1/ MEGA THREAD: Long $BRK

I follow three steps while investing in BRK.

1. Read BRK annual shareholder letters

2. Read Semper Augustus (SA) annual client letter in which @ChrisBloomstran discusses BRK for >50 pages

3. Mostly ignore others opinion on BRK and sit tight.

I follow three steps while investing in BRK.

1. Read BRK annual shareholder letters

2. Read Semper Augustus (SA) annual client letter in which @ChrisBloomstran discusses BRK for >50 pages

3. Mostly ignore others opinion on BRK and sit tight.

2/ $BRK has been ~10% of my portfolio for a while, and last week, I increased it to ~20%.

If the divergence of the market and BRK continues, I am open to make it as high as ~50% of my portfolio.

If the divergence of the market and BRK continues, I am open to make it as high as ~50% of my portfolio.

3/ Sometimes, you gotta swing hard when a fat pitch comes along.

Diversification is great and all, but it is concentration (IF you are right, a big IF) creates true wealth.

Diversification is great and all, but it is concentration (IF you are right, a big IF) creates true wealth.

4/ $BRK bought $AAPL in 2016-18 period, and on a cost basis, it was ~25% of BRK’s publicly trade portfolio of stocks.

The BRK duo thought AAPL was a fat pitch, as evidenced by its weight in the portfolio.

The BRK duo thought AAPL was a fat pitch, as evidenced by its weight in the portfolio.

5/ In 2018, Munger even said (on $AAPL), “I think we’ve been a little too restrained. I wish we owned more of it.”

Today, AAPL is ~45% of BRK’s portfolio, and it& #39;s with $60 Bn unrealized gain, it& #39;s perhaps one of the greatest investment ever!

Concentration creates true wealth.

Today, AAPL is ~45% of BRK’s portfolio, and it& #39;s with $60 Bn unrealized gain, it& #39;s perhaps one of the greatest investment ever!

Concentration creates true wealth.

6/ But if you do take the concentration route, especially with $BRK, make sure you know your capacity to suffer.

The whole SaaS index can trade at >30x in next few months whereas BRK can stand still or even worse, go down.

The whole SaaS index can trade at >30x in next few months whereas BRK can stand still or even worse, go down.

8/ Insurance

Two familiar names drive majority of the operations in this bucket: GEICO, and General Re (acquired in 1998).

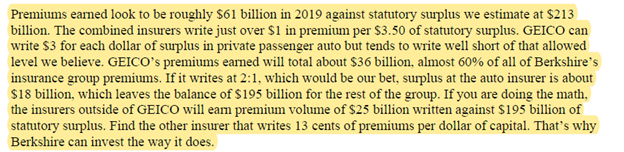

Most of us know about $BRK& #39;s float and all, but the real question is why exactly others have failed to emulate BRK’s strategy. I’ll let SA explain.

Two familiar names drive majority of the operations in this bucket: GEICO, and General Re (acquired in 1998).

Most of us know about $BRK& #39;s float and all, but the real question is why exactly others have failed to emulate BRK’s strategy. I’ll let SA explain.

9/ $BRK& #39;s moat in insurance is here to stay.

If you need more convincing, here’s one more paragraph to explain “why Berkshire can invest the way it does”, plus the valuation estimates for insurance segment (sourced from SA).

If you need more convincing, here’s one more paragraph to explain “why Berkshire can invest the way it does”, plus the valuation estimates for insurance segment (sourced from SA).

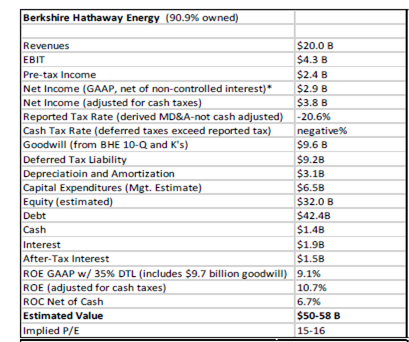

10/ Energy

Another boring business.

It’s unlikely to be growth engine for $BRK, but the economics of this business is actually decent. BRK’s utilities spend heavily on renewables, wind, and solar that lead to significant tax benefits.

Another boring business.

It’s unlikely to be growth engine for $BRK, but the economics of this business is actually decent. BRK’s utilities spend heavily on renewables, wind, and solar that lead to significant tax benefits.

11/ So even though topline may struggle to grow beyond inflation, the business may not cause much angst from bottomline perspective.

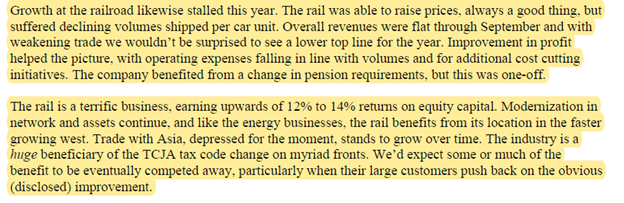

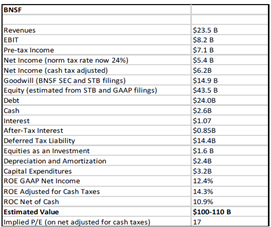

12/ BNSF

Rail also isn’t going to dazzle you with topline growth, but it’s a low to mid teen ROC business. So it’s all good.

