Notes on AR 19-20

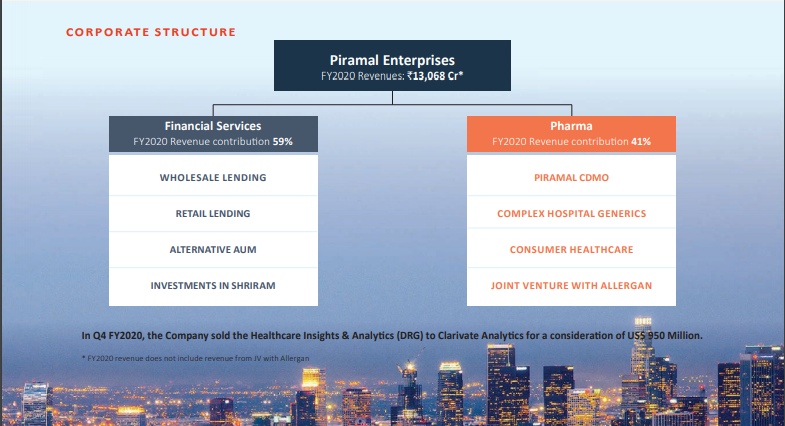

Piramal Enterprises:

AR of PEL is an ocean & it would be a gigantic tweet thread if we cover everything.

So we broke it into 3 parts:

1.Strategic Overview

2.MDA

3.Financials

This thread is only on the 1st part: Strategic Overview

@suru27 @finbloggers

Piramal Enterprises:

AR of PEL is an ocean & it would be a gigantic tweet thread if we cover everything.

So we broke it into 3 parts:

1.Strategic Overview

2.MDA

3.Financials

This thread is only on the 1st part: Strategic Overview

@suru27 @finbloggers

1/

Piramal Enterprises:

“When Management with a Reputation for Brilliance meets Business with a reputation of bad economics.”

Can the future be any different?

How?

And by when?

Management views are positive. Let’s deep dive

Piramal Enterprises:

“When Management with a Reputation for Brilliance meets Business with a reputation of bad economics.”

Can the future be any different?

How?

And by when?

Management views are positive. Let’s deep dive

2/

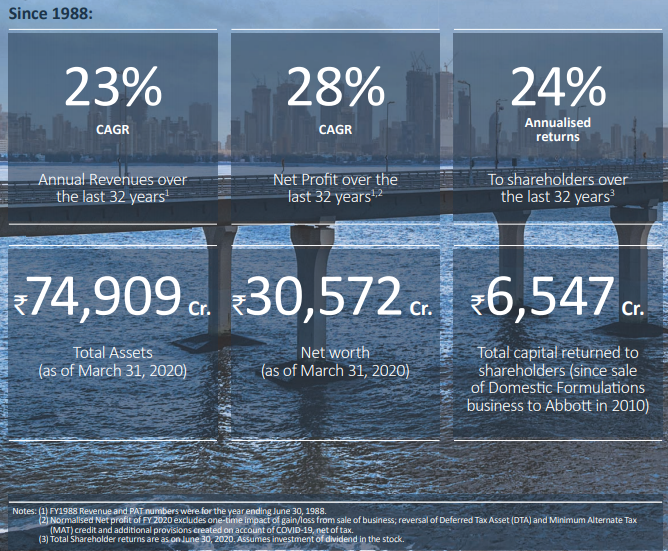

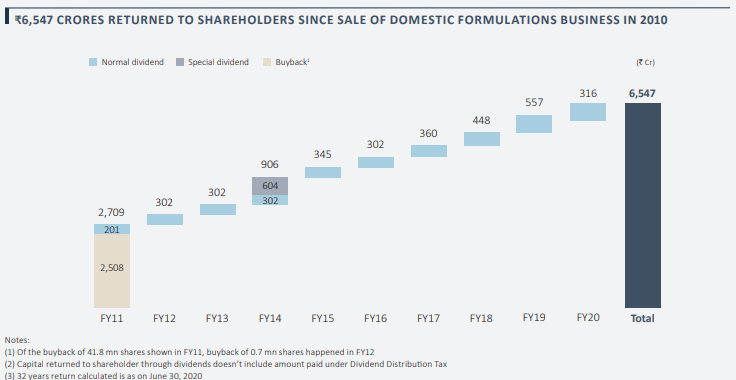

Staggering Track Record in the last 32 years (since 1988)

