$BTC + ALTS ARE BEING DUMPED ON YOU

It started, but can continue during #altseason. In this thread I will explain why I think after this altseason rally the market will collapse. Crypto is risk asset and we are still in a recession.

It started, but can continue during #altseason. In this thread I will explain why I think after this altseason rally the market will collapse. Crypto is risk asset and we are still in a recession.

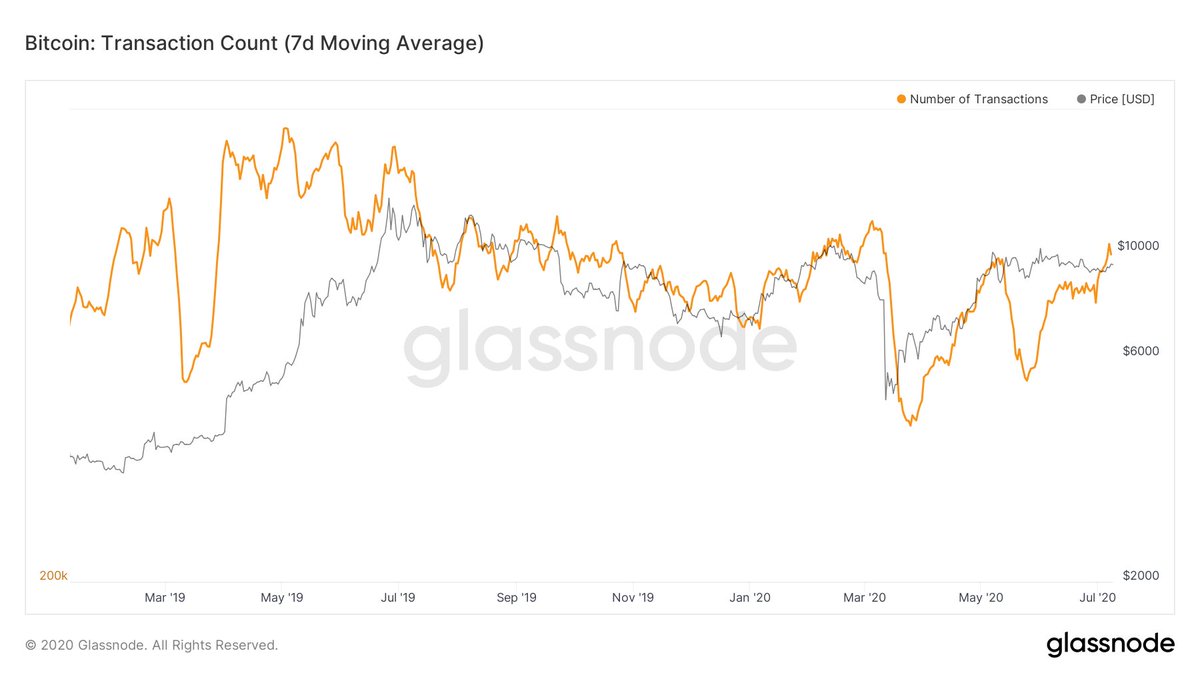

Let’s first have a look at on-chain data. This data might give an indication to where BTC is/was moving. The amount of transactions go often up near tops and bottoms. Data provided by @glassnode.

On 8 May there was the peak in transactions (7D MA, log) and the top for the $BTC rally was in. Right now we are seeing another peak, probably since traders are moving BTC towards exchanges.

