1/22. In the spirit of independence day weekend, I just published my latest writing: “Masters and Slaves of Money" where we explore why central banking is an institution of time-theft and #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> is a weapon for peace. https://medium.com/@breedlove22/masters-and-slaves-of-money-255ecc93404f">https://medium.com/@breedlov...

https://abs.twimg.com/hashflags... draggable="false" alt=""> is a weapon for peace. https://medium.com/@breedlove22/masters-and-slaves-of-money-255ecc93404f">https://medium.com/@breedlov...

2. In 1776, the US declared its independence from England. For years, the decentralized state network resisted the implementation of a central bank, knowing the evils it had caused in eras past. Today with Bitcoin, people globally are declaring their independence from The Fed.

3. Money is a tool for trading human time. Central banks, the modern-era masters of money, wield this tool as a weapon to steal time and inflict wealth inequality. History shows us that the corruption of monetary systems leads to moral decay, social collapse, and slavery.

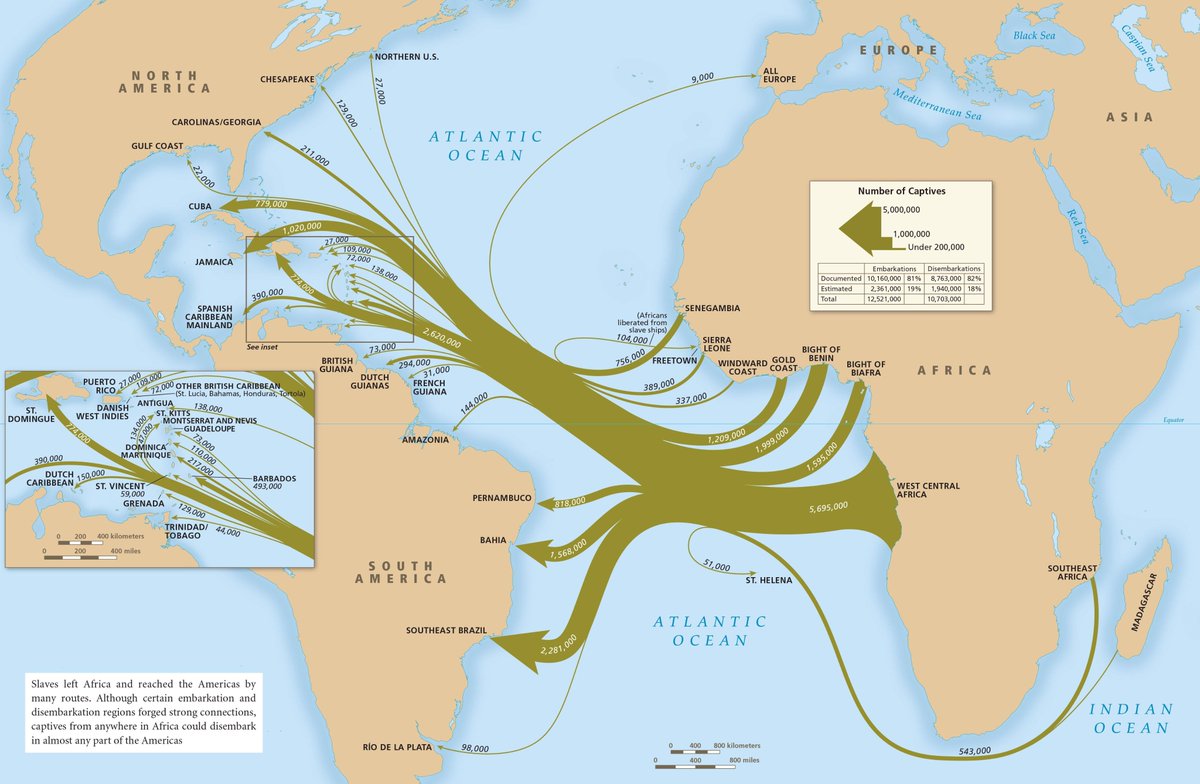

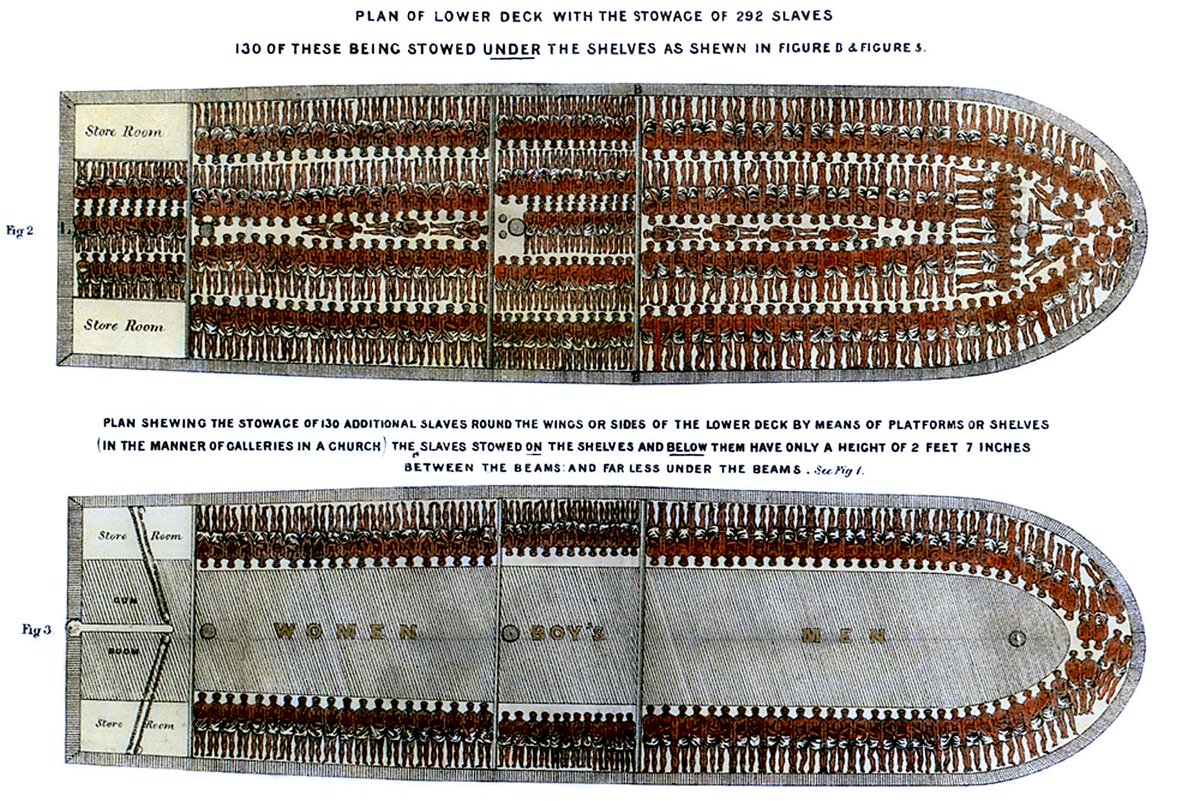

4. In ancient western Africa, aggry beads—small, decorative glass beads—were used as money for many centuries. By counterfeiting these monetary beads, Europeans executed a multi-decade plundering of African wealth, natural resources, and—ultimately—time.

5. Aggry beads would later become known as “slave beads”; as newly impoverished Africans became desperate, some were forced to sell themselves or others as slaves to their European usurpers. Slave beads became instrumental in the multi-century trans-Atlantic slave trade.

6. In a barbaric irony of history, ships landing in Africa stuffed with (counterfeit) aggry beads later departed for European and American shores with full payloads of precious human cargo—African slaves.