•Revenues 23% CAGR

•NP 28% CAGR

•Total Stock Returns (including dividends) 24% CAGR

Staggering Track Record in the last 32 years (since 1988)

•Revenues 23% CAGR

•NP 28% CAGR

•Total Stock Returns (including dividends) 24% CAGR

3/

Ajay Piramal’s Message

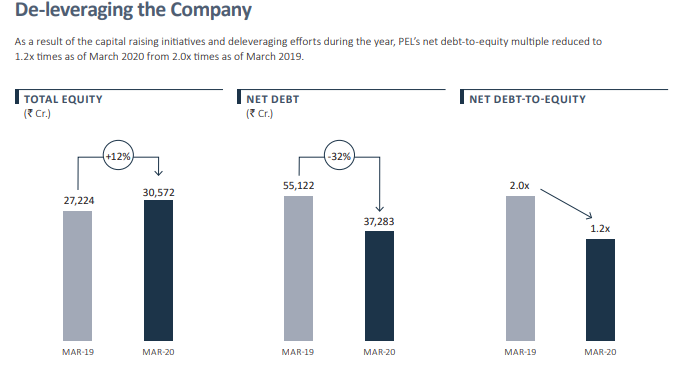

•Strengthening the Balance Sheet (BS) through equity fundraise.

•Deleveraging BS

•Profits getting impacted by higher COVID-19 related provisions and MAT credit reversals

Ajay Piramal’s Message

•Strengthening the Balance Sheet (BS) through equity fundraise.

•Deleveraging BS

•Profits getting impacted by higher COVID-19 related provisions and MAT credit reversals

4/

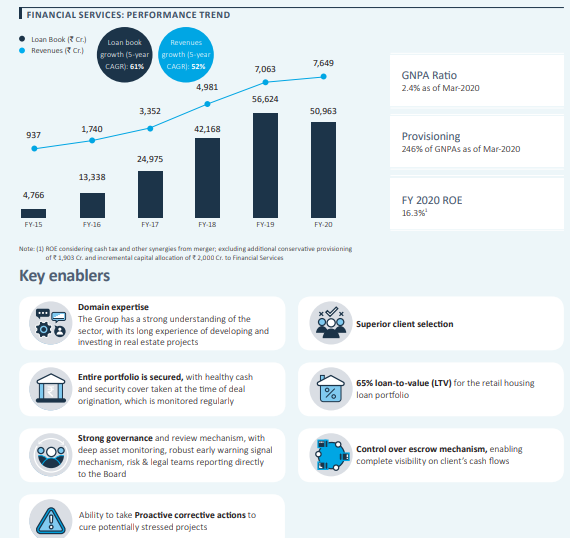

AP Message contd

Financial Service

•Trends in NBFC sector: Prolonged crisis will enhance the speed & extent of the ongoing consolidation in the NBFC sector. Only strong, well-capitalized and well-governed will survive.

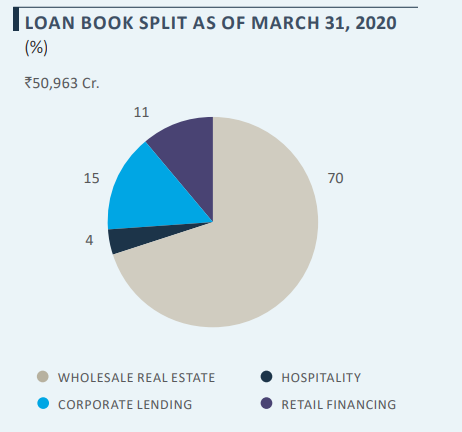

•Granularisation of the loan book: On track

AP Message contd

Financial Service

•Trends in NBFC sector: Prolonged crisis will enhance the speed & extent of the ongoing consolidation in the NBFC sector. Only strong, well-capitalized and well-governed will survive.

