Long thread about Trends, Innovators, Valuations, Volatility and the mindset needed for great long-term returns.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

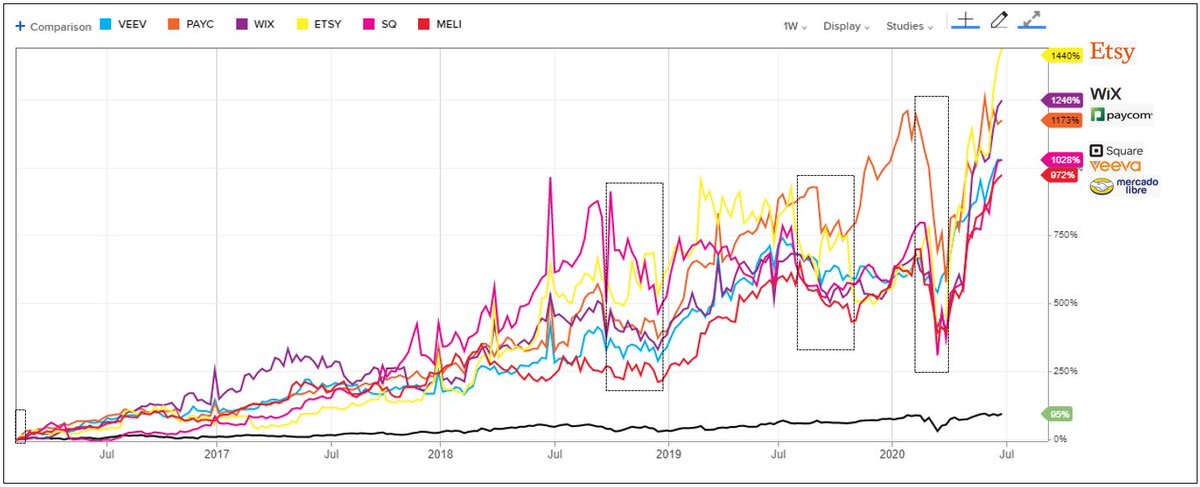

1. Few 10 Baggers in SaaS/E-Commerce/Payments land since Feb 2016 (weak time for the overall Market and especially SaaS after LinkedIn& #39;s warning in early Feb-2016).

