Continuing with the notes on 19-20 ARs on companies we are tracking, this thread is on

HDFC AMC

One of the leading AMCs in India

Fasten your seatbelt for an enjoyable ride into the business of HDFC AMC & details about the AMC industry in India

(1/n)

@suru27 @finbloggers

HDFC AMC

One of the leading AMCs in India

Fasten your seatbelt for an enjoyable ride into the business of HDFC AMC & details about the AMC industry in India

(1/n)

@suru27 @finbloggers

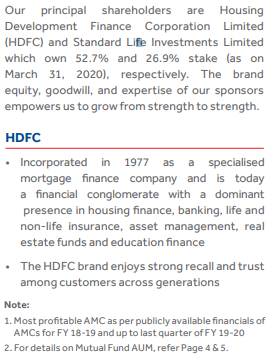

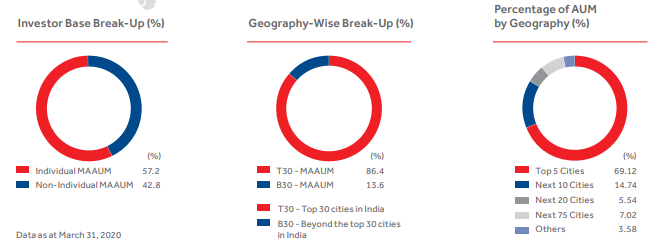

- India& #39;s most profitable AMC

- INR 3.2 Lac Crore AUM

-56 lac individuals & institutions

-Vision: Dominance+Ethics+ Professionalism+ Enhancing investor interests

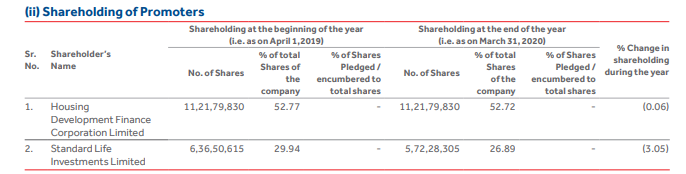

-As on 31.03.2020, shareholding

HDFC-52.7% , Standard Life Inv- 26.9%.

(2/n)

- INR 3.2 Lac Crore AUM

-56 lac individuals & institutions

-Vision: Dominance+Ethics+ Professionalism+ Enhancing investor interests

-As on 31.03.2020, shareholding

HDFC-52.7% , Standard Life Inv- 26.9%.

(2/n)

Investment Philosophy

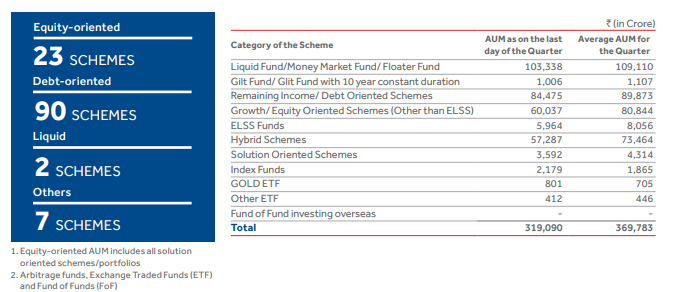

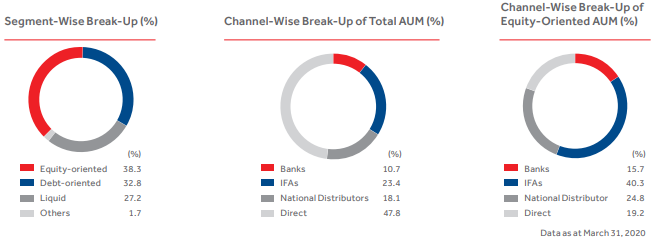

1. For Equity schemes (38% of AUM)

a. Medium to long-term based

b. Driven by fundamental research

2. For Debt schemes

a. Safety, Liquidity & Returns (SLR) in that order

b. 4 Cs of Credit - Character, Capacity, Collateral & Covenants

(3/n)

1. For Equity schemes (38% of AUM)

a. Medium to long-term based

b. Driven by fundamental research

2. For Debt schemes

a. Safety, Liquidity & Returns (SLR) in that order

b. 4 Cs of Credit - Character, Capacity, Collateral & Covenants

(3/n)