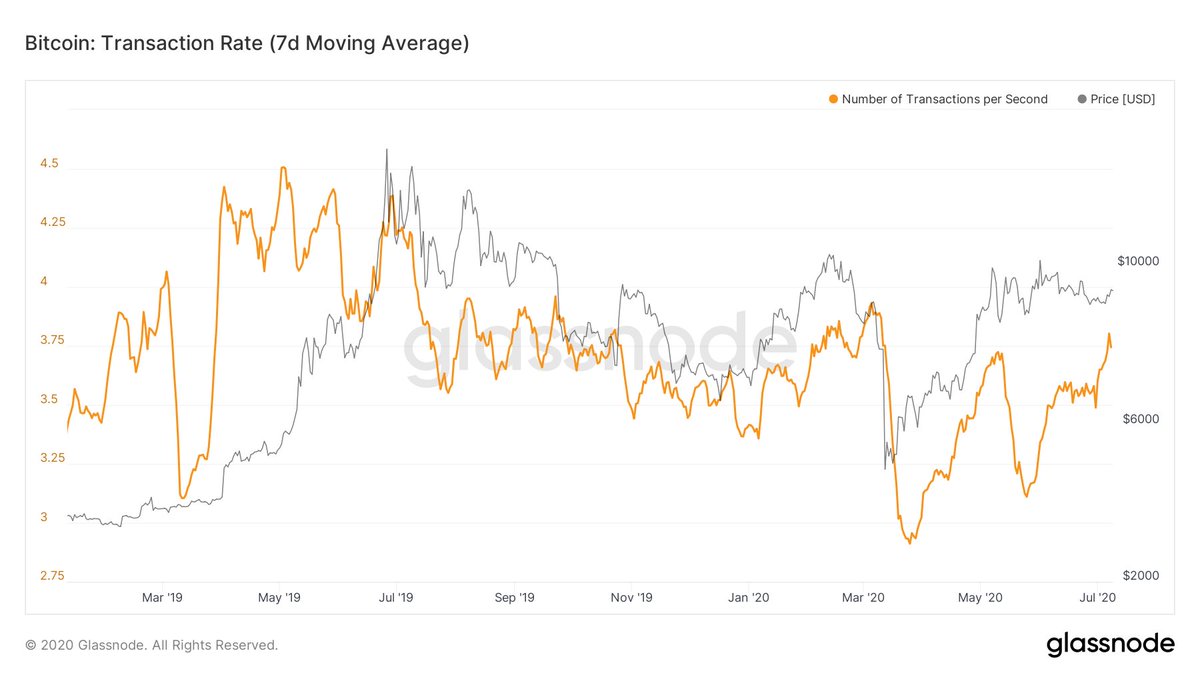

The funny thing is that as you can see in transaction rate, the rate is lower after the drop in March (7D MA, lin).

That while the transaction size mean (7D MA, lin) went up significantly after the price drop. That can be an indication traders with bigger size are transacting more. The first indication they are dumping on you after 10k.

