For my next trick, I will now attempt to summarize @ole_b_peters very insightful paper in @nature :

The Ergodicity Problem in Economics

At the risk of being hyperbolic, I think it is one of the most important papers ever published in economics.

The Ergodicity Problem in Economics

At the risk of being hyperbolic, I think it is one of the most important papers ever published in economics.

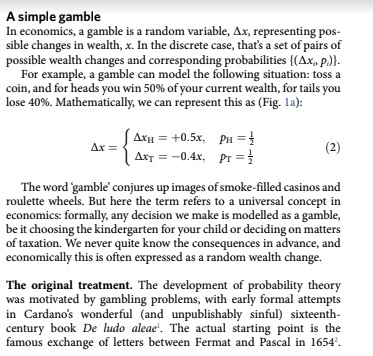

For the purposes of this paper, we only need to understand that ergodicity means that the time average of a system equals its expectation value, or ensemble average.

A way to identify an ergodic situation is to ask do I get the same result if I:

look at one individual’s trajectory across time

look at a bunch of individual’s trajectories at a single point in time

If yes: ergodic.

If not: non-ergodic.

look at one individual’s trajectory across time

look at a bunch of individual’s trajectories at a single point in time

If yes: ergodic.

If not: non-ergodic.

For example, Russian Roulette is non-ergodic: one person playing 6 times (time average) gets a very different result than 6 people playing one time (ensemble average/expectation value) https://twitter.com/ole_b_peters/status/1271146696639160320">https://twitter.com/ole_b_pet...

Economics has a major error: it assumes most economic games are ergodic, but they aren& #39;t.

To make an economic decision, I want to know how my personal fortune grows or shrinks under different scenarios, not how the average person& #39;s fortune grows or shrinks.

To make an economic decision, I want to know how my personal fortune grows or shrinks under different scenarios, not how the average person& #39;s fortune grows or shrinks.

I don& #39;t care that the average person "wins" at Russian Roulette, I care about what happens to me if I keep playing over time.

The observed behavior of people making economic decision often deviates from what traditional economic theory would predict as optimal.

This has led to the belief in "irrationality" and "biases" as a way to explain human behavior deviating from what economic models predict

This has led to the belief in "irrationality" and "biases" as a way to explain human behavior deviating from what economic models predict

However, many "biases" disappear when you realize that people intuitively understand periodicity.

You don& #39;t need an economics degree to understand that Russian Roulette six times in a row means you& #39;re going to have a bad time.

You don& #39;t need an economics degree to understand that Russian Roulette six times in a row means you& #39;re going to have a bad time.

One example is the St. Petersburg paradox which is hard to explain using traditional economic models, but makes sense through the lens of ergodicity economics.

The way traditional economics dealt with this was by adding expected utility theory: people don& #39;t just optimize for the expectation value of wealth, but the usefulness of wealth.

Thus the reason (under traditional economic reasoning) that someone doesn& #39;t participate in a positive expectation, but non-ergodic game is because they are "conservative" or "scared" as opposed to "aggressive" or "brave"

Now, let& #39;s step back and look at economics through the lens of ergodicity.

Start with an economic decision with no uncertainty:

You may choose between a job that offers $12,000 per year or $2,000 per month.

Which do you pick?

Start with an economic decision with no uncertainty:

You may choose between a job that offers $12,000 per year or $2,000 per month.

Which do you pick?

Everyone picks the $2,000 per month job, not because it is the larger amount (it isn& #39;t) but because it leads to a higher growth rate of wealth.

Ergodicity economics optimizes for growth rate over time, not across many people.

We care about our ROI when we make taking a job or making an investment, not how the average person does.

We care about our ROI when we make taking a job or making an investment, not how the average person does.

In maximizing the expectation value, expected utility theory assumes that individuals can interact with copies of themselves in parallel universes.

If you could make a million copies of yourself and each copy played Russian Roulette for $1 million each round, then there is one version of yourself that would get extremely lucky and make a ton of money.

But reality doesn& #39;t work that way. We do not live spread out across a multiverse. We live one life, through time.

It& #39;s not so much that some people are more aggressive or conservative, it& #39;s that people behave differently depending on the game are playing.

This is supported by an experiment in which a group of neuroscientists from Copenhagen split participants into two groups.

One group was playing an additive game (more ergodic)

The other group was playing a multiplicative game (less ergodic)

One group was playing an additive game (more ergodic)

The other group was playing a multiplicative game (less ergodic)

Expected Utility Theory would say that it doesn& #39;t matter which game they are playing since the expectation values are the same.

It only matters whether certain people are aggressive or conservative.

It only matters whether certain people are aggressive or conservative.

Ergodicity economics predicts something different: players playing the multiplicative game would seem more "conservative" because the game is less ergodic.

In both cases, participants would be making decisions to maximize the growth rate of their wealth

Playing conservative in the multiplicative game would maximize wealth in that game.

Playing more aggressive in the additive game would maximize wealth there.

Playing conservative in the multiplicative game would maximize wealth in that game.

Playing more aggressive in the additive game would maximize wealth there.

And, indeed, this is how participants behaved.

No biases needed!

No biases needed!

Though this line of thinking has been largely ignored by traditional economists, it has been widely appreciated by actual practitioners, most famously in the Kelly Criterion which acknowledges ergodicity economics.

https://twitter.com/TaylorPearsonMe/status/1116789716274360322">https://twitter.com/TaylorPea...

https://twitter.com/TaylorPearsonMe/status/1116789716274360322">https://twitter.com/TaylorPea...

In Conclusion: Ergodicity economics shows people (rationally) maximize the long-term growth of their wealth.

Much of what we call "risk aversion" is rational avoidance of non-ergodic games like Russian Roulette.

Much of what we call "risk aversion" is rational avoidance of non-ergodic games like Russian Roulette.

@threadreaderapp unroll

Read on Twitter

Read on Twitter