•Granularisation of the loan book: On track

5/

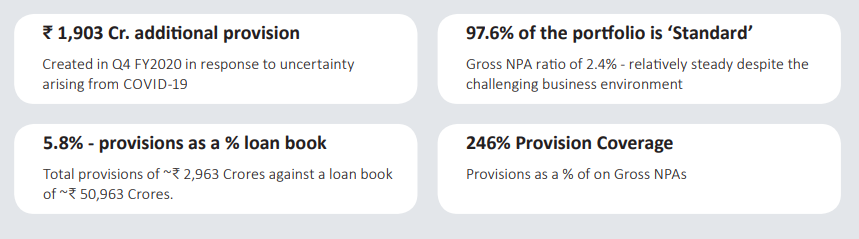

AP Message contd

Financial Service

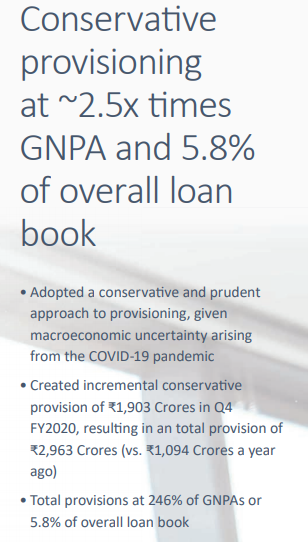

•Asset Quality & Prov: Entire Loan Assets secured. Sufficient provisioning

•Launch of a multiproduct retail lending platform, which would be fully “digital at its core”.

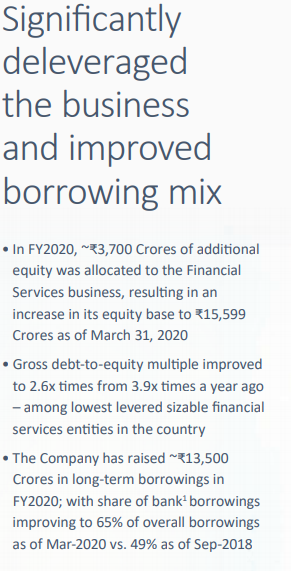

•Equity raise led to DER reducing from 3.9 to 2.6.

AP Message contd

Financial Service

•Asset Quality & Prov: Entire Loan Assets secured. Sufficient provisioning

•Launch of a multiproduct retail lending platform, which would be fully “digital at its core”.

•Equity raise led to DER reducing from 3.9 to 2.6.

6/

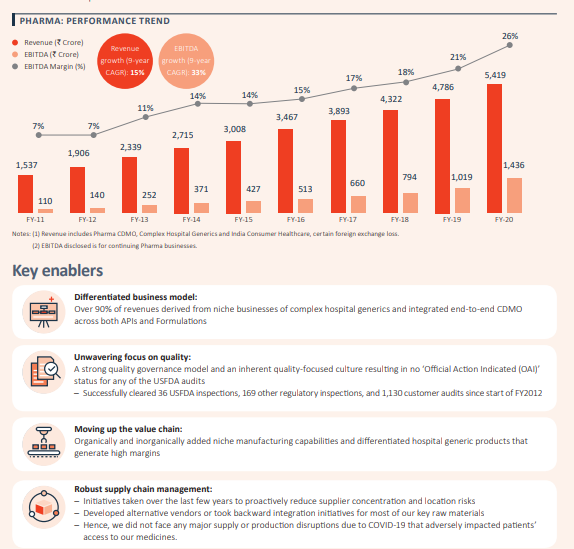

AP Message contd

Pharma

•Revenue growth of 15% CAGR in 9 yrs

•EBITDA margin at 26%, EBITDA crossed ₹1,400 Crores in FY2020.

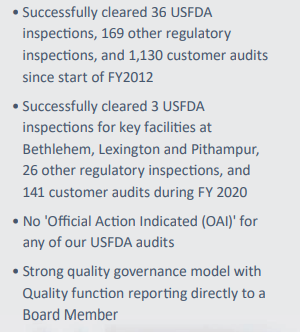

•Continued strong focus on Quality and Compliance.

•Raising strategic growth capital

AP Message contd

Pharma

•Revenue growth of 15% CAGR in 9 yrs

•EBITDA margin at 26%, EBITDA crossed ₹1,400 Crores in FY2020.

