I& #39;m going to disagree with some of these conclusions and provide counter-arguments.

I hope the fact I live in HK and disagree with this does not make me someone conflicted. I think one can disagree with the conclusions without disagreeing with the underlying sentiment. 1/n https://twitter.com/davidfickling/status/1278879871419052032">https://twitter.com/davidfick...

I hope the fact I live in HK and disagree with this does not make me someone conflicted. I think one can disagree with the conclusions without disagreeing with the underlying sentiment. 1/n https://twitter.com/davidfickling/status/1278879871419052032">https://twitter.com/davidfick...

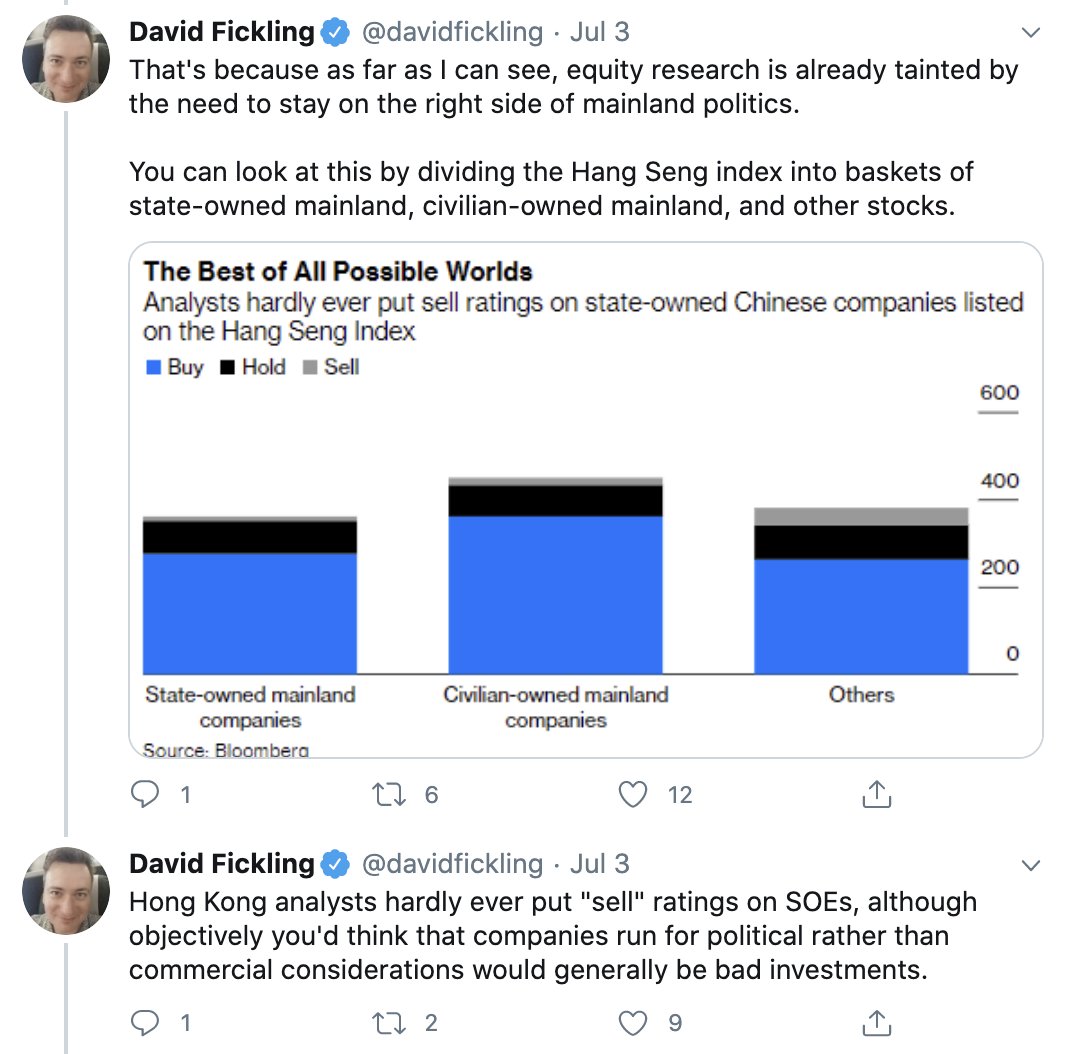

2/n: "If you believe the recommendations of Hong Kong& #39;s equity analyts, state-owned enterprise stonks only go up."

Strictly speaking, the analysis presented does not state that. There is no presentation showing analyst forecast SOE target prices are always sequentially higher.

