Weekend munching: Thread on India& #39;s EV outlook.

Since the creation of Maruti in 1980, EVs are the biggest disruption for the Indian automotive industry.

But, do startups stand a chance in this game?

Let& #39;s find out

@alokgoyal1971

@Stellaris_VP

https://www.stellarisvp.com/ev-thesis-2-0-1/">https://www.stellarisvp.com/ev-thesis...

Since the creation of Maruti in 1980, EVs are the biggest disruption for the Indian automotive industry.

But, do startups stand a chance in this game?

Let& #39;s find out

@alokgoyal1971

@Stellaris_VP

https://www.stellarisvp.com/ev-thesis-2-0-1/">https://www.stellarisvp.com/ev-thesis...

1/

The entire EV value chain can be divided into 4 categories:

1. OEM

2. Battery tech

3. Energy distribution

4. Transportation services

Over the last 12 months, we spoke to 150+ EV ecosystem participants to understand each category in depth

The entire EV value chain can be divided into 4 categories:

1. OEM

2. Battery tech

3. Energy distribution

4. Transportation services

Over the last 12 months, we spoke to 150+ EV ecosystem participants to understand each category in depth

2/

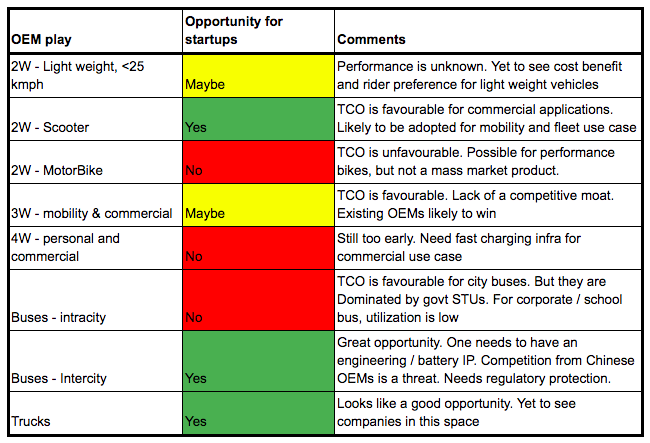

OEM - Historically, incumbents have always won the OEM game. But this time we are in front of massive disruption where biggies are stuck with innovation inertia. Giving startups a window of opportunity

3 interesting areas:

a)Scooter for commercial usage

b)Intercity bus

c)3W

OEM - Historically, incumbents have always won the OEM game. But this time we are in front of massive disruption where biggies are stuck with innovation inertia. Giving startups a window of opportunity

3 interesting areas:

a)Scooter for commercial usage

b)Intercity bus

c)3W

3/

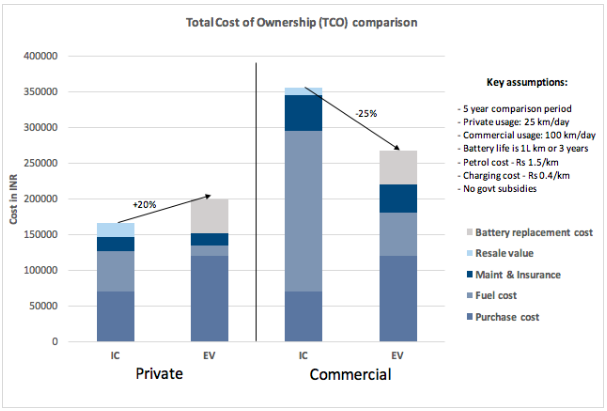

a) A commercial scooter designed for India can be a potential winner

Why commercial?

Utilization is high. Total Cost of Ownership (TCO) for a commercial application is 25% lesser for EVs. However, for personal usage, TCO for EV is 20% more as compared to IC

a) A commercial scooter designed for India can be a potential winner

Why commercial?

Utilization is high. Total Cost of Ownership (TCO) for a commercial application is 25% lesser for EVs. However, for personal usage, TCO for EV is 20% more as compared to IC

4/

What& #39;s wrong with existing scooters in the market?

Existing scooters give poor performance. Most rely on direct/indirect imports from China which are not built for harsh Indian conditions - high temp, high dust, poor roads. Ather created a good but over-priced product

What& #39;s wrong with existing scooters in the market?

