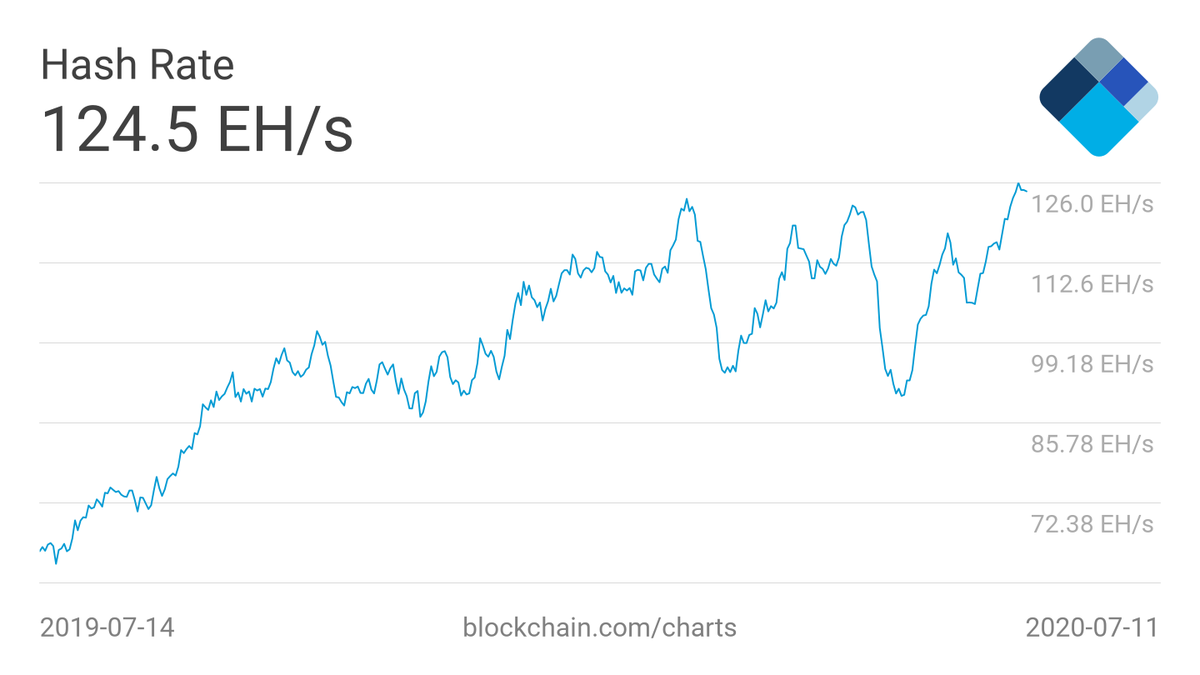

After falling 27% following the halving, Bitcoin& #39;s hash rate has just set a *new all-time high* at over 124 exahashes per second.

Once again, no "death spiral" was had. And that& #39;s long-term bullish for BTC.

Here& #39;s more on why.

Once again, no "death spiral" was had. And that& #39;s long-term bullish for BTC.

Here& #39;s more on why.

The ongoing HR surge comes on the back of 4 trends:

1) an influx of investment by Bitcoin mining firms

2) the arrival of "rainy season" in China

3) the sale of more efficient mining machines from ASIC manufacturers

4) A potential "hash rate war" (h/t @maxkeiser, @realmaxkeiser)

1) an influx of investment by Bitcoin mining firms

2) the arrival of "rainy season" in China

3) the sale of more efficient mining machines from ASIC manufacturers

4) A potential "hash rate war" (h/t @maxkeiser, @realmaxkeiser)

1) Investment by mining firms.

- Core Scientific bought 17k of Bitmain& #39;s new SHA-256 ASICs

- Peter Thiel-backed mining startup Layer1 started operations in February. Layer1 wants to control 30% of Bitcoin& #39;s hash rate

- SBI and GMO Internet are working with a large mine in Tx

- Core Scientific bought 17k of Bitmain& #39;s new SHA-256 ASICs

- Peter Thiel-backed mining startup Layer1 started operations in February. Layer1 wants to control 30% of Bitcoin& #39;s hash rate

