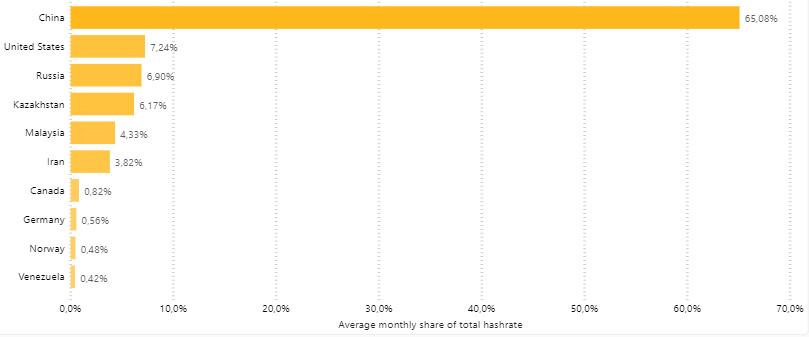

China has often been deemed as a major concern due to its striking lion& #39;s share in #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> mining. There are three important geopolitical patterns explaining the sharp decline in China& #39;s dominance over time. Thread

https://abs.twimg.com/hashflags... draggable="false" alt=""> mining. There are three important geopolitical patterns explaining the sharp decline in China& #39;s dominance over time. Thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://blog.amun.com/the-bitcoin-mining-industry-is-becoming-increasingly-tied-to-geopolitics/">https://blog.amun.com/the-bitco...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://blog.amun.com/the-bitcoin-mining-industry-is-becoming-increasingly-tied-to-geopolitics/">https://blog.amun.com/the-bitco...

1/ The 1st phenomenon was caused by the speculation around a potential ban of #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> mining due to environmental concerns and capital restrictions in China. https://www.bloomberg.com/news/articles/2017-01-13/what-s-causing-those-capital-outflows-from-china-quicktake-q-a">https://www.bloomberg.com/news/arti...

https://abs.twimg.com/hashflags... draggable="false" alt=""> mining due to environmental concerns and capital restrictions in China. https://www.bloomberg.com/news/articles/2017-01-13/what-s-causing-those-capital-outflows-from-china-quicktake-q-a">https://www.bloomberg.com/news/arti...

2/ This has led miners to export their operations to outside of China in an attempt to reduce economic uncertainty, despite China benefiting from a relatively cheaper electricity source to mine #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt="">. https://www.forbes.com/sites/colinharper/2020/06/25/new-bitcoin-mining-machines-hit-us-as-major-firm-inks-deal-with-bitmain/amp/">https://www.forbes.com/sites/col...

https://abs.twimg.com/hashflags... draggable="false" alt="">. https://www.forbes.com/sites/colinharper/2020/06/25/new-bitcoin-mining-machines-hit-us-as-major-firm-inks-deal-with-bitmain/amp/">https://www.forbes.com/sites/col...

3/ Chinese measures to curb capital flight in recent years have included a ban on local cryptoasset exchanges to prevent investors from buying #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> to eventually converting it to USD or other fiat currencies in foreign crypto exchanges

https://abs.twimg.com/hashflags... draggable="false" alt=""> to eventually converting it to USD or other fiat currencies in foreign crypto exchanges

4/ As such, the investor demand for trading cryptoassets in China has happened underground and has been concentrated in USD-pegged stablecoins, mainly Tether, rather than Bitcoin as a vehicle for capital flight. https://blog.amun.com/usd-pegged-stablecoins-is-the-new-investment-vehicle-to-promptly-flee-capital-controls/">https://blog.amun.com/usd-pegge...