Existing scooters give poor performance. Most rely on direct/indirect imports from China which are not built for harsh Indian conditions - high temp, high dust, poor roads. Ather created a good but over-priced product

5/

A scooter needs to be designed grounds up for Indian conditions. It is a complex task as the form factor imposes size & density implications on the battery. OEMs need to have strong battery skills, which is still in short supply. Claims of existing OEMs are mostly misplaced

A scooter needs to be designed grounds up for Indian conditions. It is a complex task as the form factor imposes size & density implications on the battery. OEMs need to have strong battery skills, which is still in short supply. Claims of existing OEMs are mostly misplaced

6/

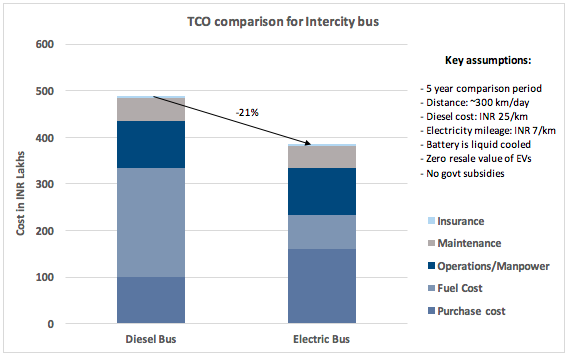

b) An electric bus with engineering IP stands a chance

While E-bus costs ~1.6 Cr vs ~1 Cr for an IC bus. Fuel costs are 70% less. (7 Rs/km for EV vs 25 Rs/km for IC). For a bus traveling 400 km/day. TCO for E-bus is 20% lesser than diesel bus

b) An electric bus with engineering IP stands a chance

While E-bus costs ~1.6 Cr vs ~1 Cr for an IC bus. Fuel costs are 70% less. (7 Rs/km for EV vs 25 Rs/km for IC). For a bus traveling 400 km/day. TCO for E-bus is 20% lesser than diesel bus

7/

Intercity buses usually travel on defined routes. One doesn& #39;t need a large charging network. Chargers at the starting point, destination and mid-way are good enough

Intercity buses usually travel on defined routes. One doesn& #39;t need a large charging network. Chargers at the starting point, destination and mid-way are good enough

8/

Chinese OEMs have 99% of the global E-bus market. They have started entering India through partnerships. Recent restrictions on investment and govt& #39;s support to protect local industry may come to rescue. But startups will need to build long term advantages over Chinese OEMs

Chinese OEMs have 99% of the global E-bus market. They have started entering India through partnerships. Recent restrictions on investment and govt& #39;s support to protect local industry may come to rescue. But startups will need to build long term advantages over Chinese OEMs

9/

c) Incumbent OEMs likely to win 3W market

While most EV activity is in 3W space, It is hard to build a meaningfully differentiated vehicle. Unlike 2W, space & battery size are not big constraints for a 3W as there is enough space. Brand & distribution will play a bigger role

c) Incumbent OEMs likely to win 3W market

While most EV activity is in 3W space, It is hard to build a meaningfully differentiated vehicle. Unlike 2W, space & battery size are not big constraints for a 3W as there is enough space. Brand & distribution will play a bigger role

10/

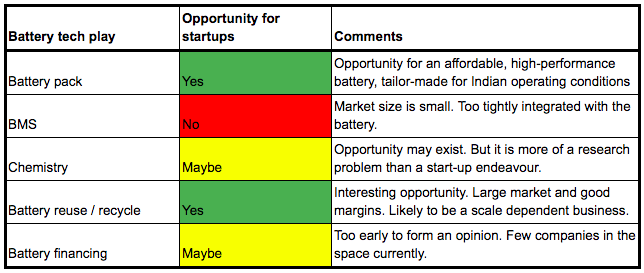

Battery Tech:

Battery accounts for 40-50% of the total vehicle cost and can draw the line between the success & failure of an electric vehicle.

Opportunities:

a) Building a high-performance battery tailor-made for Indian condition

b) Battery reuse and recycling

Battery Tech:

Battery accounts for 40-50% of the total vehicle cost and can draw the line between the success & failure of an electric vehicle.

