Chainlink Weapons Arsenal /a thread

1/ Chainlink broke its all time highs yesterday. And it just keeps going higher.

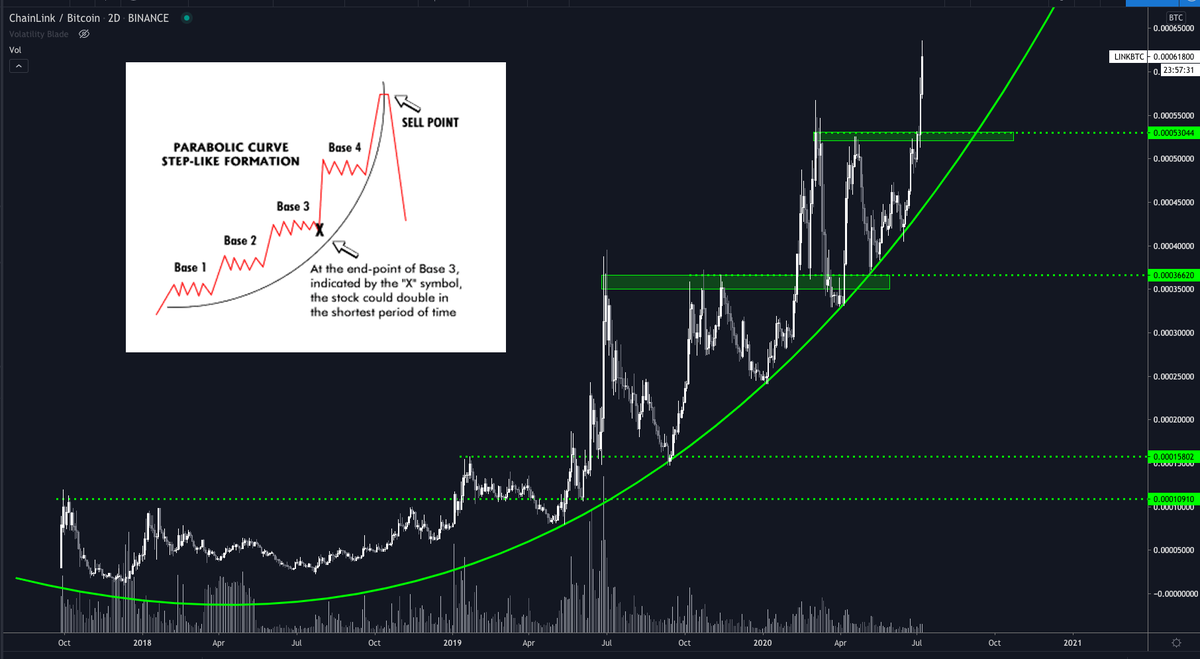

I think we& #39;re seeing a full blown parabolic advance.

$LINK

1/ Chainlink broke its all time highs yesterday. And it just keeps going higher.

I think we& #39;re seeing a full blown parabolic advance.

$LINK

2/ This shouldn& #39;t come as a big surprise if you& #39;ve followed me for awhile.

I said I was expecting this two months ago. https://mobile.twitter.com/ColeGarnerBTC/status/1258567577443303425">https://mobile.twitter.com/ColeGarne...

I said I was expecting this two months ago. https://mobile.twitter.com/ColeGarnerBTC/status/1258567577443303425">https://mobile.twitter.com/ColeGarne...

3/ $LINK marines have plenty to celebrate.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍻" title="Anstoßende Bierkrüge" aria-label="Emoji: Anstoßende Bierkrüge">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍻" title="Anstoßende Bierkrüge" aria-label="Emoji: Anstoßende Bierkrüge">

Some will hodl for the longterm — a fine strategy early in a bull market.

But parabolas almost always end in a deep retrace — so let’s talk about how I plan on strategically selling.

(We can always rebuy lower, at a discount).

Some will hodl for the longterm — a fine strategy early in a bull market.

But parabolas almost always end in a deep retrace — so let’s talk about how I plan on strategically selling.

(We can always rebuy lower, at a discount).