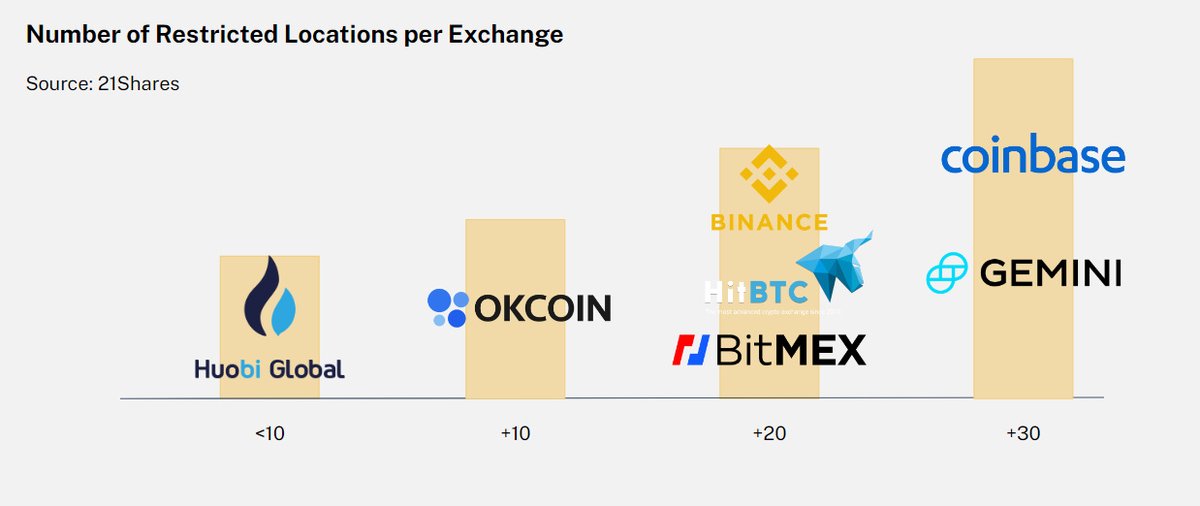

5/ The 2nd phenomenon is the Dedollarisation of various financial systems, specifically in emerging economies. A pattern was recently discovered hindering the accessibility of Bitcoin through geographical restrictions imposed by 100 cryptoasset exchanges. https://docs.google.com/spreadsheets/d/1vhM-IYVzWx1xytLxbL9FVeZdnceNJKVuvwrNdtQ7qmo/edit?usp=sharing">https://docs.google.com/spreadshe...

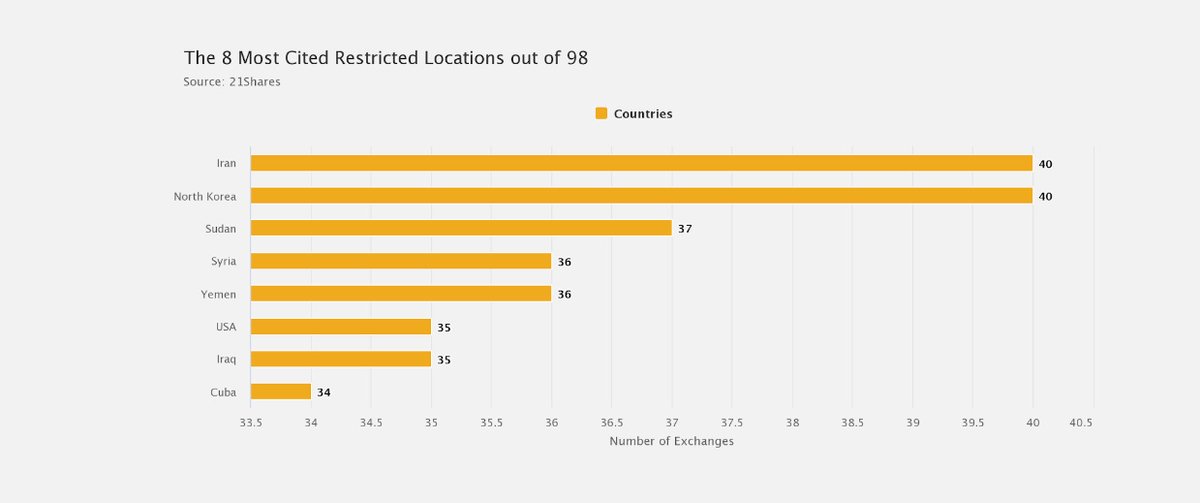

6/ It turns out that the most banned locations are countries sanctioned by the @UN such as Iran or countries embargoed by the US such as Venezuela and Cuba. However, surprisingly, the US figured in this list as well, ranked as the 8th most banned location by 35 exchanges.

7/ On the lookout for substitutes to the US dollar, leaders from Iran alongside other countries have expressed interest in using cryptoassets for bilateral trade agreements. https://www.economist.com/briefing/2020/01/18/americas-aggressive-use-of-sanctions-endangers-the-dollars-reign">https://www.economist.com/briefing/...

8/ Since accessing cryptoassets from crypto exchanges is undoubtedly impossible for users in countries like Iran, setting up mining operations to earn #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> presents another viable option.

https://abs.twimg.com/hashflags... draggable="false" alt=""> presents another viable option.

9/ As such, the surge in hash rate originating from Iran is unlikely a coincidence — especially since the US tightened the sanctions on Iran& #39;s oil exports in May 2019. https://www.bbc.co.uk/news/world-middle-east-24316661">https://www.bbc.co.uk/news/worl...

10/ As per the Bitcoin Mining Map, the participation from Iran-based miners has more than doubled in less than a year, from 1.75% of the global hash rate in September 2019 to almost 4% as of June 2020. h/t @ApollineBlandin @CambridgeAltFin @CambridgeJBS https://www.cbeci.org/mining_map ">https://www.cbeci.org/mining_ma...

11/ In the same vein, Russia started to dedollarise parts of its financial system. Since 2013, it has cut the dollar share of its foreign exchange reserves down to 24% from 45%. Interestingly, Russia has almost a 7% market share in Bitcoin mining. https://www.economist.com/briefing/2020/01/18/americas-aggressive-use-of-sanctions-endangers-the-dollars-reign">https://www.economist.com/briefing/...

