Talked to a friend this weekend who asked was I really “net up” on the stock market bc “people love to post the wins but never the losses”. Here’s a good example of why you can’t miss when you buy solid investments and sit on them. (THREAD)

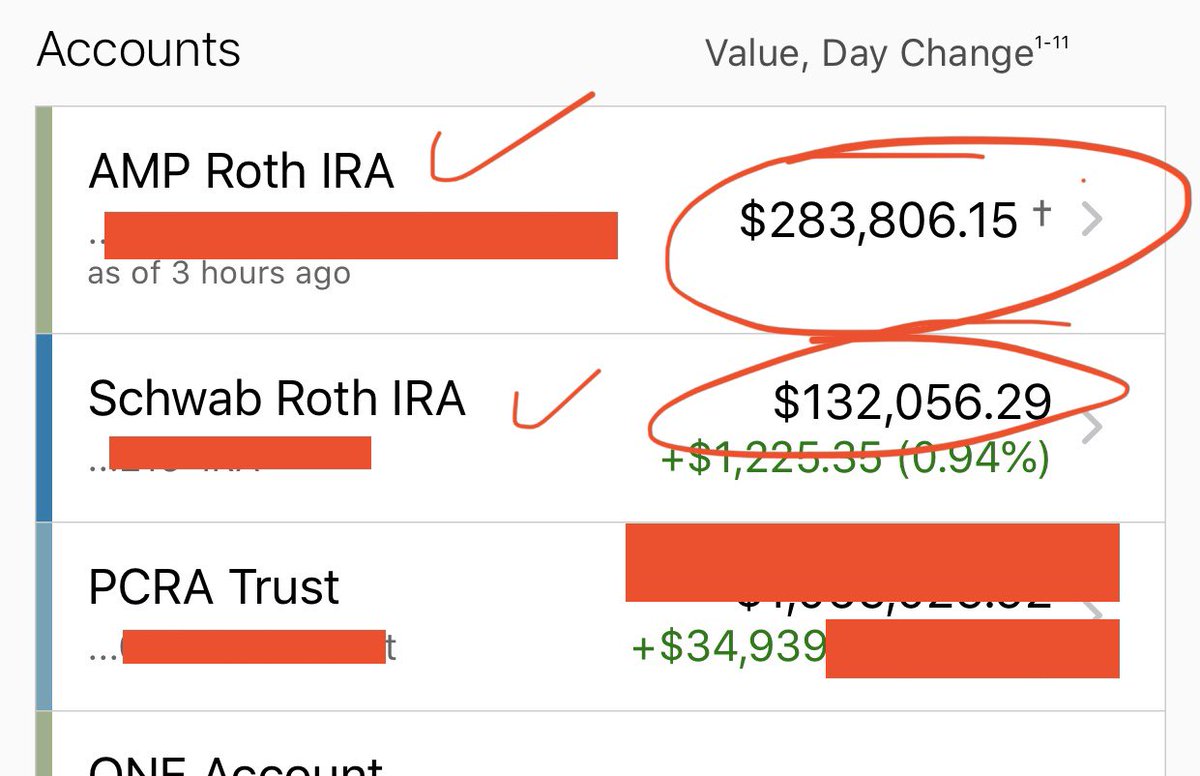

My combined Roth IRAs are ~$415k. I’ve made contributions every year since 2000 (today I do something called a back door contribution but that’s another thread). There’s limits on how much you can put in each year. When I first started, contributions were at $2,000 per year.

My contributions total $88,000 and were as follows:

2000 - 2001: $4,000 (2k/year)

2002 - 2004: $9,000 (3k/year)

2005 - 2007: $12,000 (4k/year)

2008 - 2012: $25,000 (5k/year)

2013 - 2018: $33,000 (5,500/year)

2019: $6,000

Haven’t done 2020s $6,000 yet.

2000 - 2001: $4,000 (2k/year)

2002 - 2004: $9,000 (3k/year)

2005 - 2007: $12,000 (4k/year)

2008 - 2012: $25,000 (5k/year)

2013 - 2018: $33,000 (5,500/year)

2019: $6,000

Haven’t done 2020s $6,000 yet.

I’ve def had losses in this account over the years. Between 2000 and 2004, I was basically gambling in the markets and prob broke even. 2005, I stopped buying risky trash. 2005 to 2010 was mostly index funds. Still increased principal almost 5 times. Buy good companies and wait.

The  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔌" title="Elektrostecker" aria-label="Emoji: Elektrostecker">: Early on, not only was I lazy investing this bag (indexes) but I was only investing $167/month which is more than doable for a lot of people. Cable cost about that & EFF YO SHOWS

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔌" title="Elektrostecker" aria-label="Emoji: Elektrostecker">: Early on, not only was I lazy investing this bag (indexes) but I was only investing $167/month which is more than doable for a lot of people. Cable cost about that & EFF YO SHOWS  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗣" title="Silhouette eines sprechenden Kopfes" aria-label="Emoji: Silhouette eines sprechenden Kopfes">. As my income increased, and the contribution limits went up, I increased my contributions

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗣" title="Silhouette eines sprechenden Kopfes" aria-label="Emoji: Silhouette eines sprechenden Kopfes">. As my income increased, and the contribution limits went up, I increased my contributions

Read on Twitter

Read on Twitter