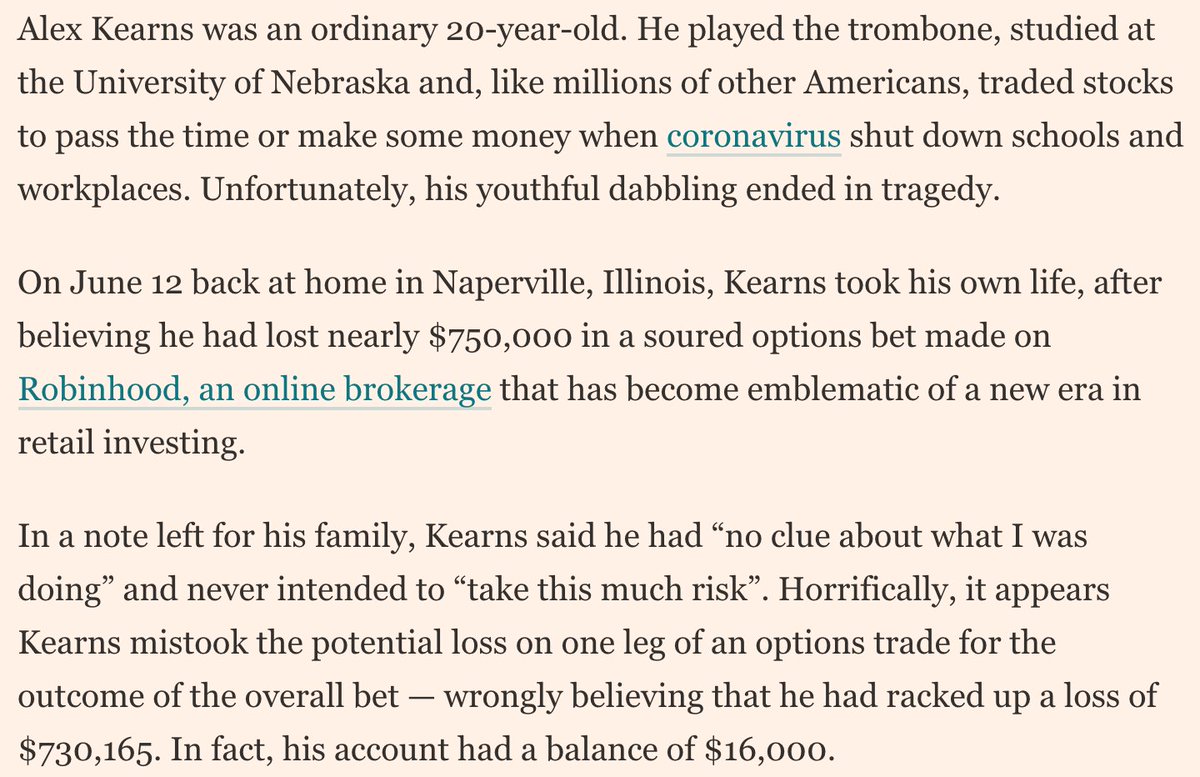

On June 12, Alex Kearns, a young student, took his own life, after believing that he had lost over $700,000 trading options on Robinhood. I’m glad that the FT has made our big piece on it free to read, but here is a long thread on my thoughts. https://www.ft.com/content/45d0a047-360f-4abf-86ee-108f436015a1">https://www.ft.com/content/4...

But first of all, mental health is a serious issue that still wrongly carries some kind of stigma. Please, if you ever feel down and need help, don’t button it up, reach out to someone! Hell, even DM me. It helps to talk. Here is more info:

Ok, like many others, I’ve laughed at the memes – Daddy Powell! BTFD! and the bombast from the likes of Portnoy. Hard not to be amused at someone telling Warren Buffett to GTFO because “I’m the captain now”. https://twitter.com/stoolpresidente/status/1270350291653791747?s=20">https://twitter.com/stoolpres...

