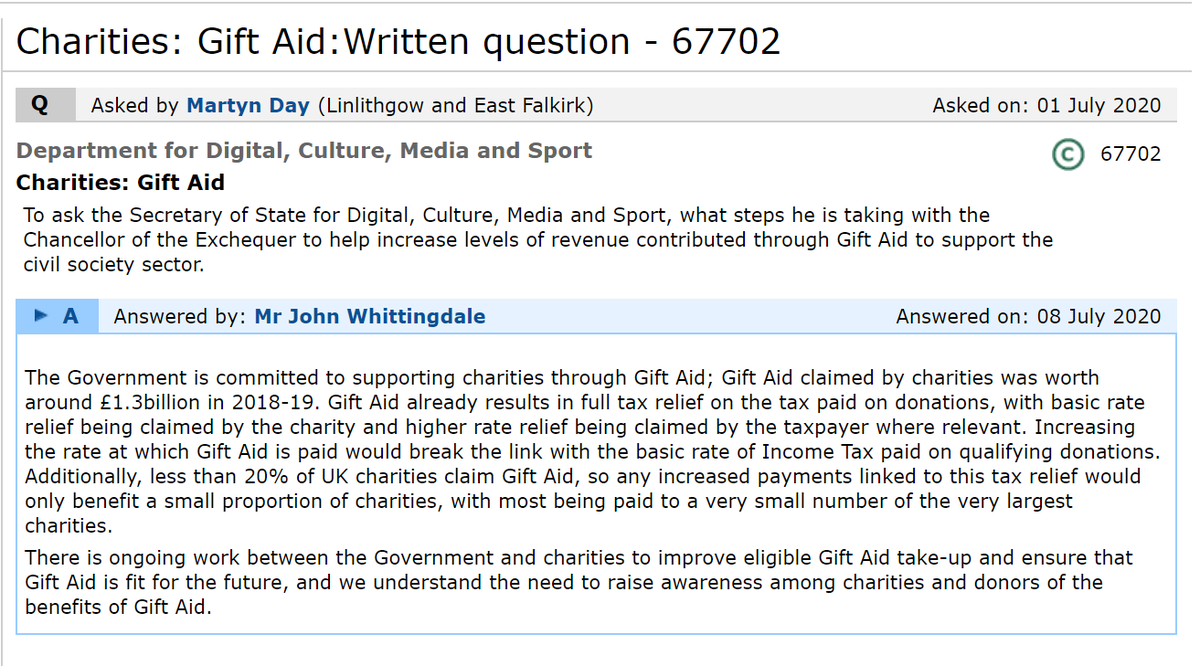

The Minister noted that <20% of charities would benefit from #GiftAidrelief. 73,050 charities claimed #GiftAid in 2018/19 approx 40% of UK charities representing a major part of the sector workforce & beneficiaries. The proposal has widespread support 2/ https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/811723/Table_4.pdf">https://assets.publishing.service.gov.uk/governmen...