- SBI and GMO Internet are working with a large mine in Tx

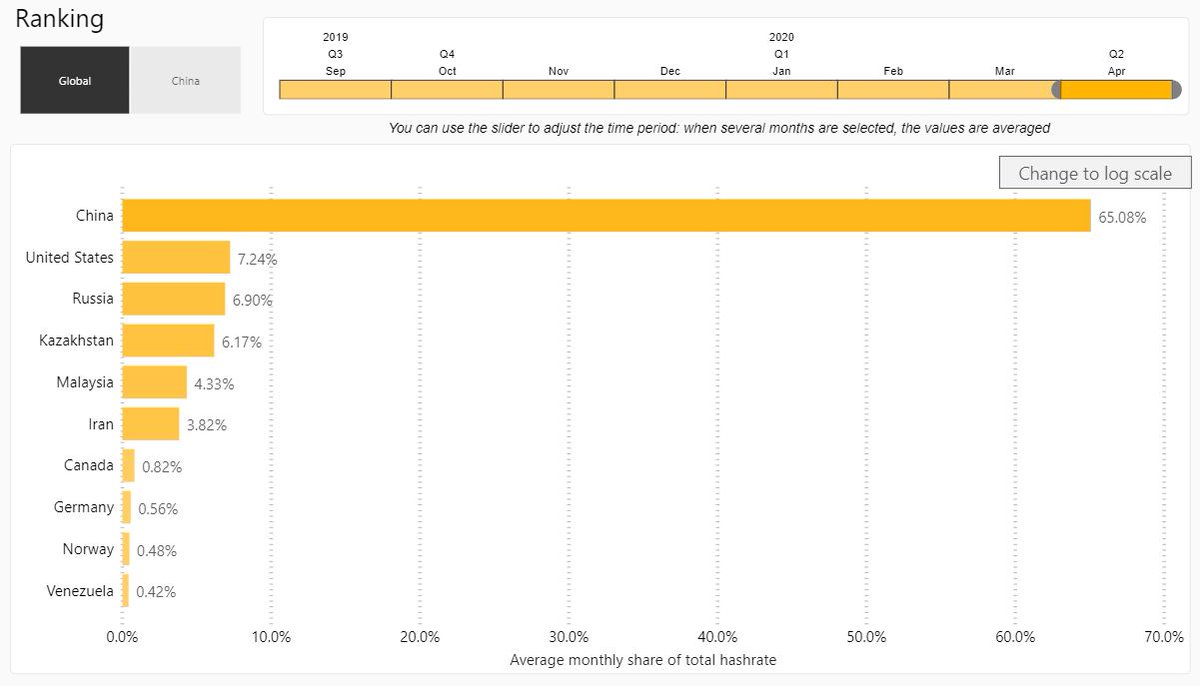

2) It& #39;s rainy season in China.

With an estimated ~65% (University of Cambridge) of all Bitcoin hash rate located in China, where hydroelectricity is prevalent, floods = much cheaper electricity rates for miners.

Some reports say during rainy season, it can cost ~$0.01/kWh.

With an estimated ~65% (University of Cambridge) of all Bitcoin hash rate located in China, where hydroelectricity is prevalent, floods = much cheaper electricity rates for miners.

Some reports say during rainy season, it can cost ~$0.01/kWh.

3) ASIC companies are rolling out new devices.

MicroBT launched the Whatsminer M30S++ in April. It is ~35% more efficient than last April& #39;s devices.

Bitmain rolled out the Antminer S19 Pro in May. It& #39;s ~27% more efficient than December& #39;s devices.

(Data: @hashrateindex)

MicroBT launched the Whatsminer M30S++ in April. It is ~35% more efficient than last April& #39;s devices.

Bitmain rolled out the Antminer S19 Pro in May. It& #39;s ~27% more efficient than December& #39;s devices.

(Data: @hashrateindex)

4) Iran, Venezuela, and other countries are starting to heavily regulate mining.

@maxkeiser/ @realmaxkeiser and others think this regulation and focus will start a "global hash rate war," spurring massive investment in the Bitcoin mining space.

@maxkeiser/ @realmaxkeiser and others think this regulation and focus will start a "global hash rate war," spurring massive investment in the Bitcoin mining space.

This confluence of trends seemingly indicates that Bitcoin& #39;s hash rate won& #39;t stop climbing, especially if BTC holds current levels or appreciates even higher.