But the dark side of all this is that we are pushing more and more people into an activity that is at best socially wasteful and according to TONS of studies actively destructive to people’s financial wellbeing – all in the name of supposedly “democratizing” investing.

I cover professional investors for a living, and as a rule they are generally smart, hard-working and have dedicated their entire lives to trying to successfully navigate market. Reality is that most of them fail! The odds on even gifted amateurs doing so are infinitesimally low.

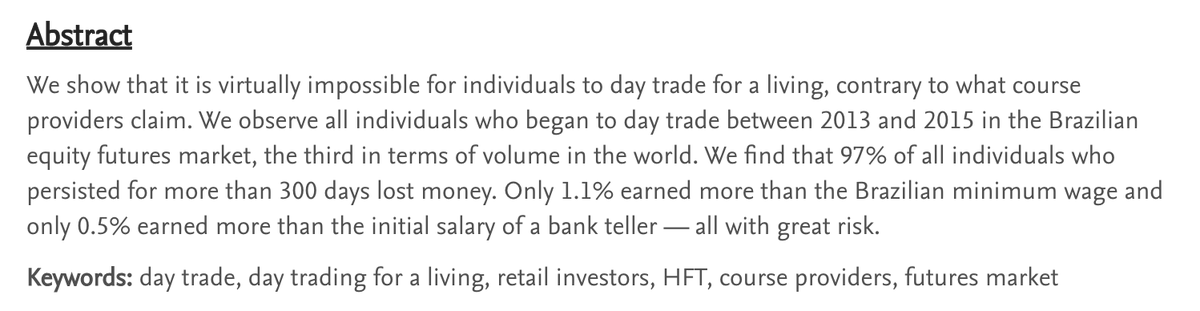

Here is a link to a 2019 study of Brazilian daytraders, that found that 97 per cent lost all the money they had put up, only 1.1 per cent made more than the Brazilian minimum wage, and only 0.5 per cent earned more than an entry-level bank clerk. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3423101">https://papers.ssrn.com/sol3/pape...

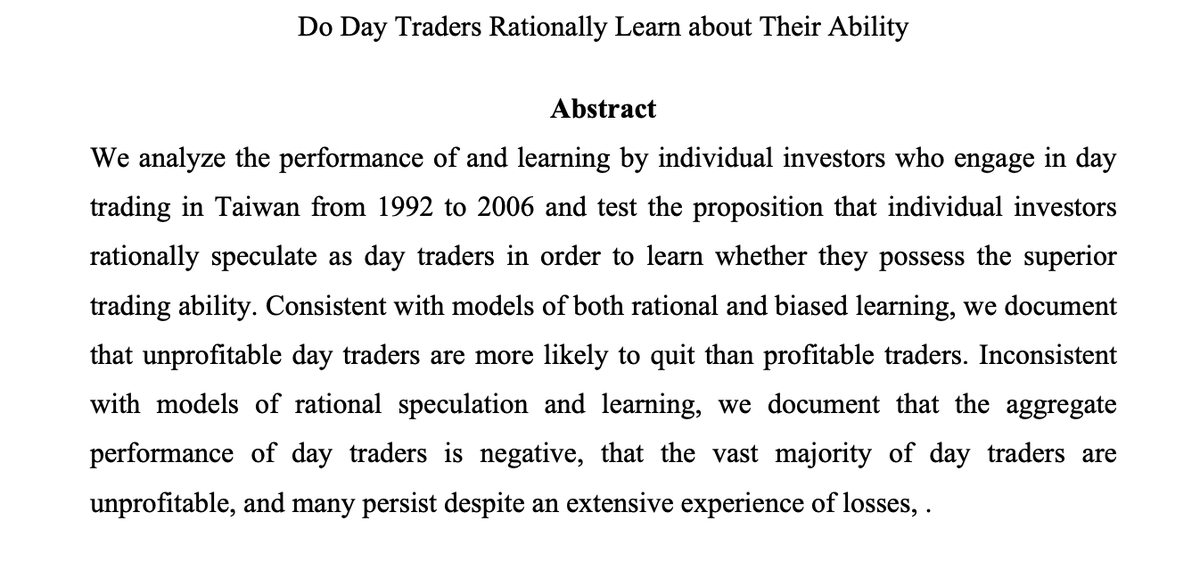

Here is an older but bigger study of Taiwanese day traders, which showed that the aggregate