•Continued strong focus on Quality and Compliance.

•Raising strategic growth capital

8/

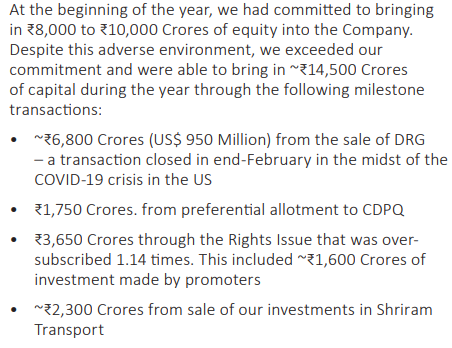

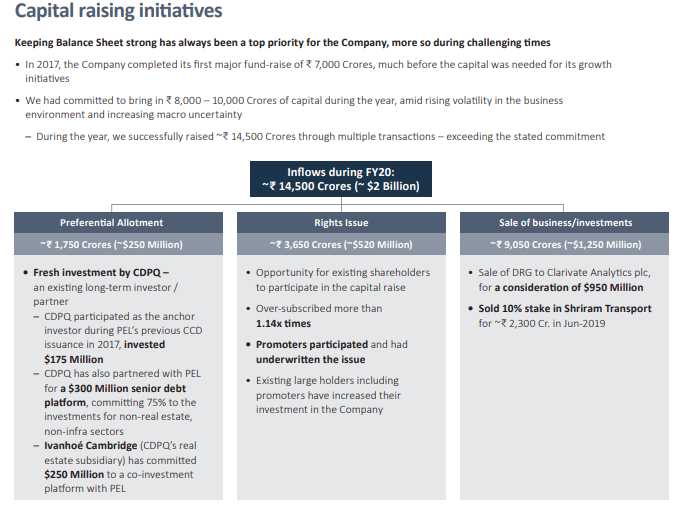

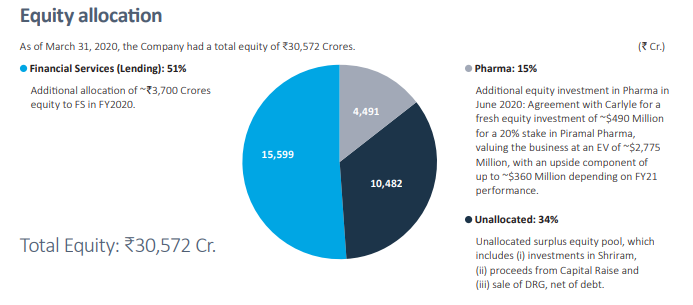

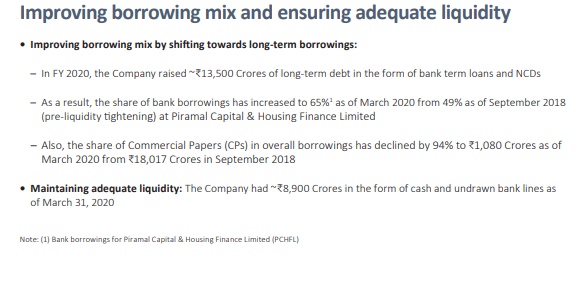

•Capital Raising

•Equity Allocation

•De-leveraging

•Improving borrowing mix & ensuring adequate liquidity

•Capital Raising

•Equity Allocation

•De-leveraging

•Improving borrowing mix & ensuring adequate liquidity

9/

Major headwinds for the financial services business in the last few years

•Regulatory & policy changes

•NBFC liquidity tightening

•Economic slowdown

•Global Pandemic of COVID-19

Major headwinds for the financial services business in the last few years

•Regulatory & policy changes

•NBFC liquidity tightening

•Economic slowdown

•Global Pandemic of COVID-19

10/

Challenges in the pharma business:

•Price erosion due to buyer consolidation in regulated markets

•Stringent regulatory audits

•Stress in the supply chain and disturbances in manufacturing operations due to the global COVID-19 pandemic

Challenges in the pharma business:

