The SA residential property market is as unhealthy as your average overweight 58yo hookah smoking dude at Cubana. The market is even weaker than Arsenal& #39;s defense.

Thinking of buying a house? When is the right time to pull the trigger? This is for you [Thread]

Thinking of buying a house? When is the right time to pull the trigger? This is for you [Thread]

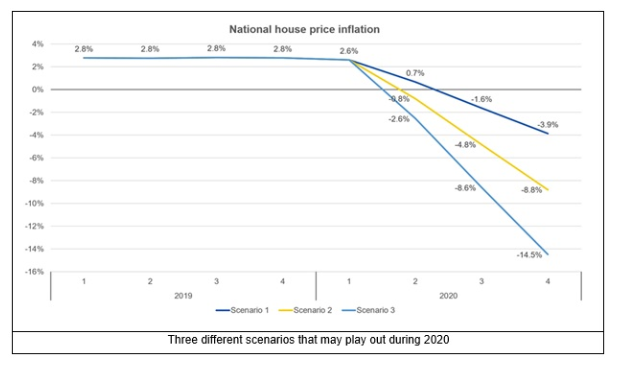

House prices are expected to fall this year. By how much?

It could get pretty bad

Here& #39;s 3 scenarios from Lightstone:

Scenario 1: Prices drop 3.9% (GDP down 3%)

Scenario 2: Prices drop 8.8% (GDP down 6%)

Scenario 3: Prices drop 14.5% (GDP down 10%)

FNB is predicting a 5% drop

It could get pretty bad

Here& #39;s 3 scenarios from Lightstone:

Scenario 1: Prices drop 3.9% (GDP down 3%)

Scenario 2: Prices drop 8.8% (GDP down 6%)

Scenario 3: Prices drop 14.5% (GDP down 10%)

FNB is predicting a 5% drop

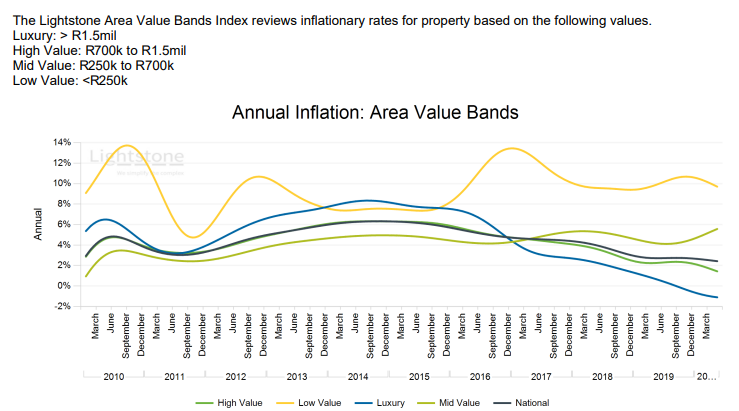

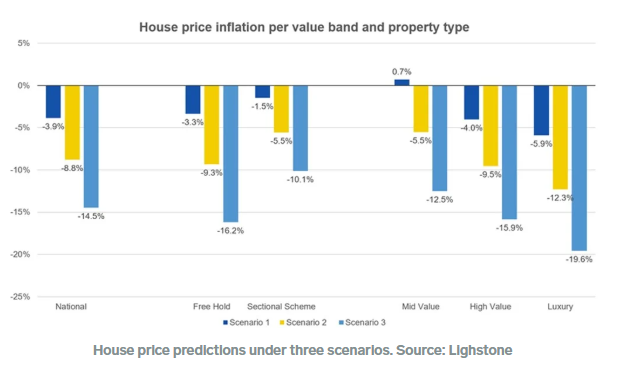

Now that we know property prices will take a hit - let& #39;s drill into which segments are most vulnerable.

Your friends owning Camps Bay mansions will be crying in cashmere. Luxury houses are already feeling the burn. Low value houses (less than R250k) are showing resilience.

Your friends owning Camps Bay mansions will be crying in cashmere. Luxury houses are already feeling the burn. Low value houses (less than R250k) are showing resilience.