performance of day traders is negative, that the vast majority of day traders are

unprofitable, and many persist despite losses. https://faculty.haas.berkeley.edu/odean/papers/Day%20Traders/Day%20Trading%20and%20Learning%20110217.pdf">https://faculty.haas.berkeley.edu/odean/pap...

performance of day traders is negative, that the vast majority of day traders are

unprofitable, and many persist despite losses. https://faculty.haas.berkeley.edu/odean/papers/Day%20Traders/Day%20Trading%20and%20Learning%20110217.pdf">https://faculty.haas.berkeley.edu/odean/pap...

Here is a more informal study by someone who mined eToro’s trade data. https://www.curiousgnu.com/day-trading ">https://www.curiousgnu.com/day-tradi...

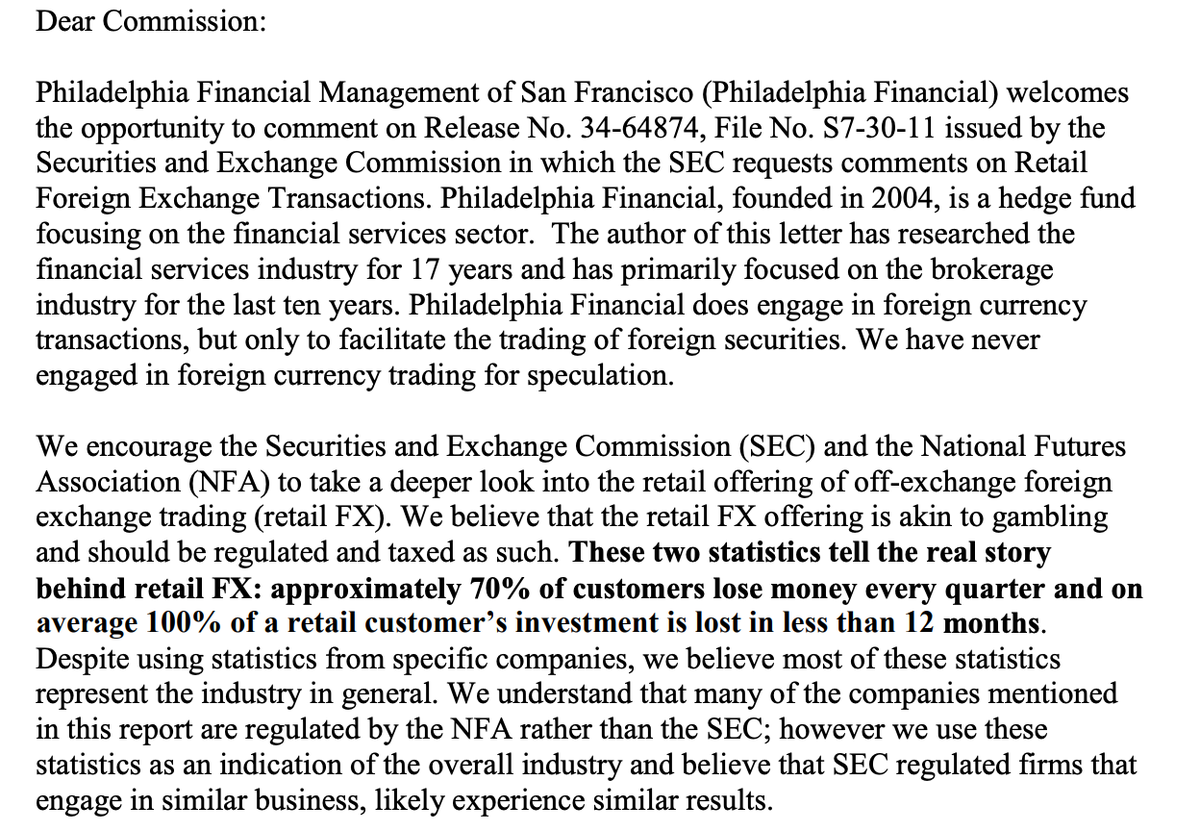

It’s not just stocks of course. Here is a letter someone sent to SEC, estimating that 70% of retail traders of FX lose money every quarter and on average 100% of a retail customer’s investment is lost in less than 12 months. HT @eva_szalay https://www.sec.gov/comments/s7-30-11/s73011-10.pdf">https://www.sec.gov/comments/...

Here& #39;s even an amusing thread i wrote last year, on how a Norwegian TV show pitted a bunch of cows against professional traders. https://twitter.com/RobinWigg/status/1218146789947334667?s=20">https://twitter.com/RobinWigg...