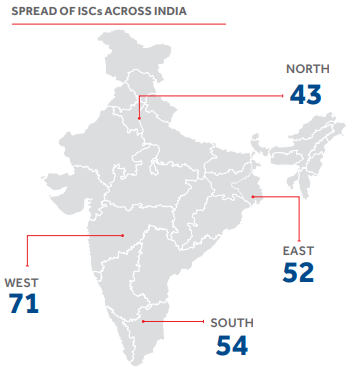

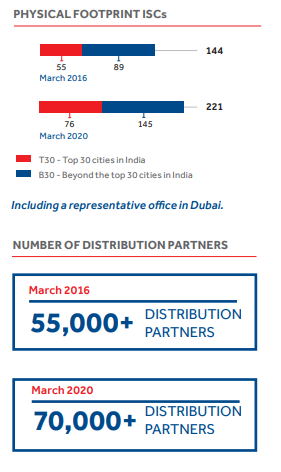

- Strong Distribution Reach

- Continuous Enhancement of Reach

-Constantly strive to be present in cities with growth prospects

(4/n)

- Continuous Enhancement of Reach

-Constantly strive to be present in cities with growth prospects

(4/n)

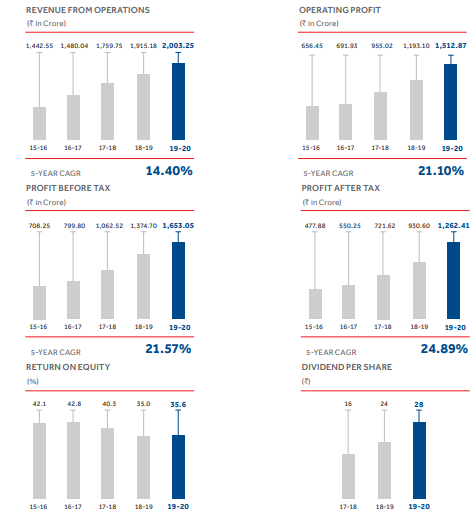

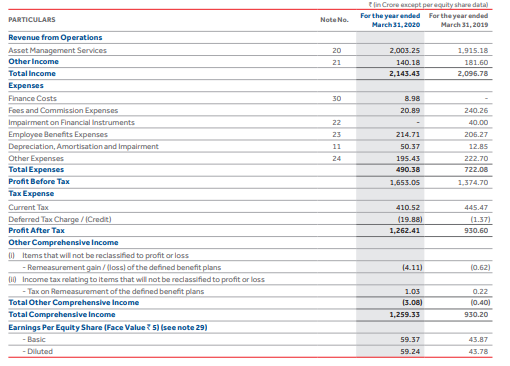

Key Performance Indicators

-Consistent growth in Revenues and Profits

-High ROE

- Increasing Dividend

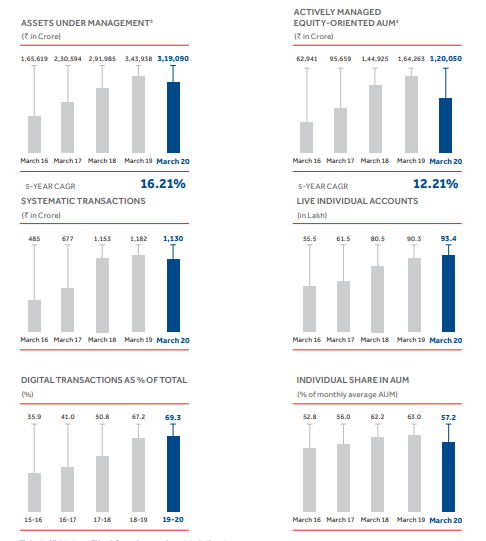

- Growing AUM, Actively managed Equity AUM, SIP

- 70% of the transaction is now on a digital platform

(5/n)

-Consistent growth in Revenues and Profits

-High ROE

- Increasing Dividend

- Growing AUM, Actively managed Equity AUM, SIP

- 70% of the transaction is now on a digital platform

(5/n)

Chairman& #39;s Message

- Unwinding from Covid-19 will be long & painful.

-RBI announcing a special liquidity window for MFs.

- Covid-19 has shed further light on the imp of saving.