Strictly speaking, the analysis presented does not state that. There is no presentation showing analyst forecast SOE target prices are always sequentially higher.

3/n: I will agree the independence of much HK-based broker research on Chinese or HK-based companies is suspect, but companies make zero bones about being vindictive regarding opinion-for-analysis, and most brokers don& #39;t want to lose access. Investors pay for ECM business.

4/n: Independent analysts (and there are a bunch in HK who are decent) may struggle because they can& #39;t offer IPO/placement access.

But frankly, investors who make their alpha from IPO access are effectively complicit with companies anyway.

But frankly, investors who make their alpha from IPO access are effectively complicit with companies anyway.

5/n: THAT SAID.... this data doesn& #39;t prove anything of the sort.

First, the relative ratio between SOE and COE buy/sell ratios in that chart is statistically insignificant.

Second, the following tweet assumes a premise which is incorrect. Just because they are SOEs and listed

First, the relative ratio between SOE and COE buy/sell ratios in that chart is statistically insignificant.

Second, the following tweet assumes a premise which is incorrect. Just because they are SOEs and listed

6/n: does not mean they are necessarily run for political considerations rather than economic. They may be, but the difference between an SOE and COE company in the same sector is rarely "that one doesn& #39;t care about profits and this one does." But that& #39;s another problem.

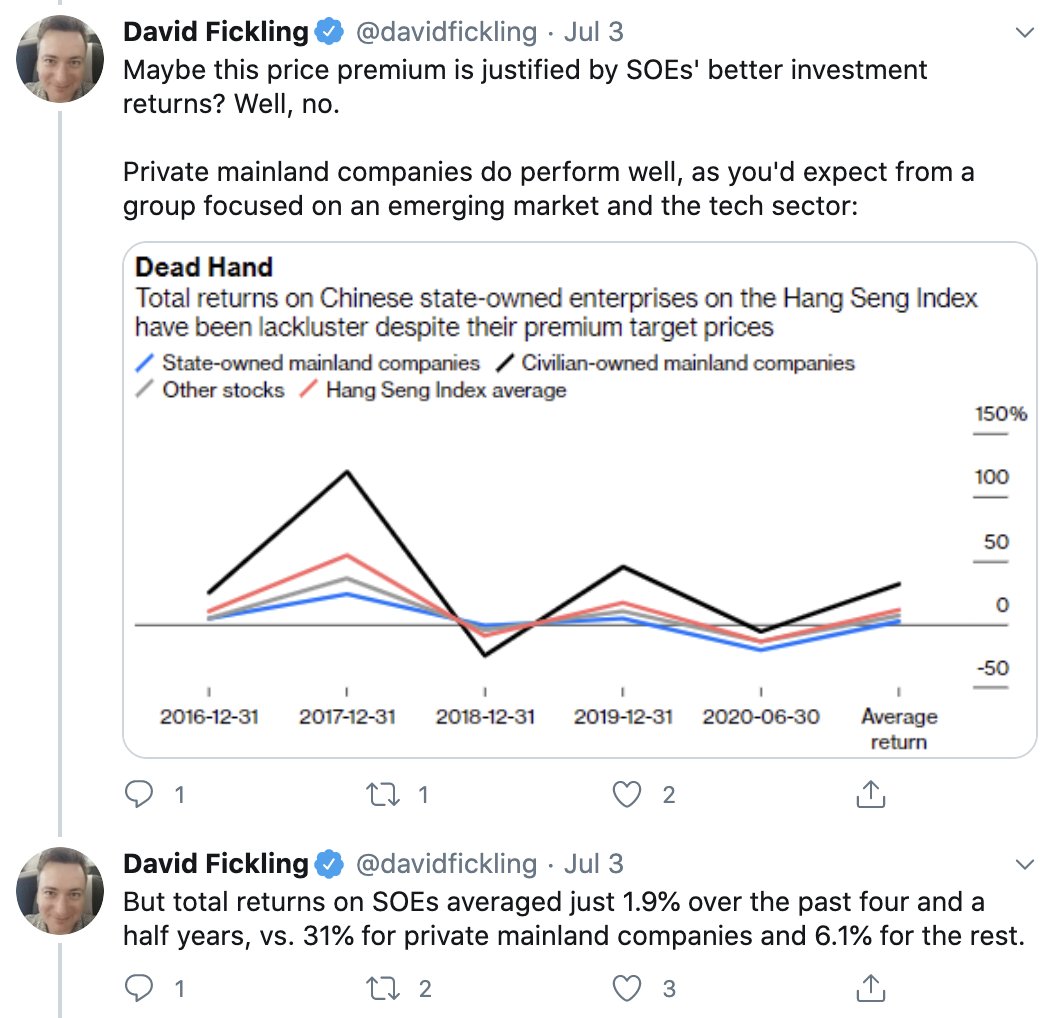

7/n: the analysis is not sector neutral. Comparing China Mobile to Tencent is not unlike comparing Verizon with a basket of Google and FB. Mobile telephone companies have lower growth rates and demand lower multiples than those companies which compound on mobile infrastructure.