Opportunities:

a) Building a high-performance battery tailor-made for Indian condition

b) Battery reuse and recycling

11/

a) A high-performance battery pack

The best opportunity for battery packs exists in the 2W & 3W. They have higher EV adoption and the possibility of separating battery and the vehicle, effectively creating an & #39;intel inside& #39; strategy where vehicles are designed around battery

a) A high-performance battery pack

The best opportunity for battery packs exists in the 2W & 3W. They have higher EV adoption and the possibility of separating battery and the vehicle, effectively creating an & #39;intel inside& #39; strategy where vehicles are designed around battery

12/

In India, most batteries have to deal with high ambient temp and endure higher shocks owing to poor road conditions. They are not designed for India, and thus degrade faster. It leads to reduced state of health (SOH), which is a measure of the amount of energy it can store

In India, most batteries have to deal with high ambient temp and endure higher shocks owing to poor road conditions. They are not designed for India, and thus degrade faster. It leads to reduced state of health (SOH), which is a measure of the amount of energy it can store

13/

Furthermore, the commercial use of scooters often promotes poor driving habits like faster acceleration & deceleration, frequent stops and erratic charging behaviour. This can impact the energy consumption from a battery by 30%, not only reducing its life but also it’s SOH

Furthermore, the commercial use of scooters often promotes poor driving habits like faster acceleration & deceleration, frequent stops and erratic charging behaviour. This can impact the energy consumption from a battery by 30%, not only reducing its life but also it’s SOH

14/

Li-ion batteries have many variations that represent a trade-off between safety, longevity & capacity depending upon ambient conditions. Temp control techniques also need to be designed according to external conditions

A battery needs to be tailor-made for Indian conditions

Li-ion batteries have many variations that represent a trade-off between safety, longevity & capacity depending upon ambient conditions. Temp control techniques also need to be designed according to external conditions

A battery needs to be tailor-made for Indian conditions

15/

However, designing an affordable high-performing battery grounds up is not just about good Engg. Prototyping & testing can take years. one needs to optimize large number of variables through many trial & error tests. The feedback loop is long. Only a few players will succeed

However, designing an affordable high-performing battery grounds up is not just about good Engg. Prototyping & testing can take years. one needs to optimize large number of variables through many trial & error tests. The feedback loop is long. Only a few players will succeed

16/

b) Battery reuse & recycle

A scooter battery pack usually has 100s of cells. Even after a battery degrades 70% of the cells are still good. New cell capacity ~10Wh. Used cell capacity (after first-life) ~8Wh. It is still good enough to be used in another battery pack

b) Battery reuse & recycle

A scooter battery pack usually has 100s of cells. Even after a battery degrades 70% of the cells are still good. New cell capacity ~10Wh. Used cell capacity (after first-life) ~8Wh. It is still good enough to be used in another battery pack

17/

Used-cell battery pack will cost 25-40% lesser than a new-cell pack of the same capacity.

A 4KWh new pack costs Rs 60k-65k. While a used one will cost Rs 35k-45k while still earning 30-40% margins and giving you the same capacity.

Used-cell battery pack will cost 25-40% lesser than a new-cell pack of the same capacity.

A 4KWh new pack costs Rs 60k-65k. While a used one will cost Rs 35k-45k while still earning 30-40% margins and giving you the same capacity.

18/

Various ML models are used to economically evaluate how much capacity is left in what cells. An accurate prediction of residual value in a used pack will lead to higher margins in the business. Low capacity cells can go for stationary applications or material extraction

Various ML models are used to economically evaluate how much capacity is left in what cells. An accurate prediction of residual value in a used pack will lead to higher margins in the business. Low capacity cells can go for stationary applications or material extraction

19/

Tech to evaluate & extract cells is not trivial, but whether it can be a strong economic moat over long-term is still debatable? This will not be a supply-constrained market and can become a volume play very quickly. Companies scaling fast will have a significant advantage

Tech to evaluate & extract cells is not trivial, but whether it can be a strong economic moat over long-term is still debatable? This will not be a supply-constrained market and can become a volume play very quickly. Companies scaling fast will have a significant advantage

20/

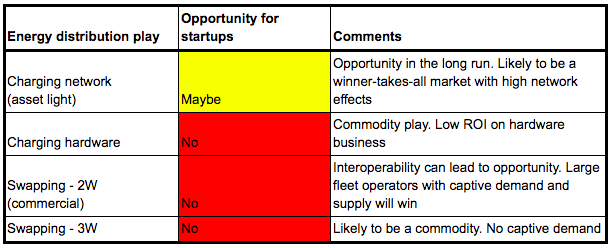

Energy distribution play:

Li-ion battery can go through 1500-2000 cycles of charging. 2 models to provide energy to batteries:

a) Charging

b) Swapping

This market, although large, has low margins and usually carries the risk of high government regulations

Energy distribution play:

Li-ion battery can go through 1500-2000 cycles of charging. 2 models to provide energy to batteries:

a) Charging

b) Swapping

This market, although large, has low margins and usually carries the risk of high government regulations

21/

Charging

Standalone charging solution is not a lucrative opportunity. Margins are thin. Hard to recover land rentals. Corporates, restaurants, malls - businesses having parking spaces will provide charging services. Charging hardware, even though a commodity, has high CapEx

Charging

Standalone charging solution is not a lucrative opportunity. Margins are thin. Hard to recover land rentals. Corporates, restaurants, malls - businesses having parking spaces will provide charging services. Charging hardware, even though a commodity, has high CapEx

22/

Opportunity for asset-light charging network - software layer sitting on top of chargers to facilitate smooth workflow from booking a charger till completion of charging. Low CapEx, High margins, Strong network effects.

e.g. ChargePoint in US, NewMotion in Europe

Opportunity for asset-light charging network - software layer sitting on top of chargers to facilitate smooth workflow from booking a charger till completion of charging. Low CapEx, High margins, Strong network effects.

e.g. ChargePoint in US, NewMotion in Europe

23/

Swapping

Commercial 2W/3W might travel >100 km/day while single battery charge lasts only 50-80 km. In such cases, swapping avoids downtime during business hours (charging takes ~4hrs). Swapping reduces upfront vehicle purchase cost as batteries are leased by the provider

Swapping

Commercial 2W/3W might travel >100 km/day while single battery charge lasts only 50-80 km. In such cases, swapping avoids downtime during business hours (charging takes ~4hrs). Swapping reduces upfront vehicle purchase cost as batteries are leased by the provider

24/

Challenges with swapping:

-50% costlier than charging

-Higher inventory cost: Needs to maintain 1.5-2x inventory to keep in circulation

-Reducing battery prices & increasing charge density improves range of EVs, making swapping obsolete

Challenges with swapping:

-50% costlier than charging

-Higher inventory cost: Needs to maintain 1.5-2x inventory to keep in circulation

-Reducing battery prices & increasing charge density improves range of EVs, making swapping obsolete

25/

Even if swapping were to succeed, companies with large captive demand (like fleet operators) will dominate. Swapping needs a large demand base & high density to be economically viable. One also needs to standardize the battery to achieve interoperability across multiple OEMs

Even if swapping were to succeed, companies with large captive demand (like fleet operators) will dominate. Swapping needs a large demand base & high density to be economically viable. One also needs to standardize the battery to achieve interoperability across multiple OEMs

26/

Transportation services play

EVs will change the face of two transportation services - last-mile logistics and consumer mobility. Faster adoption due to lower TCO. Existing organized players will seize the opportunity. Likelihood of new electric-only service provider is low

Transportation services play

EVs will change the face of two transportation services - last-mile logistics and consumer mobility. Faster adoption due to lower TCO. Existing organized players will seize the opportunity. Likelihood of new electric-only service provider is low

27/

Impact of Covid on EVs

In the short run, EV adoption will take a hit:

-Fleets & OEMs will focus on their existing business. Long term EV projects will get shelved for 12-18 months

-Govt subsidy will reduce

-Liquidity crunch will be deterrent for high CapEx purchases

Impact of Covid on EVs

In the short run, EV adoption will take a hit:

-Fleets & OEMs will focus on their existing business. Long term EV projects will get shelved for 12-18 months

-Govt subsidy will reduce

-Liquidity crunch will be deterrent for high CapEx purchases

28/

Here is the link to the detailed 3 post blog series- https://www.stellarisvp.com/ev-thesis-2-0-1/

We">https://www.stellarisvp.com/ev-thesis... are excited to see so many entrepreneurs solving such hard problems across the entire EV value chain. If you are an aspiring entrepreneur or an enthusiast in the EV space, we would love to catchup

Here is the link to the detailed 3 post blog series- https://www.stellarisvp.com/ev-thesis-2-0-1/

We">https://www.stellarisvp.com/ev-thesis... are excited to see so many entrepreneurs solving such hard problems across the entire EV value chain. If you are an aspiring entrepreneur or an enthusiast in the EV space, we would love to catchup

Read on Twitter

Read on Twitter