The very nice folks @WHO_Europe published a new report about alcohol pricing today.

I wrote most of it (with help from all sorts of wise folk), so here& #39;s a brief summary of what it says

https://www.euro.who.int/en/health-topics/disease-prevention/alcohol-use/publications/frequently-asked-questions-faq-about-alcohol-and-covid-19/alcohol-pricing-in-the-who-european-region-update-report-on-the-evidence-and-recommended-policy-actions-2020

THREAD/">https://www.euro.who.int/en/health...

I wrote most of it (with help from all sorts of wise folk), so here& #39;s a brief summary of what it says

https://www.euro.who.int/en/health-topics/disease-prevention/alcohol-use/publications/frequently-asked-questions-faq-about-alcohol-and-covid-19/alcohol-pricing-in-the-who-european-region-update-report-on-the-evidence-and-recommended-policy-actions-2020

THREAD/">https://www.euro.who.int/en/health...

Firstly we reviewed the evidence for different pricing policies - retail monopolies, alcohol taxation, Minimum Unit Pricing (MUP), banning discounts and banning below cost sales.

All of these approaches are effective, but not equally so.

All of these approaches are effective, but not equally so.

There are 3 different approaches to levying tax on alcohol:

Specific - tax is based on the alcohol content

Unitary - tax is based on the product volume

Ad valorem - tax is based on the price

Most countries have a horrible mess of all 3.

Specific - tax is based on the alcohol content

Unitary - tax is based on the product volume

Ad valorem - tax is based on the price

Most countries have a horrible mess of all 3.

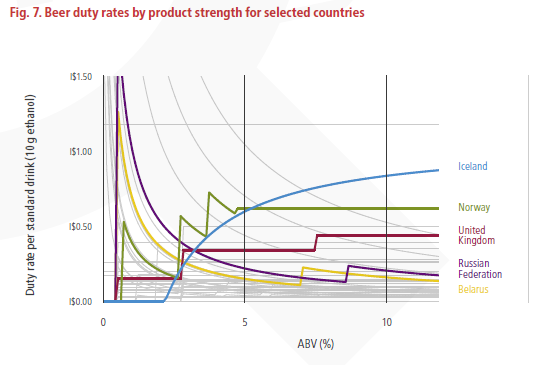

From the perspective of health, it is the alcohol content which causes harm, so we should be levying taxation on that basis (i.e. we should have specific tax).

Stronger products can get you more drunk more quickly, so there is a good argument for higher taxes at higher strength.

Stronger products can get you more drunk more quickly, so there is a good argument for higher taxes at higher strength.

And some products are much cheaper to produce - it makes sense to levy higher taxes on those products to ensure that the prices that consumers face are not markedly cheaper.

We collected data on current alcohol tax systems and rates for every WHO Europe member state. This was a massive job because many countries do *not* make their tax rates easy to find.

LESS OF THIS SORT OF THING PLEASE.

LESS OF THIS SORT OF THING PLEASE.

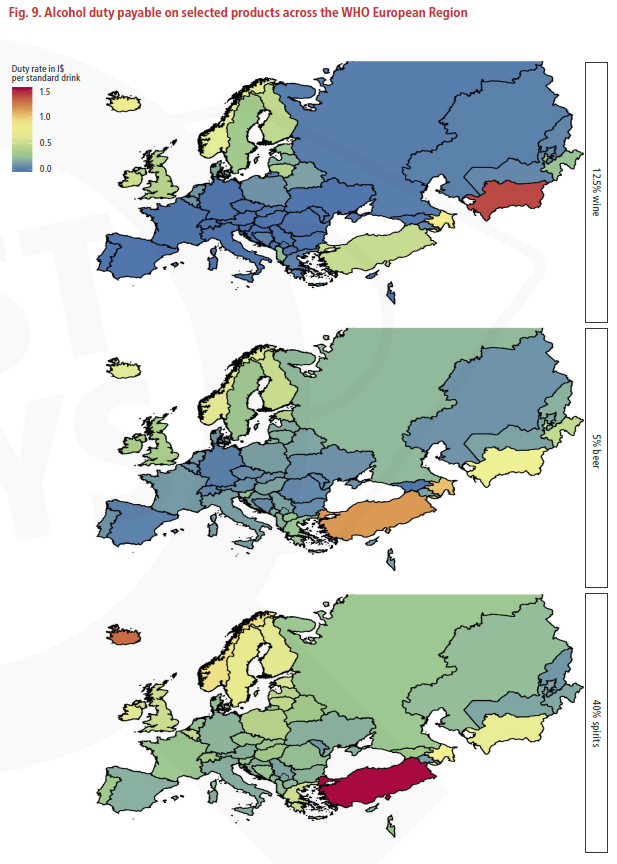

Most countries use specific taxation for spirits (well done!), many countries use it for beer (good stuff), but for wine tax is almost always unitary or there is NO DUTY AT ALL.

Andorra levies no duty whatsoever on alcohol, so is very much on the naughty step.