8/n: The HSI COE vs SOE basket is effectively something a bit like "new, growth stocks" and "old-fuddy-duddy stocks" in the S&P. Performance of those two baskets has diverged as well, and nobody is saying the difference in TP/spot price is because analysts favor railroads.

9/n: China Mobile has a PER of 9.6x and a mean analyst target price 21.8% higher than last trade. Tencent has a PER of 47.7x and a mean analyst target price 9.8% lower than last trade. This is coincidental with the conclusion, but it in no way suggests that the sell side looks

10/n: at Tencent and "ascribes" a lower premium to Tencent than to China Mobile. It means that the sellside ascribes a trailing PER of 12x to China Mobile and of ~43x to Tencent.

Yeah, I know, trailing PER blah blah blah, but 43x vs 12x is far enough apart to make the point.

Yeah, I know, trailing PER blah blah blah, but 43x vs 12x is far enough apart to make the point.

11/n: That Tencent is +39.6% this year while China Mobile is down 16.6% also coincides with @davidfickling& #39;s point. But that doesn& #39;t mean that analysts are deliberately setting higher premia to last trade to SOEs because they are SOEs. It could simply be that SOEs are in sectors

12/n: with less top-line growth. It could also be that investors ascribe a higher equity risk premium to less fundamentally less growth-y fundamentally and underperforming stocks, but analysts do not. That by itself wd more than account for such TP premia vs market differences.

13/n: it could be that analysts ascribe greater premia to spot prices because they are told if they do not they do not get paid, but anyone who knows the proclivities of Chinese SOEs to pay most HK-based brokers for ECM, DCM, and banking services would laugh at the concept.

14/n: The other problem here is that Analyst TPs ascribe value, not future returns. If the 1yr "Target Price" stays flat for years at a 24% premium to spot on average for SOEs while it rises constantly at COEs as analysts raise implied market multiples to keep up with the market

15/n: doing the same, that would result in

All you& #39;d need to do to "prove" this whole thesis is look at capital-structure-adjusted Analyst TP multiples at SOEs vs COEs in the same sector and see if the TP multiples are higher consistently.

But that is hard.

All you& #39;d need to do to "prove" this whole thesis is look at capital-structure-adjusted Analyst TP multiples at SOEs vs COEs in the same sector and see if the TP multiples are higher consistently.

But that is hard.

16/n: SOEs and COEs fundamentally operate in different businesses. Super-heavily-regulated public utility-type companies are one thing. Consumer product mfrs or those with significant inherent leverage to policy change are another.

Do analysts not want to offend SOEs? Maybe.

Do analysts not want to offend SOEs? Maybe.

17/n: But I promise the desire of SS analysts/bankers to not offend high-growth COEs is far more endemic.

That& #39;s where the business is. That& #39;s where future jobs are. No analyst looks beyond their SS role to think "After this I& #39;ll join that SOE in middle mgmt, IR, or bizdev."

That& #39;s where the business is. That& #39;s where future jobs are. No analyst looks beyond their SS role to think "After this I& #39;ll join that SOE in middle mgmt, IR, or bizdev."

18/n: As to the final point? I agree there are conflict of interest problems on the traditional sell-side in HK. But those exist everywhere. The lack of transparency at many HK- (or China-) listed companies is a central reason why they persist. Buy side needs information to make

19/19: a decision. they get it via market price (they buy what goes up) or analysis. If not available through analysis, they buy what goes up. SS Analysts may believe they have a voice only because of their access. I know that to be not true, but they do not see competition.

Postscript: Yes, I believe the ability of analysts or commentators to freely publish their opinions or research about China from HK (or China) to be impaired (if you truly are bullish on something, it isn& #39;t, so one is not constrained on all things), and this is too bad.

This is China& #39;s loss. However, the desire of powerful people to use fear/threats to silence those who wd offer opinions which do not suit them is far from new, and far from exclusive to China. Bafin/Wirecard is a recent example in finance, but outside finance they are everywhere.

Read on Twitter

Read on Twitter