Thread on $SPLK:

A couple weeks ago I did a thread on $DDOG.

One of the major questions I had was surrounding the competitive landscape. One of its major competitors is $SPLK.

Here are my thoughts on $SPLK:

A couple weeks ago I did a thread on $DDOG.

One of the major questions I had was surrounding the competitive landscape. One of its major competitors is $SPLK.

Here are my thoughts on $SPLK:

$SPLK provides software solutions to turn big data into meaningful business insights across an organization.

Its stated mission is “to make data accessible, usable, and valuable to everyone in an organization.”

Its stated mission is “to make data accessible, usable, and valuable to everyone in an organization.”

Its “Data-to-Everything” platform helps clients “investigate, monitor, analyze and act on data regardless of format or source.”

Its pre-built tools analyze data such as IT infrastructure, business analytics, and industrial data

It bills clients on a usage-based pricing model

Its pre-built tools analyze data such as IT infrastructure, business analytics, and industrial data

It bills clients on a usage-based pricing model

There are 3 key factors to $SPLK that I am going to touch on.

1. The massive total addressable market

2. Its transformation to recurring and cloud revenue

3. The balance sheet and acquisitions

1. The massive total addressable market

2. Its transformation to recurring and cloud revenue

3. The balance sheet and acquisitions

1) $SPLK has estimated that its total addressable market is over $60 billion.

Big data is a major part of business today, and I have no doubt that it will be even more important in the future.

Companies are generating and storing more data than ever before.

Big data is a major part of business today, and I have no doubt that it will be even more important in the future.

Companies are generating and storing more data than ever before.

1) The most successful companies will efficiently sort and analyze this data to gain a competitive edge. $SPLK provides this capability for many companies. It is already trusted by 92 of the Fortune 100.

It has been growing its large contracts impressively as seen below:

It has been growing its large contracts impressively as seen below:

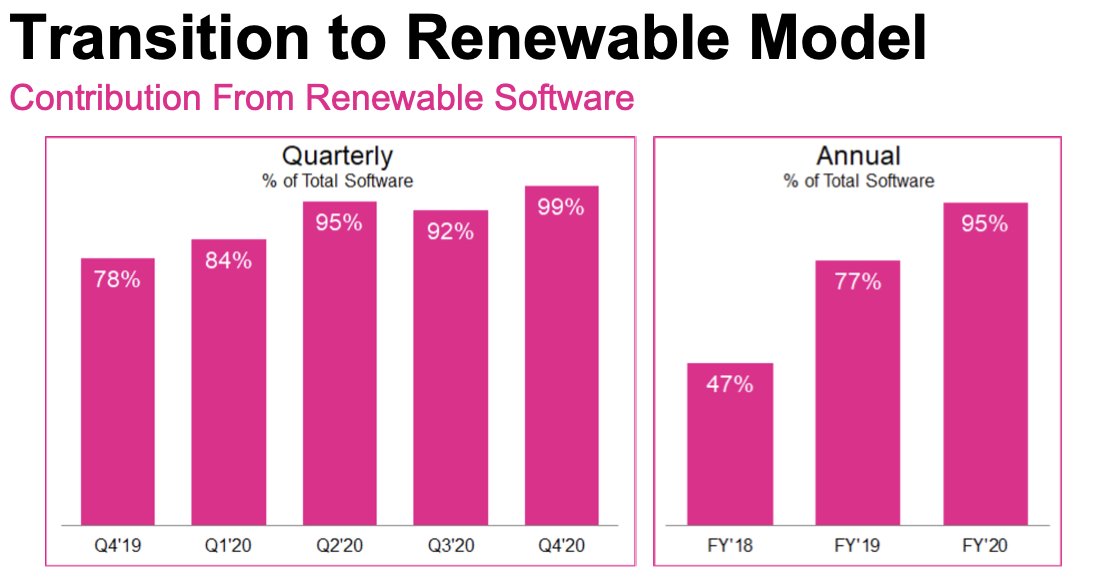

2) Over the past few years, $SPLK has transitioned from perpetual licenses to a recurring revenue model. Late in FY2020, it eliminated the sale of perpetual licenses. It has been steadily increasing its recurring revenue as seen in their investor presentation:

2) It has also been generating more cloud revenue as customers decide to host their data with $SPLK instead of on-site or with other cloud providers.

It currently represents about 44% of total software bookings and $SPLK targets it to be over 60% by FY2023.

It currently represents about 44% of total software bookings and $SPLK targets it to be over 60% by FY2023.

2) $SPLK is making concerted efforts to capitalize on the cloud and SaaS revolution and is making a lot of progress. However, its FCF turned negative in FY2020 which it attributes to investments in the transformation and slower cash collection due to the new model.

3) $SPLK has about $1.76 billion in cash and equivalents and $1.74 billion of long-term debt on the balance sheet.

It also recently issued about $1 billion of additional convertible notes which will be seen in its next quarterly report.

It also recently issued about $1 billion of additional convertible notes which will be seen in its next quarterly report.

3) The debt is higher than many of the SaaS companies that I look at, but $SPLK has been using it to strategically transform its business and acquire companies to add products and functionality. In the last two years, it has used over $1 billion in cash acquisitions.

3) Does the balance sheet worry me? Yes and no. It does have some risk due to the debt and acquisitions. If the acquisitions do not go as planned, write-downs and slowing revenue growth could significantly hurt the stock. That being said, its strategy seems to be working to date.

Some risk factors for $SPLK:

1. Competition, everyone seems to want a part of this fast-growing space

2. Valuation, it currently trades over 13x sales, though, this is less than many peers

3. Failed acquisitions, it is devoting a lot of capital to expanding through M&A

1. Competition, everyone seems to want a part of this fast-growing space

2. Valuation, it currently trades over 13x sales, though, this is less than many peers

3. Failed acquisitions, it is devoting a lot of capital to expanding through M&A

Really enjoyed looking at $SPLK. It is intriguing to me, but I have no plans to buy currently. I need to do some more thinking on it.

Soon, I will be doing a comparison thread between $DDOG and $SPLK.

In the meantime, if you have any questions/suggestions, let me know!

Soon, I will be doing a comparison thread between $DDOG and $SPLK.

In the meantime, if you have any questions/suggestions, let me know!

For full disclosure, I did start a small position (<1% of my portfolio) in $DDOG last week.

Read on Twitter

Read on Twitter