1/n

$ROKU Roku& #39;s MOAT in 5 charts - here is why Roku is not going to $0!

(Full disclosure: I am LONG and will add aggressively on the re-test of the long term trend line)

Tailwinds behind Roku& #39;s back are accelerating in 2020 (+23%) vs 2019 (+15%) https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

$ROKU Roku& #39;s MOAT in 5 charts - here is why Roku is not going to $0!

(Full disclosure: I am LONG and will add aggressively on the re-test of the long term trend line)

Tailwinds behind Roku& #39;s back are accelerating in 2020 (+23%) vs 2019 (+15%)

2/n

$ROKU Operating System has ALREADY won the streaming battle (May 2020 data below!) https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

$ROKU Operating System has ALREADY won the streaming battle (May 2020 data below!)

3/n

$ROKU The mousetrap is still working (June 2020 : 5/8 best sellers on Amazon are currently TCL Roku TVs) https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

$ROKU The mousetrap is still working (June 2020 : 5/8 best sellers on Amazon are currently TCL Roku TVs)

4/n

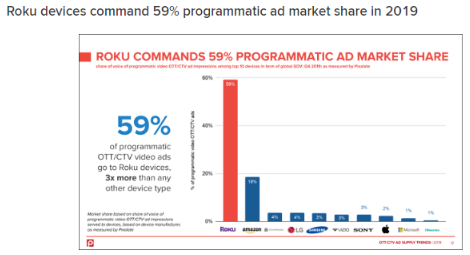

$ROKU Dominates the programmatic AD spend - Over 3x its next rival! Rebranded OneView Ad Platform to accelerate even more $$ https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

$ROKU Dominates the programmatic AD spend - Over 3x its next rival! Rebranded OneView Ad Platform to accelerate even more $$

5/n

$ROKU Despite the near-term headwinds in ad spending, pandemic lockdown will not kill Roku - In fact, quite the opposite, June: OTT Ad-spend is bouncing back! https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

$ROKU Despite the near-term headwinds in ad spending, pandemic lockdown will not kill Roku - In fact, quite the opposite, June: OTT Ad-spend is bouncing back!

6/n

$ROKU Technicals are in play reflecting known short term headwinds - Long term trend is NOT broken (at least not yet!) https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

$ROKU Technicals are in play reflecting known short term headwinds - Long term trend is NOT broken (at least not yet!)

7/n

Finally, according to Magna Global: OTT accounts for 29% of TV viewing but so far has only captured 3% of TV ad budgets. COVID-19 will only accelarate this move!

International markets will be a game-changer if Roku& #39;s past United States execution is anything to go by!

Finally, according to Magna Global: OTT accounts for 29% of TV viewing but so far has only captured 3% of TV ad budgets. COVID-19 will only accelarate this move!

International markets will be a game-changer if Roku& #39;s past United States execution is anything to go by!

8/n

What am I missing besides short term headwinds from ad budget cuts & intl expansion? And yes Google/TCL deal is not new-TCL still partners with Roku

@saxena_puru @dannyvena @RamBhupatiraju @Beth_Kindig @StockNovice @Matt_Cochrane7 @7investing

Keen to hear from Roku bears!

What am I missing besides short term headwinds from ad budget cuts & intl expansion? And yes Google/TCL deal is not new-TCL still partners with Roku

@saxena_puru @dannyvena @RamBhupatiraju @Beth_Kindig @StockNovice @Matt_Cochrane7 @7investing

Keen to hear from Roku bears!

9/n

$ROKU

Since this thread, Roku is up an incredible c30%

Roku reports Q2-20 earnings in early August.

My latest blog on Roku covering earnings preview and other thoughts is out now:

https://aacapital.substack.com/p/roku-the-digital-content-aggregator?r=1izw9&utm_campaign=post&utm_medium=web&utm_source=copy

Here">https://aacapital.substack.com/p/roku-th... are the key metrics I will be watching this quarter:

$ROKU

Since this thread, Roku is up an incredible c30%

Roku reports Q2-20 earnings in early August.

