Good morning.

I think I just found a way to secure 95% winning trades with one of my strategies.

I started the day with a bit or hyperactive mania type brain and it& #39;s probably paid off.

I think I just found a way to secure 95% winning trades with one of my strategies.

I started the day with a bit or hyperactive mania type brain and it& #39;s probably paid off.

What is it I hear you ask?

I figured a way to find the optimum closing points of an active trade with this algo. This negates the need for my original TP settings and guarantees at least a 1% win on trades but often more. It also gives multiple opportunities to close.

I figured a way to find the optimum closing points of an active trade with this algo. This negates the need for my original TP settings and guarantees at least a 1% win on trades but often more. It also gives multiple opportunities to close.

Had to manualy backtest but as long as my figures are correct, which they are.

We are looking at a strategy that has a 92% win rate.

52 trades in 2020

48 wins

4 losses

All trades 1% or more.

Not sure on the total percentage gain just now

We are looking at a strategy that has a 92% win rate.

52 trades in 2020

48 wins

4 losses

All trades 1% or more.

Not sure on the total percentage gain just now

Fees might rekt this strategy tbh

Fees can suck my nuts. I can limit in and out of the strategy now so the only factor that would be against it is slippage and or not getting fills.

Set up the test account to try it out for a few weeks. If it& #39;s awesome will go live on a big account.

Set up the test account to try it out for a few weeks. If it& #39;s awesome will go live on a big account.

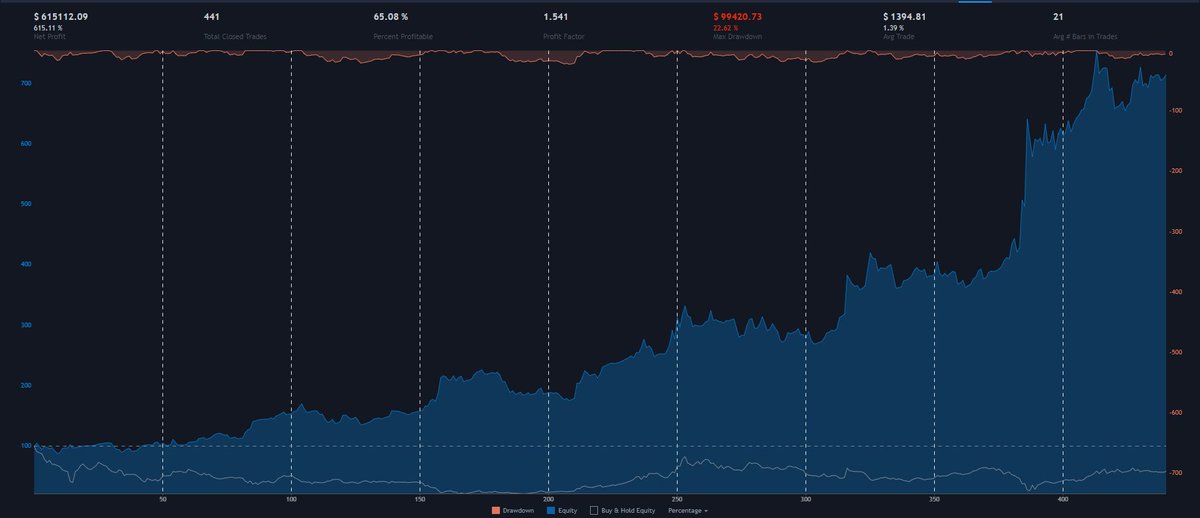

I tweaked the strategy down to more manageable parameters and am left with this backtest data.

System now takes the profit at the optimum point but also has a static 2% TP where it will close positions so whichever hits first is the closing point.

Pretty awesome.

System now takes the profit at the optimum point but also has a static 2% TP where it will close positions so whichever hits first is the closing point.

Pretty awesome.

Okay to summarize the thread:

New strategy has a manually backtested 92% win rate.

I have decided on the final play which shall be this:

Limit orders for entry signals

Limit sell set at 2%

If optimum TP signal fires the system will set limit sells and close there.

Money.

New strategy has a manually backtested 92% win rate.

I have decided on the final play which shall be this:

Limit orders for entry signals

Limit sell set at 2%

If optimum TP signal fires the system will set limit sells and close there.

Money.

Test account just closed it& #39;s first win and turned a profit plus maker rebates.

Very very happy with this.

Roughly anywhere from 5-15 trades per month averaging 1% (2% with 2x lev which I& #39;m using across the board)

Guessing at average monthly gain of around 8%

Very very happy with this.

Roughly anywhere from 5-15 trades per month averaging 1% (2% with 2x lev which I& #39;m using across the board)

Guessing at average monthly gain of around 8%

*This means the back test data I shared three tweets up in the thread is no longer relevant as I have found a way to play the original 92% win rate system*

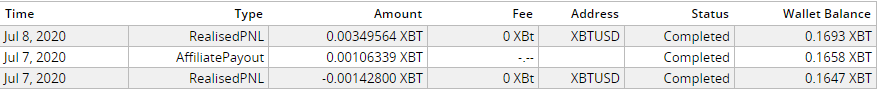

Test accounts first trade.

Affiliate payout in the middle but the trade was a nice little win.

On to the next one.

Affiliate payout in the middle but the trade was a nice little win.

On to the next one.

I also took this trade on my main account as the algo it was trading was in the exact same position and I exited $3 from the very tippy top of this candle.

Another great thing I just noticed is that this algo has cross asset discipline. This means you can essentially trade anything with it.

Potentially some of my best work.

Might get a second trade today, will document it here as well.

Oke so this is how we looking now (minus the trend line)

Entry is the buy signal but entry is candle close.

Triangle down plots are optimum take profits and the algo will close on any of these, if it doesn& #39;t get a fill it will wait for the next one OR our final TP which is set.

Entry is the buy signal but entry is candle close.

Triangle down plots are optimum take profits and the algo will close on any of these, if it doesn& #39;t get a fill it will wait for the next one OR our final TP which is set.

This means, providing we get the order filled at the entry point, we have usually a minimum of 1 exit point plus the backup TP at 2% so if one doesn& #39;t fill, the others should.

Red and green lines are stop losses.

They are at 5% which is wide but the strat has 92% win rate.

Red and green lines are stop losses.

They are at 5% which is wide but the strat has 92% win rate.

Read on Twitter

Read on Twitter