Andorra levies no duty whatsoever on alcohol, so is very much on the naughty step.

There is also huge variation in the *levels* at which different countries tax alcohol. Here we see Iceland and the UK taking different approaches to get higher taxes for stronger beer, while Russia and Belarus generally have lower taxes at higher strengths. Norway, is, erm, odd.

If we look at the duty rates on 5% beer, 12.5% wine and 40% spirits there is a lot of variation. Generally spirits are taxed more highly though.

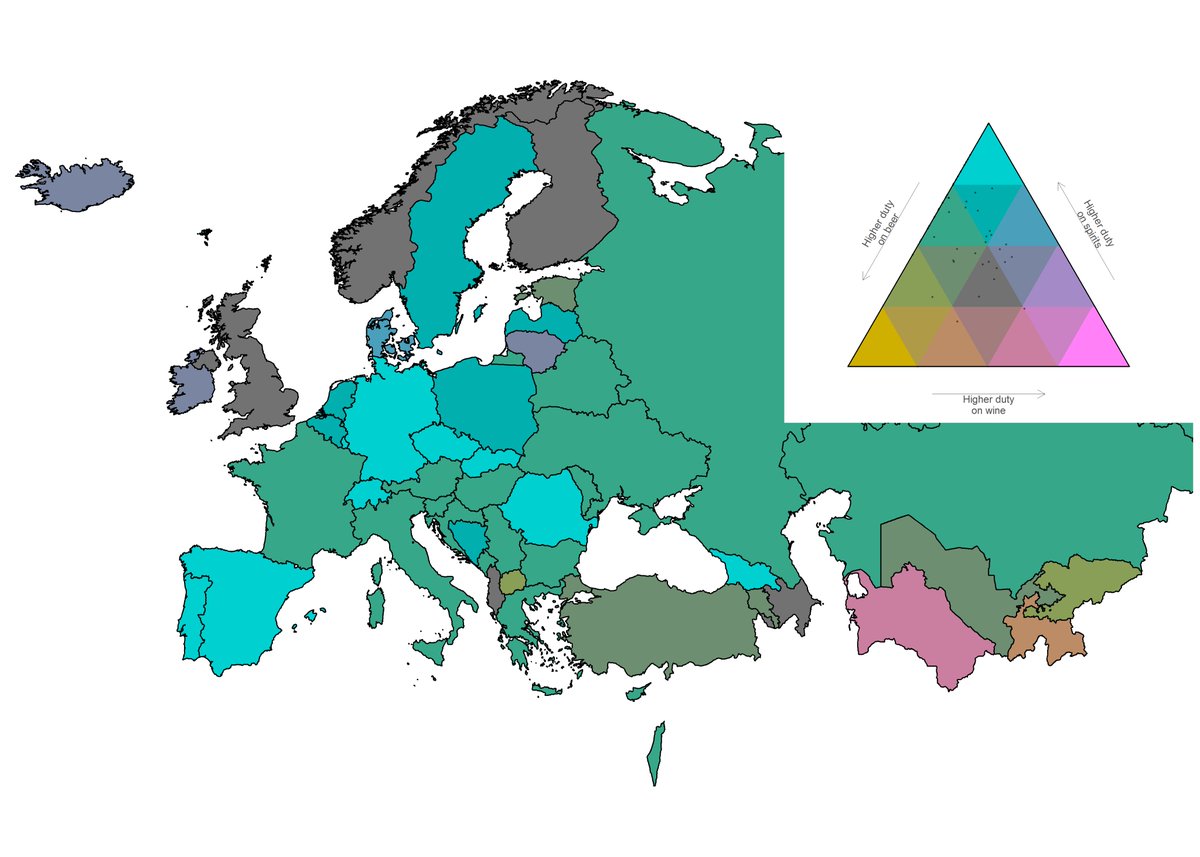

If we plot these 3 rates on the same ternary scale we can see that most countries tax spirits the highest (blue) or beer & spirits (green) while only Turkmenistan has highest taxes on wine.

UK looks quite sensible here, but this map doesn& #39;t include cider...

UK looks quite sensible here, but this map doesn& #39;t include cider...

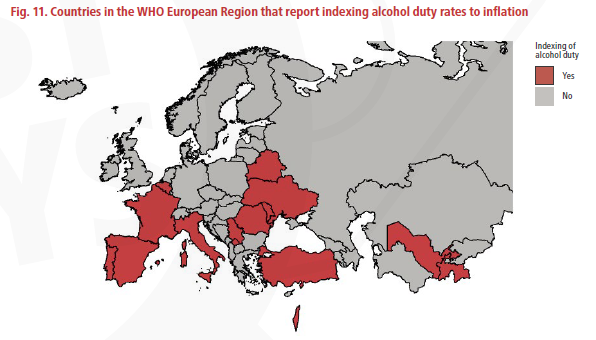

We also looked at who ties their duty rates to inflation. Doing this prevents time eroding the effective rate of tax and increasing the affordability of alcohol, while tax revenues fall.