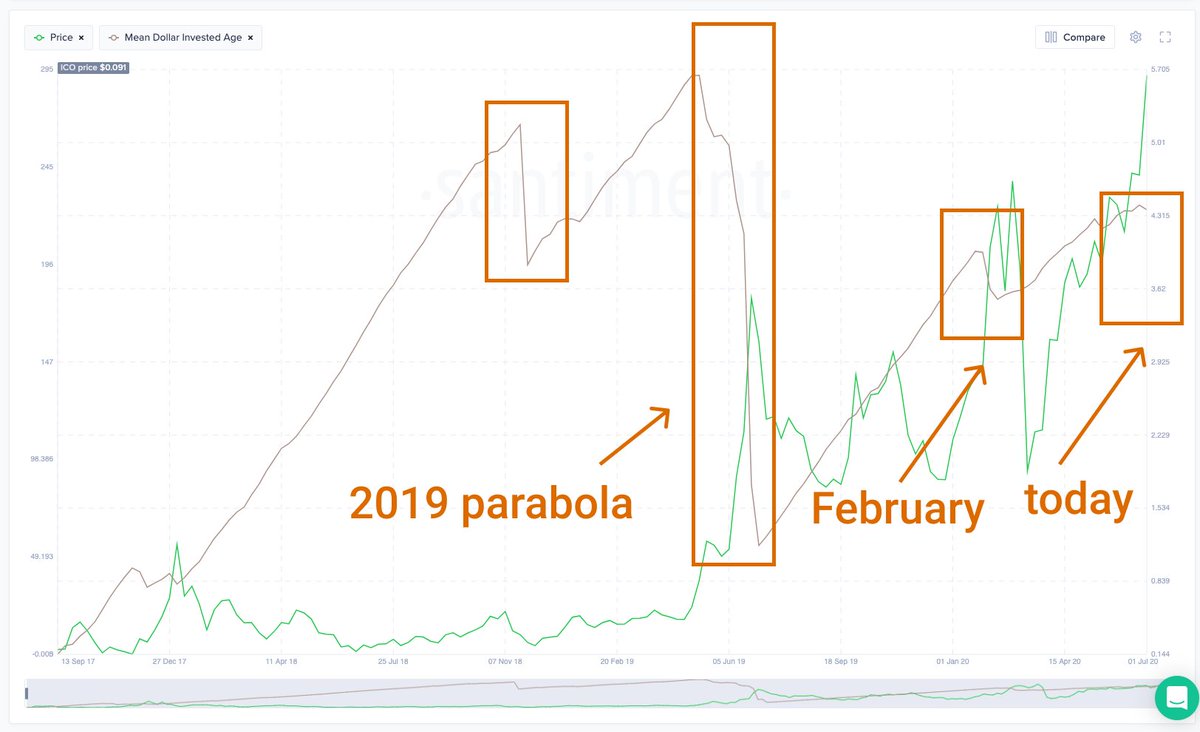

4/ Finding ideal sell points in altcoin bull runs is becoming more and more of a multi-layered onion.

I consider $LINK& #39;s parabola in 2019 the first layer.

Extrapolating that parabola& #39;s fib extension offers a very specific story.

If we& #39;re right - this move has a long way to go.

I consider $LINK& #39;s parabola in 2019 the first layer.

Extrapolating that parabola& #39;s fib extension offers a very specific story.

If we& #39;re right - this move has a long way to go.

5/ But fib extensions are a blunt instrument.

We can do a lot better.

The rules of alt season have changed a lot since 2017.

We have an arsenal of weapons that didn’t exist back then.

We can do a lot better.

The rules of alt season have changed a lot since 2017.

We have an arsenal of weapons that didn’t exist back then.

6/ $LINK& #39;s Mean Dollar Invested Age is just starting to curl down.

I’ll look for a much steeper drop -- at least as strong as the drop in February.

(data from @santimentfeed)

I’ll look for a much steeper drop -- at least as strong as the drop in February.

