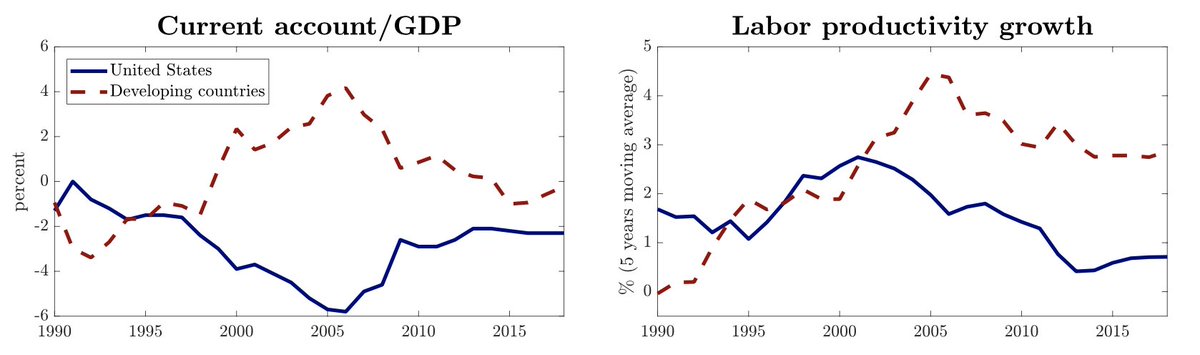

Updated version of The Global Financial Resource Curse ( https://www.dropbox.com/s/6wch3u3pjdrz927/globfincurse_june2020.pdf?dl=0).">https://www.dropbox.com/s/6wch3u3... Since the late 1990s, a global saving glut has pushed capital from developing countries to the US. But investment and productivity growth in the US have been weak, in spite of low global rates. Why?

We provide a model connecting the global saving glut and productivity growth. Think of a world composed by US and developing countries. Innovation by US firms pushes forward the world technological frontier. Developing countries, instead, grow by absorbing knowledge from the US.

A key feature is that sectors producing tradable goods are the engine of growth. Capital flows from the developing countries to the US boost demand for US non-tradable goods (e.g. construction), and depress economic activity in the US tradable sectors (e.g. manufacturing).

The result is lower investment in innovation by US firms. Since US innovation determines the world technological frontier, global growth slows down. Effect similar to natural resource curse, but financial and global in nature. Hence, we dub it the global financial resource curse.

A few more teasers, in our model the US exorbitant privilege becomes a global exorbitant duty ( @pogourinchas

@helene_rey, http://helenerey.eu/Content/_Documents/duty_23_10_2017.pdf),">https://helenerey.eu/Content/_... financial globalization generates superlow global rates ( @benbernanke, https://www.federalreserve.gov/boarddocs/speeches/2005/200503102/)">https://www.federalreserve.gov/boarddocs... - as well as weak investment and

@helene_rey, http://helenerey.eu/Content/_Documents/duty_23_10_2017.pdf),">https://helenerey.eu/Content/_... financial globalization generates superlow global rates ( @benbernanke, https://www.federalreserve.gov/boarddocs/speeches/2005/200503102/)">https://www.federalreserve.gov/boarddocs... - as well as weak investment and

growth ( @rodrikdani @arvindsubraman, https://drodrik.scholar.harvard.edu/files/dani-rodrik/files/why-did-financial-globalization-disappoint.pdf),">https://drodrik.scholar.harvard.edu/files/dan... export-led growth by developing countries backfires ( https://www.nber.org/papers/w14731 ),">https://www.nber.org/papers/w1... and a sudden stop hitting the US depresses global growth ( @krogoff @MauriceObstfeld, https://www.nber.org/chapters/c0127.pdf).">https://www.nber.org/chapters/...

What kind of policies can revive growth during the global saving glut? One possibility is to reduce US trade deficits, by imposing barriers on capital flows toward the US. But a better option is to directly support investment in innovation by US firms.

Our model thus suggests that innovation policies (see

@johnvanreenen, https://economicstrategygroup.org/auth/john-van-reenen/)">https://economicstrategygroup.org/auth/john... can play a crucial role in shielding US - and more broadly global - productivity growth from the adverse impact of

financial globalization.

@johnvanreenen, https://economicstrategygroup.org/auth/john-van-reenen/)">https://economicstrategygroup.org/auth/john... can play a crucial role in shielding US - and more broadly global - productivity growth from the adverse impact of

financial globalization.

This last point is very related to recent initiatives aiming at boosting public spending in research in the US (see @Noahpinion, https://www.bloomberg.com/opinion/articles/2020-06-01/the-u-s-gets-serious-about-catching-up-to-china-in-r-d?sref=R8NfLgwS).">https://www.bloomberg.com/opinion/a...

Read on Twitter

Read on Twitter