$TSLAQ I have a working theory that the controls in place for cash from the ABL lenders (Deutsche & Industrial and Commercial Bank) are preventing Tesla from manipulating the cash account. @montana_skeptic found the China revenue control account. (1/12)

Page 8 of the ABL agreement describes a “Cash Management Control Agreement” with core deposits under oversight and liens by Deutsche for the syndicate. These agreements are not uncommon for ABL relationships but must be enforced by the depository institution. (2/12)

This brings me back to my post yesterday of the cash flow statement & accruals manipulations. The cash flow statement must balance from the beginning of period to the end of period for the quarter. If you manipulate costs, cash must be replaced somewhere else. (3/12)

The operating section appears to be used to manipulate earnings, so it is taken. This leaves the Investing & Financing sections. Investing reports changes in long term assets. Financing is used for changes in long term debt & equity. (4/12)

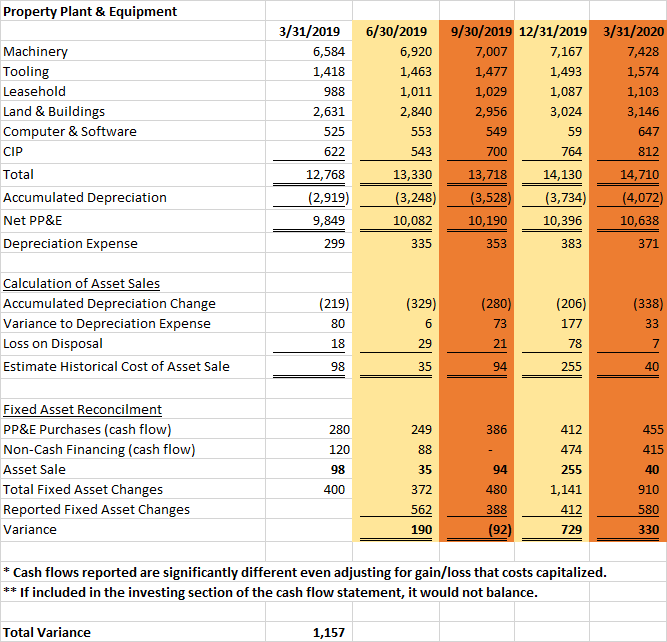

I think I found the matching accruals in PPE. You know, the missing China assets? Attached is a spread covering PPE from 3/31/19 to 3/31/20. Leasing standard changed at 12/31/18 making that year end non-comparable. (5/12)

Concentrate on two quarters: 9/30/19 & 3/31/20. Historical costs are reported on the balance sheet. Accumulated depreciation is for these assets. You can purchase assets with cash or finance them. At the same time, you can sell them. (6/12)

If you sell them, the historical cost is removed as well as the associated depreciation. The spread has three information areas. The reported PPE itemized with accumulated depreciation expense, the calculation related to asset sales, and (continued) (7/12)

the cash & non-cash financing purchase costs. It also estimates asset sales (gain/loss + change in accumulated depreciation), the reported PPE change from quarter to quarter, and the variance. A negative variance matching the sale is good. Big positive number miss bad. (8/12)

9/30 has a ($92m) variance & a $94m asset sale. So we are good. To verify it, I did another operating section of cash flows for 9/30 & it is attached. They are off by $3m vs the $2m on the asset change. So, it appears my calculations are correct. (9/12)

3/31/2020 reported a variance of $330m of assets capitalized beyond financing, cash purchases, & asset sales. Total cash flow variance is off by $396m. Not a perfect correlation like 9/30/19. I probably made an error somewhere or (continued) (10/12)

they parked it in the financing section. @BradMunchen now I need your help. These variances for fixed assets are roughly $1,157m. What is your estimate for missing CAPEX for Y, Shanghai, & Berlin? Is this enough to fill the hole? (11/12)

These amounts are well beyond materiality thresholds for audit or litigation. Does anyone in $TSLAQ have the accounting expertise to verify these number independently? All calculations are derived from the Q’s & K’s. Cash flow reports the non-cash PPE purchases. (12/12)

I really get bound into the weeds of accounting. So let me put this in English. The cannot manipulate cash due to the cash controls agreements. To make a profitable quarter, they capitalize expenses in the operating section of the cash flow statement. Reports less cash.

To offset, they do not capitalize PPE. Reports more cash. Net effect on cash flow is a wash. Lenders see it. Do their quarterly cash audits by ending balance and think the covenants are in tact. Net income is juiced. Cash is in tact.

Read on Twitter

Read on Twitter