(data from @santimentfeed)

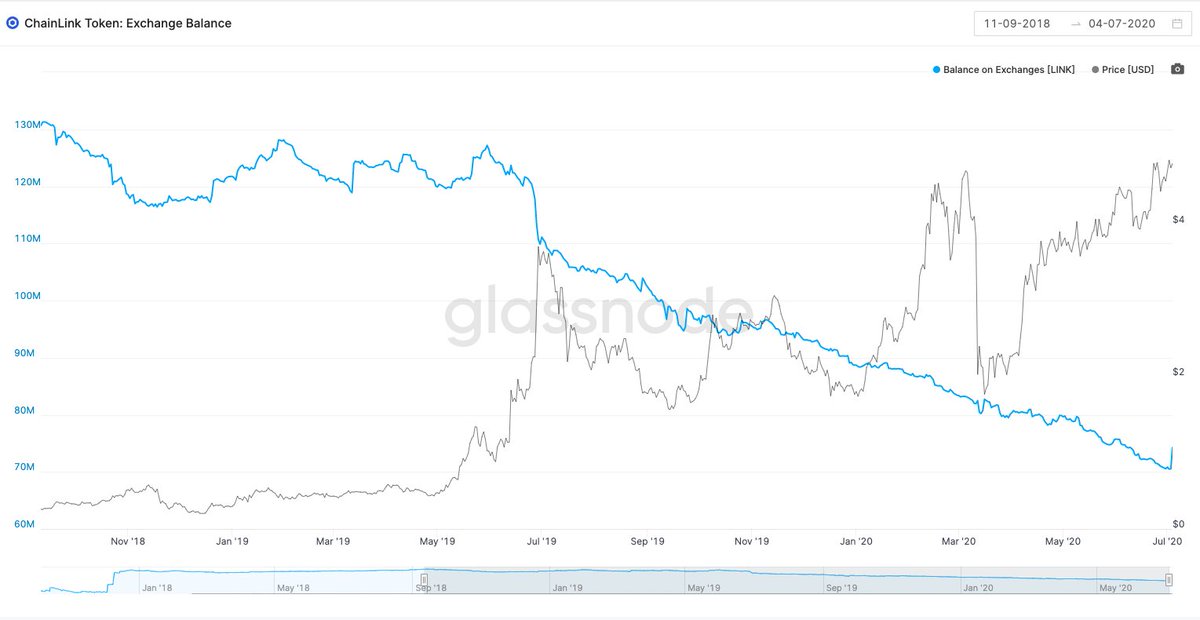

7/ $LINK& #39;s balance on exchanges tells the inverse story on-chain.

I think there& #39;s plenty of room to grow.

(platform is @glassnode)

I think there& #39;s plenty of room to grow.

(platform is @glassnode)