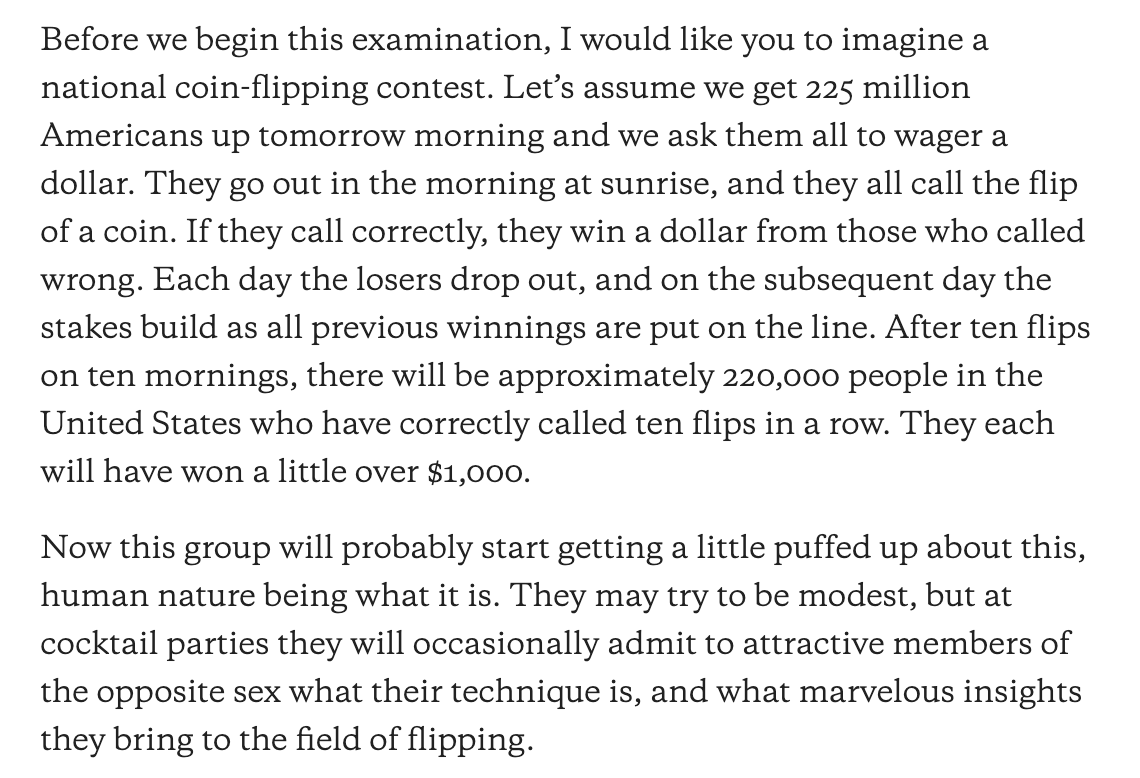

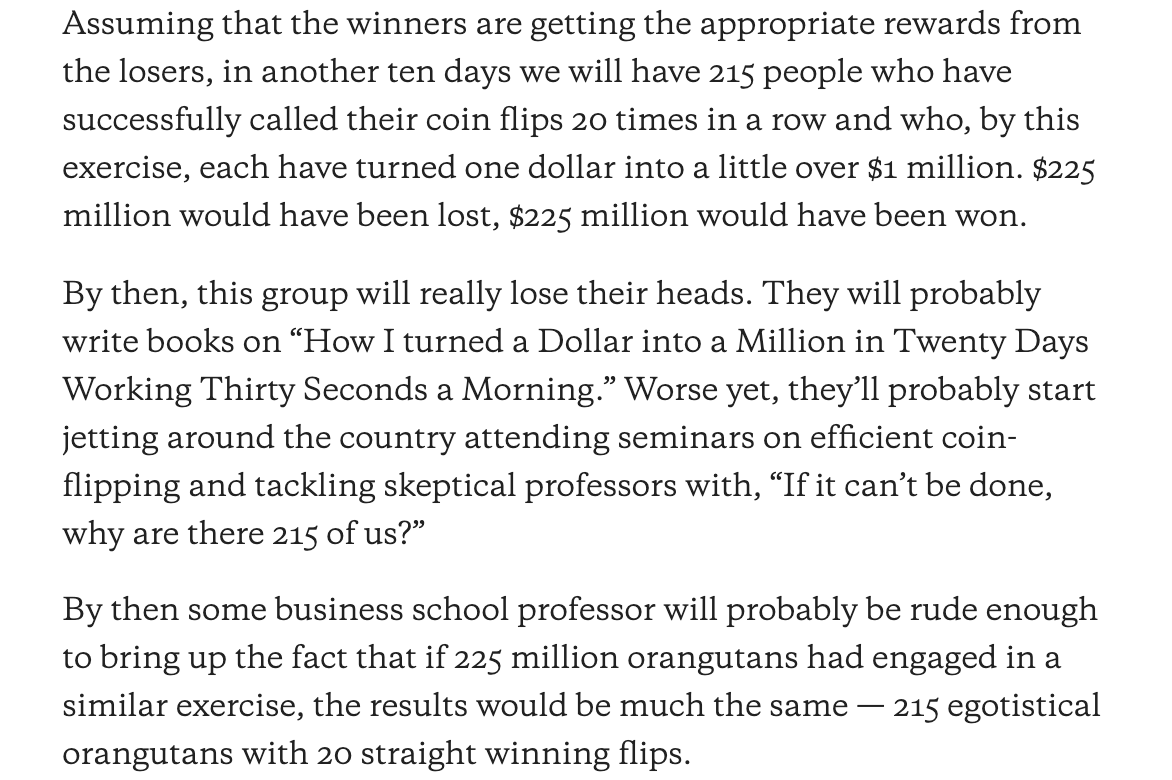

Of course, some will just through the law of probability end up doing well, and will tout their skill as evidence that it can be done, and try to sell their services. But as Warren Buffett pointed out in a famous speech in 1984, this is a fallacy. https://www8.gsb.columbia.edu/articles/columbia-business/superinvestors">https://www8.gsb.columbia.edu/articles/...