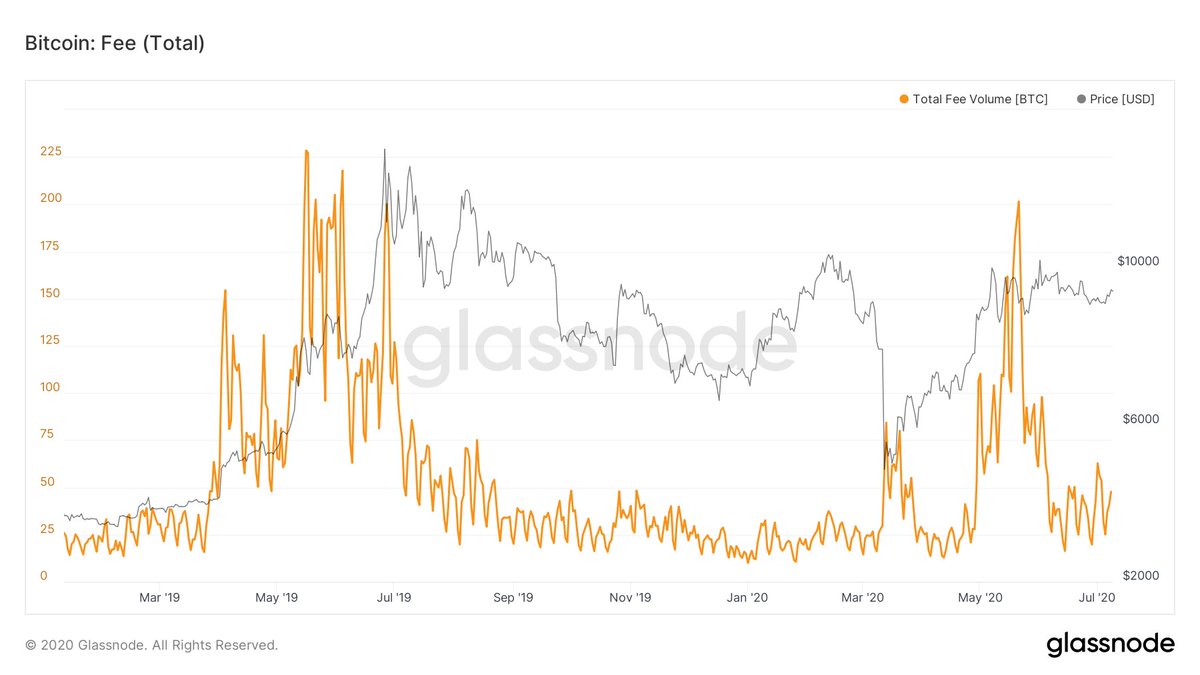

The same happens with Tx fees before the top (or bottoms). I think traders want to make sure they push their $BTC through the network and pay higher fees so they can dump on the exchanges. The last time this happened was at 21 May.

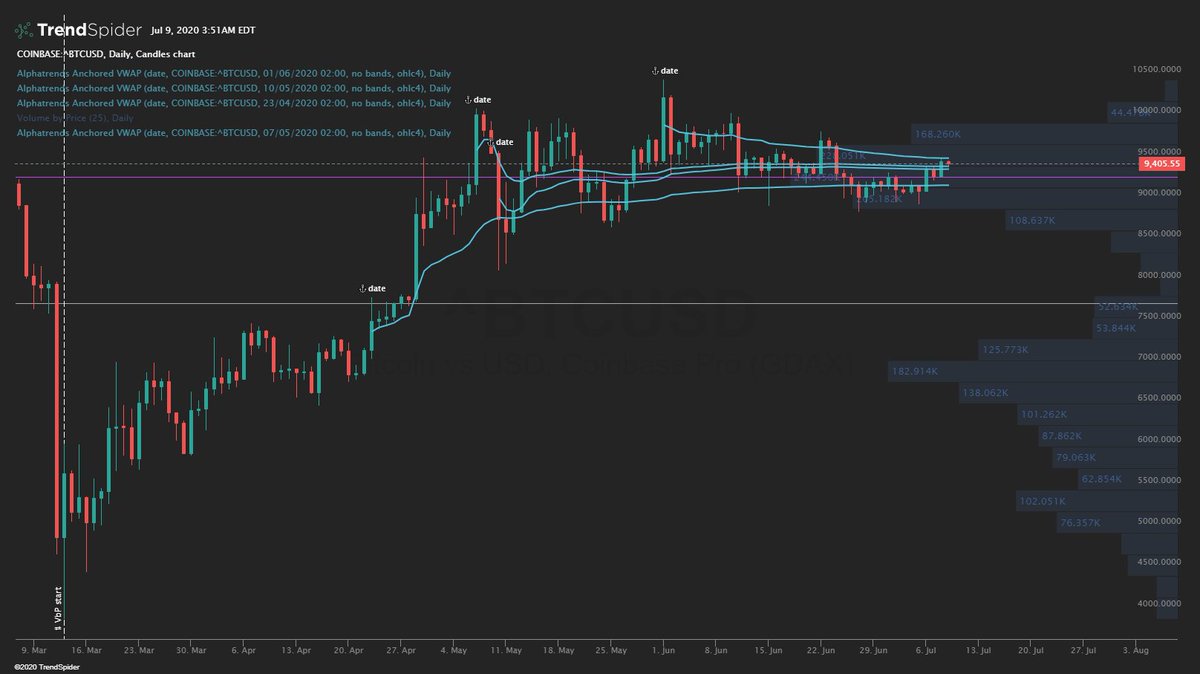

They can’t dump all at once, but have to gradually sell $BTC. They need liquidity for that. The distribution from the last months between 8.6k and 10k is an example of this.