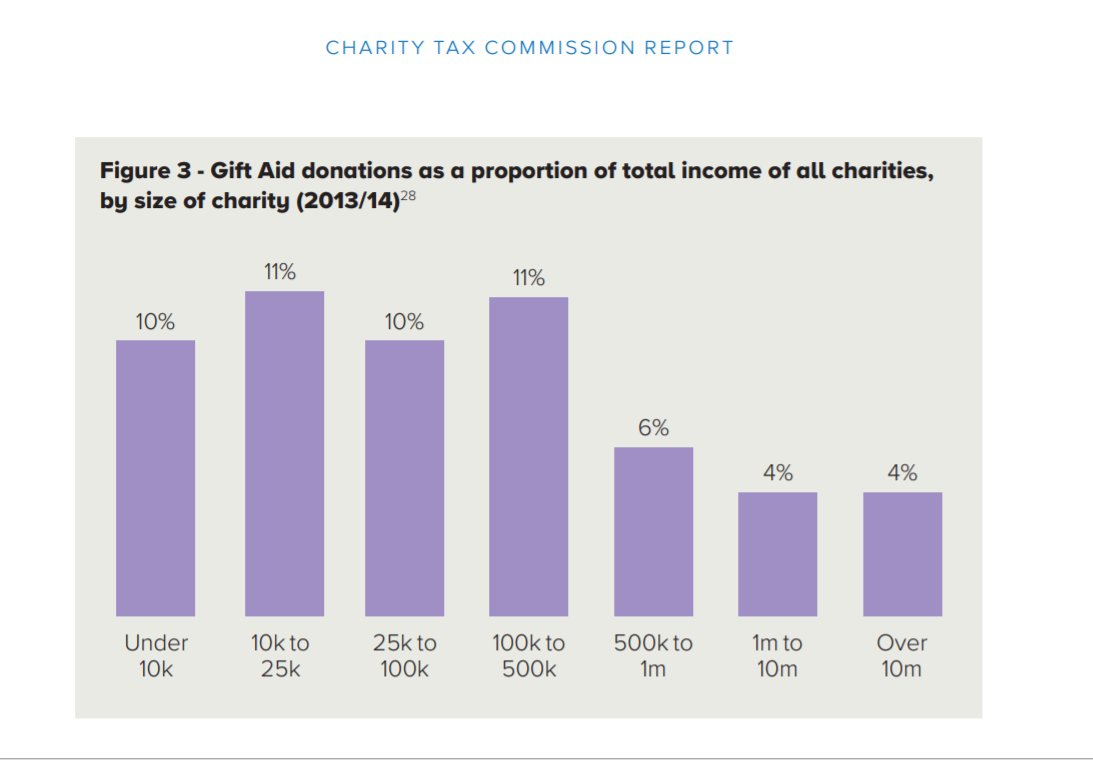

The response also notes that the main benefit would be to large charities - while true in monetary terms, #GiftAid is a significant and larger proportion of the income for smaller charities (as per @CharityTaxComm) so boosting the value of #GiftAid would make a huge difference 3/

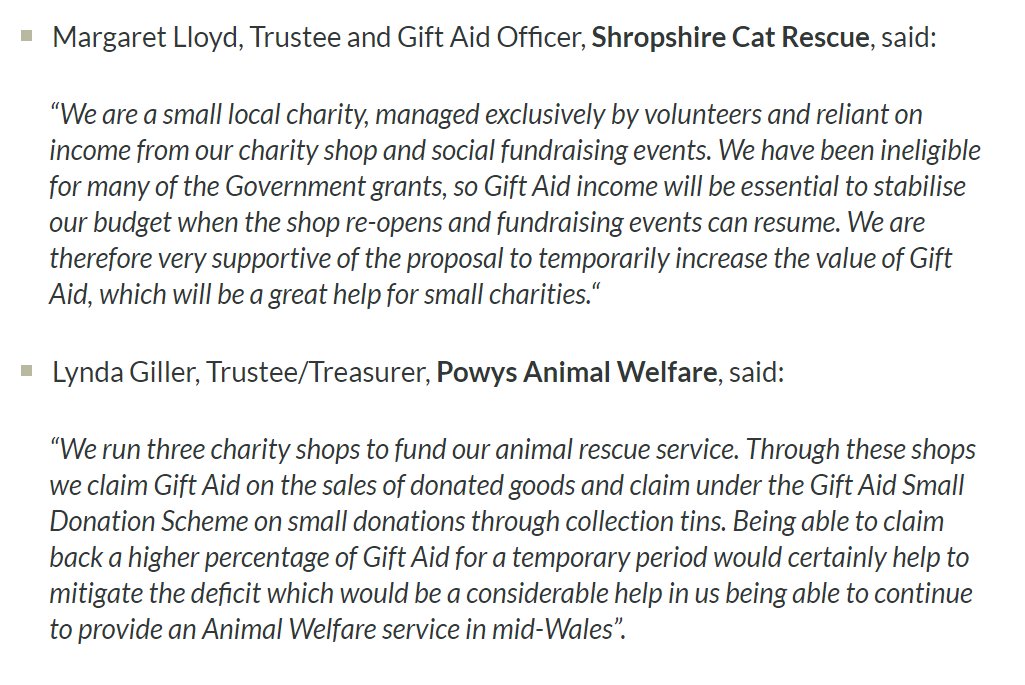

For these reasons the #GiftAidrelief campaign is generating significant support from smaller local charities including Shropshire Cat Rescue and Powys Animal Rescue as they restart their charity shop and local fundraising actvities 4/ @MargLloyd https://www.charitytaxgroup.org.uk/news-post/2020/charities-call-gift-aid-emergency-relief/">https://www.charitytaxgroup.org.uk/news-post...

