Much additional information on the $BRKA purchase of Dominion assets can be found in this presentation posted by Berkshire Hathaway energy this morning:

https://www.sec.gov/Archives/edgar/data/1081316/000119312520187362/d948170dex991.htm">https://www.sec.gov/Archives/...

https://www.sec.gov/Archives/edgar/data/1081316/000119312520187362/d948170dex991.htm">https://www.sec.gov/Archives/...

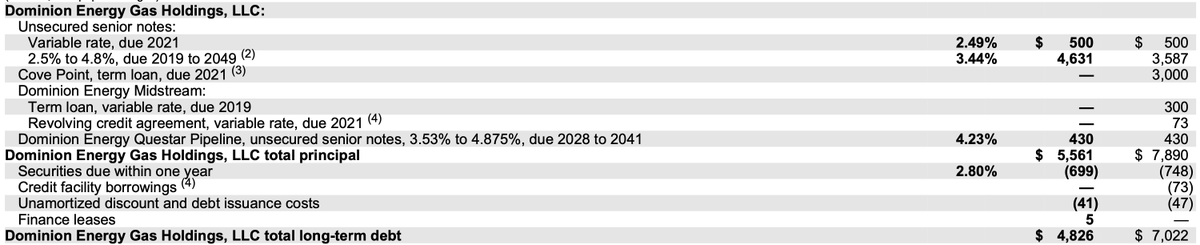

In addition to the $3.8 billion in cash used to fund the transaction, over the next year BHE plans to pay off $1.2 billion in maturing debt that is being assumed in the transaction bringing the cash commitment to $5 billion.

Here& #39;s the debt of Dominion Gas, the segment of Dominion containing the pipeline assets. (From $D 10-K)

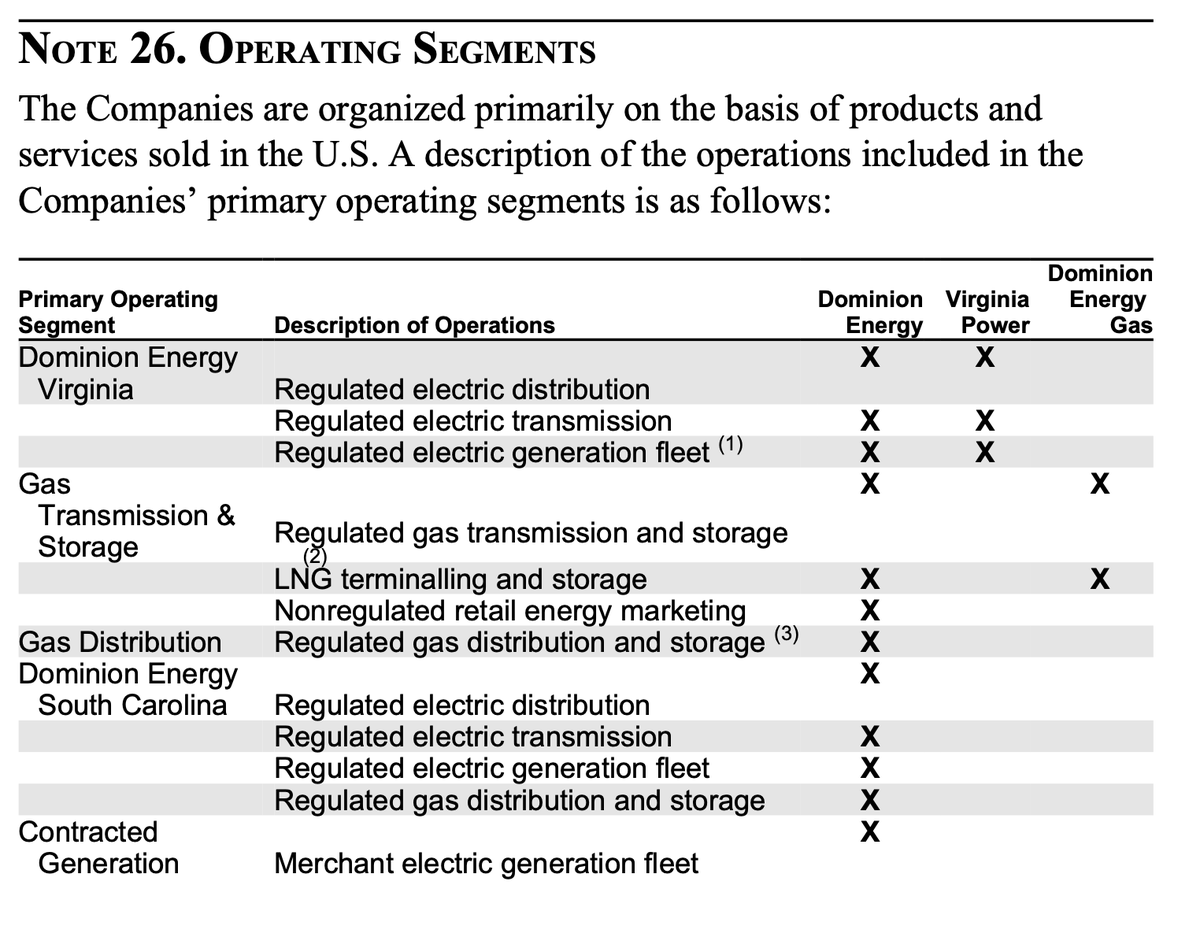

I am not sure that the Dominion Energy Gas segment results map exactly to what Berkshire is purchasing. The parent company apparently has some transmission assets.

But I think segment data in the prior tweet contains a rough idea of the numbers behind what is being purchased.

But I think segment data in the prior tweet contains a rough idea of the numbers behind what is being purchased.

Read on Twitter

Read on Twitter