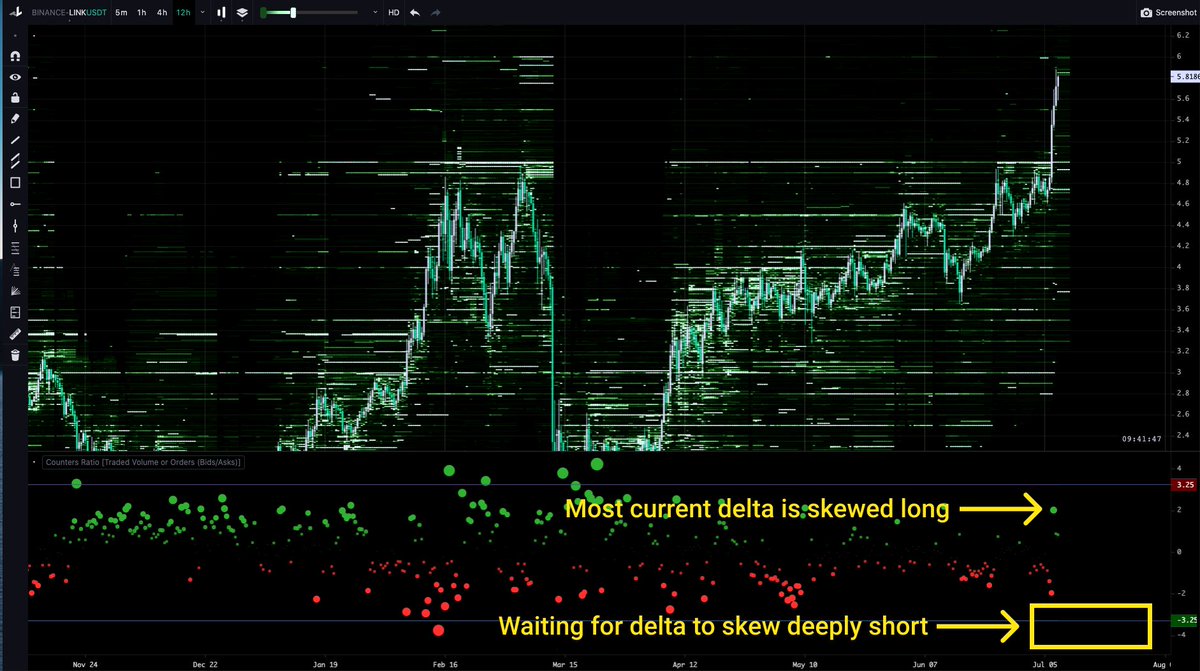

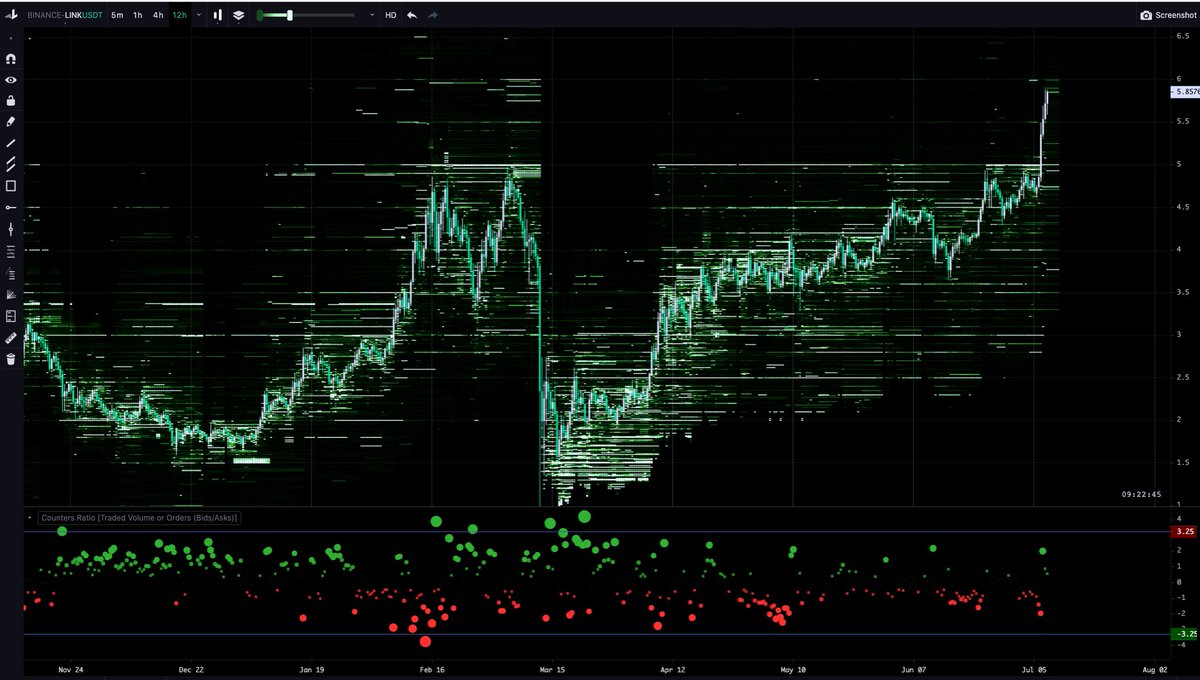

9/ You can see it on @binance& #39;s USDT pair -- by far the highest volume market for $LINK.

Orderbook delta is a leading indicator -- and a dead giveaway.

Delta should skew heavily short when whales are ready to sell.

We& #39;re not there yet.

(platform is @tradinglite)

Orderbook delta is a leading indicator -- and a dead giveaway.

Delta should skew heavily short when whales are ready to sell.

We& #39;re not there yet.

(platform is @tradinglite)