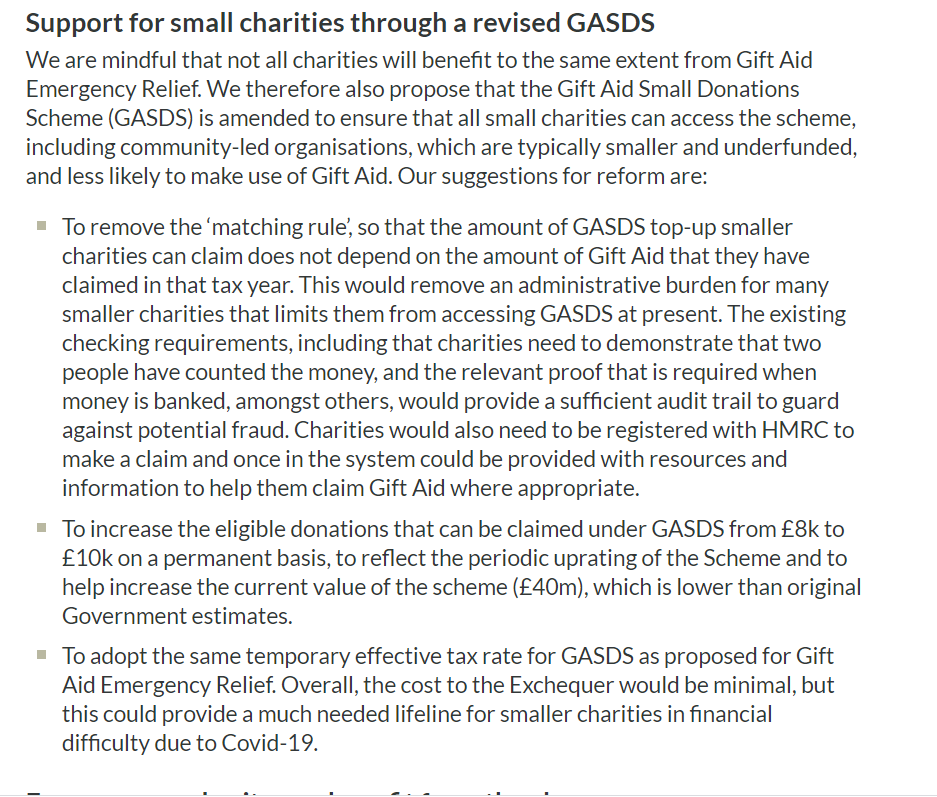

The #GiftAidRelief campaign does recognise that not all small charities make use of #GiftAid, so the proposal also makes suggested changes to the #GiftAidSmallDonationsScheme as well as promoting outreach work to promote awareness of Gift Aid #tickthebox 5/

The sector understands the importance of the link between tax paid by donors & #GiftAid - hence the proposal is time-limited to 2 years. We are asking Government to support a temporary boost to the value of #GiftAid at a time when charities are #NeverMoreNeeded due to #COVID19 6/

Importantly, there is precedent for HMRC changing the value #GiftAid is paid at with the Gift Aid Transitional Relief scheme in 2008 - we know that the mechanism works and the proposal can be implemented simply and have a number of important benefits 7/ https://webarchive.nationalarchives.gov.uk/20101011184345/http://www.hmrc.gov.uk///charities/transitional-relief.htm">https://webarchive.nationalarchives.gov.uk/201010111...

There is a long-established principle that donations to charities should not be taxed and this underpins the #Gift Aid relief. However, once unclaimed and incorrect Gift Aid claims are taken into account charities are missing out on up to £380m each year of Gift Aid each year 8/