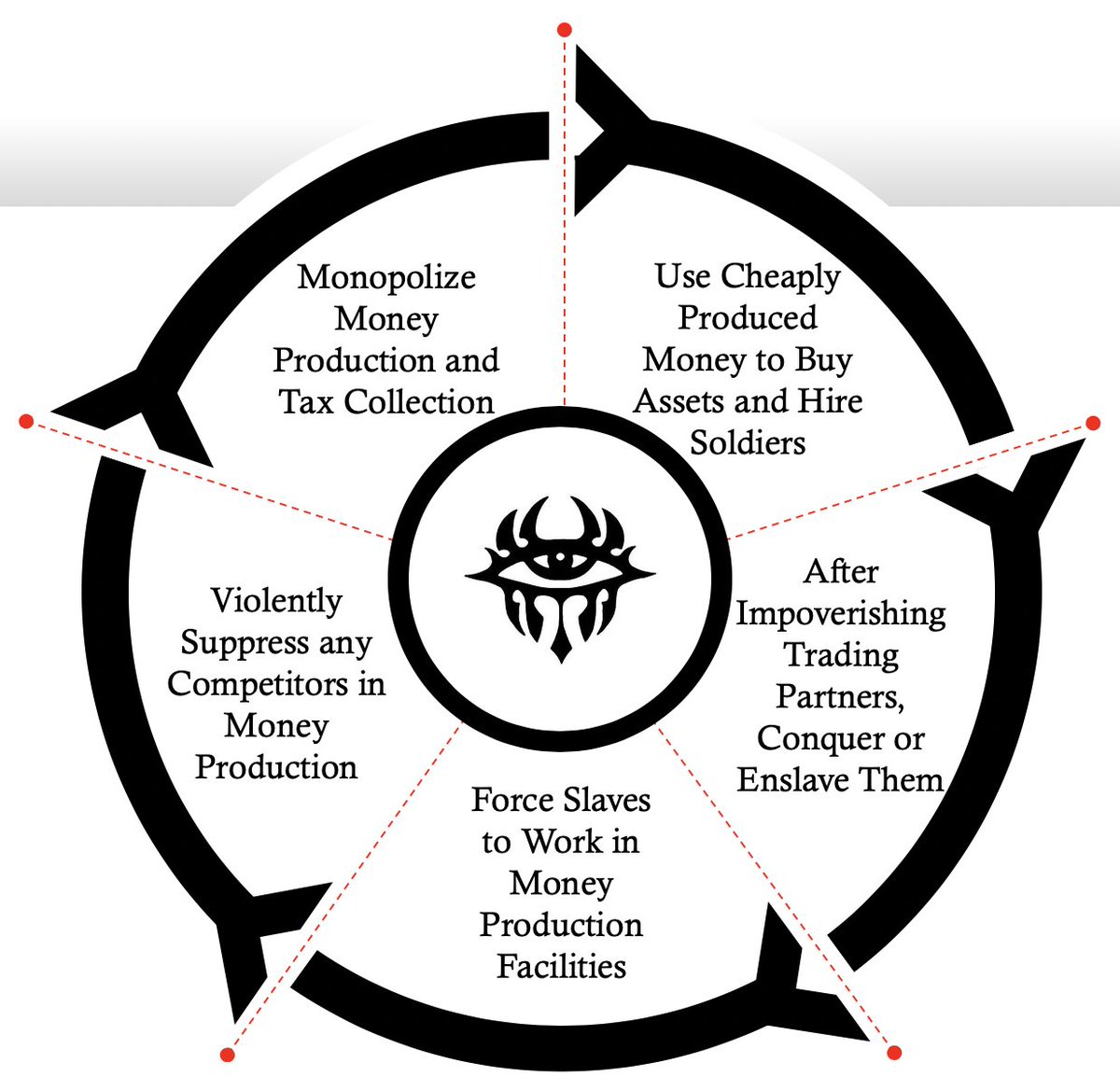

7. When free market forces are manipulated, producers gain an asymmetric ability to set prices without regard to customer preferences, thereby converting economic democracies into dictatorships, and freedom into tyranny.

8. For money, this implies monopolists can acquire human time (aka labor) in the marketplace at an unfair price. Said differently: money monopolists can steal human time—a malevolent power that effectively makes them slavemasters.

9. As a free market phenomenon, money is a direct derivation of human action and speech: all three of which are essential media for sovereign self-expression. In this sense, money may be considered a form of speech in and unto itself—the language of value—an act of free speech.

10. An inability to speak the truth (with words), or prove others wrong in the marketplace (with prices), is the death of liberty; as the 20th century so painfully taught us, restricting the logos is a slippery slope toward totalitarianism. Only free expression can be moral.

11. Countervailing to the freedom of speech, inflation is an infectious disease to society’s moral fabric—an immiseration on the soul of humanity. In this sense, Bitcoin—the only money with a 0% terminal inflation rate—is the cure for many of the moral cancers riddling our world.