$MELI $SQ $ETSY $WIX $VEEV $PAYC

$MELI $SQ $ETSY $WIX $VEEV $PAYC

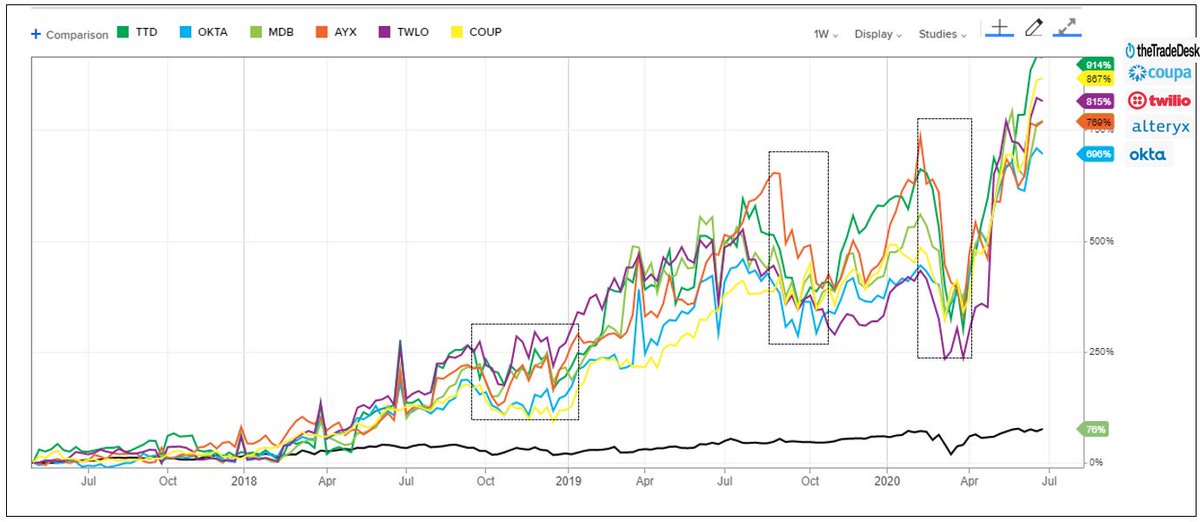

2. Few more (close to) 10-Baggers since mid-2017 (for Co& #39;s that weren& #39;t public in 2016).

$TTD $COUP $TWLO $AYX $OKTA

$TTD $COUP $TWLO $AYX $OKTA

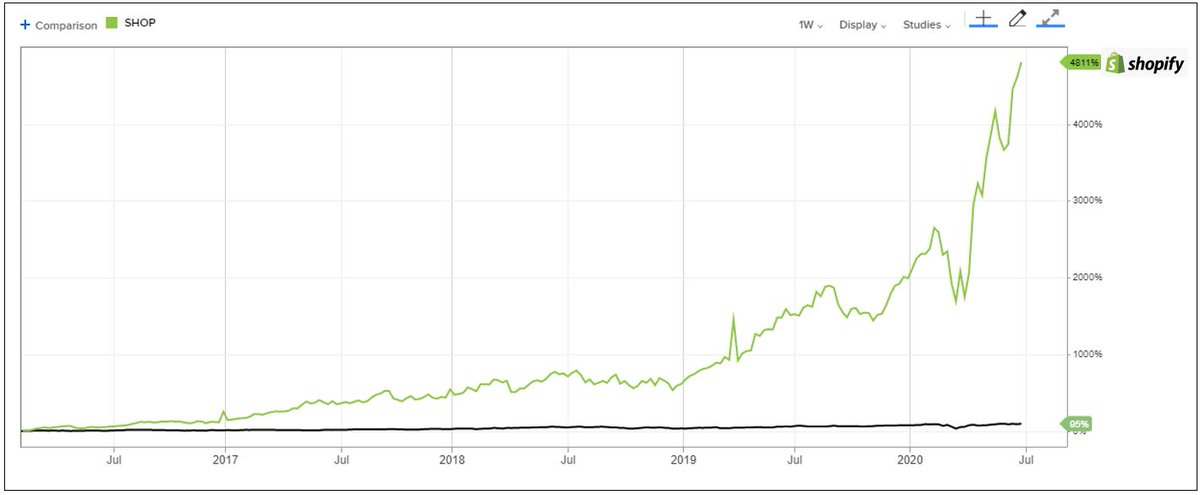

3. Of course, $SHOP with it& #39;s ridiculous 40-bagger deserves it& #39;s own chart.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Gesicht mit Freudentränen" aria-label="Emoji: Gesicht mit Freudentränen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Gesicht mit Freudentränen" aria-label="Emoji: Gesicht mit Freudentränen">

Yes, I& #39;m cherry picking on dates and few Co& #39;s but that is to illustrate few main points.

1. Good things happen in the longterm when we focus on the major trends & their leaders, get attracted first to the innovation, quality & sustainable growth & not to the hype & past returns.

1. Good things happen in the longterm when we focus on the major trends & their leaders, get attracted first to the innovation, quality & sustainable growth & not to the hype & past returns.

2. The phases of greed and fear in the Market (and in particular smaller sectors like SaaS) are always going to be there.

3. Focusing first on the more important things like evolution of trends, Customer value proposition..

3. Focusing first on the more important things like evolution of trends, Customer value proposition..

...Moat direction and Business results will help us in staying with the Leaders and get the eventual great long-term results.

Few checklist items that help me in this regard.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Being curious on the major long-term sustainable trends (Tech, Consumer..) happening around us and studying them further.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Being curious on the major long-term sustainable trends (Tech, Consumer..) happening around us and studying them further.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Checking which Companies are leading and understanding why.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Checking which Companies are leading and understanding why.

Few of my fav resources for SaaS learning and investing.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://twitter.com/RamBhupatiraju/status/1263465760686555136?s=20">https://twitter.com/RamBhupat...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://twitter.com/RamBhupatiraju/status/1263465760686555136?s=20">https://twitter.com/RamBhupat...

From competitive perspective, I find analyzing E-Commerce easier (due to geographic limitations, huge investments needed..) vs SaaS (due to the huge # vertical/horizontal possibilities, # Co& #39;s).

This sort of map (although not fully accurate) helps me. https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://twitter.com/RamBhupatiraju/status/1194254849912791043?s=20">https://twitter.com/RamBhupat...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://twitter.com/RamBhupatiraju/status/1194254849912791043?s=20">https://twitter.com/RamBhupat...

This sort of map (although not fully accurate) helps me.

Investing is high growth sectors and Co& #39;s is not easy, if you& #39;re not comfortable with the concepts of innovation and disruption (or using traditional analysis/valuation metrics) . My fav resources on Innovation/Disruption below.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://twitter.com/RamBhupatiraju/status/1258387250834018310?s=20">https://twitter.com/RamBhupat...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://twitter.com/RamBhupatiraju/status/1258387250834018310?s=20">https://twitter.com/RamBhupat...

Folks I& #39;ve learnt from w.r.t investing in innovative Co& #39;s  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏" title="Folded hands" aria-label="Emoji: Folded hands">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏" title="Folded hands" aria-label="Emoji: Folded hands">

Motley Fool https://abs.twimg.com/emoji/v2/... draggable="false" alt="🃏" title="Joker-Spielkarte" aria-label="Emoji: Joker-Spielkarte">: @DavidGFool @TMFJMo @BrianFeroldi @TMFStoffel @dannyvena @aaronbush100

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🃏" title="Joker-Spielkarte" aria-label="Emoji: Joker-Spielkarte">: @DavidGFool @TMFJMo @BrianFeroldi @TMFStoffel @dannyvena @aaronbush100

@7investing Team @7Innovator @7AustinL @Matt_Cochrane7 @7investingSteve

@saxena_puru @FromValue @investing_city @richard_chu97

Motley Fool

@7investing Team @7Innovator @7AustinL @Matt_Cochrane7 @7investingSteve

@saxena_puru @FromValue @investing_city @richard_chu97

The two strings that pull new investors into growth sectors are "I don& #39;t know/care what it is, but I want to get in on this." vs "I like and understand the trends and the growth ahead, but I already missed the Boat".

Jumping into these sectors now in a big way (all at once) due to the hype & recent gains could result in disappointment.

Understanding the trends, best Co& #39;s within & building positions slowly & methodically along the way as you gain more knowledge & confidence is the better way.

Understanding the trends, best Co& #39;s within & building positions slowly & methodically along the way as you gain more knowledge & confidence is the better way.

For young investors with decades ahead of them and who have the time, passion & interest to study & invest in individual businesses, it makes sense to invest a small portion of your Portfolio into major sustainable trends..

Read on Twitter

Read on Twitter

" title="3. Of course, $SHOP with it& #39;s ridiculous 40-bagger deserves it& #39;s own chart. https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Gesicht mit Freudentränen" aria-label="Emoji: Gesicht mit Freudentränen">" class="img-responsive" style="max-width:100%;"/>

" title="3. Of course, $SHOP with it& #39;s ridiculous 40-bagger deserves it& #39;s own chart. https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Gesicht mit Freudentränen" aria-label="Emoji: Gesicht mit Freudentränen">" class="img-responsive" style="max-width:100%;"/>