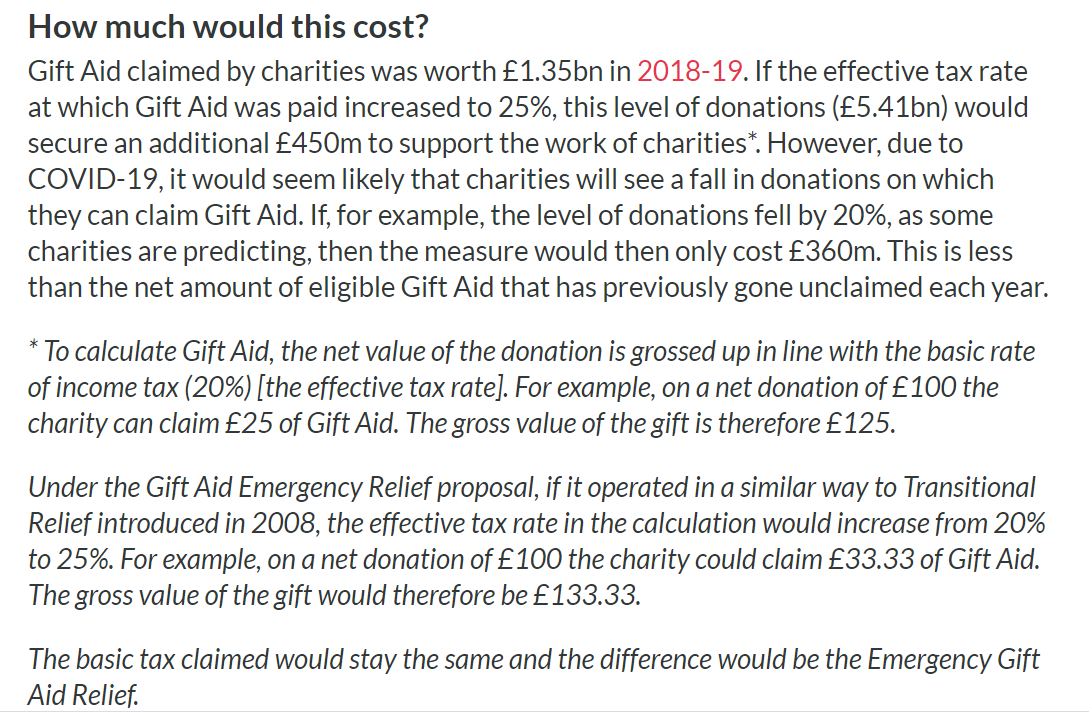

#GiftAidRelief proposals would cost £360m-£450m a year - broadly similar to unclaimed eligible #GiftAid in the same period. Supporting this temporary change is an important way for the Government to support the sector alongside longer term efforts to maximise Gift Aid take-up 9/

Hopefully this thread answers a number of @JWhittingdale concerns. @Caf @IoFtweets @NCVO @CFGtweets & others, including a wide range of charity supporters, would be happy to meet @DCMS @hmtreasury to discuss #GiftAidRelief in more detail @KemiBadenoch @RishiSunak @dianabarran /10

@threadreaderapp unroll please

Read on Twitter

Read on Twitter @MartynDaySNP for asking @DCMS to support #GiftAidRelief. @JWhittingdale confirmed support for #GiftAid but noted the proposals would break the link to tax paid & impact <20% of charities - the charity sector welcomes this dialogue & is happy to address these concerns 1/" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up"> @MartynDaySNP for asking @DCMS to support #GiftAidRelief. @JWhittingdale confirmed support for #GiftAid but noted the proposals would break the link to tax paid & impact <20% of charities - the charity sector welcomes this dialogue & is happy to address these concerns 1/">

@MartynDaySNP for asking @DCMS to support #GiftAidRelief. @JWhittingdale confirmed support for #GiftAid but noted the proposals would break the link to tax paid & impact <20% of charities - the charity sector welcomes this dialogue & is happy to address these concerns 1/" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up"> @MartynDaySNP for asking @DCMS to support #GiftAidRelief. @JWhittingdale confirmed support for #GiftAid but noted the proposals would break the link to tax paid & impact <20% of charities - the charity sector welcomes this dialogue & is happy to address these concerns 1/">

@MartynDaySNP for asking @DCMS to support #GiftAidRelief. @JWhittingdale confirmed support for #GiftAid but noted the proposals would break the link to tax paid & impact <20% of charities - the charity sector welcomes this dialogue & is happy to address these concerns 1/" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up"> @MartynDaySNP for asking @DCMS to support #GiftAidRelief. @JWhittingdale confirmed support for #GiftAid but noted the proposals would break the link to tax paid & impact <20% of charities - the charity sector welcomes this dialogue & is happy to address these concerns 1/">

@MartynDaySNP for asking @DCMS to support #GiftAidRelief. @JWhittingdale confirmed support for #GiftAid but noted the proposals would break the link to tax paid & impact <20% of charities - the charity sector welcomes this dialogue & is happy to address these concerns 1/" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up"> @MartynDaySNP for asking @DCMS to support #GiftAidRelief. @JWhittingdale confirmed support for #GiftAid but noted the proposals would break the link to tax paid & impact <20% of charities - the charity sector welcomes this dialogue & is happy to address these concerns 1/">