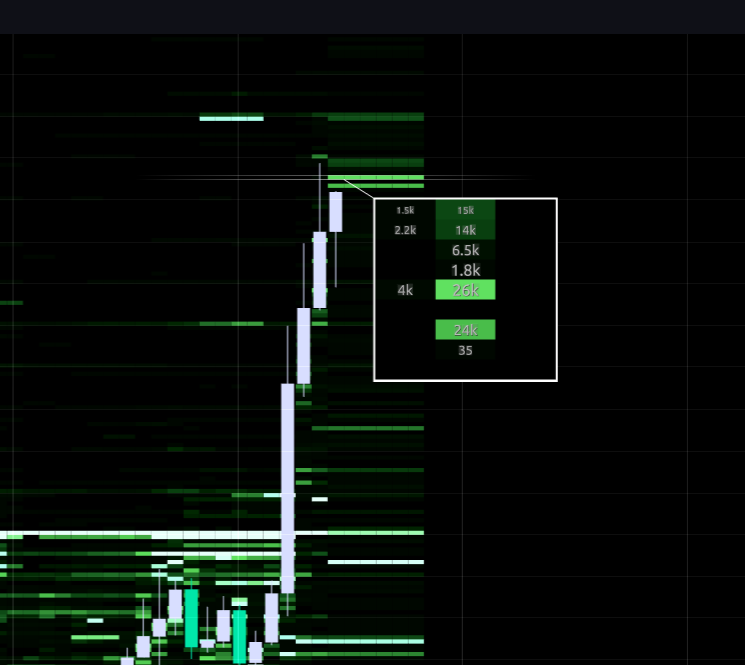

10/ We’ll likely see large sell orders start to stack up on @binance even before $LINK has a chance to hit its top.

That’s the beauty of a leading indicator.

Use it right, and smart money& #39;s next move is often obvious -- like the market is naked before your eyes.

That’s the beauty of a leading indicator.

Use it right, and smart money& #39;s next move is often obvious -- like the market is naked before your eyes.

11/ Can& #39;t whales just market sell? Orderbook delta can& #39;t account for that.

For sure. Some will, no doubt.

But savvy whales know they might only get one shot at selling the parabolic top.

I expect to see big asks in advance of real sell pressure.

For sure. Some will, no doubt.

But savvy whales know they might only get one shot at selling the parabolic top.

I expect to see big asks in advance of real sell pressure.

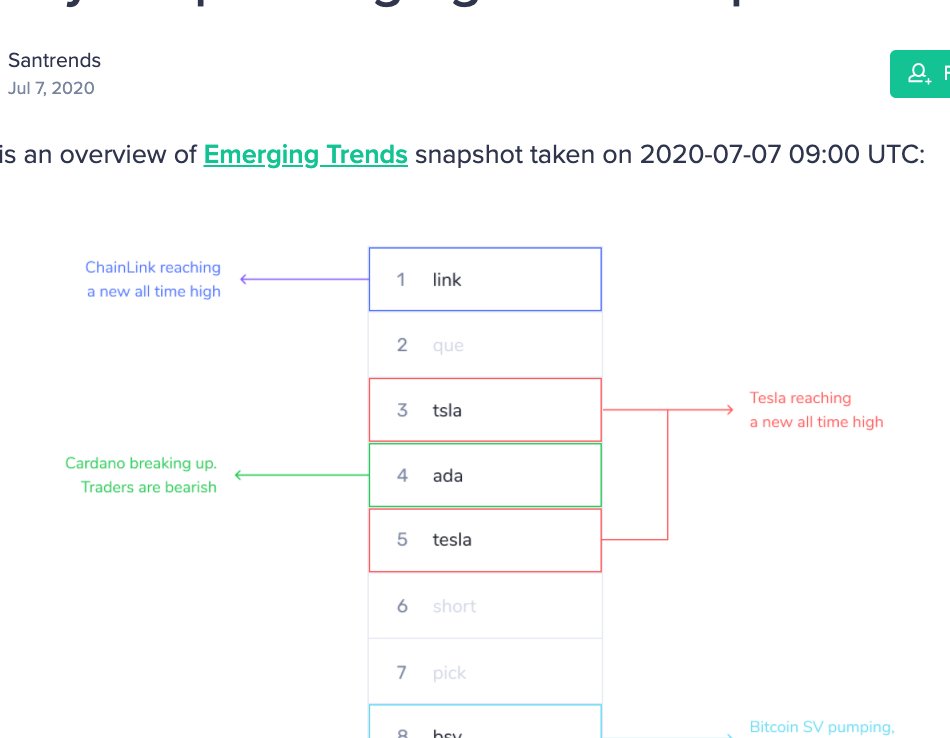

12/ Here’s another great indicator for timing altcoin tops -- social sentiment.

@santimentfeed found that anytime a cashtag rises into the top 3 positions of their proprietary emerging trends list, it& #39;s likely a top. https://insights.santiment.net/read/peak-hype%3A-timing-cryptocurrency-tops-with-social-media-data-5847">https://insights.santiment.net/read/peak...

