An important aspect of Portfolio Construction is Strategic Asset Allocation(SAA):

What is it?

- The set of exposures to asset classes that is expected to achieve the investor& #39;s objectives given the investor& #39;s risk profile and investment constraints.

THREAD

What is it?

- The set of exposures to asset classes that is expected to achieve the investor& #39;s objectives given the investor& #39;s risk profile and investment constraints.

THREAD

What is an Asset Class?

- It is a category of assets with similar characteristics, attribute, and have the same risk/reward relationship

- Basically, they are assets that act similar to each other

There are 5 major types of asset classes we will discuss.

- It is a category of assets with similar characteristics, attribute, and have the same risk/reward relationship

- Basically, they are assets that act similar to each other

There are 5 major types of asset classes we will discuss.

These 5 Asset Classes are as such:

- Equities (Stocks)

- Bonds

- Property (Residental Real Estate)

- Commodities (Oil and Gas, Metals)

- Cash (essentially a benchmark for investing)

- Equities (Stocks)

- Bonds

- Property (Residental Real Estate)

- Commodities (Oil and Gas, Metals)

- Cash (essentially a benchmark for investing)

When you, the investor, are building a portfolio it is unwise to invest in only one asset class listed above.

I am not saying if you are only invested in equities you are wrong, I am just saying that for proper SAA you should invest in multiple asset classes to minimize risk.

I am not saying if you are only invested in equities you are wrong, I am just saying that for proper SAA you should invest in multiple asset classes to minimize risk.

Personally, I like to have a 75/25 split in my portfolio between Equities and Bonds.

Also, I consider REITs as a type of Equity invest even though it provides a level of diversity in my portfolio.

Another thing is I like to hold cash in a savings account as an emergency fund.

Also, I consider REITs as a type of Equity invest even though it provides a level of diversity in my portfolio.

Another thing is I like to hold cash in a savings account as an emergency fund.

Now I am going to mention two different types of risk associated with portfolio construction.

Systematic vs Nonsystematic:

These will be discussed below.

Systematic vs Nonsystematic:

These will be discussed below.

Systematic - risk that cannot be eliminated by holding a diversified portfolio.

Nonsystematic - Unique risk of particular assets, this can be avoided by holding assets with offsetting risk.

Now, I will explain why this is important to understand.

Nonsystematic - Unique risk of particular assets, this can be avoided by holding assets with offsetting risk.

Now, I will explain why this is important to understand.

When investing, you will always have some risk, AKA Systematic Risk.

This risk will not go away no matter how diverse your portfolio.

Examples:

-Interest Rate Hikes

- Economic Downturns (COVID)

- War

- Tax Reforms

See, there is nothing you can do about this risk.

This risk will not go away no matter how diverse your portfolio.

Examples:

-Interest Rate Hikes

- Economic Downturns (COVID)

- War

- Tax Reforms

See, there is nothing you can do about this risk.

There is also, diversifiable risk, AKA Nonsytematic risk.

This risk goes away the more you diverse you portfolio.

Examples:

- Holding stocks and Bonds

- Holding different industries (Oil vs Consumer goods)

See, this risk is unnecessary because you can diversify it away.

This risk goes away the more you diverse you portfolio.

Examples:

- Holding stocks and Bonds

- Holding different industries (Oil vs Consumer goods)

See, this risk is unnecessary because you can diversify it away.

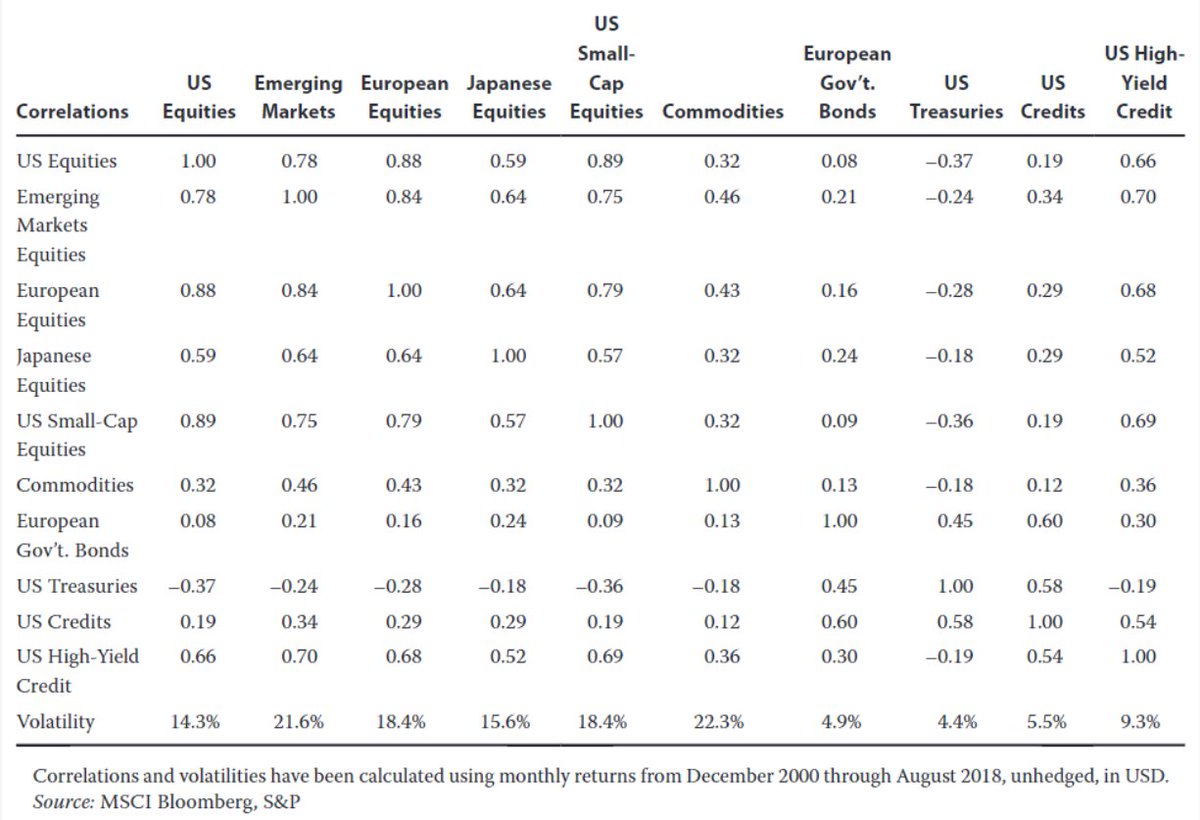

The picture below is an Asset Class Correlation Matrix:

This shows the correlation between Asset Classes.

To diversify risk, you want asset classes that are negatively correlated with one another.

So US Equities and Treasuries would essentially give you good diversity.

This shows the correlation between Asset Classes.

To diversify risk, you want asset classes that are negatively correlated with one another.

So US Equities and Treasuries would essentially give you good diversity.

Guys, I know what was stated above is a lot to take in.

It all revolves around the original tweet about SAA. If you are wanting to build a portfolio that minimizes risk it is important to understand the risk you are taking in.

If you have any questions feel free to DM us.

It all revolves around the original tweet about SAA. If you are wanting to build a portfolio that minimizes risk it is important to understand the risk you are taking in.

If you have any questions feel free to DM us.

Read on Twitter

Read on Twitter