop in vacancies, recovering slightly to -70% in July.

Still far to go for normal vacancy levels in all sectors. For the new cohort of graduates, and people who’ve lost their jobs, this is a brutal environment.

We’ll be updating this page regularly as new data comes in on the various metrics, and will also be adding new indicators as additional data sources become relevant.

Bookmark it at http://ft.com/uk-econ-tracker ">https://ft.com/uk-econ-t...

Bookmark it at http://ft.com/uk-econ-tracker ">https://ft.com/uk-econ-t...

Read on Twitter

Read on Twitter