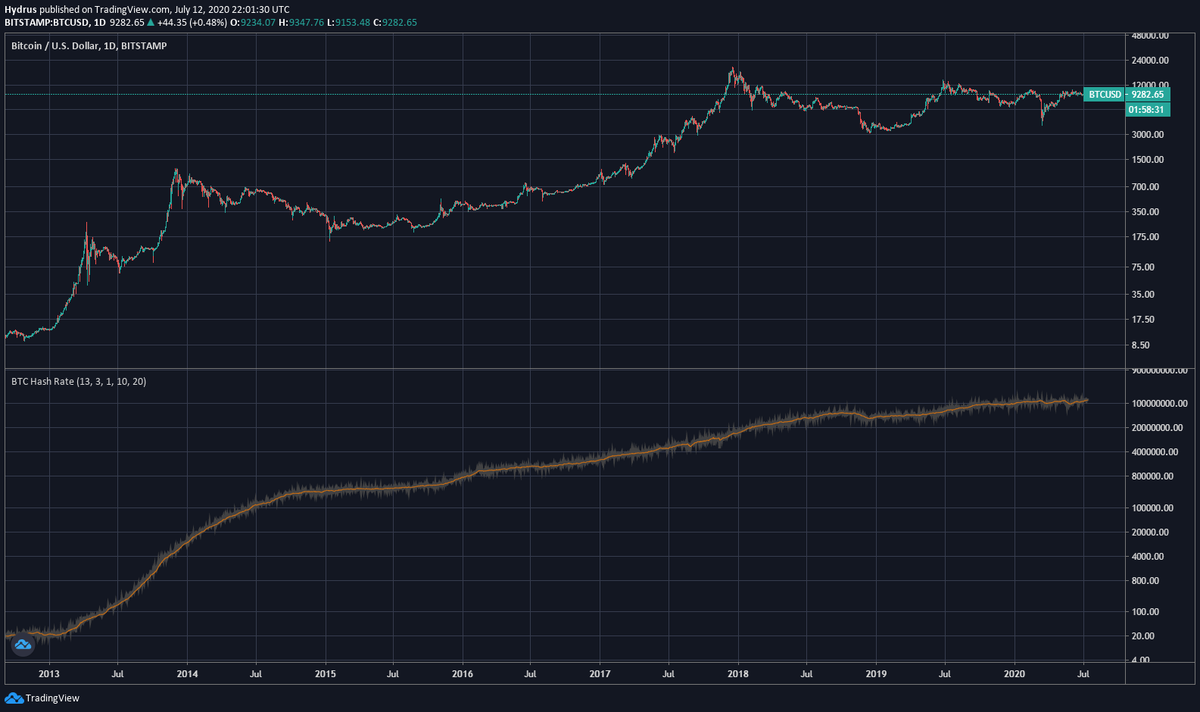

Check the chart: Bitcoin& #39;s hash rate has consistently been up and to the right, even during bear markets.

Check the chart: Bitcoin& #39;s hash rate has consistently been up and to the right, even during bear markets.

Analysis by @caprioleio has found that a strong Bitcoin mining ecosystem should correspond with higher prices. His "Energy Value" model says that "the value of Bitcoin is a function of its energy input in Joules."

Bitcoin is trading 28% below its EV as the hash rate has surged.

Bitcoin is trading 28% below its EV as the hash rate has surged.

With an R2 of ~80%, as long as the energy consumption of the Bitcoin network remains high/grows, price should follow.

https://medium.com/capriole/bitcoin-value-energy-equivalence-6d00d1baa34a">https://medium.com/capriole/...

https://medium.com/capriole/bitcoin-value-energy-equivalence-6d00d1baa34a">https://medium.com/capriole/...