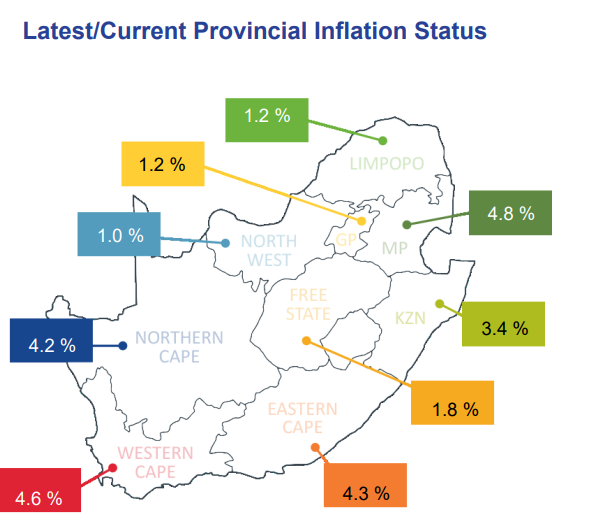

Some juicy trends:

1. Gauteng house price growth is weak sauce (1.2%). You& #39;re better off moving to another country (Cape Town)

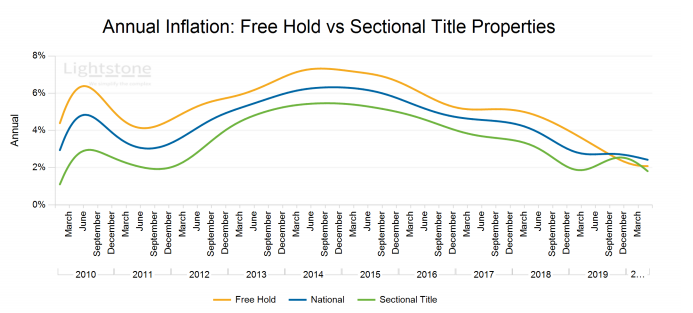

2. Both complexes and free holds are in a dark place and are losing value

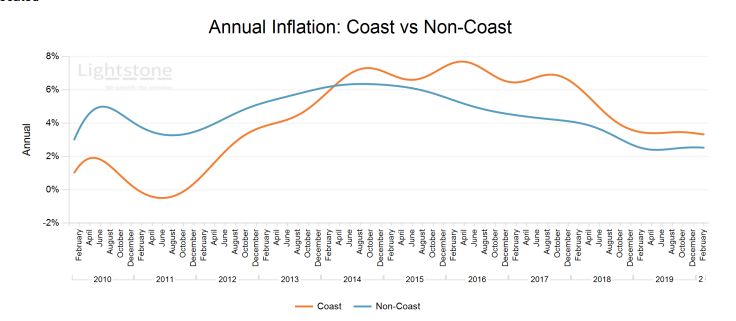

3. Buying a beach house won& #39;t save you from slower property growth

1. Gauteng house price growth is weak sauce (1.2%). You& #39;re better off moving to another country (Cape Town)

2. Both complexes and free holds are in a dark place and are losing value

3. Buying a beach house won& #39;t save you from slower property growth

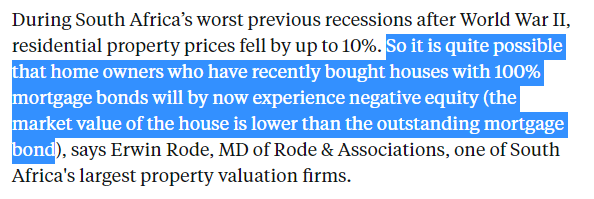

Price does not equal value.

If you take out a 100% bond for a house of R1m, you owe the bank R1m (before interest). If the house loses 5% of value - it& #39;s now worth R950k... but you& #39;re still paying back R1m.

In short - you can make a loss buying a house. Shout-out EMS Twitter.

If you take out a 100% bond for a house of R1m, you owe the bank R1m (before interest). If the house loses 5% of value - it& #39;s now worth R950k... but you& #39;re still paying back R1m.

In short - you can make a loss buying a house. Shout-out EMS Twitter.

"Interest rates are low, let me fix the rate..."

Three pro tips on this:

1. You can& #39;t usually a fix a rate for more than 5 years

2. The fixed rate will usually be higher than the current rate (banks are smart)

3. You could end up losing out if there& #39;s more rates cuts on the way

Three pro tips on this:

1. You can& #39;t usually a fix a rate for more than 5 years

2. The fixed rate will usually be higher than the current rate (banks are smart)

3. You could end up losing out if there& #39;s more rates cuts on the way

Theoretically, lowering the cost of capital (lower interest rates) should result in a higher asset values but there& #39;s always a time lag.

We& #39;re also hamstrung by unemployment, thin liquidity, greater defaults (post payment holidays) & allocations toward being overweight cash.

We& #39;re also hamstrung by unemployment, thin liquidity, greater defaults (post payment holidays) & allocations toward being overweight cash.

As the market crumbles more people will desperately try and sell you property:

- Banks

- Property development companies

- Home loan companies

- Estate agents

- "Influencers"

Remember, once the sale is done - they don& #39;t give a fuck whether your property loses value.

- Banks

- Property development companies

- Home loan companies

- Estate agents

- "Influencers"

Remember, once the sale is done - they don& #39;t give a fuck whether your property loses value.