My latest blog on Roku covering earnings preview and other thoughts is out now:

https://aacapital.substack.com/p/roku-the-digital-content-aggregator?r=1izw9&utm_campaign=post&utm_medium=web&utm_source=copy

Here">https://aacapital.substack.com/p/roku-th... are the key metrics I will be watching this quarter:

10/n

1. Total revenue: Analysts expect $311m (24% YoY less than half the growth rate of Q1-20); given the recent run up in stock, I expect Roku to beat this number

2. Platform revenue: Expect atleast $233m; anything above $250m+ will b great (50% YoY growth in a tough landscape)

1. Total revenue: Analysts expect $311m (24% YoY less than half the growth rate of Q1-20); given the recent run up in stock, I expect Roku to beat this number

2. Platform revenue: Expect atleast $233m; anything above $250m+ will b great (50% YoY growth in a tough landscape)

11/n

$ROKU

3. Active accounts: this is where Roku should really excel - expecting 42m+ active accounts (38% YoY) will be extremely positive.

4. Streaming hours: again, should excel here - expecting 14.6bn hours (55% YoY) would be very bullish

$ROKU

3. Active accounts: this is where Roku should really excel - expecting 42m+ active accounts (38% YoY) will be extremely positive.

4. Streaming hours: again, should excel here - expecting 14.6bn hours (55% YoY) would be very bullish

12/n

5. ARPU: expect it to accelarate (somewhat ironic!) & settle shy of $25/user (19% YoY). $25+wud b v bullish.

6. Platform Gross profit: Expect this to come under pressure this quarter and could fall to $131m (19% YoY) i.e bottoms out this Qtr before re-accelerating upwards.

5. ARPU: expect it to accelarate (somewhat ironic!) & settle shy of $25/user (19% YoY). $25+wud b v bullish.

6. Platform Gross profit: Expect this to come under pressure this quarter and could fall to $131m (19% YoY) i.e bottoms out this Qtr before re-accelerating upwards.

13/n

$ROKU

Overall, I see a complex picture:

Active account, streaming hrs & ARPU figures should be good. Ad budgets will remain under pressure but see some offset from budgets moving from linear TV to OTT.

Platform gross profit YoY (if poor) could result in a sell off!

$ROKU

Overall, I see a complex picture:

Active account, streaming hrs & ARPU figures should be good. Ad budgets will remain under pressure but see some offset from budgets moving from linear TV to OTT.

Platform gross profit YoY (if poor) could result in a sell off!

Read on Twitter

Read on Twitter " title="1/n $ROKU Roku& #39;s MOAT in 5 charts - here is why Roku is not going to $0! (Full disclosure: I am LONG and will add aggressively on the re-test of the long term trend line)Tailwinds behind Roku& #39;s back are accelerating in 2020 (+23%) vs 2019 (+15%)https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

" title="1/n $ROKU Roku& #39;s MOAT in 5 charts - here is why Roku is not going to $0! (Full disclosure: I am LONG and will add aggressively on the re-test of the long term trend line)Tailwinds behind Roku& #39;s back are accelerating in 2020 (+23%) vs 2019 (+15%)https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

" title="2/n $ROKU Operating System has ALREADY won the streaming battle (May 2020 data below!)https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

" title="2/n $ROKU Operating System has ALREADY won the streaming battle (May 2020 data below!)https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

" title="3/n $ROKU The mousetrap is still working (June 2020 : 5/8 best sellers on Amazon are currently TCL Roku TVs)https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

" title="3/n $ROKU The mousetrap is still working (June 2020 : 5/8 best sellers on Amazon are currently TCL Roku TVs)https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

" title="4/n $ROKU Dominates the programmatic AD spend - Over 3x its next rival! Rebranded OneView Ad Platform to accelerate even more $$https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

" title="4/n $ROKU Dominates the programmatic AD spend - Over 3x its next rival! Rebranded OneView Ad Platform to accelerate even more $$https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

" title="5/n $ROKU Despite the near-term headwinds in ad spending, pandemic lockdown will not kill Roku - In fact, quite the opposite, June: OTT Ad-spend is bouncing back!https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

" title="5/n $ROKU Despite the near-term headwinds in ad spending, pandemic lockdown will not kill Roku - In fact, quite the opposite, June: OTT Ad-spend is bouncing back!https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

" title="6/n $ROKU Technicals are in play reflecting known short term headwinds - Long term trend is NOT broken (at least not yet!)https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

" title="6/n $ROKU Technicals are in play reflecting known short term headwinds - Long term trend is NOT broken (at least not yet!)https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>