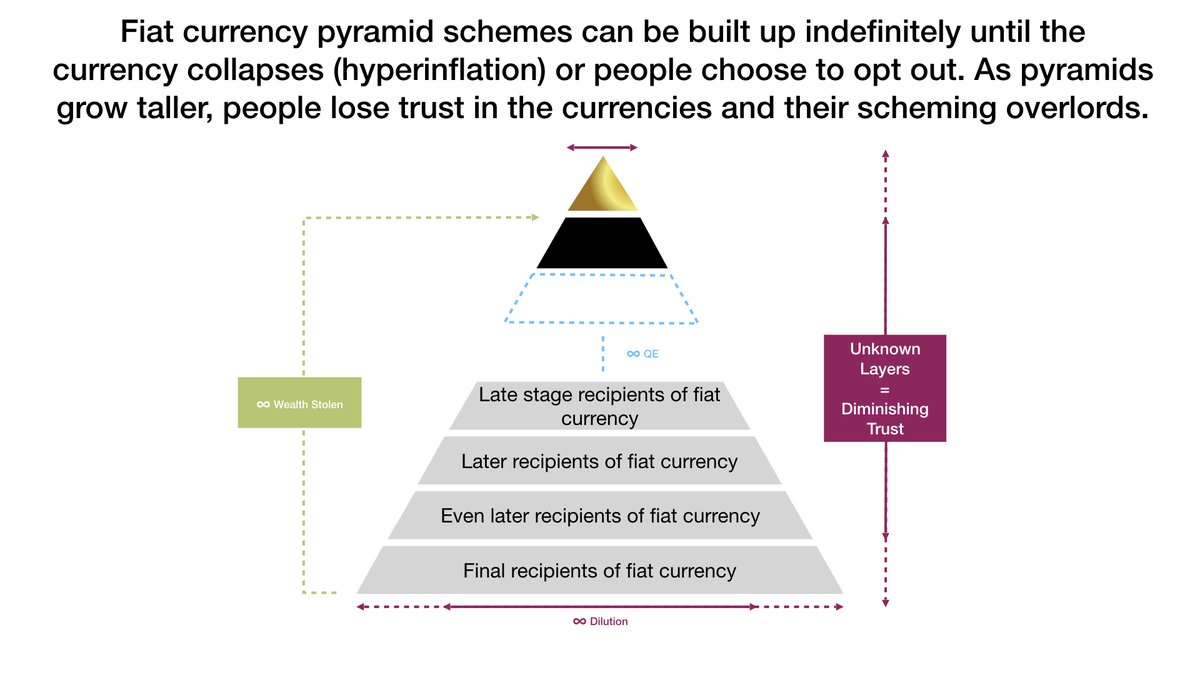

12. Inflation is the greatest con in history; an illusion that robs poor people and gives to the rich, thus driving wealth disparities and social collapse. All national currencies—including the US dollar—are pyramid schemes.

13. At the pinnacle fiat currency pyramid schemes is gold: a technology selected as money by the cumulative free choice of countless entrepreneurs throughout history. Paper currency abstractions of gold were introduced to make it more convenient for exchange, not to replace it.

14. Over time, the option to redeem currency for gold was eliminated, giving governments full control over currency scarcity, and therefore an unlimited capacity to confiscate wealth from their citizens by compromising its supply.

15.Every time a new unit of fiat currency is printed (euphemistically called “quantitative easing” or QE by central banks), new layers to the pyramid scheme are laid from the top down, and the inflationary costs are externalized onto those using fiat as a store of value.

16. So long as people remain sufficiently passive yet productive, these pyramid schemes can be built ever-higher, and continue to operate as a weapon of wealth extraction (time-theft) for their political perpetrators.