•Price erosion due to buyer consolidation in regulated markets

•Stringent regulatory audits

•Stress in the supply chain and disturbances in manufacturing operations due to the global COVID-19 pandemic

11/

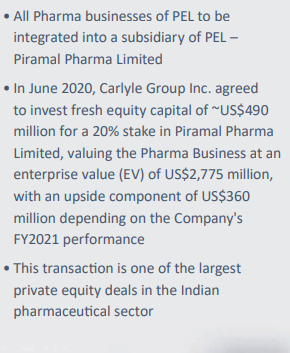

Key Development

•Sale of Healthcare Insights & Analytics business

•Shriram Transport Finance stake sale

•Fund-raising in Pharma

•To demerge the Pharma and Financial Services businesses in the medium term to unlock value for our shareholders

Key Development

•Sale of Healthcare Insights & Analytics business

•Shriram Transport Finance stake sale

•Fund-raising in Pharma

•To demerge the Pharma and Financial Services businesses in the medium term to unlock value for our shareholders

12/

COVID-19 Impact on the NBFC/HFC sector

•Deterioration in asset quality

•Heightened risk aversion across lenders to lend to NBFCs/HFCs, leading to liquidity pressures

•Demand-side pressures for clients of NBFCs, which could impact loan book growth in the near term

COVID-19 Impact on the NBFC/HFC sector

•Deterioration in asset quality

•Heightened risk aversion across lenders to lend to NBFCs/HFCs, leading to liquidity pressures

•Demand-side pressures for clients of NBFCs, which could impact loan book growth in the near term

13/

PEL’s response to COVID-19

•Stress testing the portfolio & creating extra prov

•Created higher liquidity

•Support clients and partners: Extending moratorium to clients, as per regulatory guidelines

•Corrective measures to resolve potential stress across deals

PEL’s response to COVID-19

•Stress testing the portfolio & creating extra prov

•Created higher liquidity

•Support clients and partners: Extending moratorium to clients, as per regulatory guidelines

•Corrective measures to resolve potential stress across deals

14/

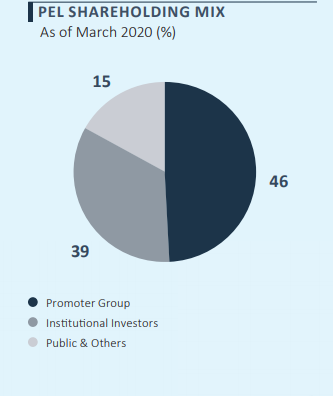

High Commitment from the Promoters

•The Promoters had invested in the Rights Issue of ~₹2,000 Crores during 2017.

•Even during the fundraise in FY 2020, the Promoters invested ~₹1,600 Crores in the Rights Issue.

High Commitment from the Promoters

•The Promoters had invested in the Rights Issue of ~₹2,000 Crores during 2017.

•Even during the fundraise in FY 2020, the Promoters invested ~₹1,600 Crores in the Rights Issue.

16/

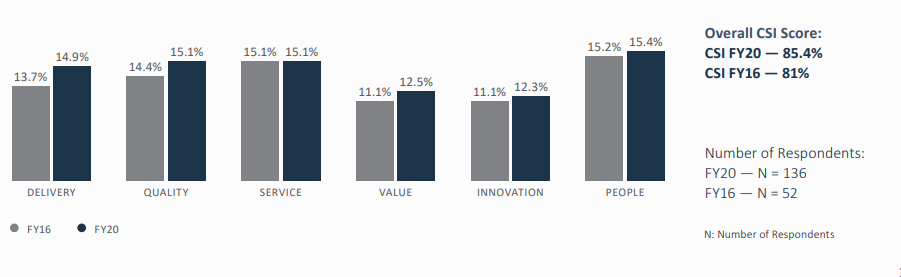

Customer Satisfaction Index (CSI) Score:

Surveys have been designed to understand the importance of delivery, quality, service, people, innovation, and value in the minds of the customers engaged with the Company in the Global Pharma services business.

Customer Satisfaction Index (CSI) Score:

Surveys have been designed to understand the importance of delivery, quality, service, people, innovation, and value in the minds of the customers engaged with the Company in the Global Pharma services business.

Read on Twitter

Read on Twitter