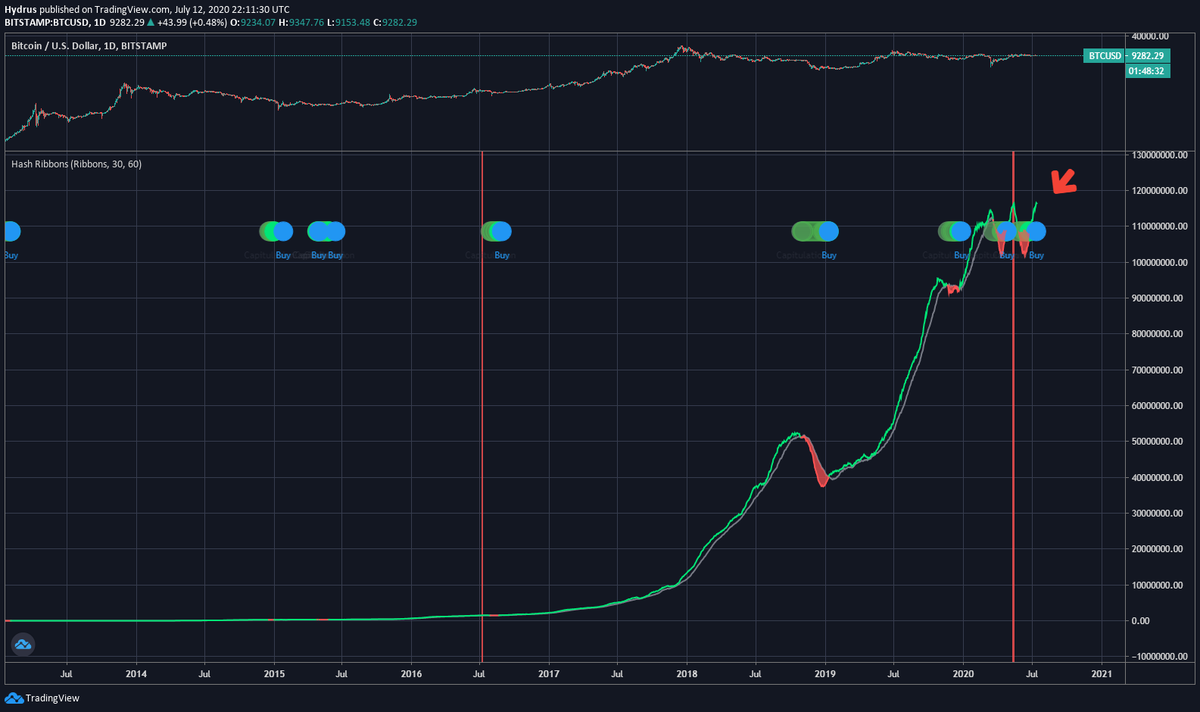

There& #39;s also the Hash Ribbons, also pioneered by @caprioleio.

The Hash Ribbons is an indicator that derives signals from crosses in the short-term and long-term moving averages of the hash rate.

It is likely to print a "buy" today for the 11th time in history.

The Hash Ribbons is an indicator that derives signals from crosses in the short-term and long-term moving averages of the hash rate.

It is likely to print a "buy" today for the 11th time in history.

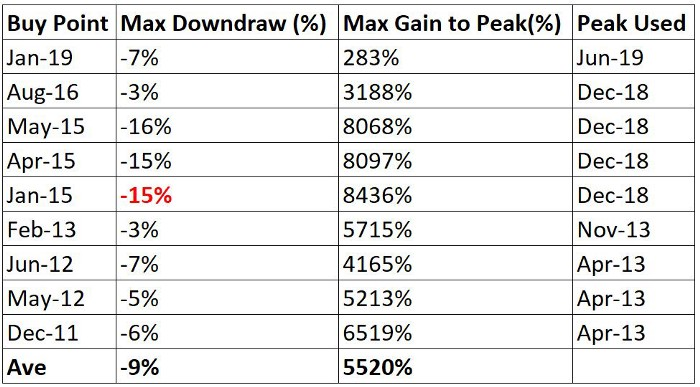

The Hash Ribbons forming a "buy" is an indicator of macro importance. This analysis by Edwards has found that the indicator has preceded all of Bitcoin& #39;s major parabolic rallies.

https://medium.com/capriole/hash-ribbons-bitcoin-bottoms-60da13095836">https://medium.com/capriole/...

https://medium.com/capriole/hash-ribbons-bitcoin-bottoms-60da13095836">https://medium.com/capriole/...

All this will be culminating in a positive adjustment in the difficulty of Bitcoin blocks. ETA: ~10 hours.

The difficulty adjustment is expected to be a +8/9% move, bringing the value to its highest ever. As @100trillionUSD recently said: https://twitter.com/100trillionUSD/status/1280928298382565377">https://twitter.com/100trilli...

The difficulty adjustment is expected to be a +8/9% move, bringing the value to its highest ever. As @100trillionUSD recently said: https://twitter.com/100trillionUSD/status/1280928298382565377">https://twitter.com/100trilli...

There we have it folks: a +9.5% Bitcoin difficulty change to bring the metric to a new all-time high of 17,345,948,872,516.

Honey badger don& #39;t care.

Honey badger don& #39;t care.

Read on Twitter

Read on Twitter