-MFs will remain relevant & imp.

-HDFC AMC is well-positioned to leverage the

opportunity

(6/n)

- Unwinding from Covid-19 will be long & painful.

-RBI announcing a special liquidity window for MFs.

- Covid-19 has shed further light on the imp of saving.

-MFs will remain relevant & imp.

-HDFC AMC is well-positioned to leverage the

opportunity

(6/n)

Key Digital Initiatives during the year

-Transaction Bot

-Quick Link

-WhatsApp for Investors

-Smart Search

-Pre-fill Campaign Forms

(8/n)

-Transaction Bot

-Quick Link

-WhatsApp for Investors

-Smart Search

-Pre-fill Campaign Forms

(8/n)

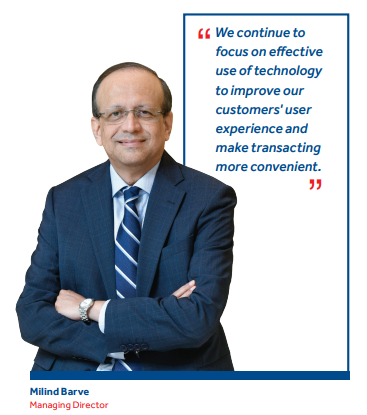

Notes from MDA

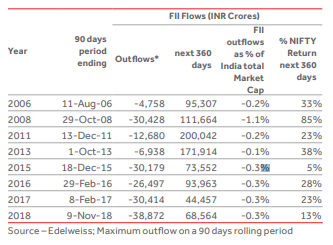

Macro Factors

- Corp Tax from 30%-22%. 15% for new manufacturing setup

-Concerns over ALM & asset quality of NBFCs

- Defaults by major Housing Finance Companies

- winding up of 6 FI schemes of Franklin

-Moody downgrading India

(9/n)

Macro Factors

- Corp Tax from 30%-22%. 15% for new manufacturing setup

-Concerns over ALM & asset quality of NBFCs

- Defaults by major Housing Finance Companies

- winding up of 6 FI schemes of Franklin

-Moody downgrading India

(9/n)

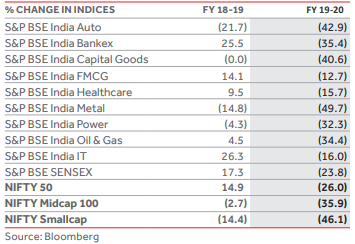

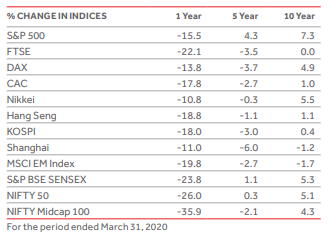

Notes from MDA

- The S&P BSE SENSEX / NIFTY 50 ended FY 19-20 with negative returns but outperformed mid-cap and smallcap indices.

-All major global indices, namely, S&P, FTSE, DAX, Nikkei,

Shanghai, delivered negative returns but most of

them outperformed NIFTY 50.

(10/n)

- The S&P BSE SENSEX / NIFTY 50 ended FY 19-20 with negative returns but outperformed mid-cap and smallcap indices.

-All major global indices, namely, S&P, FTSE, DAX, Nikkei,

Shanghai, delivered negative returns but most of

them outperformed NIFTY 50.

(10/n)

Notes from MDA

- Industry AUM fell by 6% (mostly due to fall in equity AUM)

-SEBI introduced temporary relaxations and took steps to reduce compliance burden on mutual funds and portfolio managers due to COVID.

(11/n)

- Industry AUM fell by 6% (mostly due to fall in equity AUM)

-SEBI introduced temporary relaxations and took steps to reduce compliance burden on mutual funds and portfolio managers due to COVID.

(11/n)

That brings us to the end of the notes on AR. If you want to know more about the company click on the following link:

https://www.smartsyncservices.com/hdfc-amc/

Soon">https://www.smartsyncservices.com/hdfc-amc/... we will share our notes on another listed player in the AMC space.

End

(n/n)

https://www.smartsyncservices.com/hdfc-amc/

Soon">https://www.smartsyncservices.com/hdfc-amc/... we will share our notes on another listed player in the AMC space.

End

(n/n)

Read on Twitter

Read on Twitter