@santimentfeed found that anytime a cashtag rises into the top 3 positions of their proprietary emerging trends list, it& #39;s likely a top. https://insights.santiment.net/read/peak-hype%3A-timing-cryptocurrency-tops-with-social-media-data-5847">https://insights.santiment.net/read/peak...

13/ This is our one red flag: $LINK just hit #1 on @santimentfeed& #39;s list.

But there& #39;s a signal-to-noise problem:

the sheer size of $LINK& #39;s unusually huge community renders social volume a less accurate signal.

Take partial profit if you like. I think we go higher.

But there& #39;s a signal-to-noise problem:

the sheer size of $LINK& #39;s unusually huge community renders social volume a less accurate signal.

Take partial profit if you like. I think we go higher.

14/ What am I looking for then, to sell?

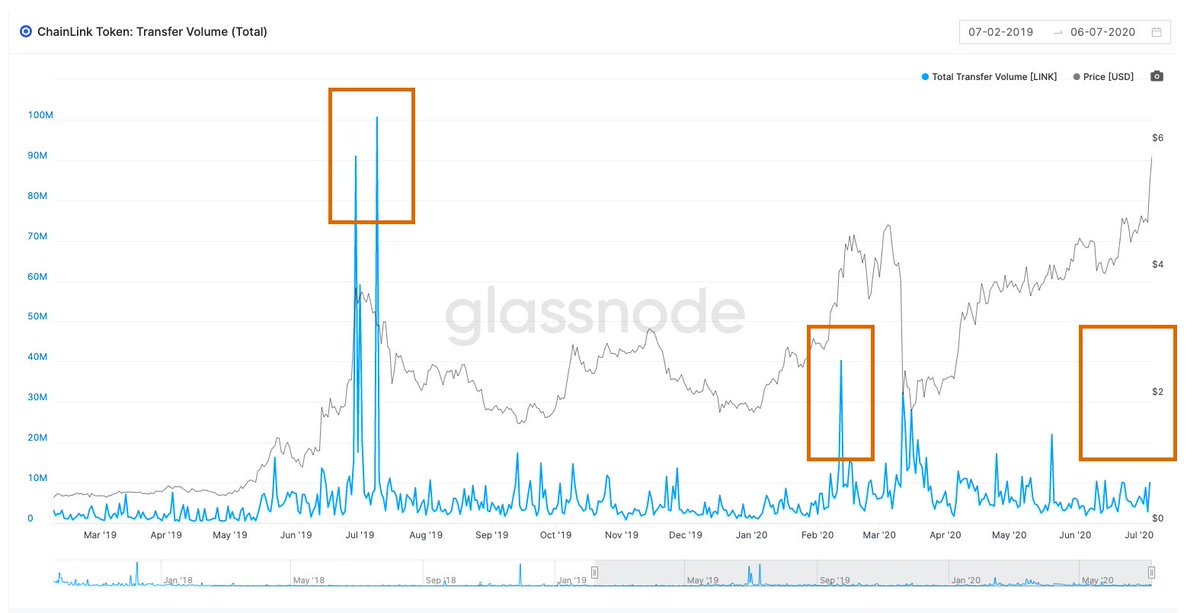

I want to see Mean Dollar Invested Age drop hard, at the same time that on-chain volume prints a huge spike.

After that, I expect @binance orderbook delta to skew heavily short.

I want to see Mean Dollar Invested Age drop hard, at the same time that on-chain volume prints a huge spike.

After that, I expect @binance orderbook delta to skew heavily short.

15/ From there, @binance orderbook heatmap on @tradinglite will dictate my take profit levels.

I’ll find the biggest orders, and slide mine in just underneath.

I expect to see multiple layers of big orders. The lower they are, the likelier they get hit.

I’ll find the biggest orders, and slide mine in just underneath.

I expect to see multiple layers of big orders. The lower they are, the likelier they get hit.

