“Original sin” is another well-documented EM macroeconomic challenge that LatAm countries have tried to surmount. Even though the capacity to borrow abroad in local currency has recently increased, the response to COVID-19 suggests there is still a long way to overcome it. 1/6

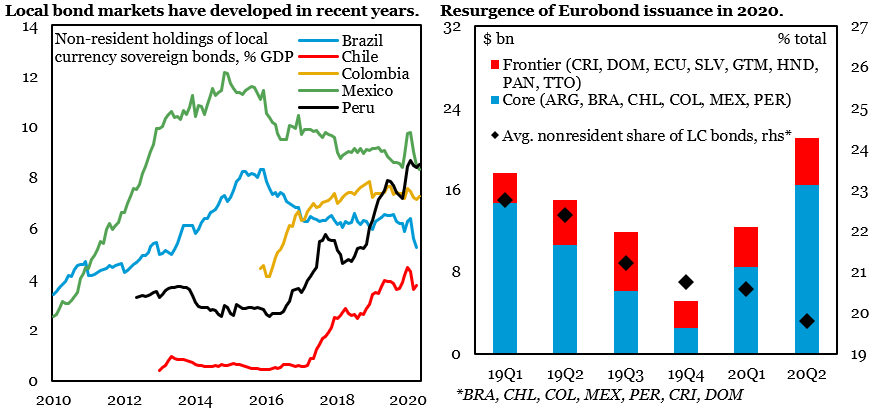

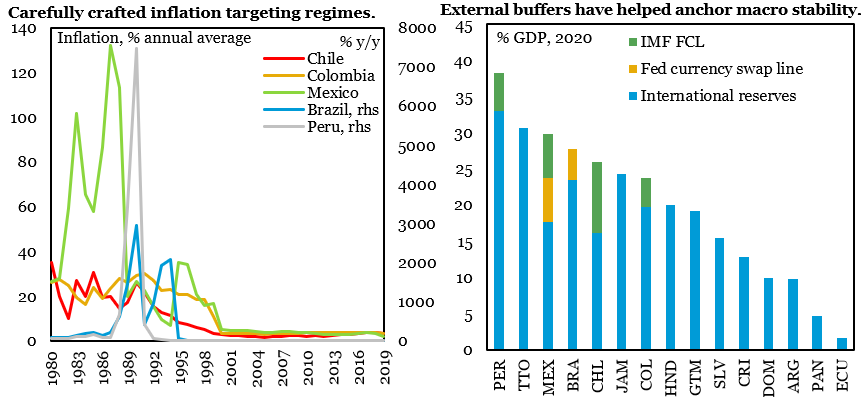

In recent years, countries like Chile, Colombia, Mexico, Brazil, and Peru have deepened local currency debt markets due to improved policy frameworks based on 1) credible inflation targeting regimes, 2) rule-based fiscal schemes, and 3) ample liquidity buffers. 2/6

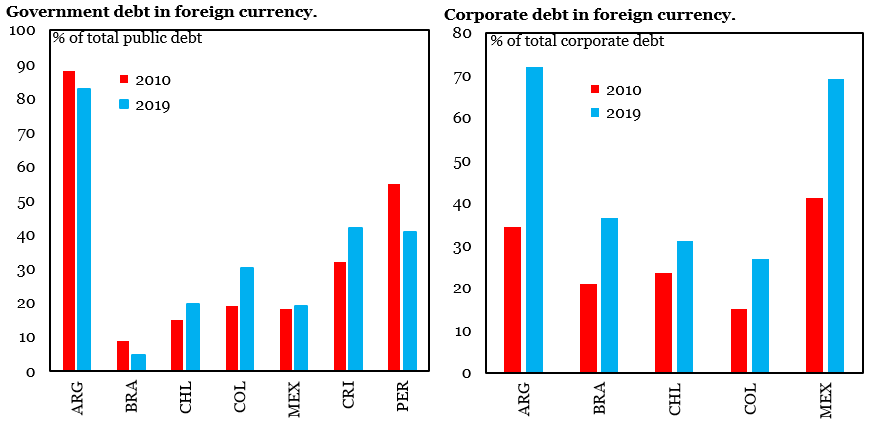

However, progress in reducing exposure to foreign currency debt has been limited, particularly for the corporate sector. 3/6

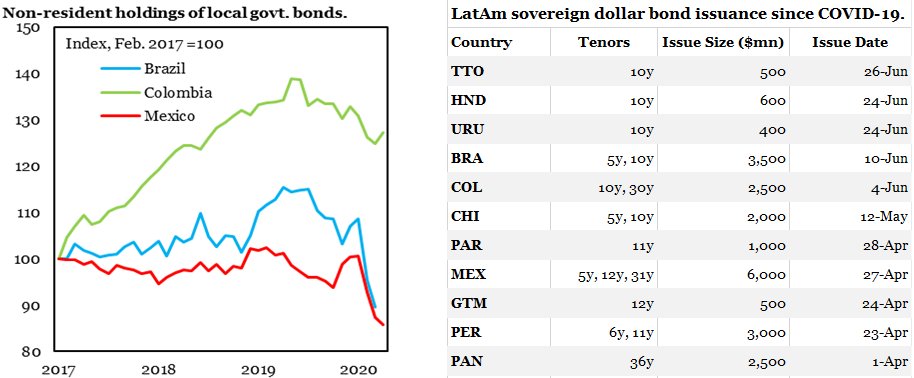

COVID-19 has led to 1) heightened exchange rate and financial market volatility, which made foreigners less eager to hold local currency debt, and 2) increased financing needs stemming from rapidly widening fiscal deficits, which triggered a surge in dollar debt issuance. 4/6

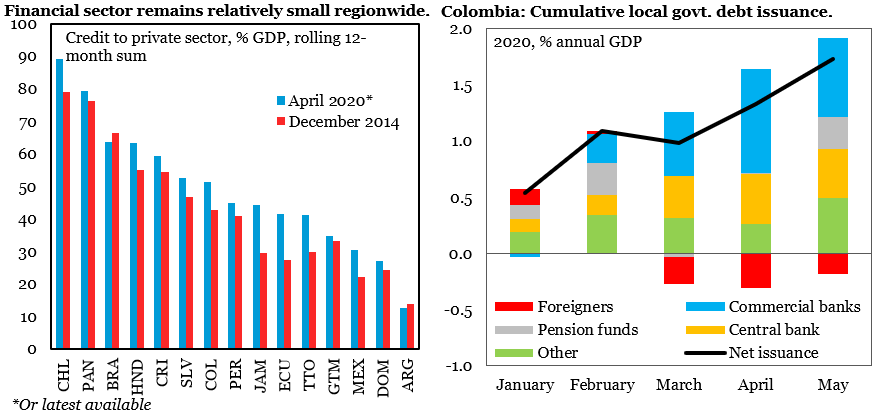

Although domestic demand for government bonds has helped offset the recent non-resident sell-off in places like Colombia and Mexico, local financial systems remain relatively small throughout the region, making financing more complicated. 5/6

Recent developments, including heavy hard-currency borrowing to face COVID19, suggest progress has not been enough to overcome “original sin”. The good news is that thanks partly to improved policies, LatAm countries have tapped markets at favorable terms despite global woes. 6/6

Read on Twitter

Read on Twitter