Less than 1/3 of European countries do this as standard.

*frowns*

Less than 1/3 of European countries do this as standard.

*frowns*

We also looked at who has some form of Minimum Unit Price for alcohol. 8 WHO member states (9 countries) have some kind of MUP. Most of these are in Eastern Europe, apply mostly to spirits, and are generally lower (after PPP adjustment) than Scotland& #39;s 50p/unit

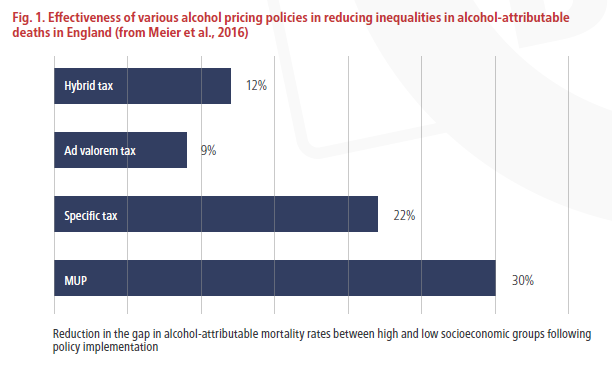

We also looked at the potential for different forms of pricing policy to reduce health inequalities. Generally most approaches seem to reduce inequality, but specific taxation and MUP are more effective than other approaches.

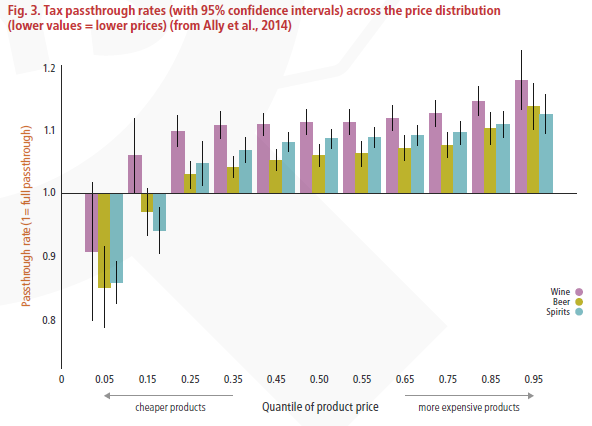

Partly this difference is because taxation allows retailers to choose what % of the tax increase to pass through to consumers. The evidence suggests they use big increases on expensive products to subsidise smaller than expected rises in cheap products.

Finally we addressed a couple of major arguments against effective alcohol policy.

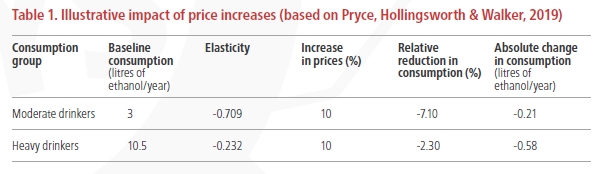

One big one is that heavier drinkers are less price sensitive.

The evidence on this is mixed, but we demonstrate that even if it& #39;s true, heavier drinkers are still more affected by price rises.

One big one is that heavier drinkers are less price sensitive.

The evidence on this is mixed, but we demonstrate that even if it& #39;s true, heavier drinkers are still more affected by price rises.

We also discuss common concerns about illicit or unrecorded alcohol. These are widely overstated and effective approaches, such as Russia& #39;s EGAIS QR code system, exist to address them and can increase the effectiveness of pricing policies while also raising tax revenue.

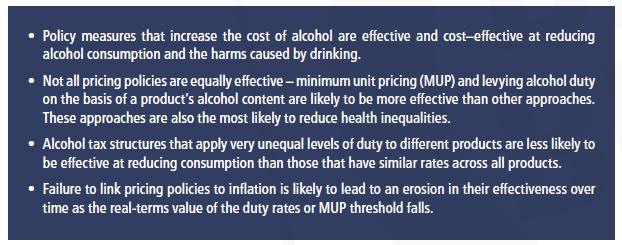

Here are the key findings and recommendations from the report.

tl;dr we already have pricing policies, but they are often poorly designed from a health perspective. With a little bit of effort we could do a lot better.

tl;dr we already have pricing policies, but they are often poorly designed from a health perspective. With a little bit of effort we could do a lot better.

Also, it would be great if the EU could stop being dunderheads about alcohol taxation and stop making it illegal for EU member states to tax alcohol on a specific basis and remove various other completely nonsensical rules they have around alcohol duties.

All of the data that underlies the country plots and the #Rstats code to generate them is here:

https://github.com/VictimOfMaths/Publications/blob/master/WHO%20Pricing%20Policy%20Brief%20Plots

/ENDS">https://github.com/VictimOfM...

https://github.com/VictimOfMaths/Publications/blob/master/WHO%20Pricing%20Policy%20Brief%20Plots

/ENDS">https://github.com/VictimOfM...

Read on Twitter

Read on Twitter