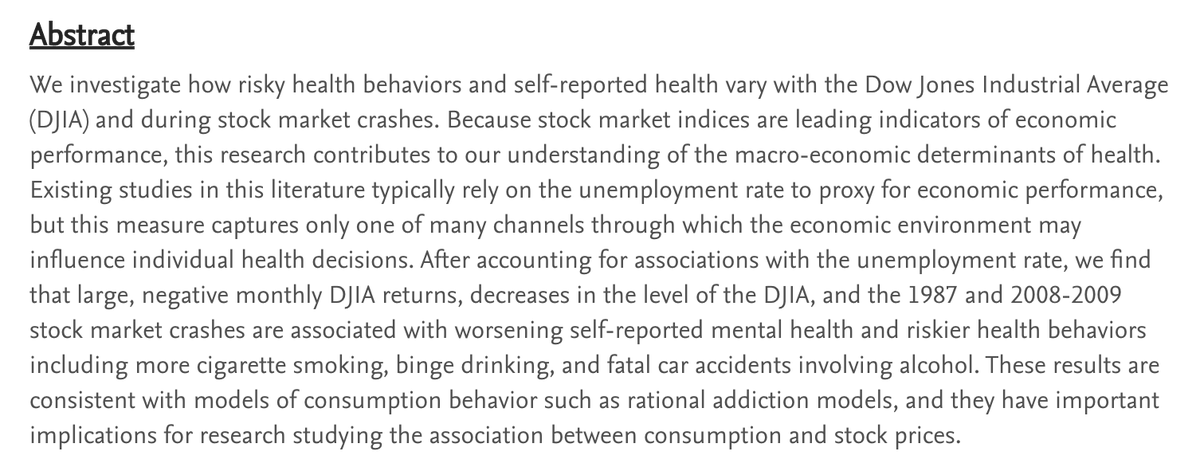

The personal impact can be severe when losses mount – as they inevitably do at some point. Here is a study showing market slumps are linked to worsening self-reported mental health and riskier health behaviour. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2202418">https://papers.ssrn.com/sol3/pape...

A Hong Kong study even found a correlation between stock market declines and self-harm by adolescents. https://www.mdpi.com/1660-4601/14/6/623">https://www.mdpi.com/1660-4601...

And yet, more and more people are getting pushed in this direction. A lot has been made of lockdown boredom, but I suspect there is an element of desperation here as well.

If people struggle to find viable, decently-paid jobs, they will explore riskier avenues. Here’s a study showing a link between economic deprivation and slot machines, for example. https://pubmed.ncbi.nlm.nih.gov/23242474/ ">https://pubmed.ncbi.nlm.nih.gov/23242474/...

Clearly, newer platforms like Robinhood are also gamifying the whole experience. I worry this will “broaden the funnel” and suck in even more vulnerable people that might not be well-positioned to deal with the inevitable setbacks.

To its credit, Robinhood responded quickly to Alex Kearns’ suicide, and have promised changes (and donated $250,000 to the American Foundation for Suicide Prevention.) https://blog.robinhood.com/news/2020/6/19/commitments-to-improving-our-options-offering">https://blog.robinhood.com/news/2020...

But I worry that all the talk of disclosure, better education and so on are bandaids on a much bigger issue: Individuals make terrible traders, and while some might do ok through sheer blind luck, we *know* the vast majority will end up losing their money.

So I do think that perhaps some more draconian regulations are warranted. I don’t quite see why ANY retail investor, no matter how “experienced”, should be allowed to trade derivatives or get margin. At best the societal benefits are negligible, and at worst they are severe.

Basically, I& #39;m 100% with @BillBrewsterSCG here. Frictionless trading - under the guise of frictionless INVESTING - is actually a bad thing, and the consequences could be severe.

Btw, @BillBrewsterSCG has done god& #39;s work in highlighting the tragedy that befell Alex, and been incredibly patient and helpful with me and countless other journalists. I can only commend his efforts, and offer condolences on the family& #39;s loss.

Many will say that this is just the bleating of an ignorant journalist - "Do U even trade dude?!" - and point out retail investors have done pretty damn well lately. Perhaps. But I kinda agree with the below sentiment.

(though in a world where i am supreme global dictator, ordinary people wouldn& #39;t be allowed to trade futures either, and possibly not even single-name stocks)

To conclude a somewhat long-winded but heartfelt thread, if you are struggling, reach out to someone - anyone. I think you& #39;d be surprised how many people have struggled with the same thoughts. We all need to be more open about mental health issues.

Read on Twitter

Read on Twitter