The liquidity profile and peg of wBTC is exponentially stronger than people realize

Let& #39;s talk about the liquidity pathways of wBTC, prop trading and why Proposal 014 should pass https://twitter.com/rleshner/status/1280305562253529088">https://twitter.com/rleshner/...

Let& #39;s talk about the liquidity pathways of wBTC, prop trading and why Proposal 014 should pass https://twitter.com/rleshner/status/1280305562253529088">https://twitter.com/rleshner/...

@gauntletnetwork & @rleshner made several decent points about the liquidity profile of wBTC as evidenced by (1) trading volume and (2) orderbook depth

While these are typically good measures of liquidity for assets, they are actually misleading for wBTC https://twitter.com/gauntletnetwork/status/1280311879097868290">https://twitter.com/gauntletn...

While these are typically good measures of liquidity for assets, they are actually misleading for wBTC https://twitter.com/gauntletnetwork/status/1280311879097868290">https://twitter.com/gauntletn...

Trading Volume

CMC is cited for trading volume of wBTC. CMC excludes @CurveFinance volume which @coingecko includes. CoinGecko shows wBTC volume as typically 2-3x higher https://twitter.com/gauntletnetwork/status/1280311879097868290">https://twitter.com/gauntletn...

CMC is cited for trading volume of wBTC. CMC excludes @CurveFinance volume which @coingecko includes. CoinGecko shows wBTC volume as typically 2-3x higher https://twitter.com/gauntletnetwork/status/1280311879097868290">https://twitter.com/gauntletn...

Orderbook Depth

Looking at orderbook tells you the amount of volume you can trade with X% slippage and this is a common measure of liquidity. The thing is, most of wBTC liquidity exists in @CurveFinance - an exchange without orderbooks https://twitter.com/rleshner/status/1280305566204612609">https://twitter.com/rleshner/...

Looking at orderbook tells you the amount of volume you can trade with X% slippage and this is a common measure of liquidity. The thing is, most of wBTC liquidity exists in @CurveFinance - an exchange without orderbooks https://twitter.com/rleshner/status/1280305566204612609">https://twitter.com/rleshner/...

Curve Liquidity

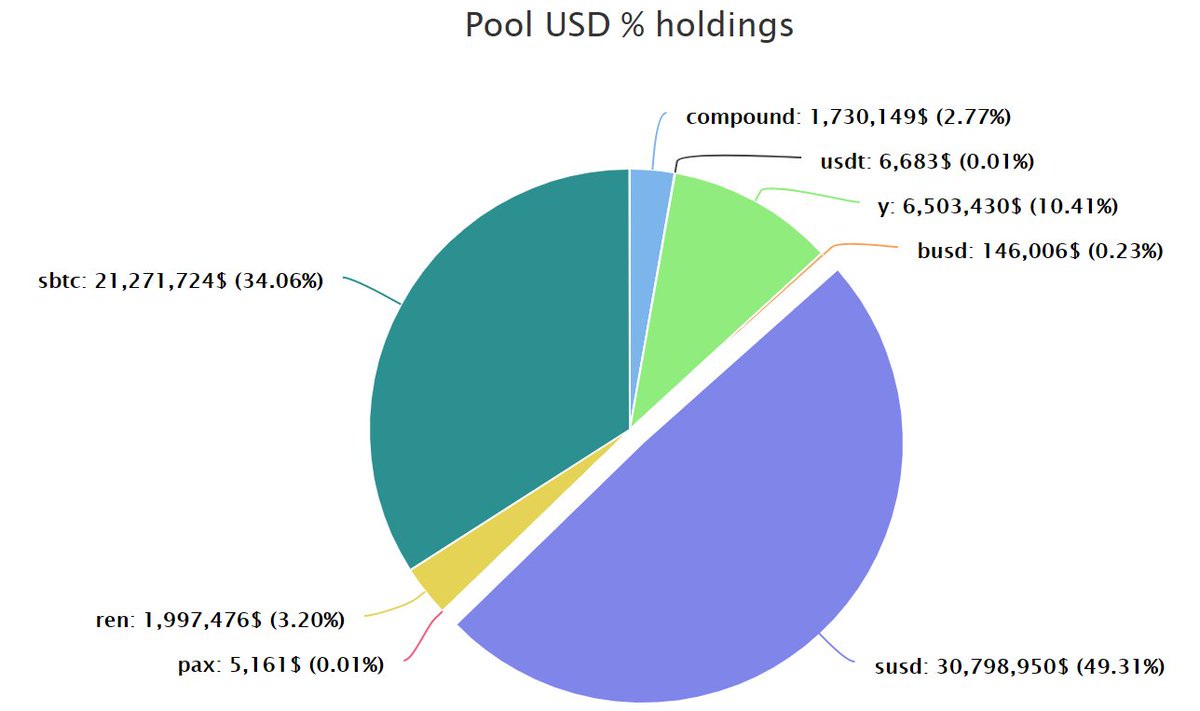

In Curve, there is $23M of sBTC/renBTC/wBTC liquidity. Curve BTC pools have a liquidity amplification of 100, meaning these curve pools offer the liquidity equivalent of $2.3B of sBTC/renBTC/wBTC in Uniswap.

In Curve, there is $23M of sBTC/renBTC/wBTC liquidity. Curve BTC pools have a liquidity amplification of 100, meaning these curve pools offer the liquidity equivalent of $2.3B of sBTC/renBTC/wBTC in Uniswap.

RenBTC and sBTC aren& #39;t liquid in typical CLOB exchanges either, but for those familiar with @synthetix_io, sBTC is incredibly liquid. You could easily convert millions of wBTC to USDC/USDT at market price with minimal slippage+fees using @synthetix_io and @CurveFinance*

RenBTC on the other hand can be exchanged 1:1 for real BTC in an hour with a 0.1% fee - much faster than the wBTC redemption process

wBTC benefits from the liquidity of both sBTC and renBTC

wBTC benefits from the liquidity of both sBTC and renBTC

Also, the effect of wBTC mint/burn friction is overstated.

The mint/burn process for USDT is arguably even more friction-heavy given banking requirements

But USDT always stays in a tight peg even during market volatility. https://twitter.com/gauntletnetwork/status/1280311895413620736">https://twitter.com/gauntletn...

The mint/burn process for USDT is arguably even more friction-heavy given banking requirements

But USDT always stays in a tight peg even during market volatility. https://twitter.com/gauntletnetwork/status/1280311895413620736">https://twitter.com/gauntletn...

This is b/c there are arbers/MMs that support the peg by providing liquidity at higher deviations and wait for mean reversion. They don& #39;t actually mint/burn

A lot of this "potential energy" of liquidity isn& #39;t expressed on OBs until its needed

Thin Binance USDT/USDC OB shown

A lot of this "potential energy" of liquidity isn& #39;t expressed on OBs until its needed

Thin Binance USDT/USDC OB shown

There are plenty of prop firms that would be happy to hold wBTC inventory for a short duration as they can inexpensively hedge it until they realize the basis differential

Buying BTC at a 8% discount is a great trade in any market condition

H/T @zhusu https://twitter.com/zhusu/status/1280322603446497283">https://twitter.com/zhusu/sta...

Buying BTC at a 8% discount is a great trade in any market condition

H/T @zhusu https://twitter.com/zhusu/status/1280322603446497283">https://twitter.com/zhusu/sta...

Read on Twitter

Read on Twitter