12/ As of late June 2020, the market share of the prohibited countries by crypto exchanges constitutes almost 30% of the global hash rate contribution. Here& #39;s the list of banned countries: https://docs.google.com/spreadsheets/d/1vhM-IYVzWx1xytLxbL9FVeZdnceNJKVuvwrNdtQ7qmo/edit?usp=sharing">https://docs.google.com/spreadshe... h/t @ApollineBlandin @CambridgeAltFin

13/ Suffice it to say that the mining industry is unquestionably tied to changes in the global geopolitical landscape — sparking ingenuity from users and institutions attempting to access cryptoassets such as Bitcoin.

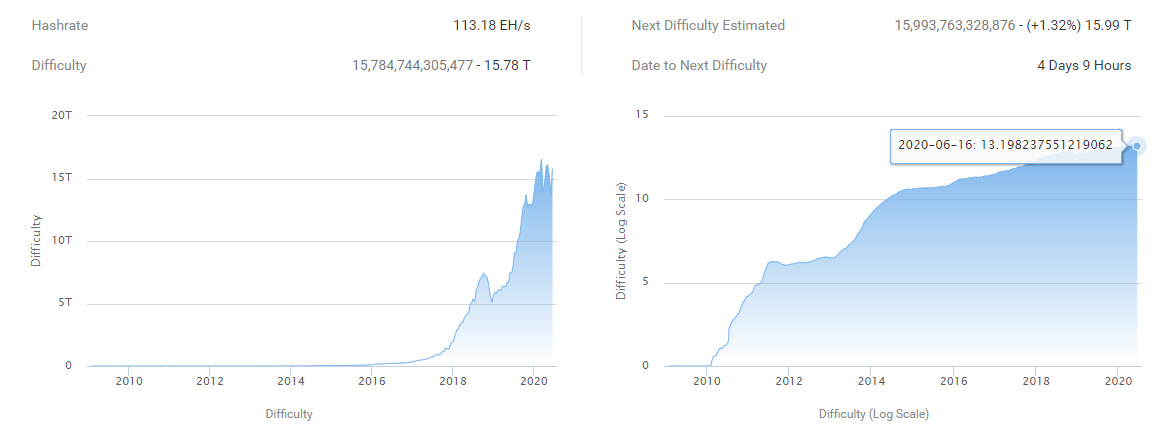

14/ The questions that remain are how competitive these miners are at staying afloat, how they’ll manage to safely self-custody Bitcoin, and whether local banks will start accepting cryptoassets such as Bitcoin for more traditional trade agreements as previously mentioned.

15/ The last and third phenomenon is the institutionalization and financing of mining operations with the United States leading this trend.

16/ As a gentle reminder, most Bitcoin miners contribute to major mining pools such as @f2pool_official , @officialpoolin and @AntPoolofficial

17/ According to a Berlin-based miner interviewed by the Amun research team, retail miners (i.e, individuals) still remain in the market.

18/ They predominantly mine with old equipment, mainly S9, with less than 10% margins and thus operate with low cash balances. These miners rely on the secondary market to buy, in batches, upgraded mining hardware at lower costs.

19/ As such, the narrative of miners liquidation influencing the price of bitcoin is not entirely true. Miners are price takers while investors in underlying spot Bitcoin and traders of associated derivatives contracts are price makers.

20/ However, it is important to note that currently the mining difficulty is at sky-high levels and eventually any increase will likely wipe out numerous retail miners — paving the way for a dominating corporations-led Bitcoin mining industry.

21/ As a result, the once-every-two-weeks mining adjustment happening tomorrow, June 30 is an important event to watch for as the adjustment will continue to increase. h/t @BitcoinCom

22/ While the US market is relatively small in terms of hash rate contribution — the paradigm has started to shift in part due to what& #39;s happening in China.

23/ Additionally, the US has experienced an uptick in new deals towards debt financing with mining equipment used as collateral — and to a lesser extent equity-based financing deals.

24/ The investor profiles interested in these deals are mainly family offices, traders, and accredited investors, although the pendulum will naturally swing towards more professional traders already familiar with Bitcoin investing.

25/ An example of this is @Hut8Mining 8 a Toronto-based bitcoin mining company that recently raised more than $8M to upgrade existing mining equipment.

26/ The company issued +5M units at a price of $1.45 per unit. Each unit represents both one common share and a warrant to purchase another common share at an exercise price of $1.80 per share within 18 months from the end of the funding round on June 25, 2020.

FIN/ This trend also helps explain the recent increase in hash rate originating from the US currently representing 7.2% of the market share — making the US the second-largest hash rate contributor after China. h/t @ApollineBlandin @CambridgeAltFin https://www.cbeci.org/mining_map ">https://www.cbeci.org/mining_ma...

Read on Twitter

Read on Twitter