1/ Thread on value versus growth and valuations:

In order to make money with a growth stock, you need to purchase it at an attractive valuation

If you overpay for a company relative to its future growth, you may not earn a return on your investment even if growth materializes

In order to make money with a growth stock, you need to purchase it at an attractive valuation

If you overpay for a company relative to its future growth, you may not earn a return on your investment even if growth materializes

I discuss the contents of this thread in more detail in this article:

https://www.dividendgrowthinvestor.com/2015/10/quality-dividend-stocks-versus-growth_5.html">https://www.dividendgrowthinvestor.com/2015/10/q...

https://www.dividendgrowthinvestor.com/2015/10/quality-dividend-stocks-versus-growth_5.html">https://www.dividendgrowthinvestor.com/2015/10/q...

2/ This concept has been illustrated by Professor Jeremy Siegel in his book The Future for Investors: Why the Tried and the True Triumph Over the Bold and the New.

https://www.amazon.com/gp/product/140008198X/ref=as_li_tl?ie=UTF8&camp=1789&creative=9325&creativeASIN=140008198X&linkCode=as2&tag=divigrowstoci-20&linkId=GIPLTO4HQMVJJWTG">https://www.amazon.com/gp/produc...

https://www.amazon.com/gp/product/140008198X/ref=as_li_tl?ie=UTF8&camp=1789&creative=9325&creativeASIN=140008198X&linkCode=as2&tag=divigrowstoci-20&linkId=GIPLTO4HQMVJJWTG">https://www.amazon.com/gp/produc...

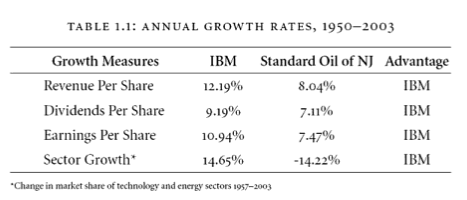

3/ He looked at the performance of $IBM & Standard Oil of New Jersey between 1950 & 2003

Standard Oil of New Jersey is now Exxon Mobil $XOM

During this period, IBM grew revenue per share by 12.19%/year, dividends per share at 9.19%/year & earnings per share at 10.94%/year

Standard Oil of New Jersey is now Exxon Mobil $XOM

During this period, IBM grew revenue per share by 12.19%/year, dividends per share at 9.19%/year & earnings per share at 10.94%/year

4/ At the same time, Standard Oil of New Jersey grew revenues per share at 8.04%/year, dividends per share at 7.11%/year and earnings per share at 7.47%/year.

Based on this information, you would think that IBM did much better for investors, right?

Based on this information, you would think that IBM did much better for investors, right?

5/ In reality, the opposite is the truth.

IBM delivered annual total returns of 13.83%/year between 1950 and 2003.

Standard Oil of New Jersey returned 14.42%/year during the same time period.

IBM delivered annual total returns of 13.83%/year between 1950 and 2003.

Standard Oil of New Jersey returned 14.42%/year during the same time period.

6/ The question is, how can a company with a lower growth end up delivering higher returns than a high growth company in an exciting new industry?

After all, IBM was a symbol of the computing era for several decades in the middle of the 20th century.

After all, IBM was a symbol of the computing era for several decades in the middle of the 20th century.

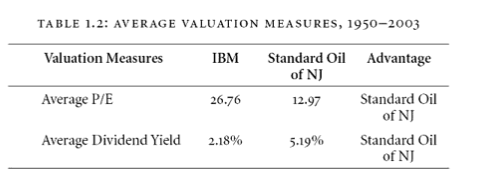

7/ In order to answer this question, we should look at valuations.

The average P/E ratio on IBM was 26.76. The average dividend yield was 2.18%/year.

The average P/E ratio on Standard Oil of New Jersey was 12.97. The average dividend yield was 5.19%.

The average P/E ratio on IBM was 26.76. The average dividend yield was 2.18%/year.

The average P/E ratio on Standard Oil of New Jersey was 12.97. The average dividend yield was 5.19%.

8/ $IBM investors paid too much for future growth as large portion of the growth was already discounted in the stock price

The avg dividend yield was low at 2.18%, due to high growth expectations

The share price rose by 11.41%/year. $IBM had a total return of 13.83%/year

The avg dividend yield was low at 2.18%, due to high growth expectations

The share price rose by 11.41%/year. $IBM had a total return of 13.83%/year

9/ With Standard Oil of New Jersey however, the expectations were low to begin with.

As a result, the valuation was low as well.

This also provided a high dividend yield of 5.19% The share price rose by 8.77%/year.

The total return was 14.42%/year.

As a result, the valuation was low as well.

This also provided a high dividend yield of 5.19% The share price rose by 8.77%/year.

The total return was 14.42%/year.

10/ When you have consistently low valuation, coupled with a high dividend yield where dividends are reinvested all the time, you are essentially turbocharging investment returns.

When you reinvest dividends at low valuations, this acts as an returns accelerator

When you reinvest dividends at low valuations, this acts as an returns accelerator

11/

To put it in perspective, $1000 invested in Standard Oil in 1950 compounded to $1.26 million by 2003

The same investment in $IBM compounded to $961,000.

End

To put it in perspective, $1000 invested in Standard Oil in 1950 compounded to $1.26 million by 2003

The same investment in $IBM compounded to $961,000.

End

Read on Twitter

Read on Twitter