Rail also isn’t going to dazzle you with topline growth, but it’s a low to mid teen ROC business. So it’s all good.

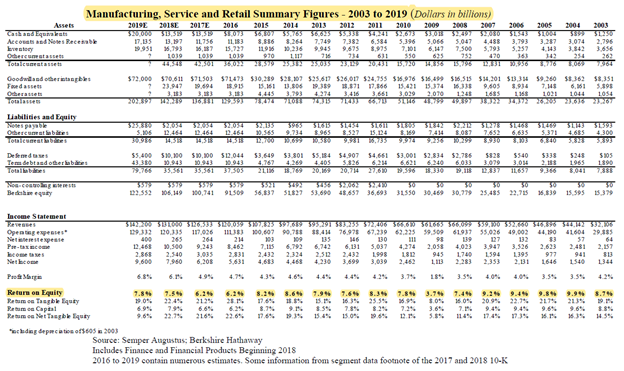

13/ MSR&F

$BRK owns too many businesses to fit in this tweet.

Instead of listing all these businesses, let’s look at the segment wise picture. SA isn’t fond of the economics of MSR&F, and it will be clear why once you take a glance at ROE for this segment.

$BRK owns too many businesses to fit in this tweet.

Instead of listing all these businesses, let’s look at the segment wise picture. SA isn’t fond of the economics of MSR&F, and it will be clear why once you take a glance at ROE for this segment.

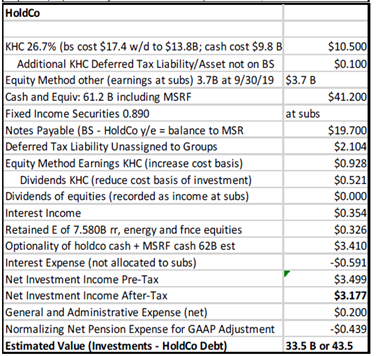

14/ Equity Method Investments

Kraft Heinz (~27% stake), Pilot Flying J (~39%), Berkadia (50%), Electric Transmission Texas (50%)

Kraft Heinz (~27% stake), Pilot Flying J (~39%), Berkadia (50%), Electric Transmission Texas (50%)

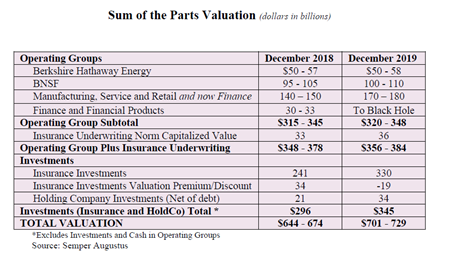

15/ So putting this all together, Sum-Of-The-Parts (SOTP) valuation comes out to be ~$700 Bn.

Current market cap is ~$450 Bn.

Current market cap is ~$450 Bn.

16/ But wait! SOTP is boring, and it mostly doesn’t work.

Okay then, let’s do this another way!

Here comes GAAP adjusted Financials approach.

Okay then, let’s do this another way!

Here comes GAAP adjusted Financials approach.

17/ $BRK’s GAAP net earnings was $45 B, $4 B, and $85 B in 2017, 2018, and 2019 respectively. So obviously you need to adjust a lot of things to normalize these earnings!

Yup, a lot of adjustments.

Yup, a lot of adjustments.

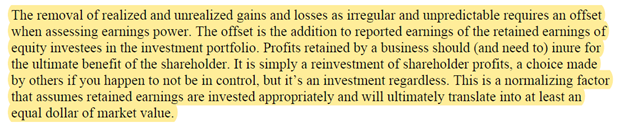

18/ While it’s intuitive that we should exclude gains/losses from marketable securities to make earnings comparable, it may not be obvious we need to *include* retained earnings of the public market investments to make it apple-to-apple.

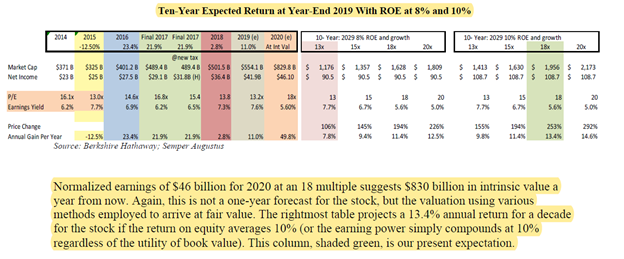

19/ So after all the adjustments, $BRK’s economic earnings for last 3 years were ~$28 B, ~$36 B, and ~$42 B respectively.

At 18x multiple, BRK is worth ~$750 B. Again, current market cap is $450 B.

At 18x multiple, BRK is worth ~$750 B. Again, current market cap is $450 B.

