I& #39;ve had a number of new people join the dividend journey lately so here is a quick explanation of why I& #39;m on here.

I tweet about dividend investing, SaaS stocks, Software, and Business in general.

I& #39;m not a one-trick pony, mostly because I& #39;m old now.

[Thread]

I tweet about dividend investing, SaaS stocks, Software, and Business in general.

I& #39;m not a one-trick pony, mostly because I& #39;m old now.

[Thread]

First of all I have a job as a VP of Engineering at a software startup and have had some mild success as a software entrepreneur.

I& #39;m not a full-time twitter hustler.

My day job is great and pays very well.

This twitter thing is for fun and to help people.

I& #39;m not a full-time twitter hustler.

My day job is great and pays very well.

This twitter thing is for fun and to help people.

My dividend investing really began in earnest several years ago once I had a bit of financial stability.

I wanted to grow an almost fully passive side income.

So I started throwing $700/month at growing a dividend portfolio.

I wanted to grow an almost fully passive side income.

So I started throwing $700/month at growing a dividend portfolio.

Over the years it grew, but any large chunks of money I received were invested in the portfolio.

At the end of 2019 I received an huge chunk and threw most of it into my dividend portfolio.

I also rolled my 401(k) into my SaaS growth retirement portfolio.

At the end of 2019 I received an huge chunk and threw most of it into my dividend portfolio.

I also rolled my 401(k) into my SaaS growth retirement portfolio.

In January I took a mini-retirement and decided to write a book on dividend investing.

While learning about marketing, I started hanging out on Twitter.

There I saw @CJ_Johnson17th and @CalebGregory304 and holy shit was I hooked.

While learning about marketing, I started hanging out on Twitter.

There I saw @CJ_Johnson17th and @CalebGregory304 and holy shit was I hooked.

I bought @CJ_Johnson17th Hustler& #39;s Field Manual in February as I was writing my book.

Twitter Money was eye opening.

Not an affiliate, but wish I was.

dividendcultivator@gmail.com if you see this Chris https://abs.twimg.com/emoji/v2/... draggable="false" alt="😉" title="Zwinkerndes Gesicht" aria-label="Emoji: Zwinkerndes Gesicht"> https://gumroad.com/l/RHFMR ">https://gumroad.com/l/RHFMR&q...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😉" title="Zwinkerndes Gesicht" aria-label="Emoji: Zwinkerndes Gesicht"> https://gumroad.com/l/RHFMR ">https://gumroad.com/l/RHFMR&q...

Twitter Money was eye opening.

Not an affiliate, but wish I was.

dividendcultivator@gmail.com if you see this Chris

I saw @CalebGregory304& #39;s book and thought I could take a different, maybe more high-risk, spin on dividend investing.

To be honest, I especially love the Exit Plan, that outlines how he got out of the rat race.

I& #39;m an affiliate for his book https://gumroad.com/a/681735283 ">https://gumroad.com/a/6817352...

To be honest, I especially love the Exit Plan, that outlines how he got out of the rat race.

I& #39;m an affiliate for his book https://gumroad.com/a/681735283 ">https://gumroad.com/a/6817352...