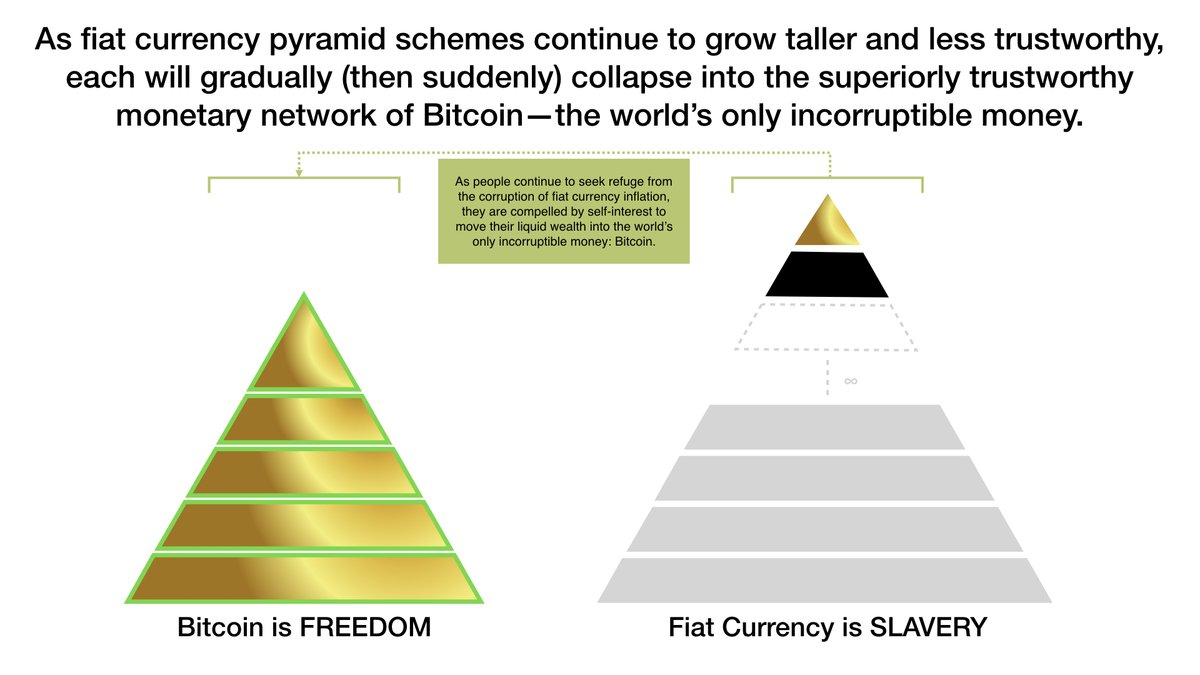

17. All monies exhibit a multi-level marketing valuation dynamic: for Bitcoin, early adopters benefit disproportionately by anticipating later adoption by others. But unlike the unknowable supplies of fiat currency pyramid schemes, Bitcoin has a universally known supply.

18. The absolute scarcity of the Bitcoin increasingly outcompetes fiat currency pyramid schemes as they grow comparatively taller and less trustworthy through QE. Eventually, these proverbial “houses of cards” collapse into the full transparency and certainty of Bitcoin.

19. How big are these schemes? Using annual wage data from the social security administration, changes in US M2 money supply, and assuming 2,000 average annual working hours per worker, we arrive at some startling figures.

20. By dividing the growth in USD supply by the average hourly wage each year in dollars, we calculate a proxy for the hours stolen from society through USD supply expansion.

21. Stealing an average of 7.6% working hours per year since 1981, bureaucrats at The Fed have managed to scalp nearly one trillion hours off the backs of hard working people. This is equivalent to enslaving 11.7M people for 40 years straight.

22. Read about this and much more in the completed work "Masters and Slaves of Money" linked here: https://medium.com/@breedlove22/masters-and-slaves-of-money-255ecc93404f">https://medium.com/@breedlov...

Thank you for feedback while writing:

@jimmysong @TuurDemeester @dergigi @Bquittem @Willem_VdBergh @RelevantPeter @gladstein @100trillionUSD @sthenc

@jimmysong @TuurDemeester @dergigi @Bquittem @Willem_VdBergh @RelevantPeter @gladstein @100trillionUSD @sthenc

@real_vijay

@saifedean

@Bquittem

@princey1976

@danheld

@naval

@NickSzabo4

@nic__carter

@MartyBent

@pierre_rochard

@APompliano

@cburniske

@MarkYusko

@CaitlinLong_

@timevalueofbtc

@nntaleb

@stephanlivera

@PeterMcCormack

@dergigi

@hasufl

@saifedean

@Bquittem

@princey1976

@danheld

@naval

@NickSzabo4

@nic__carter

@MartyBent

@pierre_rochard

@APompliano

@cburniske

@MarkYusko

@CaitlinLong_

@timevalueofbtc

@nntaleb

@stephanlivera

@PeterMcCormack

@dergigi

@hasufl

Read on Twitter

Read on Twitter