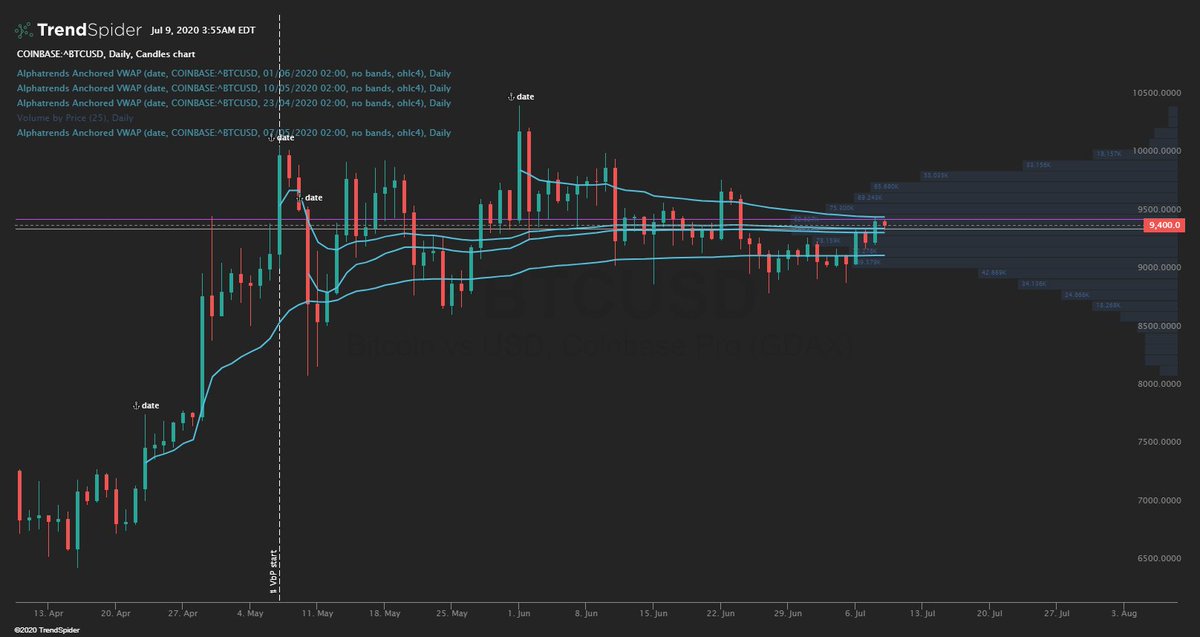

Right now $BTC price is being compressed between VWAPS (anchored from multiple swing H/L). A break up or down would indicate the direction. The POC of the volume by price is showing BTC is slightly above it (anchored on March low).

However, if we anchor VBP from the top of the rally, we see that traders who have been buying in the distribution are now under water. If price dumps more, they will be stopped out. This can cascade until we see true capitulation.

Cue the altseason. The gains on $BTC have to go somewhere and are now flowing into alts.

Add TikTok, add Robinhood traders, add euphoria. Perfect for retails to throw money in the market and buy the top. New bag holders can be made. TOTAL still going up, but at HTF resistance.

Add TikTok, add Robinhood traders, add euphoria. Perfect for retails to throw money in the market and buy the top. New bag holders can be made. TOTAL still going up, but at HTF resistance.

As you can see in this totally obvious chart, the $BTC.D is dropping indicating money/BTC is moving to alts. Bigger players can use the BTC they now have on the exchanges to get more BTC or even better: move their BTC through alts to USD(T).

Whales often initiate #altseason by doing the first pushes, sell on the way up, retails push it up later until there aren’t buyers left.

We have a small rally because BTC profits from money flowing into the market. Some need to buy BTC first from their USD holdings to buy alts.

We have a small rally because BTC profits from money flowing into the market. Some need to buy BTC first from their USD holdings to buy alts.

Right now it is waiting for an imbalance in long and shorts, with longs > shorts (over-leveraging, funding, possible liquidations).

After #altseason the gains have to go back to $BTC and USD(T). BTC can be dumped in this rally up. That is when the big sell off begins and traders first get trapped in alt bags and then in BTC.

An example of this is that BTC is going down, while alts still rally. That’s when this credo applies: Up in BTC, down in USD.

After that there is less new money coming in the market and alts only go up because traders move BTC around. Then the music stops and people will move out of alts, thus stopping the #altseason.

At the end the late buyers capitulate and move out of alts and $BTC.

That& #39;s when you can accumulate for the longer term (again).

That& #39;s when you can accumulate for the longer term (again).

Let me know what you think is missing in the analysis or what is happening in the market!

I would love to hear.

I would love to hear.

Read on Twitter

Read on Twitter