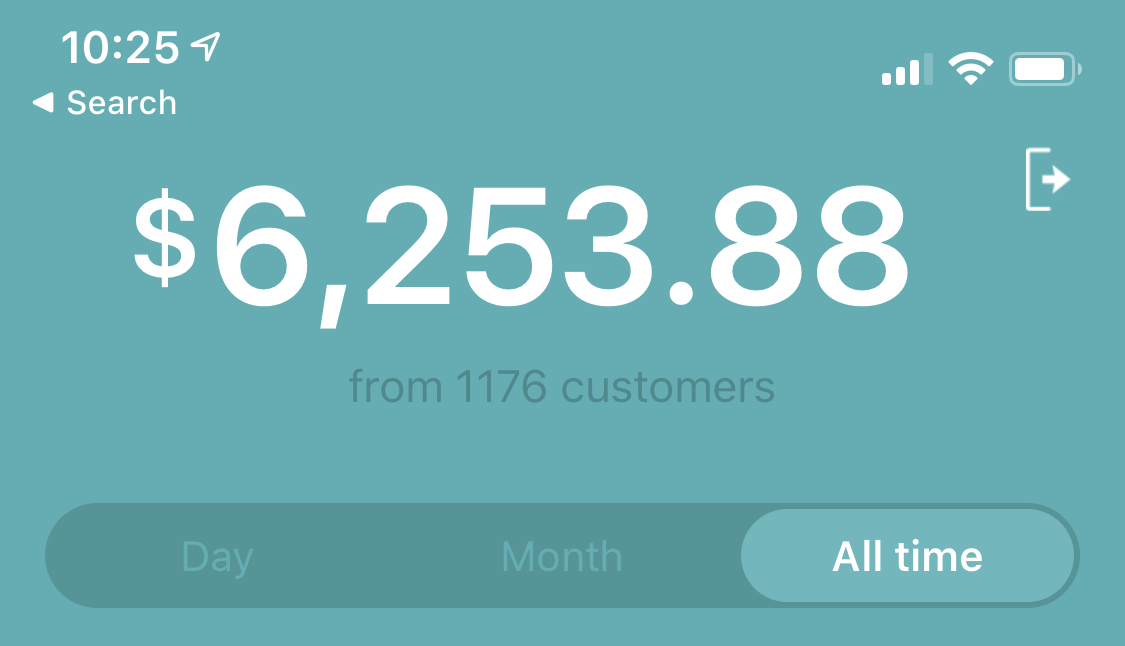

I made my first book sale in March, and since then have helped over 1,000 people and delivered over $6k in value.

It& #39;s crazy.

I& #39;ve met great people as well and am grateful for everyone.

Jim Cramer blocking me was a blessing in disguise as I met @BusinessFamous through my sale

It& #39;s crazy.

I& #39;ve met great people as well and am grateful for everyone.

Jim Cramer blocking me was a blessing in disguise as I met @BusinessFamous through my sale

He& #39;s a cool cat and funny as hell. Please give him a follow.

...

The crazy thing is I wrote the book right before the Corona crash. The first thing I did was start buying all the stocks that were on my list based on the criteria in the book.

REITs, MLPs, high quality C-corps

...

The crazy thing is I wrote the book right before the Corona crash. The first thing I did was start buying all the stocks that were on my list based on the criteria in the book.

REITs, MLPs, high quality C-corps

By mid March I was fully invested.

I saw fear, and experience told me that was when I should be buying so I did with conviction.

Maybe a little too early, but with a long-term horizon I was happy to get great prices.

I saw fear, and experience told me that was when I should be buying so I did with conviction.

Maybe a little too early, but with a long-term horizon I was happy to get great prices.

I& #39;ve only made slight tweaks to the portfolios since then.

Added $AVGO.

Swapped $EPR for $DLR.

Bought some $LVGO for the SaaS portfolio.

I& #39;m not a trader.

I invest for the long haul.

Added $AVGO.

Swapped $EPR for $DLR.

Bought some $LVGO for the SaaS portfolio.

I& #39;m not a trader.

I invest for the long haul.

Back in 2017 I started building some dividend software that I used to help me make investing decisions.

The data broke after a while and I let it languish.

But after seeing that people need tools, I decided to resurrect the project.

I hired a good friend to help out...

The data broke after a while and I let it languish.

But after seeing that people need tools, I decided to resurrect the project.

I hired a good friend to help out...

Since then I& #39;ve spent over $2k in book sales proceeds to improve the software and will continue to do so indefinitely.

My goal with it isn& #39;t to make money.

It is to have a tool that I can use and share with a few dividend fanatic friends.

My goal with it isn& #39;t to make money.

It is to have a tool that I can use and share with a few dividend fanatic friends.

At the moment it covers base costs which means it will be sticking around for a while!

The features are based on the principles are outlined in my book. http://gum.co/CSdwG ">https://gum.co/CSdwG&quo...

The features are based on the principles are outlined in my book. http://gum.co/CSdwG ">https://gum.co/CSdwG&quo...

You can find the software below.

If you& #39;re new to dividend investing, I& #39;d hold off until you& #39;ve read more on the topic.

Otherwise give it a spin.

If it doesn& #39;t work out for you I& #39;m happy to refund your membership. http://gum.co/mHSuK/earlybird ">https://gum.co/mHSuK/ear...

If you& #39;re new to dividend investing, I& #39;d hold off until you& #39;ve read more on the topic.

Otherwise give it a spin.

If it doesn& #39;t work out for you I& #39;m happy to refund your membership. http://gum.co/mHSuK/earlybird ">https://gum.co/mHSuK/ear...

Thanks for following and I& #39;ll try to keep pumping out interesting content!

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏🏽" title="Folded hands (mittlerer Hautton)" aria-label="Emoji: Folded hands (mittlerer Hautton)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏🏽" title="Folded hands (mittlerer Hautton)" aria-label="Emoji: Folded hands (mittlerer Hautton)">

Jimmy

Jimmy

Read on Twitter

Read on Twitter