Assume:

The year is 50% to be sunny.

The risk free rate is 0

We can see the stocks have -1 correlation

Few things to think about:

1. SUN has a higher expected return and Sharpe than RAIN

2. There is an arbitrage. You can put 50% into each stock and earn 4% in sunny years and 0% in rainy years for an EV of +2% on the portfolio

Market prices of these stocks will adjust to there is no arb. Let& #39;s stay simple

2. There is an arbitrage. You can put 50% into each stock and earn 4% in sunny years and 0% in rainy years for an EV of +2% on the portfolio

Market prices of these stocks will adjust to there is no arb. Let& #39;s stay simple

Let& #39;s keep SUN& #39;s price constant so its returns characteristics are unched.

It is reasonable to RAIN to be bid up so it returns only 1% in a rainy year and loses 4% in a sunny year. RAIN& #39;s expected value is now -1% per year instead of zero.

Why would the market bid that much?

It is reasonable to RAIN to be bid up so it returns only 1% in a rainy year and loses 4% in a sunny year. RAIN& #39;s expected value is now -1% per year instead of zero.

Why would the market bid that much?

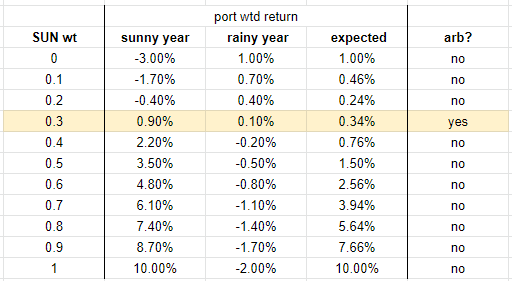

There& #39;s still an arb.

You could put 30% of the portfolio into SUN and 70% in RAIN and still earn 34 bps per year with NO risk (remember RFR is 0%)

You could put 30% of the portfolio into SUN and 70% in RAIN and still earn 34 bps per year with NO risk (remember RFR is 0%)

Besides showing how valuable low or neg correlated assets are in a portfolio, it shows how assets can look overpriced in isolation. The price is justified.

Price is set by the buyer best equipped to underwrite the risk.

Price is set by the buyer best equipped to underwrite the risk.

If you weren& #39;t willing to bid RAIN up you can bet SUN would have.

This is the intuition for why you do not get paid for diversifiable risks and why you are incinerating money if you don& #39;t diversify. https://www.notion.so/abdelmessih/The-Diversification-Imperative-0ffbc51024104c5e88d76e3866a6d5e7">https://www.notion.so/abdelmess...

This is the intuition for why you do not get paid for diversifiable risks and why you are incinerating money if you don& #39;t diversify. https://www.notion.so/abdelmessih/The-Diversification-Imperative-0ffbc51024104c5e88d76e3866a6d5e7">https://www.notion.so/abdelmess...

It& #39;s worth asking yourself, what assets do I think look overpriced but perhaps because I have the wrong perspective?

You are looking at RAIN but don& #39;t see what the SUN investor sees.

Once you internalize this, you can understand market-making and flow trading.

You are looking at RAIN but don& #39;t see what the SUN investor sees.

Once you internalize this, you can understand market-making and flow trading.

If X is willing to pay me a high looking price for a stock or option, what& #39;s the probability they are selling something else to someone else such that they are happy to pay me the "high" price.

Are they legging a portfolio that I& #39;d be happy to leg if I saw the whole picture?

Are they legging a portfolio that I& #39;d be happy to leg if I saw the whole picture?

So whenever you trade with someone you must always wonder:

What flow have they seen?

I always want to know if my counterparty is "smart". Not IQ-wise. But how much they see.

Do they get a phone call before me?

Is the deal I& #39;m being shown passed on by "smart" folks already?

What flow have they seen?

I always want to know if my counterparty is "smart". Not IQ-wise. But how much they see.

Do they get a phone call before me?

Is the deal I& #39;m being shown passed on by "smart" folks already?

If you extend this logic, it will humble you to the prices in markets.

If prices are always being set by the party who most efficiently underwrites/hedges/prices the risk and you know you are not one of those parties then you should wonder...

am I being arbed?

If prices are always being set by the party who most efficiently underwrites/hedges/prices the risk and you know you are not one of those parties then you should wonder...

am I being arbed?

Read on Twitter

Read on Twitter