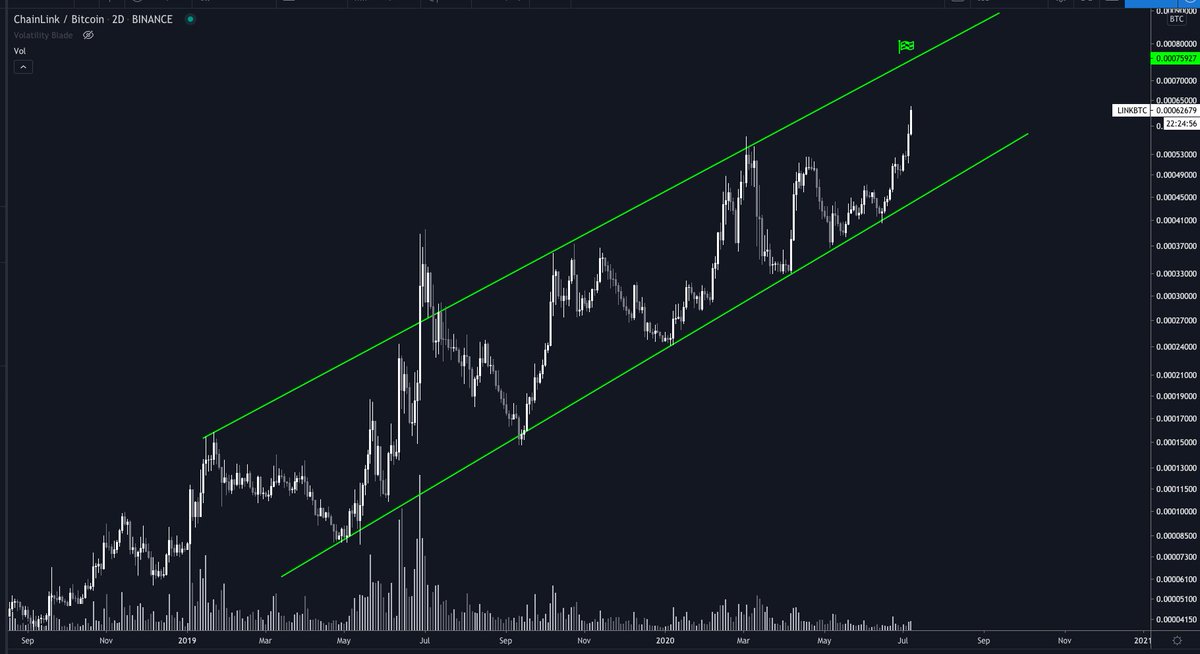

16/ Want a more tangible profit target?

Check out $LINK& #39;s logarithmic channel.

Picture perfect, touch-for-touch, dating back almost two years.

Broken only once...by the parabola.

I’ll take some profit at the top trendline, around 75k sats, just to be safe.

Check out $LINK& #39;s logarithmic channel.

Picture perfect, touch-for-touch, dating back almost two years.

Broken only once...by the parabola.

I’ll take some profit at the top trendline, around 75k sats, just to be safe.

17/ I consider all of this target practice for next year, when the real face-melting alt moves likely start to kick off.

These are just a few of the weapons worth using.

There are others, new ones are invented all the time, and they just keep getting better. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

These are just a few of the weapons worth using.

There are others, new ones are invented all the time, and they just keep getting better.

Read on Twitter

Read on Twitter

Some will hodl for the longterm — a fine strategy early in a bull market.But parabolas almost always end in a deep retrace — so let’s talk about how I plan on strategically selling.(We can always rebuy lower, at a discount)." title="3/ $LINK marines have plenty to celebrate. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍻" title="Anstoßende Bierkrüge" aria-label="Emoji: Anstoßende Bierkrüge">Some will hodl for the longterm — a fine strategy early in a bull market.But parabolas almost always end in a deep retrace — so let’s talk about how I plan on strategically selling.(We can always rebuy lower, at a discount)." class="img-responsive" style="max-width:100%;"/>

Some will hodl for the longterm — a fine strategy early in a bull market.But parabolas almost always end in a deep retrace — so let’s talk about how I plan on strategically selling.(We can always rebuy lower, at a discount)." title="3/ $LINK marines have plenty to celebrate. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍻" title="Anstoßende Bierkrüge" aria-label="Emoji: Anstoßende Bierkrüge">Some will hodl for the longterm — a fine strategy early in a bull market.But parabolas almost always end in a deep retrace — so let’s talk about how I plan on strategically selling.(We can always rebuy lower, at a discount)." class="img-responsive" style="max-width:100%;"/>