Today& #39;s publication of the border operating model an explicit acknowledgement that exiting the EU& #39;s customs union and single market will create additional costs for British businesses trading with the EU.

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/899991/200713_BPDG_-_Border_Operating_Model_FINAL_1320_edit.pdf">https://assets.publishing.service.gov.uk/governmen...

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/899991/200713_BPDG_-_Border_Operating_Model_FINAL_1320_edit.pdf">https://assets.publishing.service.gov.uk/governmen...

Positively, this means we no longer have to discuss blockchain enabled zeppelins and "GATT 24", and can focus on preparing for the rupture at the end of the year.

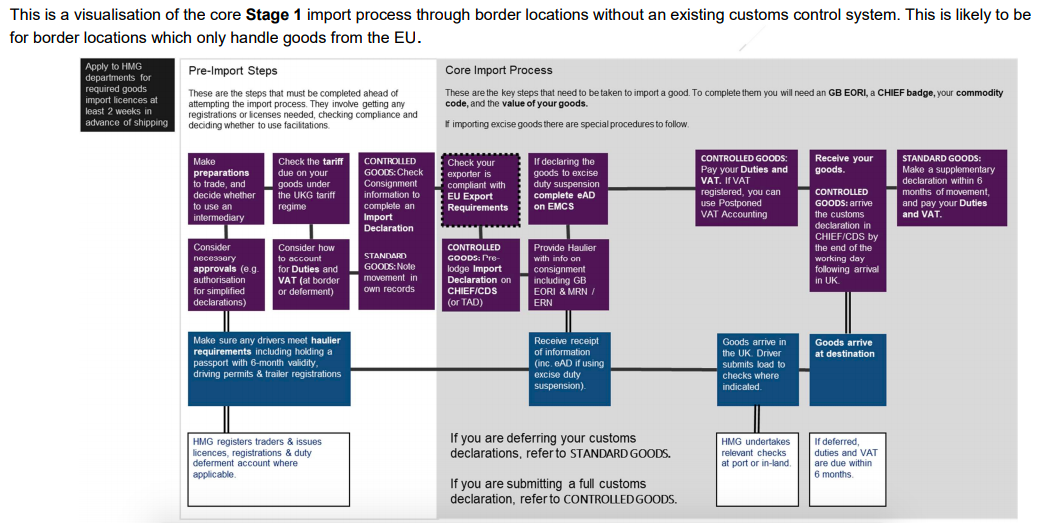

For imports, customs controls are being phased in in two stages. From Jan 1st, importers from EU will have to decide whether to

- declare imports & pay duties as would from RoW; or

- take advantage of scheme allowing deferral of declarations and payment of duties for 6 months

- declare imports & pay duties as would from RoW; or

- take advantage of scheme allowing deferral of declarations and payment of duties for 6 months

For an importer bringing in goods via Dover and taking advantage of deferral scheme, process goes something like this:

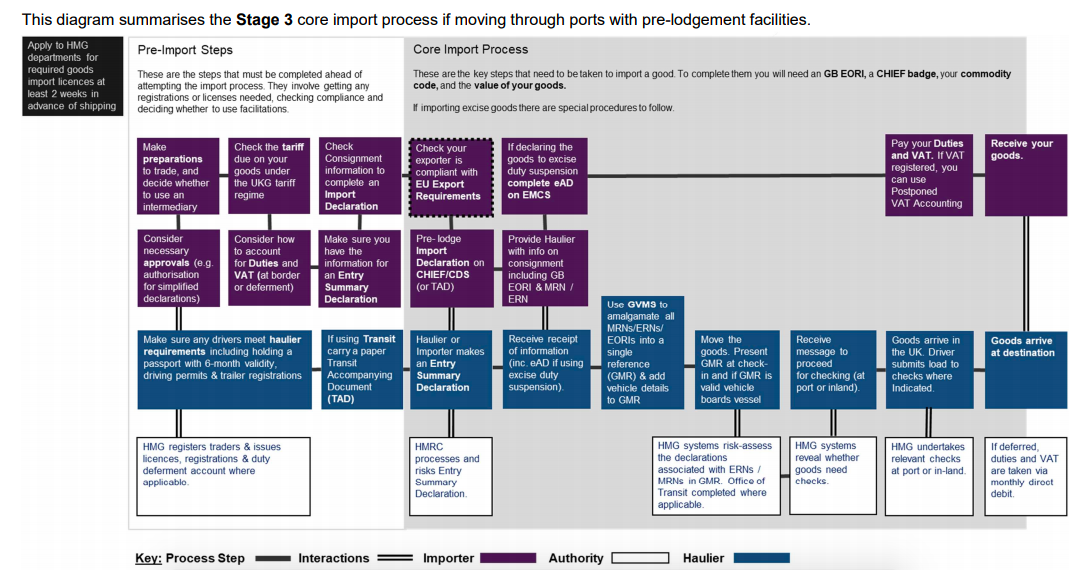

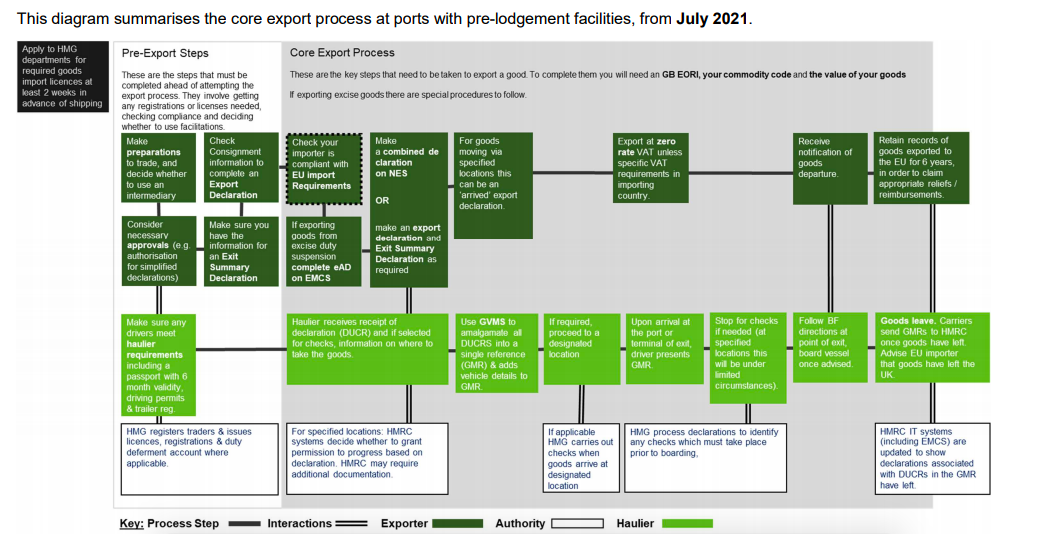

However, once the 6 months are up (so July next year), comprehensive import procedures will apply, and the process for importing goods via Dover will look something like this:

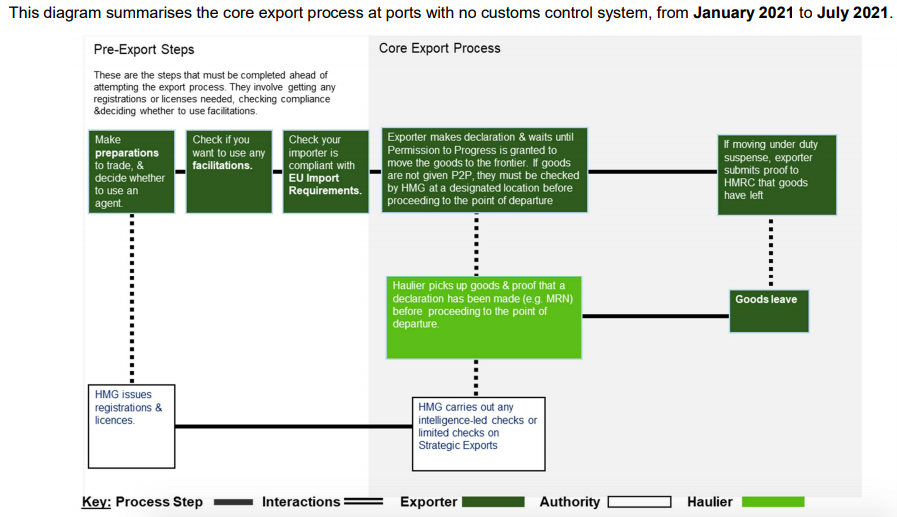

For exporters via roll-on-roll off ports, also a two stage process. From January to July 2021 it goes something like this:

This is just a snapshot, and only part of the process.

If the EU & UK conclude a free trade agreement, further guidance will have to be produced outlining the process by which traders can qualify for zero tariffs under the FTA.

Again, document is here: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/899991/200713_BPDG_-_Border_Operating_Model_FINAL_1320_edit.pdf">https://assets.publishing.service.gov.uk/governmen...

If the EU & UK conclude a free trade agreement, further guidance will have to be produced outlining the process by which traders can qualify for zero tariffs under the FTA.

Again, document is here: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/899991/200713_BPDG_-_Border_Operating_Model_FINAL_1320_edit.pdf">https://assets.publishing.service.gov.uk/governmen...

Read on Twitter

Read on Twitter