20/ This is all good, but can I look at this from another angle? Okay, since you asked…

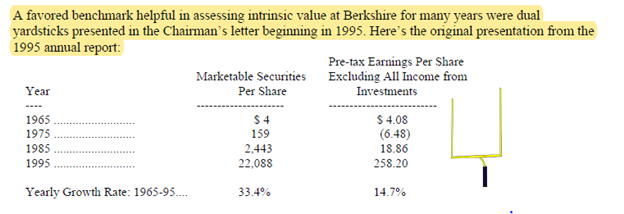

Let’s look at two-pronged approach. $BRK used to present this in its annual letter till 1995.

Let’s look at two-pronged approach. $BRK used to present this in its annual letter till 1995.

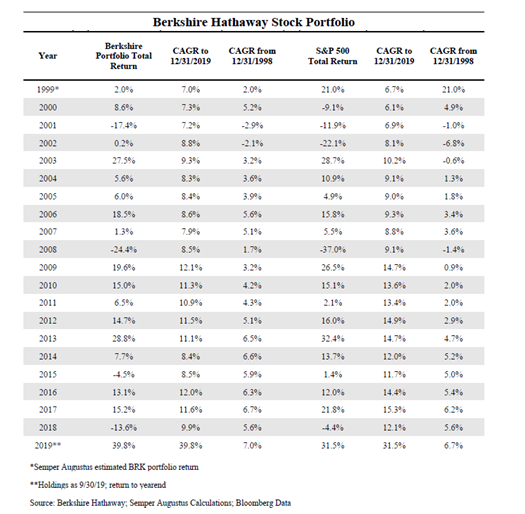

21/ Buffett is receiving a lot of flak recently for his stock picking skills!!!

It’s true that last 10 years has not been great for the Oracle of Omaha, but his portfolio’s 20-year return is still marginally ahead.

It’s true that last 10 years has not been great for the Oracle of Omaha, but his portfolio’s 20-year return is still marginally ahead.

22/ Here’s what the two-pronged approach tells us about valuation: $756 B.

Current market cap, in case you forgot, is ~$450 B.

Current market cap, in case you forgot, is ~$450 B.

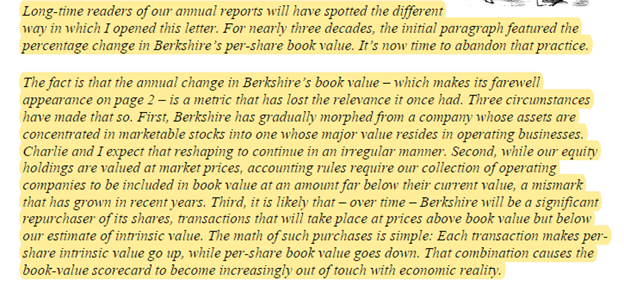

23/ How about P/B? Isn’t it also cheap and relevant for $BRK?

At ~1.1x, it’s certainly cheap. But Buffett kinda told us in 2018 not to focus on BV anymore.

At ~1.1x, it’s certainly cheap. But Buffett kinda told us in 2018 not to focus on BV anymore.

24/ SA disagreed with this view and provided cogent explanation why BV is still relevant for $BRK.

If you’re very keen, go ahead and read page 77-80 of SA letter.

Link: https://static.fmgsuite.com/media/documents/c388840b-3dda-41da-a062-077bf785255b.pdf">https://static.fmgsuite.com/media/doc...

If you’re very keen, go ahead and read page 77-80 of SA letter.

Link: https://static.fmgsuite.com/media/documents/c388840b-3dda-41da-a062-077bf785255b.pdf">https://static.fmgsuite.com/media/doc...

25/ Of all the ways we can look at, $BRK’s intrinsic value hovers between $700-800 B.

@PrefShares also recently tried to value $BRK and took a rather conservative approach, and yet in that approach, $BRK was ~$600 B company.

https://twitter.com/PrefShares/status/1275872786830024709">https://twitter.com/PrefShare...

@PrefShares also recently tried to value $BRK and took a rather conservative approach, and yet in that approach, $BRK was ~$600 B company.

https://twitter.com/PrefShares/status/1275872786830024709">https://twitter.com/PrefShare...

26/ “In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

For an unleveraged company with sustainable ~8% ROE, investors are paying a LOT more than 13x these days.

For an unleveraged company with sustainable ~8% ROE, investors are paying a LOT more than 13x these days.

End/ $BRK will be weighed in the long run.

Who cares if it’s 1 year, 5 years, or 20 years?

I can wait.

Who cares if it’s 1 year, 5 years, or 20 years?

I can wait.

Since most of the numbers in this thread are just a bit dated and thanks to Covid-19, you may be more interested in post-Corona situation, give this a read/listen to get updated views by Chris. https://acquirersmultiple.com/2020/05/berkshire-shrinking-its-way-to-profitability/">https://acquirersmultiple.com/2020/05/b...

Read on Twitter

Read on Twitter