When it comes to any economic data - there& #39;s a strong chance Q2 and Q3 is worse than Q1. GDP, unemployment, housing data, growth stats, retail data will all be even more fucked.

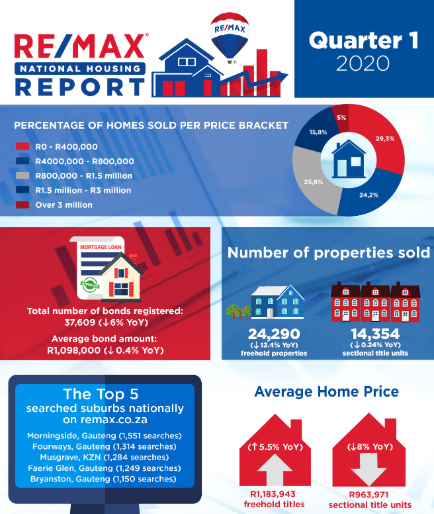

You can already see property sales slippage looking at the REMAX sales figures.

You can already see property sales slippage looking at the REMAX sales figures.

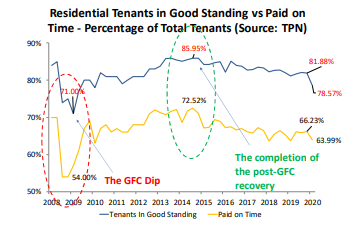

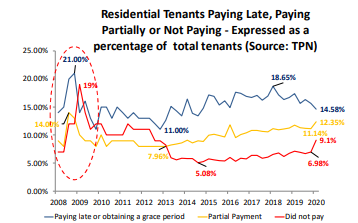

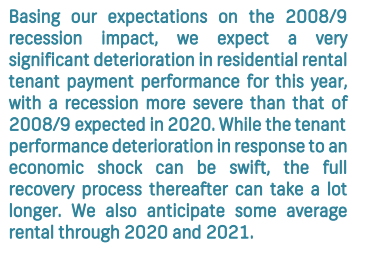

Useful to keep an eye of tenant default rates & compare it against the financial crisis in 2008. This could get apocalyptic. Take a look at the "did not pay" line.

This will get worse now that payment holidays are done.

(Solid data from FNB property strategy)

This will get worse now that payment holidays are done.

(Solid data from FNB property strategy)

Differences between qualifying and affordability [thread] https://twitter.com/iamkoshiek/status/1249989655480741889?s=20">https://twitter.com/iamkoshie...

How paying a little extra on a home loan goes a long way [thread] https://twitter.com/iamkoshiek/status/1193477129633185792?s=20">https://twitter.com/iamkoshie...

How credit pricing models sometimes end up being discriminatory https://twitter.com/iamkoshiek/status/1199715225269866499?s=20">https://twitter.com/iamkoshie...

Few things to consider before buying a house [thread] https://twitter.com/SlwaneToYou/status/1267068623757197313?s=20">https://twitter.com/SlwaneToY...

Rent vs. Buy [thread] https://twitter.com/C_Renzo29/status/1264664299504578562?s=20">https://twitter.com/C_Renzo29...

The most useful property links+thread references

1. Lightstone June report https://www.lightstoneproperty.co.za/news/Residential_Property_Indices_June_2020.pdf

2.">https://www.lightstoneproperty.co.za/news/Resi... FNB/ PayProp & REMAX sector insights library

https://www.myproperty.co.za/tools/property-index

3.">https://www.myproperty.co.za/tools/pro... Residential property think pieces

https://propertywheel.co.za/category/residential/

4.">https://propertywheel.co.za/category/... Global comparison https://businesstech.co.za/news/property/363390/south-africas-house-price-increases-vs-other-major-countries/">https://businesstech.co.za/news/prop...

1. Lightstone June report https://www.lightstoneproperty.co.za/news/Residential_Property_Indices_June_2020.pdf

2.">https://www.lightstoneproperty.co.za/news/Resi... FNB/ PayProp & REMAX sector insights library

https://www.myproperty.co.za/tools/property-index

3.">https://www.myproperty.co.za/tools/pro... Residential property think pieces

https://propertywheel.co.za/category/residential/

4.">https://propertywheel.co.za/category/... Global comparison https://businesstech.co.za/news/property/363390/south-africas-house-price-increases-vs-other-major-countries/">https://businesstech.co.za/news/prop...

On the macro side you have US elections, a stock market artificially fuelled by Fed stimulus & a deep disconnect with equity valuations to the real economy.

SA property also looks far from bottoming out.

Could be worth holding off on that big ticket purchase - for 2020 at least

SA property also looks far from bottoming out.

Could be worth holding off on that big ticket purchase - for 2020 at least

Shout-out for making it to the end. I genuinely fucking appreciate you! Make Finance Great Again #MFGA

Read on Twitter

Read on Twitter